Physical branches offer personalized customer service and immediate assistance for complex banking needs, enhancing trust through face-to-face interactions. Virtual branches provide convenient 24/7 access to banking services, allowing users to manage accounts, transfer funds, and pay bills from any location. Emphasizing security and user-friendly digital interfaces, virtual branches optimize efficiency while reducing operational costs compared to traditional brick-and-mortar establishments.

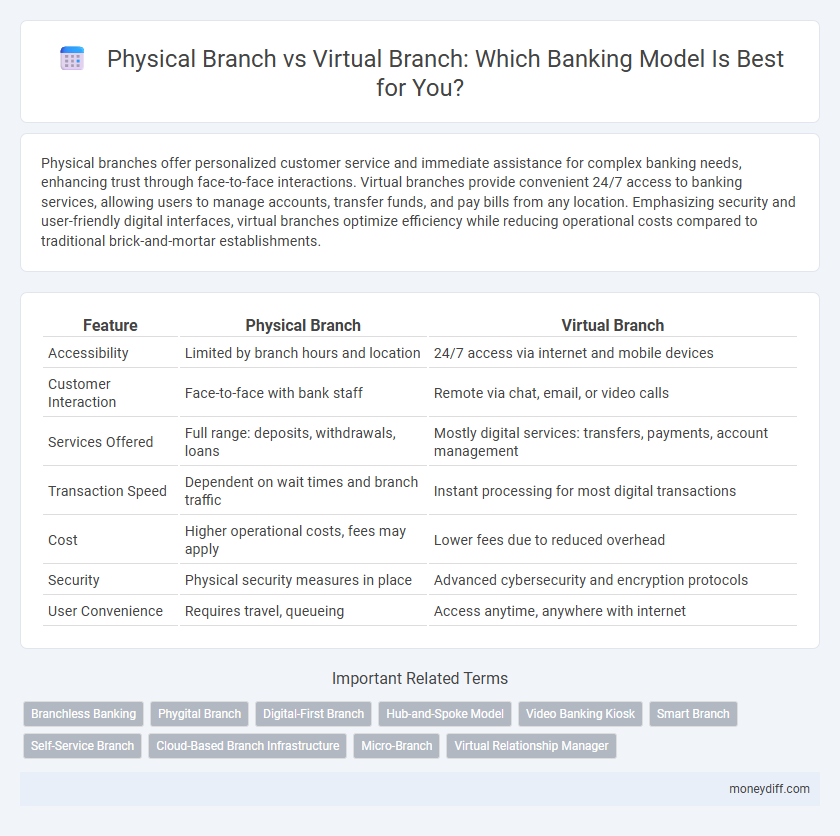

Table of Comparison

| Feature | Physical Branch | Virtual Branch |

|---|---|---|

| Accessibility | Limited by branch hours and location | 24/7 access via internet and mobile devices |

| Customer Interaction | Face-to-face with bank staff | Remote via chat, email, or video calls |

| Services Offered | Full range: deposits, withdrawals, loans | Mostly digital services: transfers, payments, account management |

| Transaction Speed | Dependent on wait times and branch traffic | Instant processing for most digital transactions |

| Cost | Higher operational costs, fees may apply | Lower fees due to reduced overhead |

| Security | Physical security measures in place | Advanced cybersecurity and encryption protocols |

| User Convenience | Requires travel, queueing | Access anytime, anywhere with internet |

Introduction to Physical and Virtual Bank Branches

Physical bank branches provide traditional, face-to-face customer services, including cash deposits, withdrawals, and personalized financial advice, typically located in accessible urban or suburban areas. Virtual bank branches leverage digital platforms and mobile applications, enabling clients to conduct transactions, manage accounts, and access financial services remotely with enhanced convenience and 24/7 availability. The evolution from physical to virtual branches reflects the banking industry's response to technological advancements and changing customer preferences for seamless, efficient service delivery.

Accessibility: Physical Branches vs Virtual Platforms

Physical bank branches provide direct, face-to-face service essential for complex transactions and personalized assistance, often preferred by customers with limited digital literacy. Virtual banking platforms offer 24/7 accessibility via smartphones and computers, enabling instant account management, bill payments, and fund transfers from any location with internet access. The increasing adoption of mobile apps and online portals enhances financial inclusion by bridging geographical barriers, while physical branches maintain critical roles in customer trust and high-security services.

Cost Efficiency for Banks and Customers

Physical bank branches incur higher operational costs such as rent, utilities, and staffing, significantly impacting the overall expense structure for banks. Virtual branches reduce these overheads by leveraging digital platforms, enabling banks to offer services at a fraction of the cost while providing 24/7 access for customers. Cost efficiency in virtual branches translates to lower fees and increased convenience, making digital banking a financially attractive option for both institutions and clients.

Security and Privacy Considerations

Physical banking branches offer robust security measures such as secure vaults, on-site staff verification, and physical surveillance systems that protect against unauthorized access and fraud. Virtual branches rely heavily on advanced encryption protocols, multi-factor authentication, and continuous network monitoring to safeguard customer data and prevent cyberattacks. Both models must comply with stringent regulatory standards like GDPR and PCI DSS to ensure privacy protection and secure financial transactions.

Customer Experience and Personalized Service

Physical branches offer direct, in-person customer service, enabling personalized assistance through face-to-face interactions and immediate problem-solving, which enhances customer trust and satisfaction. Virtual branches provide 24/7 accessibility, leveraging AI-driven chatbots and personalized digital interfaces to deliver tailored banking experiences efficiently and conveniently. Combining both platforms allows banks to optimize customer experience by blending human empathy with innovative technology-driven personalization.

Range of Services: Traditional vs Digital

Physical banking branches offer a wide range of in-person services including cash deposits, loan consultations, safe deposit boxes, and personalized financial advice, catering to customers who prefer face-to-face interactions. Virtual branches provide digital access to essential banking services such as account management, fund transfers, mobile check deposits, and real-time customer support, leveraging online platforms and mobile apps for convenience. While virtual branches excel in 24/7 accessibility and automation, physical branches remain critical for complex transactions and personalized service.

Technological Advances Shaping Banking Branches

Technological advances such as AI-driven chatbots, biometric authentication, and real-time data analytics have transformed virtual banking branches into efficient, secure platforms that offer personalized customer experiences without the need for physical presence. Physical branches increasingly integrate digital kiosks and smart ATMs to enhance service speed and convenience while maintaining face-to-face interactions for complex transactions. The rise of cloud computing and mobile banking apps fuels the shift towards virtual branches, enabling banks to reduce operational costs and expand accessibility beyond traditional geographic limitations.

Convenience and Time Management

Virtual banking branches offer unparalleled convenience by enabling 24/7 access to account management and transactions from any location, significantly reducing time spent commuting and waiting in line. Physical branches provide personalized services and face-to-face interactions, which can be essential for complex financial decisions but require scheduled visits and adherence to branch hours. Integrating virtual services with physical locations can optimize time management and enhance overall banking convenience for customers.

Challenges and Limitations of Each Model

Physical bank branches face challenges such as high operational costs, limited accessibility during non-business hours, and geographic constraints restricting customer reach. Virtual branches encounter limitations including cybersecurity risks, lack of personalized customer service, and dependence on digital literacy and internet connectivity. Both models must address these issues to optimize customer experience and operational efficiency.

Future Trends: Hybrid Banking Solutions

Hybrid banking solutions combine the personalized service of physical branches with the convenience and efficiency of virtual banking platforms, reshaping the future of customer engagement. Advanced technologies such as AI-driven chatbots, biometric authentication, and augmented reality enable seamless interactions across both physical and digital channels. Banks investing in hybrid models see increased customer satisfaction and operational efficiency by offering tailored financial services accessible anytime, anywhere.

Related Important Terms

Branchless Banking

Branchless banking leverages digital platforms and mobile technology to provide financial services without the need for physical branch locations, significantly reducing operational costs and enhancing customer convenience. This model enables real-time transactions, 24/7 account access, and expanded reach to underserved populations, driving financial inclusion and transforming traditional banking paradigms.

Phygital Branch

Phygital branches integrate physical banking locations with virtual technology, offering customers seamless access to in-person services and online banking features. This hybrid model enhances customer experience by combining the personalized interaction of physical branches with the convenience and efficiency of digital platforms.

Digital-First Branch

Digital-first branches leverage advanced technologies such as AI-powered kiosks and biometric authentication to enhance customer experience while reducing operational costs compared to traditional physical branches. These virtual branches offer seamless 24/7 access to banking services, personalized financial advice, and instant transaction capabilities, driving higher engagement and convenience in modern banking.

Hub-and-Spoke Model

The Hub-and-Spoke model in banking leverages physical branches as central hubs offering comprehensive services while virtual branches act as spokes providing convenient, remote access to basic transactions and customer support. This hybrid approach optimizes operational efficiency, enhances customer reach, and balances cost-effectiveness with personalized financial services.

Video Banking Kiosk

Video banking kiosks combine the personalized service of physical branches with the convenience of virtual banking, enabling customers to conduct complex transactions remotely through real-time video interactions with bank representatives. These kiosks enhance accessibility in high-traffic or underserved areas, reduce operational costs compared to maintaining full-service branches, and improve customer satisfaction by offering immediate support without the need for in-person visits.

Smart Branch

Smart branches combine advanced technologies like AI, biometric authentication, and interactive kiosks to enhance customer experience and streamline banking operations. These physical locations offer personalized services and seamless digital integration, bridging the gap between traditional banking and virtual branches.

Self-Service Branch

Self-service branches leverage advanced kiosks, ATMs, and digital interfaces to provide customers efficient, contactless banking options without teller assistance. These branches reduce operational costs and increase convenience by enabling 24/7 access to services like cash deposits, withdrawals, account management, and loan applications.

Cloud-Based Branch Infrastructure

Cloud-based branch infrastructure in banking enhances operational efficiency by enabling virtual branches that provide 24/7 customer access without physical limitations, reducing overhead costs and accelerating service deployment. Integration of cloud technologies supports seamless scalability, real-time data processing, and robust security measures, driving a transformative shift from traditional physical branches to agile virtual platforms.

Micro-Branch

Micro-branches offer a compact, cost-effective alternative to traditional physical bank branches, providing essential services in high-traffic locations while leveraging digital tools to enhance customer experience. These hybrid banking points combine personalized service with virtual banking features, increasing accessibility and operational efficiency for both rural and urban customers.

Virtual Relationship Manager

Virtual Relationship Managers in banking leverage AI-driven platforms to offer personalized financial advice and 24/7 support, enhancing customer engagement without geographic constraints. This digital approach reduces operational costs and increases accessibility compared to traditional physical branches, driving higher customer satisfaction through instant, tailored interactions.

Physical Branch vs Virtual Branch for banking. Infographic

moneydiff.com

moneydiff.com