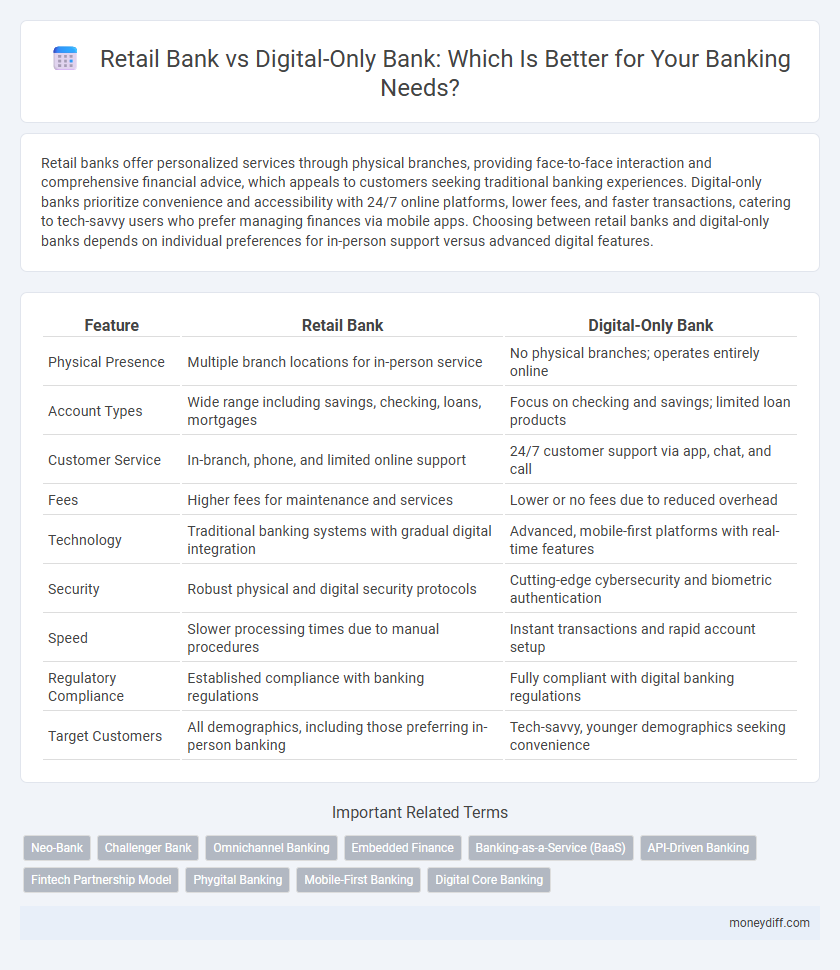

Retail banks offer personalized services through physical branches, providing face-to-face interaction and comprehensive financial advice, which appeals to customers seeking traditional banking experiences. Digital-only banks prioritize convenience and accessibility with 24/7 online platforms, lower fees, and faster transactions, catering to tech-savvy users who prefer managing finances via mobile apps. Choosing between retail banks and digital-only banks depends on individual preferences for in-person support versus advanced digital features.

Table of Comparison

| Feature | Retail Bank | Digital-Only Bank |

|---|---|---|

| Physical Presence | Multiple branch locations for in-person service | No physical branches; operates entirely online |

| Account Types | Wide range including savings, checking, loans, mortgages | Focus on checking and savings; limited loan products |

| Customer Service | In-branch, phone, and limited online support | 24/7 customer support via app, chat, and call |

| Fees | Higher fees for maintenance and services | Lower or no fees due to reduced overhead |

| Technology | Traditional banking systems with gradual digital integration | Advanced, mobile-first platforms with real-time features |

| Security | Robust physical and digital security protocols | Cutting-edge cybersecurity and biometric authentication |

| Speed | Slower processing times due to manual procedures | Instant transactions and rapid account setup |

| Regulatory Compliance | Established compliance with banking regulations | Fully compliant with digital banking regulations |

| Target Customers | All demographics, including those preferring in-person banking | Tech-savvy, younger demographics seeking convenience |

Understanding Retail Banks and Digital-Only Banks

Retail banks offer a broad range of financial services including savings accounts, loans, and in-branch customer support, catering to customers who prefer personalized service with physical access. Digital-only banks operate exclusively online, providing streamlined, low-cost banking solutions through mobile apps and web platforms, appealing to tech-savvy users seeking convenience and fast transactions. The core difference lies in physical presence and service delivery, with retail banks emphasizing traditional customer relationships while digital-only banks leverage technology for enhanced user experience and operational efficiency.

Key Differences in Services Offered

Retail banks provide comprehensive financial services including in-person branch access, ATM networks, and a wide range of personalized customer support options, catering to clients who value face-to-face interaction. Digital-only banks operate exclusively online, offering streamlined services such as mobile banking, fast account setup, and lower fees, appealing to tech-savvy customers seeking convenience and efficiency. The primary difference lies in accessibility and customer experience, with retail banks emphasizing physical presence and digital-only banks focusing on innovative, app-driven services.

Accessibility and Convenience Compared

Retail banks offer widespread physical branches and in-person customer service, enhancing accessibility for clients who prefer face-to-face interactions and cash transactions. Digital-only banks provide seamless 24/7 access through mobile apps and online platforms, enabling instant account management and lower operational costs. Convenience in retail banks is limited by branch hours, whereas digital-only banks deliver real-time services without geographical or time constraints.

Technology Integration and User Experience

Retail banks offer a blend of physical branches and online services, providing personalized support and traditional banking touchpoints, while integrating technology such as mobile apps and ATMs for convenience. Digital-only banks operate exclusively online, leveraging advanced technology platforms like AI-driven customer service, real-time transaction monitoring, and seamless app interfaces to enhance user experience with faster, 24/7 access. The digital-only model emphasizes streamlined, intuitive usability and lower fees through automation, contrasting with retail banks' hybrid approach balancing technology with in-person interactions.

Security Measures and Customer Trust

Retail banks implement comprehensive security measures such as biometric authentication, multi-factor verification, and in-branch fraud detection systems to safeguard customer assets and build trust. Digital-only banks emphasize advanced encryption protocols, real-time transaction monitoring, and AI-driven threat detection to protect users in an online environment. Customer trust in retail banks often stems from physical branch presence and personalized service, while digital-only banks rely heavily on transparent security practices and seamless user experience to ensure confidence in their platforms.

Fees, Charges, and Account Minimums

Retail banks typically impose higher fees and require larger account minimums compared to digital-only banks, which often offer lower or no fees and minimal balance requirements to attract tech-savvy customers. Digital-only banks leverage technology to reduce operational costs, enabling competitive pricing and fee waivers on services such as ATM withdrawals, overdrafts, and monthly maintenance. Consumers seeking cost-effective banking solutions prioritize digital-only banks for their transparent fee structures and lower financial entry barriers.

Customer Support: In-Person vs. Online

Retail banks provide customer support through in-person service at physical branches, allowing personalized assistance and immediate resolution of complex issues. Digital-only banks offer online customer support via chat, email, or phone, emphasizing convenience and 24/7 accessibility but sometimes facing challenges in handling intricate problems. The choice between retail and digital-only banking depends on customer preferences for face-to-face interaction versus remote, tech-driven support.

Loan and Credit Product Availability

Retail banks provide a broad range of loan and credit products, including personal loans, mortgages, and credit cards, supported by in-branch advisory services and flexible repayment options. Digital-only banks offer streamlined loan applications and instant credit decisions through online platforms, focusing on convenience but often with a narrower selection of loan products. Both banking models leverage credit risk assessment algorithms, yet retail banks tend to maintain more diverse loan portfolios due to established customer relationships.

Digital Innovation and Future Trends

Digital-only banks leverage cutting-edge technology such as AI-driven customer service, blockchain security, and real-time data analytics to deliver seamless and personalized banking experiences without physical branches. Retail banks are increasingly integrating digital innovations like mobile apps and contactless payments to stay competitive, but digital-only banks set new standards in agility and user engagement. Future trends indicate a rise in embedded finance and open banking APIs, enabling digital-only banks to create ecosystem-driven platforms that redefine customer-centric financial services.

Choosing the Right Bank for Your Money Management

Choosing the right bank for your money management depends on your preferences for convenience and service. Retail banks offer in-person support, extensive branch networks, and a wide range of financial products including loans and credit cards, ideal for customers valuing personal interaction. Digital-only banks provide lower fees, high-yield savings accounts, and easy mobile access, best suited for tech-savvy users seeking efficient online banking solutions.

Related Important Terms

Neo-Bank

Neo-banks, as digital-only banks, offer streamlined services through mobile apps and online platforms, eliminating the need for physical branches and reducing operational costs compared to traditional retail banks. These banks leverage advanced technology and data analytics to deliver personalized financial products, faster transactions, and enhanced user experiences, attracting tech-savvy customers seeking convenience and efficiency in banking.

Challenger Bank

Challenger banks, a subset of digital-only banks, leverage advanced technology and user-centric mobile platforms to offer faster, more personalized banking services compared to traditional retail banks with physical branches. These fintech-driven institutions emphasize seamless digital experiences, lower fees, and innovative features like instant account opening and real-time spending analytics.

Omnichannel Banking

Retail banks integrate physical branches with digital platforms to provide omnichannel banking experiences, allowing customers to switch seamlessly between in-person services and mobile or online banking. Digital-only banks emphasize robust digital interfaces and personalized AI-driven services, prioritizing convenience and real-time access while lacking physical locations.

Embedded Finance

Retail banks offer comprehensive financial services through physical branches and digital channels, integrating embedded finance solutions like payment processing and lending directly within customer platforms. Digital-only banks leverage fully digital infrastructures to embed finance seamlessly into apps and services, enhancing user experience with real-time transactions, personalized financial products, and API-driven integrations.

Banking-as-a-Service (BaaS)

Retail banks leveraging Banking-as-a-Service (BaaS) platforms expand their product offerings by integrating third-party financial services, enhancing customer experience through physical and digital channels. Digital-only banks utilize BaaS to rapidly deploy innovative financial solutions, reduce infrastructure costs, and scale operations efficiently in a highly competitive digital banking landscape.

API-Driven Banking

Retail banks often integrate API-driven banking solutions to enhance customer experiences through seamless connectivity with third-party services, enabling personalized financial products and streamlined operations. Digital-only banks rely heavily on APIs to offer agile, scalable platforms that facilitate instant account access, real-time transactions, and innovative financial tools without traditional branch infrastructure.

Fintech Partnership Model

Retail banks increasingly leverage fintech partnership models to enhance customer experience and expand digital services, combining physical branch networks with innovative financial technologies. Digital-only banks rely heavily on fintech collaborations to deliver seamless, scalable, and cost-efficient banking solutions without traditional infrastructure, driving faster product development and personalized financial services.

Phygital Banking

Retail banks combine physical branches with digital services, offering customers personalized experiences through face-to-face interactions and online platforms. Digital-only banks operate exclusively online, leveraging advanced technology to provide seamless, convenient banking solutions without physical locations, emphasizing phygital banking by integrating digital convenience with selective physical touchpoints.

Mobile-First Banking

Retail banks provide comprehensive in-branch services combined with digital platforms, catering to customers who value physical access alongside online convenience. Digital-only banks prioritize mobile-first banking with seamless app functionality, real-time transactions, and personalized financial management tools, enhancing user experience for tech-savvy clients.

Digital Core Banking

Digital-only banks leverage advanced digital core banking platforms that enable real-time transaction processing, seamless customer experiences, and lower operational costs compared to traditional retail banks with legacy systems. These digital core solutions drive agility, scalability, and integration with fintech innovations, positioning digital-only banks as leaders in modern banking services.

Retail bank vs Digital-only bank for banking. Infographic

moneydiff.com

moneydiff.com