Overdraft protection helps prevent declined transactions by covering shortfalls using linked accounts or credit lines, avoiding fees and maintaining spending ability. Early payday access allows customers to receive their paychecks before the official deposit date, providing immediate funds to manage cash flow gaps without borrowing. Choosing between these options depends on individual financial habits and the need for convenience versus cost-effectiveness.

Table of Comparison

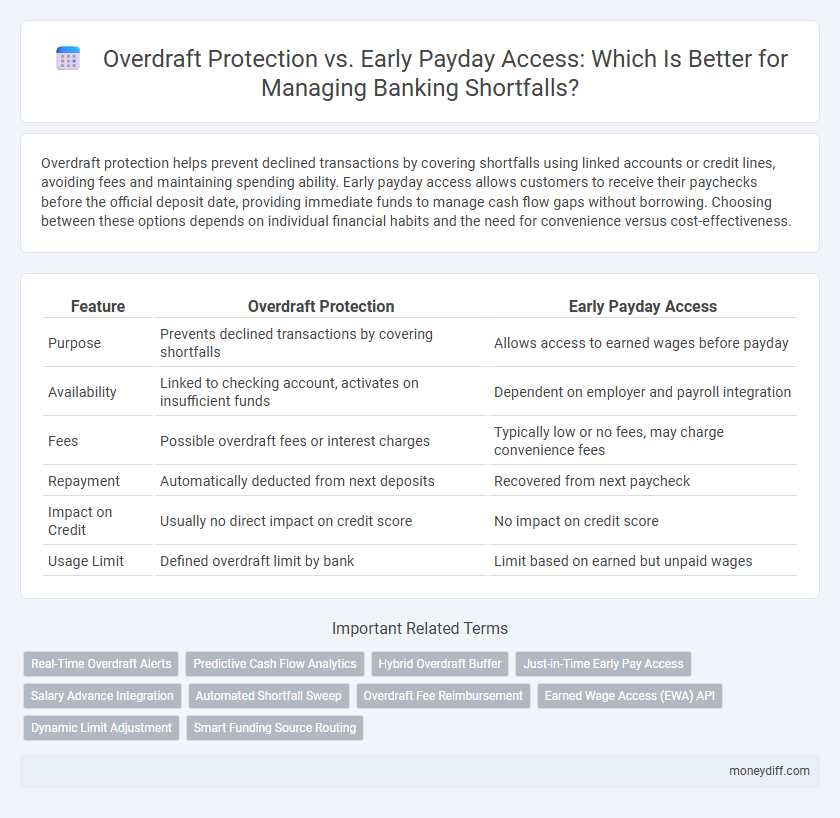

| Feature | Overdraft Protection | Early Payday Access |

|---|---|---|

| Purpose | Prevents declined transactions by covering shortfalls | Allows access to earned wages before payday |

| Availability | Linked to checking account, activates on insufficient funds | Dependent on employer and payroll integration |

| Fees | Possible overdraft fees or interest charges | Typically low or no fees, may charge convenience fees |

| Repayment | Automatically deducted from next deposits | Recovered from next paycheck |

| Impact on Credit | Usually no direct impact on credit score | No impact on credit score |

| Usage Limit | Defined overdraft limit by bank | Limit based on earned but unpaid wages |

Understanding Overdraft Protection

Overdraft protection is a banking service that automatically covers transactions exceeding an account balance, preventing declined payments and overdraft fees. It typically links to a savings account, credit card, or line of credit, allowing seamless fund transfers during shortfalls. Understanding the costs and terms of overdraft protection is crucial for effective financial management and avoiding unexpected debt.

What is Early Payday Access?

Early Payday Access allows bank customers to receive their direct deposit payments up to two days in advance, providing quicker access to funds during shortfalls. This service helps avoid overdraft fees by covering expenses as soon as possible, improving cash flow management without relying on loans. Compared to overdraft protection, Early Payday Access offers a proactive solution to manage finances without incurring additional charges.

Key Differences Between Overdraft Protection and Early Payday Access

Overdraft protection prevents declined transactions by covering shortfalls up to a set limit, often incurring fees based on the bank's policy, whereas early payday access allows customers to receive their direct deposits before the official payday, enhancing cash flow without overdraft fees. Overdraft protection typically involves repaying the borrowed amount with interest or fees, while early payday access is linked to the timing of payroll deposits and may come with subscription fees or require specific account types. The key difference lies in overdraft protection addressing immediate payment shortfalls after transactions, while early payday access advances funds prior to payroll, reducing the likelihood of overdrafts.

Costs and Fees: Overdraft vs Early Pay

Overdraft protection typically incurs fees ranging from $30 to $35 per transaction, which can accumulate quickly during multiple shortfalls, whereas early payday access often involves smaller fixed fees or interest rates tied to advances. Overdraft fees may also include daily charges after initial transactions, increasing overall costs significantly. Early payday options generally provide transparent fee structures that can be less costly compared to unpredictable overdraft penalties.

Impact on Credit and Financial Health

Overdraft protection helps avoid declined transactions and fees but may include interest or service charges, potentially impacting credit if linked to loans or credit lines. Early payday access provides immediate funds without credit checks, reducing the risk of missed payments and negative credit impacts but can encourage dependency and reduce savings. Both options require careful use to protect overall financial health and avoid escalating debt or credit score damage.

Ease of Access and Eligibility

Overdraft protection provides automatic coverage for transactions exceeding the account balance but often requires a linked savings or credit account and may involve fees or credit checks, affecting eligibility. Early payday access allows customers to receive their direct deposit funds ahead of the scheduled payday with fewer eligibility requirements and no impact on credit, offering greater ease of access through many mobile banking apps. Both options aim to mitigate shortfalls, but early payday access typically offers quicker availability without the risk of overdraft fees.

Pros and Cons of Overdraft Protection

Overdraft protection helps customers avoid declined transactions and fees by covering shortfalls up to a preset limit, providing peace of mind during unexpected expenses. The main advantage is reducing the risk of overdraft fees and immediate access to funds, though it may involve monthly fees or high transfer charges from linked accounts. A key drawback is reliance on overdraft can lead to accumulating debt and increased financial strain if not managed carefully.

Pros and Cons of Early Payday Access

Early payday access allows customers to receive their wages before the official payday, providing quick relief from short-term cash shortfalls without incurring overdraft fees. However, this service may come with fees or require enrollment in specific accounts, potentially creating dependency on advance payments and reducing overall financial flexibility. Unlike overdraft protection, early payday access does not cover unexpected large expenses, limiting its usefulness for substantial overdrafts.

Choosing the Right Solution for Your Needs

Overdraft protection provides a safety net by covering transactions when your account balance is insufficient, often with associated fees that vary by bank. Early payday access allows you to receive your paycheck before the scheduled deposit date, helping avoid shortfalls without incurring overdraft charges. Selecting the right solution depends on your account usage patterns, fee tolerance, and the timing of your cash flow needs to minimize costs and maintain financial stability.

Smart Strategies to Manage Financial Shortfalls

Overdraft protection offers a safety net by covering transactions that exceed your account balance, often preventing costly fees and declined payments. Early payday access allows individuals to receive their wages ahead of the scheduled payday, providing immediate liquidity without relying on credit. Leveraging these tools strategically can enhance cash flow management and reduce financial stress during shortfalls.

Related Important Terms

Real-Time Overdraft Alerts

Real-time overdraft alerts provide immediate notifications during account shortfalls, enabling timely actions to avoid overdraft fees and maintain financial stability. Early payday access offers funds in advance but lacks the instant monitoring benefits of real-time alerts, which are crucial for proactive overdraft management.

Predictive Cash Flow Analytics

Predictive cash flow analytics enhances overdraft protection by forecasting potential shortfalls and automatically maintaining account balances through linked credit or savings, reducing fees and improving financial stability. Early payday access leverages these analytics to advance funds based on incoming deposits, offering timely liquidity without incurring overdraft costs, thus optimizing cash flow management for banking customers.

Hybrid Overdraft Buffer

Hybrid Overdraft Buffer combines the benefits of traditional overdraft protection and early payday access, providing users with a seamless safety net for shortfalls by allowing controlled negative balances while advancing funds based on upcoming deposits. This innovative solution minimizes overdraft fees and improves cash flow management, enhancing customer financial stability and reducing reliance on expensive short-term credit alternatives.

Just-in-Time Early Pay Access

Just-in-Time Early Payday Access provides immediate funds before the scheduled payday, reducing reliance on costly overdraft protection fees and minimizing account shortfalls. This approach enhances financial stability by offering timely liquidity, helping consumers avoid overdraft penalties and maintain better cash flow management.

Salary Advance Integration

Overdraft protection offers a safety net by covering transactions when funds are insufficient, often incurring fees, while early payday access through salary advance integration provides employees with timely access to earned wages without overdraft penalties. Salary advance integration streamlines fund availability directly from payroll systems, enhancing cash flow management and reducing reliance on costly overdraft services.

Automated Shortfall Sweep

Automated Shortfall Sweep offers a seamless solution by automatically transferring funds from a linked account to cover overdrafts, reducing reliance on costly overdraft protection fees and minimizing the need for early payday access. This system enhances cash flow management by preventing declined transactions and late fees while leveraging real-time account monitoring to ensure sufficient funds are available.

Overdraft Fee Reimbursement

Overdraft protection services often include overdraft fee reimbursement policies that help customers avoid costly fees when their account balance dips below zero, providing a financial safety net during shortfalls. Early payday access, while offering quicker fund availability, typically does not include fee reimbursement, making overdraft protection a more cost-effective solution for managing unexpected expenses.

Earned Wage Access (EWA) API

Earned Wage Access (EWA) APIs provide employees with immediate access to earned but unpaid wages, reducing reliance on traditional overdraft protection that often incurs fees and impacts credit scores. Integrating EWA APIs into banking platforms enhances financial wellness by offering transparent, fee-free shortfall management compared to costly overdraft services.

Dynamic Limit Adjustment

Dynamic limit adjustment in overdraft protection allows banks to automatically increase the available credit line based on real-time account activity and creditworthiness, reducing declined transactions and fees. Early payday access offers immediate fund availability but lacks the adaptive credit flexibility provided by dynamic overdraft limits, which optimizes shortfall management with tailored borrowing capacity.

Smart Funding Source Routing

Smart funding source routing prioritizes overdraft protection by automatically linking checking accounts to backup funding sources like savings or credit cards, minimizing fees during shortfalls. Early payday access leverages payroll data through fintech platforms to advance earned wages, offering a cost-effective alternative by reducing reliance on overdraft fees and enhancing liquidity management.

Overdraft Protection vs Early Payday Access for managing shortfalls. Infographic

moneydiff.com

moneydiff.com