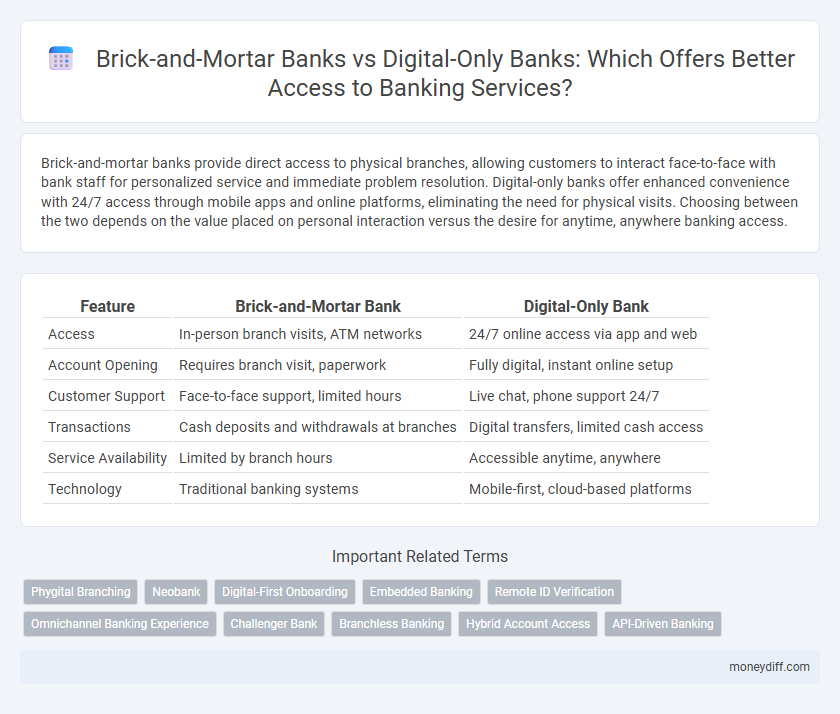

Brick-and-mortar banks provide direct access to physical branches, allowing customers to interact face-to-face with bank staff for personalized service and immediate problem resolution. Digital-only banks offer enhanced convenience with 24/7 access through mobile apps and online platforms, eliminating the need for physical visits. Choosing between the two depends on the value placed on personal interaction versus the desire for anytime, anywhere banking access.

Table of Comparison

| Feature | Brick-and-Mortar Bank | Digital-Only Bank |

|---|---|---|

| Access | In-person branch visits, ATM networks | 24/7 online access via app and web |

| Account Opening | Requires branch visit, paperwork | Fully digital, instant online setup |

| Customer Support | Face-to-face support, limited hours | Live chat, phone support 24/7 |

| Transactions | Cash deposits and withdrawals at branches | Digital transfers, limited cash access |

| Service Availability | Limited by branch hours | Accessible anytime, anywhere |

| Technology | Traditional banking systems | Mobile-first, cloud-based platforms |

Physical Accessibility: Branch Locations vs Digital Platforms

Brick-and-mortar banks provide extensive physical accessibility through numerous branch locations, enabling in-person services such as cash deposits, withdrawals, and financial consultations. Digital-only banks prioritize accessibility via intuitive digital platforms, offering 24/7 account management, mobile deposits, and instant transfers without geographical limitations. Customers valuing face-to-face interaction and physical presence often prefer brick-and-mortar banks, while those seeking convenience and rapid access favor digital-only banks with comprehensive online services.

Account Opening Procedures: In-Person vs Online

Brick-and-mortar banks require customers to visit physical branches for account opening, enabling face-to-face verification and personalized assistance, which enhances security and trust. Digital-only banks offer streamlined online account opening processes using remote identity verification technologies such as facial recognition and document upload, providing convenience and speed. Access to traditional branch services remains a crucial factor for users prioritizing in-person support, while tech-savvy customers prefer the flexibility of fully digital onboarding.

ATM and Cash Deposit Network Availability

Brick-and-mortar banks typically offer extensive ATM and cash deposit networks, providing customers with convenient access to physical cash transactions and in-person services. Digital-only banks often rely on partnerships with third-party ATM networks for cash withdrawals but may have limited options for cash deposits, challenging users who require frequent physical cash handling. The availability of robust ATM infrastructure and cash deposit capabilities remains a critical factor for customers weighing traditional banks against digital-only alternatives.

Customer Service: Face-to-Face Support vs Virtual Assistance

Brick-and-mortar banks provide direct face-to-face customer service, allowing personalized support and immediate resolution of complex banking issues through in-person interactions. Digital-only banks rely on virtual assistance, leveraging AI chatbots, video calls, and 24/7 online support to offer convenient and efficient service without geographic limitations. While physical branches enhance trust and personal connection, digital banks prioritize accessibility and rapid response through advanced technology platforms.

Business Hours: Traditional Banking vs 24/7 Digital Access

Traditional brick-and-mortar banks operate within set business hours, typically from 9 AM to 5 PM on weekdays, limiting customer access to in-person services. Digital-only banks provide 24/7 access through mobile apps and online platforms, enabling business transactions and account management anytime, anywhere. This constant accessibility enhances operational efficiency and supports businesses requiring flexible banking outside conventional hours.

Mobile App Functionality and Usability

Brick-and-mortar banks offer in-person access, providing customers with physical branches for complex transactions and personalized service, whereas digital-only banks prioritize mobile app functionality to deliver seamless, 24/7 banking experiences with intuitive interfaces and real-time notifications. Mobile apps of digital-only banks often feature advanced usability elements such as biometric authentication, instant fund transfers, budgeting tools, and AI-driven customer support, enhancing convenience and efficiency. Customers valuing immediate digital interaction benefit from app-driven services, while those requiring face-to-face assistance prefer traditional branches.

Security Measures: Physical vs Digital

Brick-and-mortar banks provide tangible security measures including vaults, safes, and physical guards to protect assets and customer data on-site. Digital-only banks implement advanced cybersecurity protocols such as end-to-end encryption, multi-factor authentication, and continuous monitoring to safeguard digital transactions and personal information. While physical banks rely on controlled environments and secure locations, digital banks emphasize software-driven protection against cyber threats and identity theft.

Access for Underbanked or Tech-Challenged Customers

Brick-and-mortar banks provide essential physical access points for underbanked and tech-challenged customers, ensuring personalized service and face-to-face assistance that digital-only banks cannot replicate. These traditional banks often maintain extensive branch networks and ATMs in underserved areas, addressing barriers like limited internet access and low digital literacy. While digital-only banks offer convenience, their reliance on technology may create obstacles for customers lacking reliable devices or familiarity with online banking platforms.

International Access and Travel Convenience

Brick-and-mortar banks offer reliable in-person services and global ATM networks that provide seamless access for international travelers. Digital-only banks excel in providing real-time currency exchange rates, low foreign transaction fees, and app-based account management accessible worldwide. Travelers benefit from combining physical branch support with the convenience of digital banking tools tailored for cross-border access.

Emergency Services: Immediate Help vs Online Resolution

Brick-and-mortar banks provide immediate, face-to-face emergency assistance, crucial for urgent situations like fraud resolution or lost cards, ensuring faster personal intervention. Digital-only banks rely on online support channels such as chatbots, apps, and call centers that offer 24/7 access but may have delayed responses during high-demand periods. Customers seeking instant emergency help often prefer physical branches, while those comfortable with digital tools value the convenience and accessibility of digital-only banking platforms.

Related Important Terms

Phygital Branching

Phygital branching in banking combines the convenience of digital platforms with the personalized service of brick-and-mortar locations, enhancing customer access through integrated online and physical touchpoints. This hybrid approach supports seamless transactions, personalized advisory services, and instant problem resolution, bridging the gap between digital-only banks and traditional branches.

Neobank

Brick-and-mortar banks offer physical branches providing personalized customer service and immediate cash access, appealing to clients valuing face-to-face interactions. Neobanks operate entirely online, delivering 24/7 digital access, lower fees, and innovative financial tools tailored for tech-savvy users seeking convenience and real-time account management.

Digital-First Onboarding

Digital-only banks prioritize digital-first onboarding, enabling customers to open accounts swiftly through mobile apps or websites without visiting physical branches, enhancing convenience and accessibility. Brick-and-mortar banks often incorporate digital onboarding but still require in-person visits for certain services, limiting the speed and flexibility of account access compared to fully digital institutions.

Embedded Banking

Brick-and-mortar banks offer physical branches providing direct customer service and embedded banking solutions integrated within local communities, enhancing trust and accessibility for in-person transactions. Digital-only banks excel in seamless embedded banking experiences through advanced mobile apps and APIs, enabling real-time access to financial services embedded within third-party platforms for greater convenience.

Remote ID Verification

Brick-and-mortar banks often require in-person visits for identity verification, which can delay account opening and limit accessibility for remote customers. Digital-only banks leverage advanced remote ID verification technologies, such as biometric authentication and AI-driven document scanning, enabling faster, secure, and seamless access for users regardless of location.

Omnichannel Banking Experience

Brick-and-mortar banks offer personalized in-branch services combined with digital platforms, ensuring seamless omnichannel access for customers preferring face-to-face interactions. Digital-only banks prioritize mobile and online interfaces, delivering 24/7 accessibility with integrated features across devices to enhance user convenience and real-time account management.

Challenger Bank

Challenger banks, as digital-only entities, offer seamless 24/7 access to banking services through mobile apps and online platforms, eliminating the need for physical branches. Unlike brick-and-mortar banks, challenger banks prioritize user-friendly digital interfaces and real-time transaction capabilities, enhancing customer convenience and financial management efficiency.

Branchless Banking

Digital-only banks prioritize branchless banking, offering 24/7 access through mobile apps and online platforms, which reduces the need for physical locations and lowers operational costs. Brick-and-mortar banks provide in-person services and personalized support via branches but may have limited accessibility outside business hours and higher fees due to physical infrastructure.

Hybrid Account Access

Hybrid account access combines the physical convenience of brick-and-mortar banks with the 24/7 digital services of online-only banks, offering customers flexible transaction options, including in-person assistance and seamless mobile banking. This integration enhances user experience by providing secure ATM access, branch services, and real-time account management through robust digital platforms.

API-Driven Banking

Brick-and-mortar banks offer physical branch access, facilitating in-person services and personalized customer interactions, while digital-only banks leverage API-driven banking technology to provide seamless, real-time financial data integration and enhanced digital user experiences. API-driven banking enables digital banks to deliver faster, more flexible services such as instant account updates, automated payments, and third-party app connectivity, transforming customer access and operational efficiency.

Brick-and-Mortar Bank vs Digital-Only Bank for access Infographic

moneydiff.com

moneydiff.com