Bank loyalty programs offer structured rewards to encourage repeat business through points or cashback, directly enhancing customer retention and satisfaction. Embedded rewards platforms integrate seamlessly with everyday banking activities, providing personalized benefits and real-time incentives that increase engagement without requiring separate sign-ups. Choosing between these approaches depends on a bank's goal to either build traditional, predictable loyalty or to deliver dynamic, context-driven customer experiences.

Table of Comparison

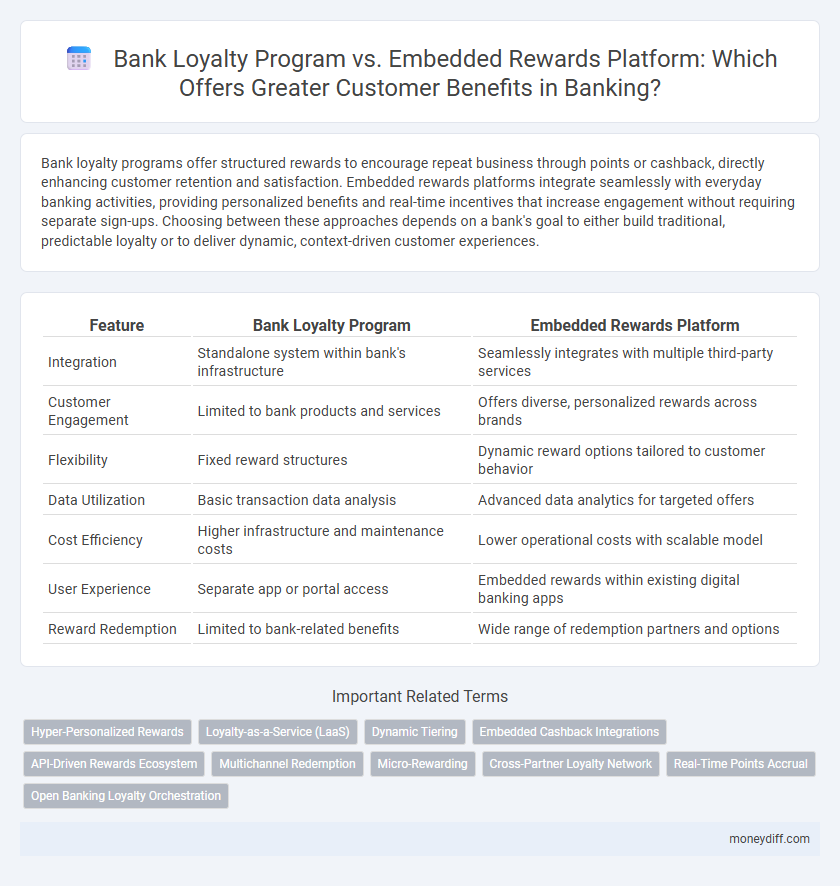

| Feature | Bank Loyalty Program | Embedded Rewards Platform |

|---|---|---|

| Integration | Standalone system within bank's infrastructure | Seamlessly integrates with multiple third-party services |

| Customer Engagement | Limited to bank products and services | Offers diverse, personalized rewards across brands |

| Flexibility | Fixed reward structures | Dynamic reward options tailored to customer behavior |

| Data Utilization | Basic transaction data analysis | Advanced data analytics for targeted offers |

| Cost Efficiency | Higher infrastructure and maintenance costs | Lower operational costs with scalable model |

| User Experience | Separate app or portal access | Embedded rewards within existing digital banking apps |

| Reward Redemption | Limited to bank-related benefits | Wide range of redemption partners and options |

Understanding Bank Loyalty Programs: Core Features

Bank loyalty programs typically feature point accumulation for transactions, exclusive discounts, and tiered membership levels that incentivize repeat business and enhance customer retention. These programs often integrate seamlessly with existing banking services, allowing users to redeem rewards through mobile apps or online platforms with ease. Understanding the inherent flexibility and data-driven personalization in bank loyalty programs reveals their core advantage in fostering long-term customer engagement compared to standalone embedded rewards platforms.

What Are Embedded Rewards Platforms?

Embedded rewards platforms integrate seamlessly within banking apps, offering personalized incentives based on customers' real-time transaction data and behavior patterns. Unlike traditional bank loyalty programs that rely on fixed points systems, these platforms enable dynamic, context-driven rewards such as instant cashback, tailored discounts, or partner offers directly at the point of sale. This approach enhances customer engagement by providing relevant, timely benefits that increase satisfaction and drive long-term loyalty.

Comparing Customer Benefits: Loyalty Programs vs Embedded Rewards

Bank loyalty programs typically offer point-based rewards, cashback, or exclusive discounts that encourage repeat banking activities, enhancing customer retention through tangible financial incentives. Embedded rewards platforms integrate seamlessly with customer transactions, providing real-time, personalized benefits such as instant cashback, partner offers, and automated savings, which boost engagement by delivering value at the point of use. While loyalty programs emphasize long-term accumulation of rewards, embedded platforms prioritize convenience and immediacy, resulting in a more dynamic and interactive customer experience.

Personalization: Which System Serves Customers Better?

Bank loyalty programs often rely on predefined reward tiers and generic offers, limiting personalization based on individual customer behavior. Embedded rewards platforms leverage real-time data analytics and AI to tailor rewards, ensuring that benefits align closely with each customer's unique spending patterns and preferences. This dynamic personalization enhances customer engagement and satisfaction, making embedded rewards platforms more effective in serving diverse customer needs.

Flexibility and Redemption Options Explained

Bank loyalty programs often limit customers to specific reward categories and fixed redemption options, while embedded rewards platforms offer greater flexibility by integrating various partners and allowing real-time, personalized rewards. Embedded platforms enable seamless redemption across multiple channels, including digital wallets, merchant discounts, and cashback, providing a more versatile user experience. This adaptability enhances customer satisfaction by aligning reward options with individual preferences and spending habits.

Seamless Integration: Embedded Rewards vs Traditional Approaches

Embedded rewards platforms offer seamless integration by directly linking customer transactions with personalized rewards within banking apps, eliminating the need for separate loyalty cards or codes. Traditional bank loyalty programs often require manual enrollment and redemption steps, creating friction for customers and limiting engagement. Leveraging embedded rewards enhances user experience by providing real-time incentives and streamlining benefit access through existing banking infrastructure.

Impact on Customer Retention and Engagement

Bank loyalty programs often drive customer retention by offering targeted rewards and exclusive benefits, increasing long-term engagement through personalized incentives. Embedded rewards platforms integrate seamlessly within everyday transactions, enhancing user experience and fostering habitual engagement by delivering instant, context-relevant value. Both approaches boost customer loyalty, but embedded platforms tend to create higher frequency interactions, leading to improved retention through continuous, real-time rewards.

Security Considerations in Both Models

Bank loyalty programs often face heightened security risks due to centralized data storage of sensitive customer information, making robust encryption and regular security audits essential. Embedded rewards platforms, integrated directly within banking apps, leverage tokenization and real-time fraud detection, reducing exposure to data breaches by minimizing data transmission. Both models require strict compliance with regulations such as PCI DSS and GDPR to ensure customer data protection and maintain trust.

Cost Efficiency for Customers: Hidden Fees and Real Value

Bank loyalty programs often include hidden fees and restrictions that diminish the real value customers receive, reducing overall cost efficiency. Embedded rewards platforms integrate seamlessly with customers' everyday transactions, providing transparent benefits without extra charges. This approach maximizes financial returns, ensuring customers gain more tangible rewards without unexpected costs.

Future Trends: The Evolving Landscape of Banking Rewards

Bank loyalty programs are increasingly integrating with embedded rewards platforms, shifting from isolated point systems to seamless, real-time benefit experiences that enhance customer engagement. Data-driven personalization and AI-powered insights enable banks to tailor rewards based on spending behavior and preferences, driving deeper loyalty and higher retention rates. Future trends emphasize hybrid models combining traditional loyalty structures with embedded platforms, leveraging open banking APIs for expanded partner ecosystems and frictionless, omnichannel reward redemption.

Related Important Terms

Hyper-Personalized Rewards

Hyper-personalized rewards in bank loyalty programs leverage advanced data analytics and AI to tailor benefits uniquely to individual customer behaviors and preferences, enhancing engagement and satisfaction. Embedded rewards platforms integrate seamlessly with everyday banking activities, enabling real-time personalized offers and incentives that drive increased usage and loyalty through contextual relevance.

Loyalty-as-a-Service (LaaS)

Loyalty-as-a-Service (LaaS) enables banks to integrate customizable loyalty programs with embedded rewards platforms, enhancing customer engagement through seamless, data-driven experiences. Unlike traditional bank loyalty programs, embedded rewards platforms leverage real-time transactions and partner ecosystems to deliver personalized incentives that drive higher retention and customer lifetime value.

Dynamic Tiering

Dynamic tiering in bank loyalty programs customizes rewards based on real-time customer behavior, enhancing engagement by offering personalized incentives that reflect individual spending patterns. Embedded rewards platforms leverage this approach to seamlessly integrate benefits into everyday banking activities, driving higher satisfaction and retention through adaptive, data-driven tier structures.

Embedded Cashback Integrations

Embedded cashback integrations in banking loyalty programs seamlessly deliver instant rewards by linking purchases directly to customer accounts, enhancing user engagement and satisfaction. These platforms utilize real-time data analytics to customize offers, driving higher transaction volumes and fostering long-term customer retention.

API-Driven Rewards Ecosystem

An API-driven rewards ecosystem enables banks to seamlessly integrate embedded rewards platforms, offering personalized and real-time customer benefits beyond traditional bank loyalty programs. This approach leverages data connectivity and third-party partnerships to enhance user engagement, increase transaction frequency, and drive higher customer lifetime value through tailored incentives.

Multichannel Redemption

Bank loyalty programs often limit customer rewards to specific channels, whereas embedded rewards platforms enable seamless multichannel redemption, allowing customers to redeem points across digital, in-branch, and partner platforms. This integrated approach enhances user experience and maximizes the value of rewards by offering flexibility and convenience in accessing benefits anytime, anywhere.

Micro-Rewarding

Bank loyalty programs typically offer points or cashback for transactions, driving repeat business through structured rewards, whereas embedded rewards platforms integrate micro-rewarding directly into customer interactions, providing instant small-scale incentives that enhance engagement and foster continuous usage. Micro-rewarding within embedded platforms leverages real-time data to personalize benefits, increase customer satisfaction, and boost long-term loyalty more effectively than traditional point accumulation systems.

Cross-Partner Loyalty Network

Cross-partner loyalty networks amplify customer benefits by enabling banks to integrate rewards from multiple businesses, creating a seamless and versatile rewards ecosystem that enhances user engagement beyond traditional bank loyalty programs. Embedded rewards platforms leverage this interconnected system to offer personalized, real-time incentives, driving higher retention and diversified spending across partnered brands.

Real-Time Points Accrual

Bank loyalty programs typically offer delayed points accrual requiring manual tracking, whereas embedded rewards platforms provide real-time points accumulation directly integrated with transactions, enhancing customer engagement and immediate reward redemption. This instant feedback loop increases user satisfaction and drives higher spending frequency by making benefits transparent and accessible at the point of purchase.

Open Banking Loyalty Orchestration

Open Banking Loyalty Orchestration enables banks to integrate multiple reward sources, optimizing customer benefits through personalized offers and seamless transaction-based incentives. Unlike traditional Bank Loyalty Programs, embedded rewards platforms leverage real-time data sharing and API connectivity to deliver dynamic, tailored experiences that increase customer engagement and lifetime value.

Bank Loyalty Program vs Embedded Rewards Platform for customer benefits. Infographic

moneydiff.com

moneydiff.com