Commercial banks offer traditional business banking services with established regulatory frameworks and comprehensive financial products including loans, deposits, and payment processing. Embedded finance providers integrate banking services directly into non-financial platforms, enabling seamless access to financial tools within business operations without requiring a separate banking relationship. Businesses choosing between the two should consider factors such as customization, user experience, regulatory compliance, and the scope of financial services needed.

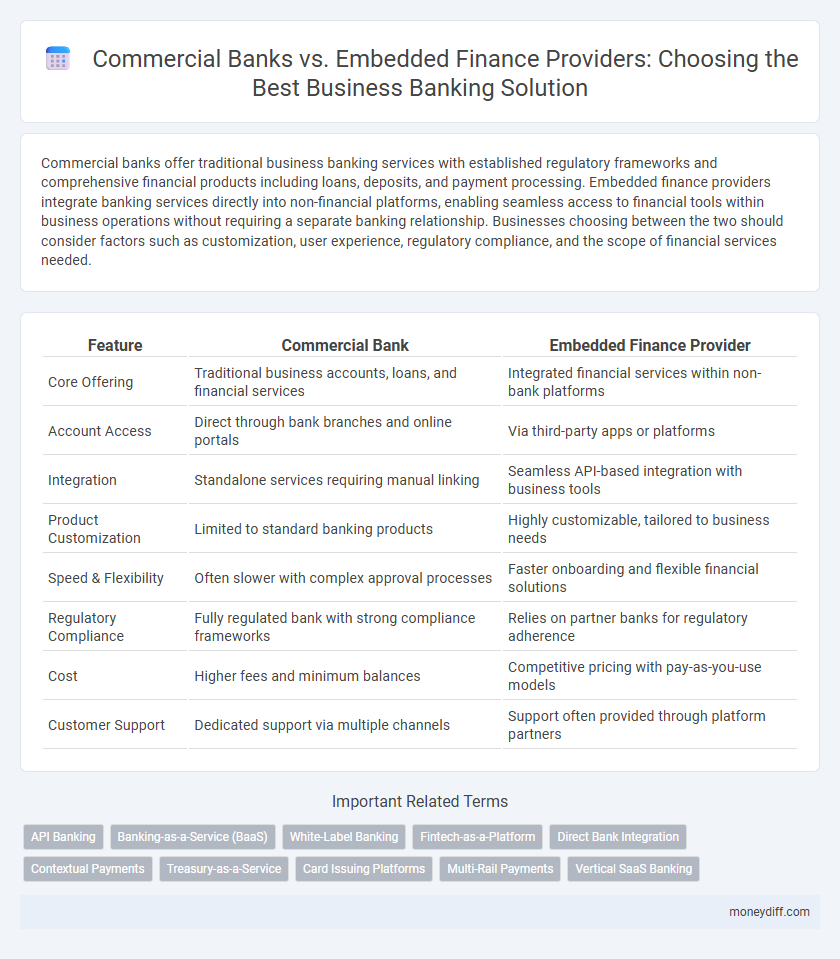

Table of Comparison

| Feature | Commercial Bank | Embedded Finance Provider |

|---|---|---|

| Core Offering | Traditional business accounts, loans, and financial services | Integrated financial services within non-bank platforms |

| Account Access | Direct through bank branches and online portals | Via third-party apps or platforms |

| Integration | Standalone services requiring manual linking | Seamless API-based integration with business tools |

| Product Customization | Limited to standard banking products | Highly customizable, tailored to business needs |

| Speed & Flexibility | Often slower with complex approval processes | Faster onboarding and flexible financial solutions |

| Regulatory Compliance | Fully regulated bank with strong compliance frameworks | Relies on partner banks for regulatory adherence |

| Cost | Higher fees and minimum balances | Competitive pricing with pay-as-you-use models |

| Customer Support | Dedicated support via multiple channels | Support often provided through platform partners |

Overview of Commercial Banks and Embedded Finance Providers

Commercial banks are traditional financial institutions offering a broad range of banking services, including business accounts, loans, and payment processing, supported by established regulatory frameworks. Embedded finance providers integrate financial services directly into non-financial platforms, enabling seamless access to banking functionalities within business software or e-commerce ecosystems. This integration allows businesses to streamline transactions and enhance customer experience without relying solely on conventional banking interfaces.

Key Differences in Business Banking Services

Commercial banks offer traditional business banking services including checking accounts, loans, and treasury management with established regulatory frameworks and physical branch access. Embedded finance providers integrate financial services directly within non-financial platforms, enabling seamless payment processing, credit, and banking functionalities tailored to specific industry verticals. Key differences lie in the delivery model, customization capabilities, and integration of banking services within business operations versus standalone financial institution offerings.

Speed and Flexibility in Account Opening

Commercial banks typically require extensive documentation and longer processing times for business account openings, resulting in lower speed and flexibility. Embedded finance providers leverage APIs and digital platforms to enable near-instantaneous account setup with minimal paperwork, offering superior agility and user experience. This speed and flexibility empower businesses to access financial services quickly, improving cash flow management and operational efficiency.

Customization of Financial Products

Commercial banks offer standardized business banking products with limited customization options, often requiring businesses to fit into predefined frameworks. Embedded finance providers deliver highly customizable financial solutions integrated directly into business workflows, enabling tailored services such as invoicing, payments, and credit facilities specific to industry needs. The adaptability of embedded finance drives greater efficiency and personalized user experiences compared to traditional commercial banking models.

Cost Structures and Fee Transparency

Commercial banks typically operate with higher overhead costs due to physical branch networks and extensive regulatory compliance, resulting in complex fee structures that may include monthly maintenance fees, transaction charges, and minimum balance penalties. Embedded finance providers leverage digital platforms to offer streamlined banking services with lower operational expenses, translating into more transparent and often reduced fees for businesses. The clarity in cost structures from embedded finance providers enhances budgeting accuracy and reduces unexpected financial burdens for business clients compared to traditional commercial banking models.

Technology Integration and API Capabilities

Commercial banks offer traditional business banking with established technology infrastructure, but often have limited API capabilities that restrict seamless integration with modern software. Embedded finance providers excel in technology integration by delivering flexible, API-first platforms that enable businesses to embed financial services directly into their existing workflows. These providers allow for customized banking experiences, real-time data access, and faster product deployment, making them ideal for digitally savvy businesses seeking agile financial solutions.

Regulatory Compliance and Security Measures

Commercial banks operate under stringent regulatory frameworks such as Basel III and Anti-Money Laundering (AML) laws, ensuring robust security measures including multi-factor authentication and encryption to protect business banking clients. Embedded finance providers, while integrating financial services within non-bank platforms, often rely on licensed banking partners to manage compliance and security, focusing on seamless user experience without compromising regulatory standards. Both entities prioritize data protection and fraud prevention, but commercial banks typically have more direct oversight and dedicated compliance teams tailored to complex regulatory environments.

Customer Support and Relationship Management

Commercial banks offer dedicated relationship managers and extensive customer support teams specialized in business banking, ensuring personalized assistance and proactive financial advice. Embedded finance providers integrate banking services directly into business platforms but typically rely on automated support systems, which may limit personalized interaction. Businesses seeking tailored guidance and ongoing relationship management often prefer commercial banks for their in-depth expertise and human touch in customer service.

Suitability for Different Business Sizes and Industries

Commercial banks offer tailored business banking solutions ideal for large enterprises requiring extensive credit facilities, treasury services, and global transaction support. Embedded finance providers excel in serving small to medium-sized businesses by integrating financial services within industry-specific platforms, enhancing convenience and operational efficiency. Industries with niche financial needs benefit from embedded finance's seamless integration, while traditional banks remain preferable for complex, large-scale financial operations.

Future Trends in Business Banking Solutions

Commercial banks are evolving by integrating digital platforms and AI-driven analytics to enhance personalized business banking services, while embedded finance providers embed financial solutions directly into non-financial business ecosystems, streamlining access to credit, payments, and cash management. Future trends indicate a shift towards hyper-personalization, real-time data integration, and seamless API connectivity, enabling businesses to manage finances within their operational workflows without leaving their primary software environments. This convergence fosters greater efficiency, reduces transaction friction, and supports agile financial decision-making in an increasingly digital economy.

Related Important Terms

API Banking

Commercial banks offer established API banking platforms with robust compliance, security, and wide-ranging financial products essential for business banking needs, supporting traditional account management and transaction services. Embedded finance providers leverage API banking to seamlessly integrate financial services into non-banking platforms, offering businesses streamlined payment processing, lending, and cash flow management within their existing software ecosystems.

Banking-as-a-Service (BaaS)

Commercial banks offer traditional business banking services with established regulatory compliance and a broad range of financial products, while Embedded Finance Providers leverage Banking-as-a-Service (BaaS) platforms to integrate banking functionalities directly into non-bank business applications, enabling seamless, real-time financial operations and enhanced customer experiences. BaaS empowers businesses to embed payment processing, lending, and account management features without the need to partner directly with a traditional commercial bank, streamlining financial service delivery and innovation.

White-Label Banking

Commercial banks offer traditional business banking services with established regulatory frameworks and extensive branch networks, while embedded finance providers enable seamless white-label banking solutions integrated directly into non-bank platforms, enhancing customer experience and operational efficiency. White-label banking through embedded finance allows businesses to offer customized financial products under their brand without the need for full banking licenses or infrastructure investment.

Fintech-as-a-Platform

Commercial banks offer traditional business banking services with established regulatory frameworks and capital reserves, while embedded finance providers leverage Fintech-as-a-Platform models to integrate financial services directly into non-bank digital ecosystems, enhancing customer experience and accelerating service delivery. Fintech-as-a-Platform enables embedded finance providers to rapidly scale tailored solutions such as payment processing, lending, and treasury management by using APIs and cloud infrastructure, disrupting conventional banking methods for SMEs and startups.

Direct Bank Integration

Commercial banks offer robust direct bank integration through established APIs, enabling seamless access to traditional financial services, real-time transaction processing, and comprehensive account management. Embedded finance providers focus on integrating banking functionalities directly into non-bank platforms, offering businesses customized financial solutions with simplified user experiences but often limited scope compared to full-service commercial bank APIs.

Contextual Payments

Commercial banks offer robust business banking solutions with established contextual payment systems integrated into traditional financial products, ensuring secure and compliant transactions. Embedded finance providers enable seamless contextual payments by integrating financial services directly into business platforms, enhancing user experience with real-time data-driven payment processing and automation.

Treasury-as-a-Service

Commercial banks offer traditional treasury services with established regulations, extensive capital reserves, and comprehensive risk management frameworks ideal for large-scale business banking. Embedded finance providers deliver Treasury-as-a-Service through integrated APIs, enabling real-time liquidity management, automated cash flow, and seamless payment solutions directly within business platforms.

Card Issuing Platforms

Commercial banks offer established card issuing platforms with robust regulatory compliance and integrated financial products tailored for business banking, ensuring secure transactions and trusted merchant services. Embedded finance providers leverage agile, API-driven card issuing solutions that enable seamless integration within business ecosystems, facilitating custom-branded payment cards and real-time expense management for enhanced operational control.

Multi-Rail Payments

Commercial banks offer traditional business banking with multi-rail payment systems integrating ACH, wire transfers, and card networks, ensuring broad accessibility and regulatory compliance. Embedded finance providers leverage API-driven platforms to embed payment capabilities directly within business software, enabling seamless multi-rail transactions with enhanced customization and faster settlement.

Vertical SaaS Banking

Commercial banks offer traditional business banking services with established regulatory frameworks, extensive financial products, and dedicated relationship management, whereas embedded finance providers integrated within Vertical SaaS platforms deliver seamless, industry-specific banking solutions directly within software workflows. Vertical SaaS banking leverages embedded finance to enhance operational efficiency, automate cash flow, and provide real-time financial insights tailored to niche industries, driving superior customer experience and faster decision-making for businesses.

Commercial Bank vs Embedded Finance Provider for business banking Infographic

moneydiff.com

moneydiff.com