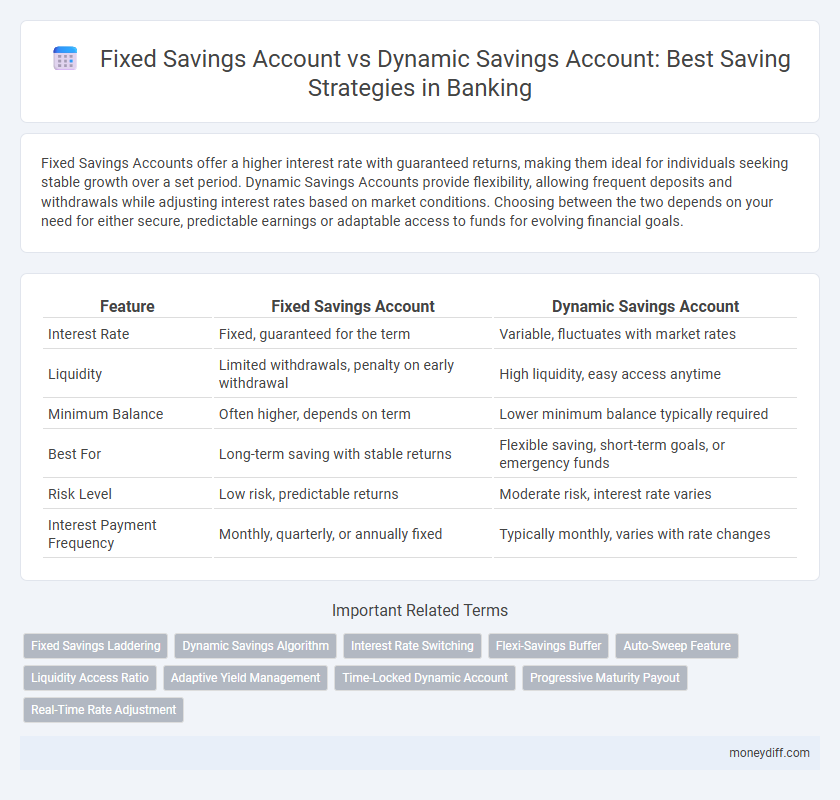

Fixed Savings Accounts offer a higher interest rate with guaranteed returns, making them ideal for individuals seeking stable growth over a set period. Dynamic Savings Accounts provide flexibility, allowing frequent deposits and withdrawals while adjusting interest rates based on market conditions. Choosing between the two depends on your need for either secure, predictable earnings or adaptable access to funds for evolving financial goals.

Table of Comparison

| Feature | Fixed Savings Account | Dynamic Savings Account |

|---|---|---|

| Interest Rate | Fixed, guaranteed for the term | Variable, fluctuates with market rates |

| Liquidity | Limited withdrawals, penalty on early withdrawal | High liquidity, easy access anytime |

| Minimum Balance | Often higher, depends on term | Lower minimum balance typically required |

| Best For | Long-term saving with stable returns | Flexible saving, short-term goals, or emergency funds |

| Risk Level | Low risk, predictable returns | Moderate risk, interest rate varies |

| Interest Payment Frequency | Monthly, quarterly, or annually fixed | Typically monthly, varies with rate changes |

Understanding Fixed Savings Accounts

Fixed Savings Accounts offer a predetermined interest rate for a specified tenure, ensuring consistent returns and financial predictability. These accounts restrict withdrawals until maturity, making them ideal for long-term savings goals and disciplined investment. Compared to Dynamic Savings Accounts, fixed accounts provide stability and higher interest rates, benefiting savers seeking guaranteed growth.

What Are Dynamic Savings Accounts?

Dynamic savings accounts offer flexible deposit and withdrawal options, allowing account holders to adjust their savings based on changing financial needs. Unlike fixed savings accounts with predetermined terms and interest rates, dynamic accounts provide competitive interest rates that often vary with market conditions, enhancing growth potential. These accounts are ideal for individuals who prioritize liquidity and want to optimize returns without sacrificing access to funds.

Key Differences Between Fixed and Dynamic Savings

Fixed Savings Accounts offer a predetermined interest rate and fixed tenure, providing stable returns with limited access to funds during the term. Dynamic Savings Accounts feature variable interest rates and flexible deposit or withdrawal options, allowing savers to adjust their contributions according to changing financial goals. The choice depends on risk tolerance, liquidity needs, and desired growth stability within a comprehensive banking savings strategy.

Interest Rates: Fixed vs Dynamic Savings

Fixed Savings Accounts offer a guaranteed interest rate for the entire term, providing predictable returns and stability for long-term savings goals. Dynamic Savings Accounts have variable interest rates that fluctuate based on market conditions, potentially yielding higher returns during favorable economic periods but also posing the risk of lower interest earnings. Choosing between fixed and dynamic interest rates depends on an individual's risk tolerance and preference for either stable or potentially higher, but uncertain, income from savings.

Accessibility and Withdrawal Flexibility

Fixed Savings Accounts typically offer higher interest rates but limit accessibility and withdrawal flexibility by imposing penalties or restrictions on early withdrawals. Dynamic Savings Accounts provide greater liquidity, allowing customers to access funds and make withdrawals without penalties, making them suitable for emergency funds or fluctuating cash needs. Choosing between these accounts depends on balancing the priority of higher returns against the necessity for flexible access to savings.

Risk Levels in Savings Options

Fixed Savings Accounts offer lower risk with guaranteed interest rates and principal protection over a set term, making them ideal for conservative savers seeking stability. Dynamic Savings Accounts carry higher risk due to fluctuating interest rates tied to market conditions, but they provide flexibility and the potential for higher returns. Evaluating an individual's risk tolerance and financial goals is crucial when choosing between these savings options.

Long-Term vs Short-Term Savings Goals

Fixed Savings Accounts offer higher interest rates with locked-in terms, making them ideal for long-term savings goals and wealth accumulation. Dynamic Savings Accounts provide flexible access to funds without penalties, suited for short-term goals and emergency reserves. Choosing between these accounts depends on the saver's need for liquidity versus maximizing interest earnings over time.

Fees and Penalties Comparison

Fixed Savings Accounts often impose penalties for early withdrawal, including loss of interest and additional fees, which can significantly reduce overall returns. Dynamic Savings Accounts typically offer more flexibility with fewer or no penalties on withdrawals but may have higher maintenance fees or lower interest rates. Choosing between the two depends on the saver's need for liquidity versus maximizing interest earnings while minimizing unexpected charges.

Which Account Suits Your Saving Habits?

Fixed Savings Accounts offer higher interest rates and predictable returns, ideal for savers with a long-term mindset who prefer locking funds for a set period. Dynamic Savings Accounts provide flexibility with easy access and variable interest rates, suited for individuals who require liquidity and frequent transactions. Evaluating your saving habits, such as commitment duration and cash flow needs, helps determine the best account to maximize growth and convenience.

Choosing the Right Savings Account for Your Financial Strategy

Selecting the right savings account depends on your financial goals and cash flow needs, with fixed savings accounts offering higher interest rates through locked-in deposits that optimize long-term growth. Dynamic savings accounts provide flexibility by allowing variable deposits and withdrawals, ideal for managing irregular income or emergency funds while earning competitive interest. Balancing these options enhances diversification, ensuring both stability and accessibility in your overall saving strategy.

Related Important Terms

Fixed Savings Laddering

Fixed Savings Laddering maximizes interest earnings by dividing funds into multiple fixed deposits with staggered maturity dates, allowing access to portions of savings periodically while benefiting from higher fixed rates. This strategy contrasts with Dynamic Savings Accounts, which offer liquidity but typically lower returns, making laddering optimal for disciplined savers seeking balance between growth and accessibility.

Dynamic Savings Algorithm

Dynamic Savings Accounts utilize advanced algorithms that automatically adjust deposit amounts based on spending patterns and income fluctuations, maximizing interest earnings and liquidity compared to Fixed Savings Accounts with static deposit schedules. These algorithm-driven accounts optimize cash flow management by analyzing real-time data and market interest rates, resulting in higher financial efficiency and personalized savings growth.

Interest Rate Switching

Fixed Savings Accounts offer stable interest rates locked in for the term, ensuring predictable returns but no benefit from rising rates. Dynamic Savings Accounts allow interest rate switching, enabling account holders to capitalize on fluctuating market rates and potentially earn higher returns when rates increase.

Flexi-Savings Buffer

A Fixed Savings Account offers higher interest rates with locked-in deposits, while a Dynamic Savings Account, or Flexi-Savings Buffer, provides liquidity allowing automatic transfers to cover unexpected expenses without penalties. Utilizing a Flexi-Savings Buffer enhances cash flow management by combining savings growth potential with immediate access to funds, optimizing overall financial flexibility.

Auto-Sweep Feature

The Auto-Sweep feature in Dynamic Savings Accounts automatically transfers surplus funds from the savings account to a fixed deposit, optimizing interest earnings without locking in funds permanently. Fixed Savings Accounts offer predetermined interest rates and tenure but lack the liquidity and flexibility benefits provided by the Auto-Sweep mechanism in Dynamic Savings Accounts.

Liquidity Access Ratio

Fixed Savings Accounts offer lower Liquidity Access Ratios as funds are locked for a predetermined period, limiting immediate withdrawals and reducing cash flow flexibility. Dynamic Savings Accounts provide higher Liquidity Access Ratios, enabling easier access to funds without penalties and supporting more agile financial management.

Adaptive Yield Management

Fixed Savings Accounts offer a predetermined interest rate providing stable returns ideal for risk-averse investors, whereas Dynamic Savings Accounts utilize Adaptive Yield Management algorithms to optimize interest earnings by adjusting rates based on market fluctuations and liquidity needs. Implementing Adaptive Yield Management in Dynamic Savings Accounts allows depositors to maximize yield potential through real-time rate adaptations, enhancing overall savings growth compared to fixed-rate alternatives.

Time-Locked Dynamic Account

Time-Locked Dynamic Savings Accounts offer flexible interest rates that adjust based on market conditions while requiring funds to be locked for a predetermined period, combining higher yields with disciplined saving. Compared to Fixed Savings Accounts with static interest rates, these accounts optimize returns by leveraging dynamic rates without sacrificing the security of time-locked deposits.

Progressive Maturity Payout

Fixed Savings Accounts offer a predetermined interest rate and maturity date, ensuring a predictable payout schedule ideal for conservative savers seeking steady growth. Dynamic Savings Accounts adapt interest rates and maturities based on market conditions, enabling progressive maturity payouts that optimize returns through flexible reinvestment strategies.

Real-Time Rate Adjustment

Fixed Savings Accounts offer a stable interest rate locked in for the term, ensuring predictable returns ideal for risk-averse investors. Dynamic Savings Accounts provide real-time rate adjustments that fluctuate with market conditions, allowing savers to capitalize on rising interest rates and maximize growth potential.

Fixed Savings Account vs Dynamic Savings Account for saving strategies. Infographic

moneydiff.com

moneydiff.com