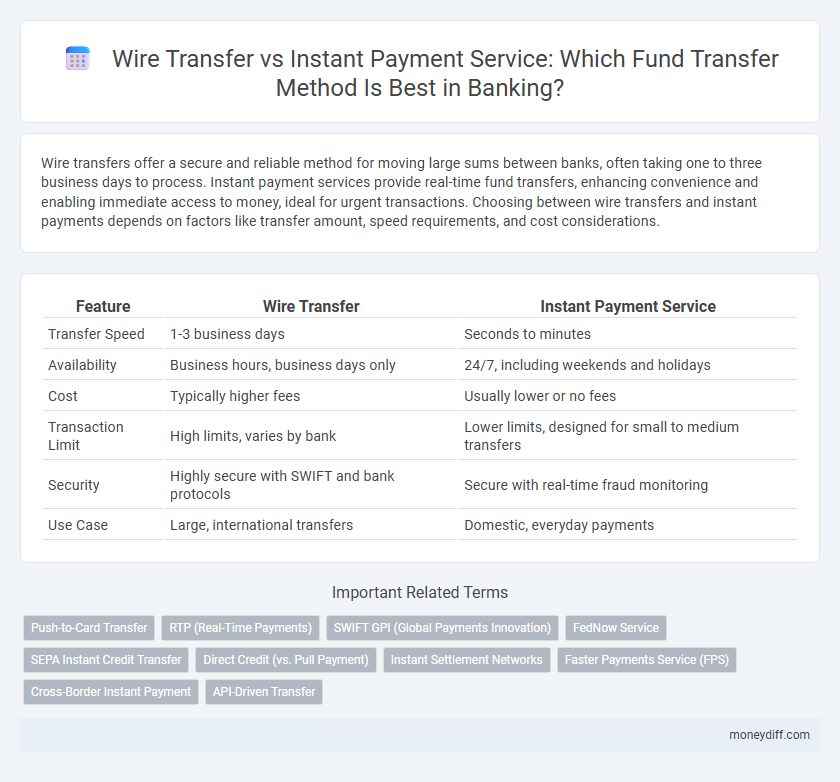

Wire transfers offer a secure and reliable method for moving large sums between banks, often taking one to three business days to process. Instant payment services provide real-time fund transfers, enhancing convenience and enabling immediate access to money, ideal for urgent transactions. Choosing between wire transfers and instant payments depends on factors like transfer amount, speed requirements, and cost considerations.

Table of Comparison

| Feature | Wire Transfer | Instant Payment Service |

|---|---|---|

| Transfer Speed | 1-3 business days | Seconds to minutes |

| Availability | Business hours, business days only | 24/7, including weekends and holidays |

| Cost | Typically higher fees | Usually lower or no fees |

| Transaction Limit | High limits, varies by bank | Lower limits, designed for small to medium transfers |

| Security | Highly secure with SWIFT and bank protocols | Secure with real-time fraud monitoring |

| Use Case | Large, international transfers | Domestic, everyday payments |

Understanding Wire Transfers: Fundamentals and Process

Wire transfers involve electronically moving funds between banks through a secure network such as SWIFT or Fedwire, typically requiring 1-3 business days for settlement due to intermediary bank processing. This method ensures high transaction security and is ideal for large sums or international transfers, though fees and processing times vary by institution and destination. Understanding the wire transfer process, including sender and receiver bank coordination and regulatory compliance checks, is essential for safe and efficient fund transfers.

What Are Instant Payment Services? Key Features

Instant Payment Services enable the real-time transfer of funds between bank accounts, providing immediate confirmation and settlement typically within seconds. Key features include 24/7 availability, enhanced security protocols, and interoperability across multiple financial institutions and payment networks. Unlike traditional wire transfers, these services support lower transaction fees and accessibility via mobile and online platforms, facilitating faster, convenient, and seamless payments.

Speed Comparison: Wire Transfer vs Instant Payment Service

Wire transfers typically take 1 to 3 business days to complete, depending on the banks and countries involved, while Instant Payment Services process transactions within seconds or minutes, enabling near real-time fund availability. The speed advantage of Instant Payment Services dramatically enhances cash flow management and reduces settlement risk for both individuals and businesses. Despite faster processing, wire transfers remain preferred for larger or international transfers due to their reliability and security features.

Cost and Fees: A Comparative Analysis

Wire transfers typically incur higher fees, ranging from $25 to $50 per transaction, especially for international transfers, while instant payment services often charge lower or no fees for domestic transfers, enhancing cost efficiency. Wire transfers may also involve intermediary bank fees, increasing total costs, whereas instant payment services operate within integrated networks, reducing additional expenses. Choosing instant payment services can result in significant savings for frequent or small-value transactions due to their lower cost structure and faster processing times.

Security Measures in Fund Transfers

Wire transfers employ rigorous security protocols including multi-factor authentication, encryption, and verification steps to prevent fraud and unauthorized access. Instant Payment Services integrate advanced real-time fraud detection systems and end-to-end encryption to secure transactions while enabling rapid fund transfers. Both methods require compliance with banking regulations such as AML and KYC to enhance overall transactional security.

Global Reach and Accessibility

Wire transfers offer extensive global reach by enabling cross-border transactions to nearly all countries, making them ideal for international fund transfers despite longer processing times. Instant payment services prioritize accessibility with real-time transactions primarily within domestic or regional networks but have limited global coverage compared to wire transfers. Financial institutions increasingly integrate both methods to balance the need for wide geographic reach and swift fund accessibility.

Transaction Limits: What You Need to Know

Wire transfers typically have higher transaction limits, often ranging from $10,000 to $1,000,000 per transfer depending on the bank and account type, making them suitable for large-value transactions. Instant payment services generally have lower limits, usually between $500 and $5,000 per transaction, designed for quick, everyday payments with immediate settlement. Understanding these limits helps businesses and individuals choose the appropriate method based on transfer amount and urgency.

Use Cases: When to Choose Wire Transfer vs Instant Payment

Wire transfers provide a secure and reliable option for high-value or international transactions that require formal banking processes and detailed tracking. Instant Payment Services are ideal for urgent, low-value transfers within the same country, enabling near real-time fund availability and convenience for daily consumer or small business payments. Choosing between wire transfers and instant payments depends on transaction urgency, amount, geographic scope, and the need for traceability.

User Experience and Convenience

Wire transfers typically involve processing times ranging from several hours to multiple business days, which may delay access to funds and reduce user convenience. Instant Payment Services offer near real-time fund transfers, significantly enhancing user experience by providing immediate access to transferred money and enabling faster financial decision-making. The seamless integration of Instant Payment Services with mobile and online banking platforms further improves convenience by allowing users to initiate and track transactions effortlessly.

Future Trends in Fund Transfer Technology

Future trends in fund transfer technology emphasize seamless integration of Instant Payment Services with blockchain and AI to enhance security, speed, and accessibility for global transactions. Wire transfers are evolving through automation and real-time tracking features, reducing settlement times and operational costs. Emerging innovations prioritize interoperability and user-centric mobile platforms, driving widespread adoption of instantaneous cross-border payments.

Related Important Terms

Push-to-Card Transfer

Push-to-Card Transfer enables real-time fund transfers directly to recipients' debit or credit cards, offering faster settlement compared to traditional wire transfers that often require hours to days for processing. This instant payment service enhances liquidity and convenience by eliminating intermediary steps common in wire transfers, providing immediate access to funds for both consumers and businesses.

RTP (Real-Time Payments)

Real-Time Payments (RTP) enable immediate fund transfers, offering a significant advantage over traditional wire transfers that typically take hours to days for processing and settlement. RTP systems enhance transaction speed, availability 24/7, and provide end-to-end payment tracking, making them ideal for urgent and low-value payments in the banking sector.

SWIFT GPI (Global Payments Innovation)

SWIFT gpi revolutionizes cross-border wire transfers by enabling faster, transparent, and traceable transactions with end-to-end tracking, significantly reducing settlement times compared to traditional wire transfers. Instant Payment Services excel in rapid domestic fund transfers but lack the global reach, security standards, and comprehensive tracking capabilities that SWIFT gpi provides for international banking transactions.

FedNow Service

FedNow Service enables real-time instant payments with settlement occurring within seconds, offering greater speed and availability compared to traditional wire transfers which may take hours to process and often operate only during banking hours. Unlike wire transfers, FedNow supports 24/7 fund transfers with immediate access to funds, enhancing liquidity and improving cash flow management for both consumers and businesses.

SEPA Instant Credit Transfer

SEPA Instant Credit Transfer enables real-time fund transfers across Eurozone banks within seconds, offering 24/7 availability and settlement guarantees that surpass traditional wire transfers, which typically require several hours to days and depend on banking hours and batch processing. This instant payment service reduces settlement risk and enhances liquidity management for businesses and consumers by ensuring immediate fund availability and confirmation.

Direct Credit (vs. Pull Payment)

Wire Transfer enables direct credit by securely transferring funds from the sender's account to the recipient's bank account, typically taking 1-3 business days, while Instant Payment Services facilitate immediate direct credit settlements within seconds, enhancing cash flow and liquidity. Direct credit systems minimize fraud risks inherent in pull payment methods by authorizing funds exclusively from the payer's account to the payee, ensuring faster, secure, and verified electronic fund transfers.

Instant Settlement Networks

Instant Settlement Networks enable real-time fund transfers, offering seamless, 24/7 availability with immediate confirmation and settlement, significantly reducing counterparty risk compared to traditional Wire Transfers that typically settle within one to three business days. These networks leverage advanced payment infrastructures to facilitate instant liquidity, enhancing cash flow management and operational efficiency in banking transactions.

Faster Payments Service (FPS)

Faster Payments Service (FPS) enables near-instantaneous fund transfers between UK bank accounts, offering a significant speed advantage over traditional wire transfers that can take several hours to days. FPS supports transfers up to PS250,000 with real-time settlement, making it ideal for urgent payments and improving liquidity management for both individuals and businesses.

Cross-Border Instant Payment

Cross-border instant payment services enable real-time fund transfers across international banking networks, significantly reducing settlement times compared to traditional wire transfers, which often take several days and incur higher fees. These instant systems leverage advanced payment infrastructures and standardized messaging protocols to enhance transparency, security, and operational efficiency in global money transfers.

API-Driven Transfer

API-driven wire transfers enable secure, high-value transactions with established settlement times, making them suitable for corporate and cross-border payments. Instant Payment Services leverage real-time APIs to deliver immediate fund transfers, enhancing liquidity and customer experience for retail and small business banking.

Wire Transfer vs Instant Payment Service for fund transfers. Infographic

moneydiff.com

moneydiff.com