Branch banking provides direct human interaction and immediate assistance for complex transactions, offering a sense of security and personalized service. App-only banking delivers 24/7 convenience, allowing users to manage accounts, transfer funds, and deposit checks instantly from anywhere. Choosing between the two depends on the customer's preference for physical access versus digital ease and speed.

Table of Comparison

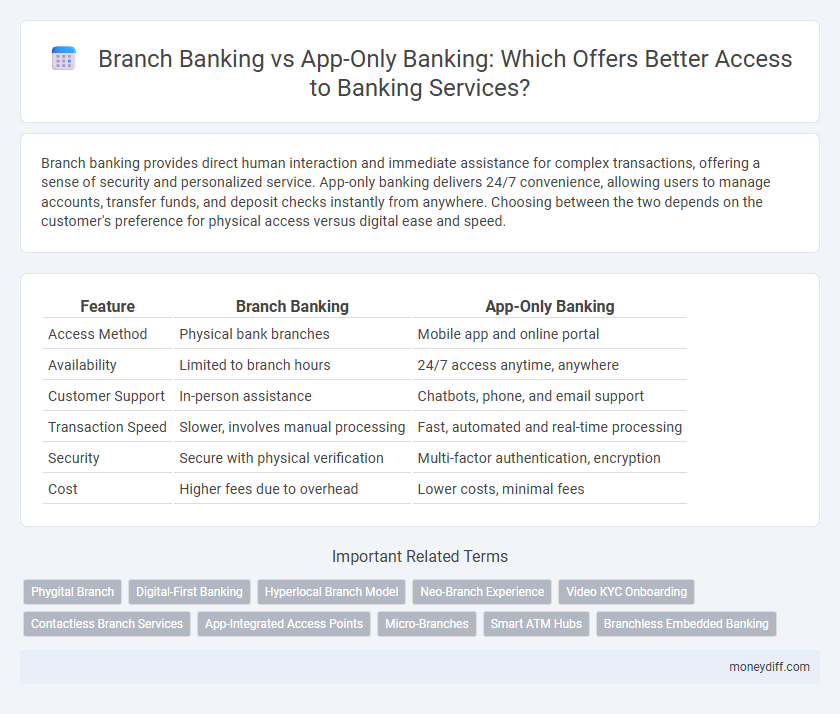

| Feature | Branch Banking | App-Only Banking |

|---|---|---|

| Access Method | Physical bank branches | Mobile app and online portal |

| Availability | Limited to branch hours | 24/7 access anytime, anywhere |

| Customer Support | In-person assistance | Chatbots, phone, and email support |

| Transaction Speed | Slower, involves manual processing | Fast, automated and real-time processing |

| Security | Secure with physical verification | Multi-factor authentication, encryption |

| Cost | Higher fees due to overhead | Lower costs, minimal fees |

Introduction to Branch and App-Only Banking

Branch banking offers customers physical locations for in-person transactions, personalized service, and immediate access to cash and financial advice. App-only banking provides 24/7 digital access to accounts, seamless mobile payments, and advanced security features through smartphones. Both models cater to different user preferences, balancing convenience with personalized support.

Accessibility and Convenience Comparison

Branch banking offers direct face-to-face interaction, personalized assistance, and access to cash deposits and withdrawals, making it highly accessible for customers who prefer in-person services or lack reliable internet. App-only banking provides 24/7 access, instant transactions, and seamless management of accounts through mobile devices, catering to tech-savvy users seeking maximum convenience without geographical constraints. While branch banking ensures comprehensive service access, app-only banking excels in speed and ease for everyday banking tasks, highlighting a trade-off between physical presence and digital flexibility.

Physical Presence vs Digital Availability

Branch banking provides customers with physical access to banking services, enabling face-to-face interactions, cash deposits, and personalized assistance, which is crucial for complex transactions and trust-building. App-only banking prioritizes digital availability, offering 24/7 access to financial services through mobile devices, seamless online transactions, and instant account management without geographical constraints. The choice between branch banking and app-only banking hinges on the balance between the need for physical presence and the convenience of digital accessibility.

Account Opening and Customer Onboarding

Branch banking offers personalized assistance during account opening and customer onboarding, enabling in-person document verification and immediate support for complex queries. App-only banking provides a streamlined, 24/7 digital account opening process with automated identity verification and instant account activation, enhancing convenience and speed. Both methods prioritize security and compliance but differ in accessibility and user experience preferences.

Transaction Speed and Efficiency

Branch banking offers personalized service with face-to-face interactions but often involves longer transaction times due to in-person queues and manual processing. App-only banking delivers faster transaction speeds by leveraging automated systems and instant digital approvals, significantly enhancing operational efficiency. Customers prioritizing quick access to funds and seamless transactions benefit more from the real-time capabilities of app-only banking platforms.

Personalized Service and Human Assistance

Branch banking offers personalized service and human assistance through face-to-face interactions, enabling customers to build trusted relationships and receive tailored financial advice. App-only banking provides convenient 24/7 access to account management and transactions but often lacks the personalized touch and immediate human support available at physical branches. Customers seeking customized solutions and empathetic customer care typically prefer branch banking for its direct human engagement.

Security Measures and Trust Concerns

Branch banking provides physical security measures such as on-site personnel and secure vaults, fostering greater customer trust through face-to-face interactions. App-only banking relies heavily on advanced digital encryption, multi-factor authentication, and real-time fraud detection to safeguard accounts but may raise concerns among users unfamiliar with technology-driven security. While branch banking offers tangible assurance through direct oversight, app-only banking emphasizes convenience, requiring continuous updates in cybersecurity protocols to maintain user confidence.

Service Availability: Hours and Locations

Branch banking offers extensive service availability with physical locations typically operating during regular business hours and some offering extended evening or weekend times, providing in-person assistance with complex transactions. App-only banking delivers 24/7 access to account management and basic financial services through mobile devices, eliminating the constraints of physical location and hours but lacking face-to-face interaction. Customers seeking convenience and round-the-clock access prefer app-only banking, while those valuing personalized services and cash handling options tend to favor branch banking.

Cost Implications for Consumers

Branch banking typically incurs higher costs for consumers due to fees associated with maintaining physical locations, such as account maintenance fees or transaction charges. App-only banking reduces these costs by eliminating overhead, often offering lower fees, higher interest rates on deposits, and free digital transactions. Consumers face fewer expenses when choosing app-only banks, benefiting from streamlined, technology-driven services without the premium costs of brick-and-mortar branches.

Choosing the Right Banking Model for Your Needs

Branch banking provides direct, in-person access to financial services, ideal for customers valuing face-to-face interaction and complex transactions. App-only banking offers 24/7 convenience through mobile platforms, suitable for tech-savvy users prioritizing quick access and lower fees. Selecting the right banking model depends on individual preferences for accessibility, transaction complexity, and customer service requirements.

Related Important Terms

Phygital Branch

Phygital branches integrate physical presence with app-only banking features to enhance customer access by offering in-person services alongside seamless digital transactions. This hybrid model leverages touchpoints such as biometric authentication and personalized kiosks to combine convenience with personalized support, optimizing customer engagement and operational efficiency.

Digital-First Banking

Branch banking provides in-person access and personalized customer service, catering to clients who prefer physical interactions, while app-only banking prioritizes convenience and 24/7 accessibility through digital platforms. Emphasizing digital-first banking strategies, financial institutions leverage mobile apps and online services to offer seamless account management, instant notifications, and advanced security features, driving customer engagement without the need for physical branches.

Hyperlocal Branch Model

Hyperlocal branch banking enhances access by situating physical branches within close proximity to customers, offering personalized services and immediate support tailored to community needs. In contrast, app-only banking provides convenience through 24/7 digital access but may lack the trust and detailed assistance that hyperlocal branches deliver to underserved or less tech-savvy populations.

Neo-Branch Experience

Neo-branch experience merges digital convenience with physical banking by integrating app-only features such as QR code access and biometric authentication within modern branches, enhancing user interaction and transaction speed. This hybrid model provides broader access by combining round-the-clock digital services with in-person assistance, optimizing customer engagement and operational efficiency.

Video KYC Onboarding

Branch banking offers in-person customer verification but often entails longer wait times and limited hours, whereas app-only banking leverages Video KYC onboarding for instant, secure identity verification 24/7, enhancing customer convenience and operational efficiency. Video KYC integrates biometric authentication and AI-driven document verification, reducing fraud risk while enabling seamless digital access from any location.

Contactless Branch Services

Contactless branch services in traditional banking branches offer seamless in-person support while minimizing physical contact, combining face-to-face interaction with digital convenience. App-only banking emphasizes instant access and remote transactions through mobile platforms, prioritizing speed and user autonomy without any branch visits.

App-Integrated Access Points

App-only banking leverages app-integrated access points such as biometric authentication, geolocation services, and real-time transaction alerts to provide seamless, secure access without physical branches. In contrast, traditional branch banking relies heavily on in-person visits, limiting accessibility and convenience compared to the instant, 24/7 access offered by app-based platforms.

Micro-Branches

Micro-branches offer enhanced physical access to banking services in underserved areas, combining personalized customer support with localized convenience unlike app-only banking, which relies solely on digital platforms and may exclude customers with limited internet access. These compact branch setups balance the human touch of traditional banking with technology, improving financial inclusion for populations less comfortable with apps.

Smart ATM Hubs

Smart ATM Hubs enhance branch banking by providing secure, cash and check deposit, withdrawal, and account services without teller assistance, bridging the gap between physical branches and digital app-only banking. These hubs extend 24/7 access to banking transactions in remote or underserved locations, offering the convenience of app banking with the tangibility and immediacy of in-person services.

Branchless Embedded Banking

Branch banking offers physical access and personalized service through local branches, essential for customers who value face-to-face interactions and cash transactions. App-only banking, particularly branchless embedded banking, provides seamless digital access integrated within non-banking platforms, enhancing convenience and real-time transaction capabilities without the need for physical branches.

Branch Banking vs App-Only Banking for access Infographic

moneydiff.com

moneydiff.com