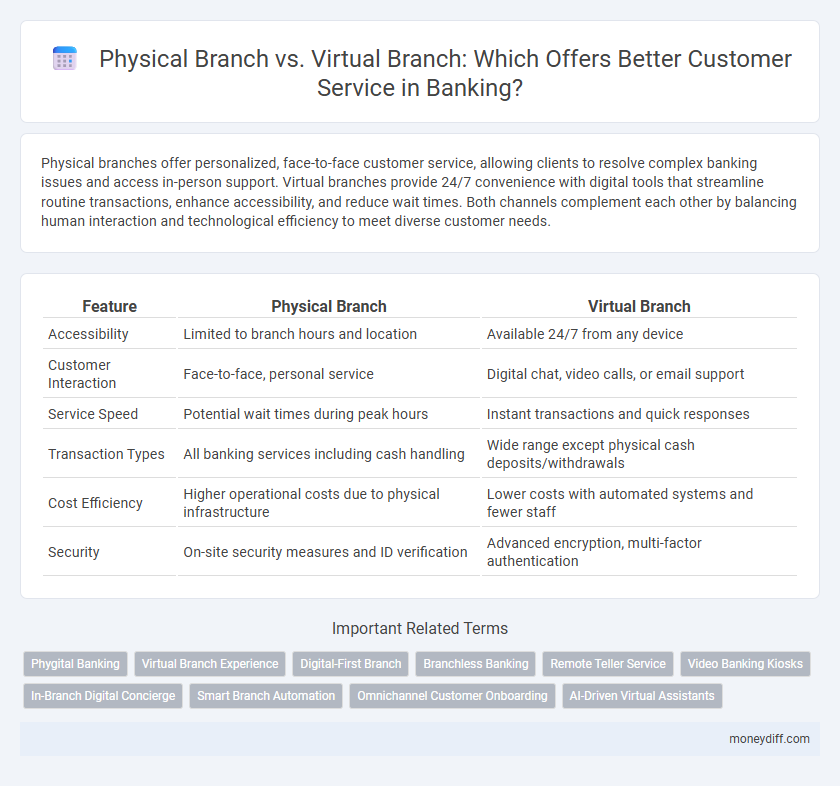

Physical branches offer personalized, face-to-face customer service, allowing clients to resolve complex banking issues and access in-person support. Virtual branches provide 24/7 convenience with digital tools that streamline routine transactions, enhance accessibility, and reduce wait times. Both channels complement each other by balancing human interaction and technological efficiency to meet diverse customer needs.

Table of Comparison

| Feature | Physical Branch | Virtual Branch |

|---|---|---|

| Accessibility | Limited to branch hours and location | Available 24/7 from any device |

| Customer Interaction | Face-to-face, personal service | Digital chat, video calls, or email support |

| Service Speed | Potential wait times during peak hours | Instant transactions and quick responses |

| Transaction Types | All banking services including cash handling | Wide range except physical cash deposits/withdrawals |

| Cost Efficiency | Higher operational costs due to physical infrastructure | Lower costs with automated systems and fewer staff |

| Security | On-site security measures and ID verification | Advanced encryption, multi-factor authentication |

Introduction: The Evolving Landscape of Banking

Physical bank branches continue to provide personalized customer service and cash handling, essential for complex transactions and relationship building. Virtual branches utilize advanced digital platforms to offer 24/7 accessibility, online account management, and instant support through AI-powered chatbots. This shift reflects evolving consumer preferences for convenience and technological integration in banking services.

Defining Physical and Virtual Bank Branches

Physical bank branches are traditional, brick-and-mortar locations where customers can perform banking transactions in person, accessing services such as cash deposits, withdrawals, loan consultations, and personalized financial advice. Virtual bank branches operate entirely online, providing digital platforms and mobile apps that enable customers to conduct banking activities remotely, including account management, fund transfers, and customer support through chat or video calls. Both physical and virtual branches play critical roles in enhancing customer service by offering distinct channels tailored to diverse banking preferences and needs.

Customer Experience: In-Person vs. Digital Interactions

Physical bank branches provide personalized customer service through face-to-face interactions that build trust and allow immediate resolution of complex issues, enhancing overall satisfaction. Virtual branches offer 24/7 accessibility with digital tools such as chatbots, mobile apps, and video calls, delivering convenience and fast response times tailored to tech-savvy customers. Combining both channels enables banks to meet diverse preferences, optimizing customer experience across traditional and digital touchpoints.

Accessibility: Location, Hours, and Digital Reach

Physical bank branches offer localized accessibility with fixed operating hours, providing face-to-face customer service in specific geographic areas. Virtual branches enable 24/7 digital reach, allowing customers to access banking services anytime and anywhere via online platforms and mobile applications. Combining physical and virtual channels enhances overall accessibility, meeting diverse customer preferences for location convenience and flexible service hours.

Range of Services: What Each Model Offers

Physical branches provide a comprehensive range of services, including cash handling, notarization, and in-person financial advice, catering to personalized customer needs. Virtual branches offer convenient access to digital banking services such as online account management, mobile deposits, and real-time chat support, enabling 24/7 availability. While physical locations excel in complex service delivery and relationship building, virtual branches emphasize speed, accessibility, and self-service options for routine transactions.

Security and Privacy Considerations

Physical branches provide enhanced security through in-person verification and secure handling of sensitive documents, reducing risks of identity theft and fraud. Virtual branches implement advanced encryption, multi-factor authentication, and biometric verification to protect customer data and transactions in real-time digital environments. Both models face challenges; physical locations must secure against insider threats, while virtual services require constant cyber threat monitoring and privacy compliance with regulations like GDPR and CCPA.

Personalization in Customer Service

Physical branches enable personalized customer service through face-to-face interactions, allowing banking staff to tailor solutions based on real-time emotional cues and individual client needs. Virtual branches leverage advanced AI and data analytics to deliver customized banking experiences, utilizing transaction histories and behavior patterns to offer relevant product recommendations and support. Combining both channels enhances personalization by blending human empathy with digital precision, improving overall customer satisfaction and loyalty.

Cost Efficiency for Banks and Customers

Physical branches incur higher operational costs, including rent, utilities, and staffing, making virtual branches a more cost-efficient option for banks seeking to reduce expenses. Virtual branches lower transaction costs for customers by eliminating travel time and offering 24/7 access to banking services through digital platforms. This shift towards virtual branches enhances cost efficiency by optimizing resource allocation and improving customer experience simultaneously.

Adapting to Consumer Preferences and Trends

Physical branches provide personalized, face-to-face interactions that build trust and cater to customers who prefer traditional banking methods, while virtual branches offer convenience and 24/7 accessibility aligning with the growing demand for digital solutions. Banks investing in hybrid models can effectively meet diverse consumer preferences by combining tactile customer service with seamless online experiences. Embracing emerging technologies like AI chatbots and mobile apps enhances virtual branch capabilities, driving higher engagement and satisfaction among tech-savvy users.

Choosing the Right Model for Individual Needs

Choosing the right banking model depends on customer preferences for convenience, accessibility, and service type. Physical branches offer personalized face-to-face support, ideal for complex transactions and trust-building, while virtual branches provide 24/7 access, faster service, and cost-effective solutions suited for tech-savvy users. Analyzing individual needs, transaction frequency, and digital literacy ensures optimal alignment between customer expectations and service delivery.

Related Important Terms

Phygital Banking

Phygital banking blends physical branch advantages with virtual branch convenience, enhancing customer service through integrated touchpoints and personalized digital experiences. This hybrid approach leverages in-branch staff expertise alongside seamless online platforms to deliver efficient, accessible, and interactive banking solutions.

Virtual Branch Experience

Virtual branches offer 24/7 accessibility, personalized digital interactions, and instant transaction capabilities that enhance customer convenience and reduce operational costs for banks. Advanced technologies like AI-driven chatbots and video conferencing replicate in-branch services, providing seamless support and faster resolution without the need for physical visits.

Digital-First Branch

Digital-first branches streamline customer service by integrating advanced AI chatbots and remote assistance tools, reducing wait times and enhancing 24/7 accessibility compared to traditional physical branches. These virtual branches leverage real-time data analytics to personalize banking experiences, driving higher customer satisfaction and operational efficiency.

Branchless Banking

Branchless banking offers customers seamless access to financial services through virtual branches, reducing the need for physical branch visits and enhancing convenience with 24/7 availability. Virtual branches leverage digital platforms and advanced technologies like mobile apps, AI chatbots, and secure online transactions to optimize customer service while minimizing operational costs for banks.

Remote Teller Service

Remote teller services bridge the gap between physical branch convenience and virtual accessibility by enabling customers to conduct transactions through video or digital kiosks without entering a bank. This hybrid model enhances customer service efficiency, reduces wait times, and offers personalized assistance, combining the reliability of in-person interaction with the flexibility of virtual banking.

Video Banking Kiosks

Video banking kiosks combine the personalized service of physical branches with the convenience of virtual banking by enabling customers to interact face-to-face with banking representatives remotely. These kiosks enhance customer experience through secure video communication, real-time assistance, and immediate access to a wide range of banking services without the need for a full branch visit.

In-Branch Digital Concierge

In-branch digital concierge services enhance physical banking locations by providing personalized, real-time assistance through interactive kiosks and AI-powered terminals, improving customer engagement and reducing wait times. This hybrid approach combines the trust and familiarity of physical branches with the efficiency and convenience of virtual technology, optimizing customer service experience.

Smart Branch Automation

Smart branch automation integrates AI-powered kiosks and biometric authentication to enhance physical branch efficiency, reducing wait times and enabling personalized customer interactions. Virtual branches leverage cloud-based platforms and real-time video support to provide seamless, secure, and 24/7 banking services, complementing automated in-branch experiences with digital convenience.

Omnichannel Customer Onboarding

Physical branches provide in-person engagement and trust-building crucial for complex financial services, while virtual branches offer seamless, 24/7 accessibility through digital platforms enhancing customer convenience and speed. Integrating both channels into an omnichannel customer onboarding system ensures consistent data flow, personalized experiences, and reduced onboarding time, driving higher customer satisfaction and retention.

AI-Driven Virtual Assistants

AI-driven virtual assistants in banking enhance customer service by providing 24/7 support, instant responses, and personalized financial advice, reducing the need for physical branch visits. These virtual branches leverage natural language processing and machine learning to handle complex queries efficiently, improving customer satisfaction and operational scalability.

Physical Branch vs Virtual Branch for customer service. Infographic

moneydiff.com

moneydiff.com