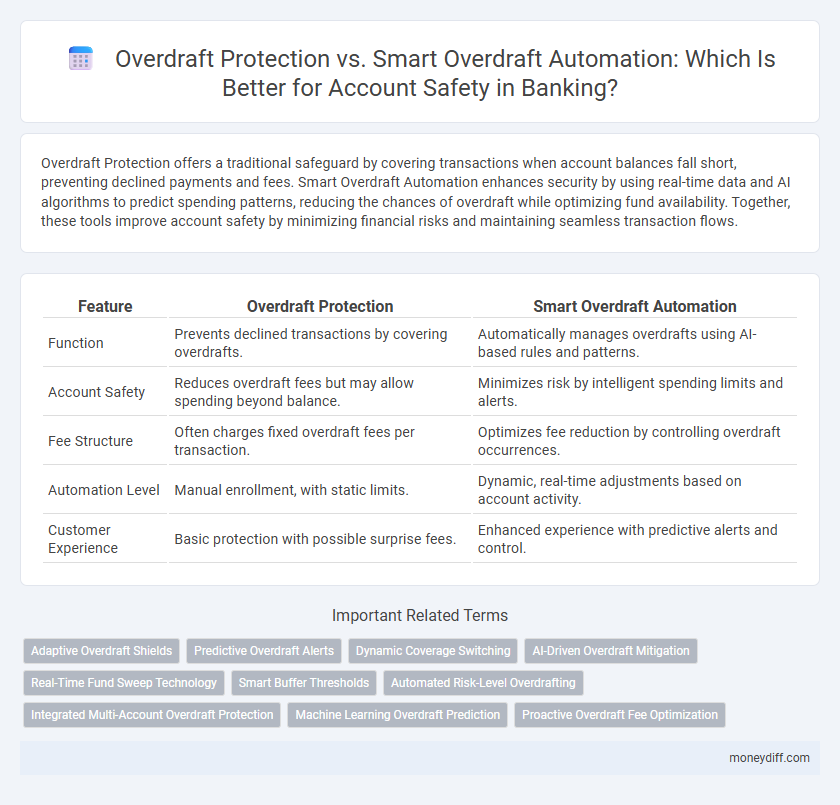

Overdraft Protection offers a traditional safeguard by covering transactions when account balances fall short, preventing declined payments and fees. Smart Overdraft Automation enhances security by using real-time data and AI algorithms to predict spending patterns, reducing the chances of overdraft while optimizing fund availability. Together, these tools improve account safety by minimizing financial risks and maintaining seamless transaction flows.

Table of Comparison

| Feature | Overdraft Protection | Smart Overdraft Automation |

|---|---|---|

| Function | Prevents declined transactions by covering overdrafts. | Automatically manages overdrafts using AI-based rules and patterns. |

| Account Safety | Reduces overdraft fees but may allow spending beyond balance. | Minimizes risk by intelligent spending limits and alerts. |

| Fee Structure | Often charges fixed overdraft fees per transaction. | Optimizes fee reduction by controlling overdraft occurrences. |

| Automation Level | Manual enrollment, with static limits. | Dynamic, real-time adjustments based on account activity. |

| Customer Experience | Basic protection with possible surprise fees. | Enhanced experience with predictive alerts and control. |

Understanding Overdraft Protection in Banking

Overdraft protection in banking safeguards account holders from declined transactions and overdraft fees by linking checking accounts to savings or credit lines, ensuring funds cover shortfalls. This traditional method provides a safety net but may incur interest or transfer fees, depending on the linked source. Smart overdraft automation enhances this protection through real-time monitoring and automated fund transfers, reducing fees and improving account management efficiency.

What is Smart Overdraft Automation?

Smart Overdraft Automation is an advanced banking feature that monitors account balances in real-time to prevent overdrafts by automatically transferring funds from linked accounts or approved lines of credit. This technology reduces fees and improves financial management by proactively managing shortfalls before they trigger costly penalties. Compared to traditional overdraft protection, Smart Overdraft Automation offers enhanced security and seamless account safety through automated, intelligent transaction handling.

Key Differences: Overdraft Protection vs Automation

Overdraft Protection typically involves a pre-approved line of credit or linking to a savings account to cover transactions exceeding the available balance, minimizing overdraft fees. In contrast, Smart Overdraft Automation uses AI-driven algorithms to analyze spending patterns and automatically manage fund transfers or transaction approvals, enhancing real-time account safety. The key difference lies in proactive, automated decision-making versus manual or predetermined coverage, significantly reducing the risk of declined transactions and unexpected fees.

The Benefits of Traditional Overdraft Protection

Traditional overdraft protection provides account holders with a financial safety net by automatically covering transactions that exceed their available balance, preventing declined payments and associated fees. This service helps maintain account continuity, ensuring critical bills and purchases are processed without interruption. By linking to a savings account or line of credit, it offers cost-effective coverage that reduces the risk of overdraft penalties and preserves credit standing.

How Smart Automation Enhances Account Safety

Smart overdraft automation enhances account safety by using real-time transaction monitoring and predictive analytics to prevent overdrafts before they occur. This technology instantly transfers funds from linked accounts or alerts users to low balances, reducing the risk of declined transactions and associated fees. Unlike traditional overdraft protection, smart automation adapts dynamically to individual spending patterns, providing a proactive and personalized safety net.

Costs and Fees: Comparing Overdraft Options

Overdraft Protection often involves fixed fees or daily charges that can quickly accumulate, leading to higher costs for account holders during short-term cash shortages. Smart Overdraft Automation leverages real-time account monitoring and AI algorithms to minimize unnecessary overdrafts, typically reducing fees by approving only essential transactions or temporarily linking to backup accounts. Choosing Smart Overdraft Automation can significantly lower overall overdraft costs while enhancing account safety through proactive financial management.

Which Option Offers Better Fraud Prevention?

Smart Overdraft Automation offers superior fraud prevention compared to traditional Overdraft Protection by utilizing real-time transaction monitoring and machine learning algorithms to detect unusual activity instantly. This technology minimizes the risk of unauthorized overdrafts and reduces false declines by analyzing spending patterns and flagging suspicious transactions. Enhanced security features combined with automated alerts provide a proactive approach to safeguarding account integrity against fraudulent behavior.

Impact on Credit Score and Account Health

Overdraft Protection offers a safety net by covering transactions that exceed the account balance, minimizing declined transactions and potential fees, which helps maintain a positive account history but typically does not affect credit scores. Smart Overdraft Automation enhances account health by using predictive analytics to manage funds proactively, reducing overdraft occurrences and lowering the risk of negative balances, thereby supporting better financial habits without impacting credit reports. Both systems improve account safety, but Smart Overdraft Automation provides a more dynamic approach to preventing overdrafts, contributing to overall account stability.

Choosing the Right Overdraft Solution for You

Overdraft Protection offers a traditional safety net by linking your checking account to a savings account or credit line to cover shortfalls, preventing declined transactions and fees. Smart Overdraft Automation uses real-time data and machine learning to predict overdrafts and dynamically manage funds, optimizing account safety with minimal fees and improved cash flow. Choosing the right solution depends on your financial habits, transaction volume, and preference for manual control versus automated, data-driven overdraft management.

Future Trends in Overdraft Management Technologies

Future trends in overdraft management technologies emphasize the integration of AI-driven smart overdraft automation, which dynamically analyzes spending patterns to prevent account overdrafts more effectively than traditional overdraft protection. Banks are increasingly leveraging machine learning algorithms to offer personalized overdraft limits and real-time alerts, enhancing account safety and reducing fees. These innovations aim to improve customer experience by minimizing financial stress and promoting responsible banking habits through predictive analytics and automated safeguards.

Related Important Terms

Adaptive Overdraft Shields

Adaptive Overdraft Shields enhance account safety by dynamically managing funds to prevent overdrafts, unlike traditional overdraft protection which merely covers excess withdrawals. Smart Overdraft Automation leverages real-time data and behavioral analytics to optimize fund transfers, reducing fees and maintaining liquidity efficiently.

Predictive Overdraft Alerts

Overdraft Protection offers a safety net by automatically covering transactions that exceed an account's balance, typically through linked backup accounts or credit lines, reducing the risk of declined payments and overdraft fees. Smart Overdraft Automation leverages predictive overdraft alerts powered by AI to forecast potential shortfalls before they occur, enabling proactive fund transfers or spending adjustments that enhance account safety and minimize financial disruptions.

Dynamic Coverage Switching

Dynamic Coverage Switching in Smart Overdraft Automation enhances account safety by automatically adjusting protection based on real-time transaction activity and account balances, reducing overdraft fees and preventing declined transactions. Unlike traditional overdraft protection that relies on static limits, this technology leverages predictive analytics to optimize coverage dynamically and ensure seamless fund access.

AI-Driven Overdraft Mitigation

AI-driven overdraft mitigation enhances account safety by automatically analyzing spending patterns and available balances to prevent overdrafts before they occur. Unlike traditional overdraft protection, smart overdraft automation uses real-time data and machine learning algorithms to offer personalized alerts and seamless funds transfers, reducing fees and financial stress for account holders.

Real-Time Fund Sweep Technology

Overdraft Protection traditionally prevents account declines by linking savings or credit accounts, while Smart Overdraft Automation utilizes Real-Time Fund Sweep Technology to instantly transfer funds and cover transactions without manual intervention. This advanced technology enhances account safety by minimizing overdraft fees and ensuring seamless liquidity management in real time.

Smart Buffer Thresholds

Smart Overdraft Automation enhances account safety by implementing dynamic buffer thresholds that adjust in real-time based on spending patterns and account behavior, reducing the risk of declined transactions or unexpected fees. Unlike traditional overdraft protection that offers static coverage limits, smart buffers provide personalized, predictive safeguards ensuring more precise control over overdraft occurrences.

Automated Risk-Level Overdrafting

Overdraft protection offers a safety net by preventing declined transactions, but smart overdraft automation enhances account security through real-time, automated risk-level overdrafting that dynamically adjusts limits based on spending patterns and account risk profiles. This advanced system reduces overdraft fees and fraud exposure by leveraging machine learning algorithms to anticipate and manage potential overdrafts proactively.

Integrated Multi-Account Overdraft Protection

Integrated Multi-Account Overdraft Protection enhances account safety by automatically covering overdrafts using linked accounts, minimizing fees and declines. Smart Overdraft Automation further optimizes this process through real-time alerts and AI-driven fund transfers, reducing risk and ensuring seamless transaction approval.

Machine Learning Overdraft Prediction

Machine Learning Overdraft Prediction enhances Smart Overdraft Automation by analyzing transaction patterns to proactively prevent overdraft occurrences, reducing fees and improving account safety. Unlike traditional Overdraft Protection, which reacts after account depletion, smart automation uses predictive algorithms to manage funds dynamically and optimize customer financial health.

Proactive Overdraft Fee Optimization

Overdraft Protection manually shields accounts from unexpected fees by linking savings or credit, while Smart Overdraft Automation uses real-time analytics and machine learning to proactively optimize fee prevention based on spending patterns. This advanced technology reduces costly overdrafts by dynamically adjusting thresholds and alerting customers before fees occur, enhancing overall account safety and financial health.

Overdraft Protection vs Smart Overdraft Automation for account safety Infographic

moneydiff.com

moneydiff.com