Credit unions offer personalized service and lower fees, making them ideal for members seeking community-focused money management solutions. Community fintech banks leverage advanced technology to provide seamless digital banking experiences and innovative financial tools. Choosing between the two depends on whether you prioritize personalized support or cutting-edge digital convenience for managing your finances.

Table of Comparison

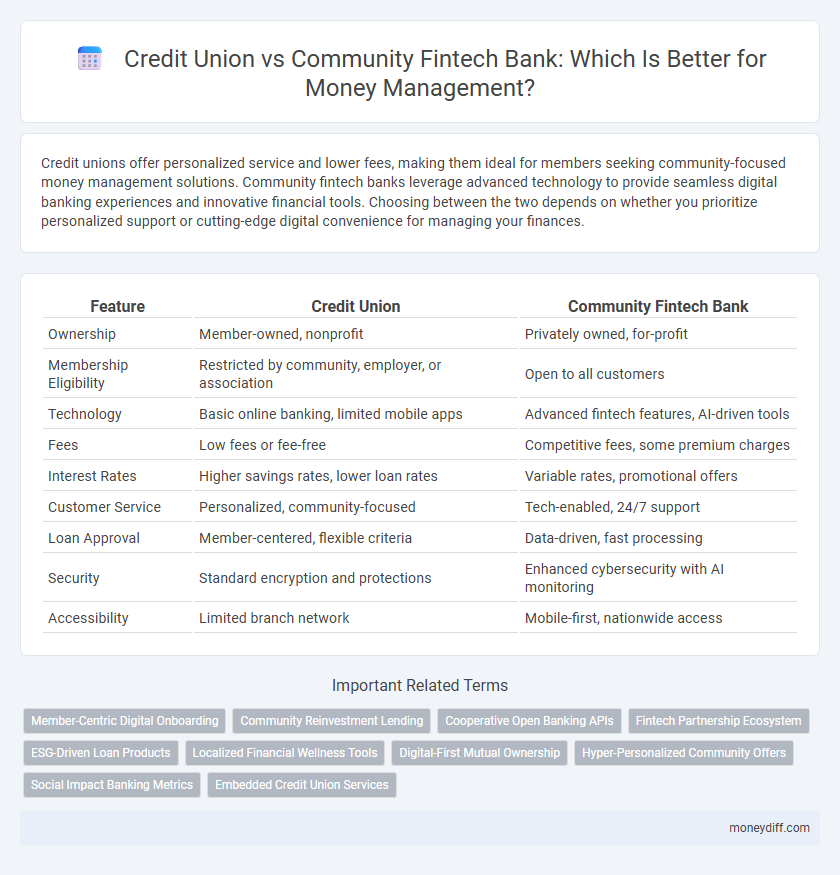

| Feature | Credit Union | Community Fintech Bank |

|---|---|---|

| Ownership | Member-owned, nonprofit | Privately owned, for-profit |

| Membership Eligibility | Restricted by community, employer, or association | Open to all customers |

| Technology | Basic online banking, limited mobile apps | Advanced fintech features, AI-driven tools |

| Fees | Low fees or fee-free | Competitive fees, some premium charges |

| Interest Rates | Higher savings rates, lower loan rates | Variable rates, promotional offers |

| Customer Service | Personalized, community-focused | Tech-enabled, 24/7 support |

| Loan Approval | Member-centered, flexible criteria | Data-driven, fast processing |

| Security | Standard encryption and protections | Enhanced cybersecurity with AI monitoring |

| Accessibility | Limited branch network | Mobile-first, nationwide access |

Understanding the Basics: Credit Unions vs Community Fintech Banks

Credit unions are member-owned, nonprofit financial cooperatives that prioritize personalized service and lower fees, making them ideal for those seeking community-focused money management. Community fintech banks combine technology-driven solutions with a local presence, offering innovative mobile banking, faster digital transactions, and streamlined customer experiences. When comparing credit unions and community fintech banks, evaluating factors such as fee structures, accessibility, interest rates, and digital capabilities helps consumers make informed decisions for effective money management.

Membership Requirements and Accessibility

Credit unions require members to meet specific eligibility criteria, such as employment, geography, or affiliation, which can limit accessibility but foster a community-focused environment. Community fintech banks offer broader accessibility with minimal membership restrictions, leveraging digital platforms to serve diverse populations efficiently. Both options provide tailored money management solutions, but fintech banks emphasize convenience and inclusivity through innovative technology.

Account Offerings and Product Range

Credit unions offer competitive savings accounts and low-interest loans tailored to member needs, emphasizing personalized service and community focus. Community fintech banks provide diverse digital-first financial products, including mobile wallets, instant transfers, and integrated budgeting tools, catering to tech-savvy users seeking convenience. Both prioritize security and customer support, but fintech banks lead in innovative account features and seamless online access.

Fee Structures and Transparency

Credit unions typically offer lower fees and greater fee transparency compared to community fintech banks, as they are member-owned and prioritize customer benefits over profits. Community fintech banks may have innovative digital platforms but can include complex fee structures that are less clearly disclosed, impacting money management decisions. Transparent fee disclosure in credit unions aids in better budgeting and cost predictability for account holders.

Interest Rates: Savings, Checking, and Loans

Credit unions typically offer higher interest rates on savings accounts and lower rates on loans compared to community fintech banks, making them attractive for members seeking better returns and affordable borrowing. Community fintech banks leverage technology to provide competitive checking account rates and flexible loan options, appealing to tech-savvy customers. Interest rate variations between these institutions often reflect their operational models, member ownership in credit unions, and digital innovation focus in fintech banks.

Digital Banking Features and Technology

Credit unions offer personalized digital banking features with secure mobile apps and online account management, emphasizing member-centric services and lower fees. Community fintech banks leverage advanced technology like AI-driven financial insights, real-time transaction tracking, and seamless digital wallets to enhance user experience and efficiency. Both provide robust digital platforms, but fintech banks often prioritize innovative tech integration for faster, more customized money management solutions.

Customer Service and Personalized Support

Credit unions excel in customer service by offering personalized support through member-focused relationships and community engagement, ensuring tailored financial advice and solutions. Community fintech banks leverage advanced technology to enhance accessibility and streamline service, but may lack the deep personal connection of credit unions. Customers seeking highly individualized attention often prefer credit unions for money management.

Security, Regulation, and Protection of Funds

Credit unions prioritize member security through stringent regulatory oversight by the National Credit Union Administration (NCUA), ensuring federal insurance on deposits up to $250,000 for comprehensive fund protection. Community fintech banks combine innovative technology with adherence to banking regulations by the Federal Deposit Insurance Corporation (FDIC), offering similar deposit insurance while enhancing cybersecurity measures with advanced encryption and real-time fraud detection. Both institutions emphasize protecting consumer funds, but credit unions typically focus more on personalized service within a nonprofit framework, whereas community fintech banks leverage technology to deliver secure, user-friendly financial management solutions.

Community Impact and Social Responsibility

Community fintech banks leverage advanced technology to provide accessible, inclusive financial services while actively supporting local economic growth and social initiatives. They often reinvest profits into community programs focused on education, affordable housing, and small business development, enhancing social responsibility beyond traditional banking. Compared to credit unions, these banks blend innovation with a strong ethical commitment, driving measurable positive impact in underserved communities.

Choosing the Right Partner for Your Money Management

Credit unions offer member-owned, not-for-profit models emphasizing personalized service and lower fees, making them ideal for individuals seeking trustworthy, community-focused money management. Community fintech banks leverage advanced technology platforms to provide seamless digital banking experiences, competitive interest rates, and innovative financial products tailored for tech-savvy customers. Assessing your priorities, such as relationship depth, digital convenience, and cost efficiency, is essential when choosing between a credit union and a community fintech bank for optimal money management.

Related Important Terms

Member-Centric Digital Onboarding

Credit unions offer member-centric digital onboarding designed to prioritize personalized service and community-focused benefits, enhancing trust and financial inclusion. Community fintech banks leverage advanced digital tools to streamline account setup processes, providing seamless, user-friendly experiences that combine technology with localized support.

Community Reinvestment Lending

Community fintech banks emphasize community reinvestment lending by leveraging advanced technology to provide accessible, data-driven loan products that target underserved local populations. Credit unions also focus on reinvestment but typically operate with more traditional, member-centric models that may limit scalability and innovation compared to fintech-driven solutions.

Cooperative Open Banking APIs

Credit Unions, driven by member-focused governance, often leverage Cooperative Open Banking APIs to offer personalized money management tools, promoting financial inclusion and data privacy. Community Fintech Banks utilize Open Banking APIs to integrate innovative financial solutions seamlessly, enhancing user experience with real-time data access and streamlined services.

Fintech Partnership Ecosystem

Credit union members benefit from personalized money management, but community fintech banks leverage robust fintech partnership ecosystems to offer advanced digital services, including real-time analytics and AI-driven budgeting tools. This collaboration enables fintech banks to enhance user experience with seamless integrations, faster transaction processing, and innovative financial products tailored to diverse customer needs.

ESG-Driven Loan Products

Credit unions often provide ESG-driven loan products emphasizing community impact and sustainable development, promoting financial inclusion and environmental responsibility. In contrast, community fintech banks leverage advanced digital platforms to offer personalized ESG-focused loans with transparency and faster processing tailored to socially conscious borrowers.

Localized Financial Wellness Tools

Credit unions often provide localized financial wellness tools tailored to community needs, emphasizing personalized budgeting and savings programs that reflect regional economic conditions. In contrast, community fintech banks leverage advanced technology platforms to deliver real-time financial insights and customized digital solutions, enhancing local money management with seamless user experiences.

Digital-First Mutual Ownership

Credit unions operate under a digital-first mutual ownership model, empowering members with democratic control while offering personalized money management tools tailored to community needs. Community fintech banks combine innovative digital platforms with localized service, providing seamless, user-friendly financial solutions that prioritize customer engagement and financial inclusion.

Hyper-Personalized Community Offers

Credit unions leverage member data to deliver hyper-personalized financial solutions tailored to local community needs, enhancing trust and engagement through customized loan rates and savings programs. Community fintech banks utilize advanced AI algorithms to analyze spending patterns and offer dynamic, targeted offers and budgeting tools that adapt in real-time to individual financial behaviors within specific neighborhoods.

Social Impact Banking Metrics

Credit unions typically outperform community fintech banks in social impact banking metrics by offering higher loan approval rates to underserved populations and reinvesting profits into local community development projects. Community fintech banks, however, leverage digital platforms to enhance financial inclusion and provide real-time access to personalized money management tools that promote responsible financial behaviors.

Embedded Credit Union Services

Embedded Credit Union services integrate seamless financial solutions within community fintech banks, offering personalized money management tools that leverage the trust and member-focused benefits of credit unions. This fusion enhances accessibility to low-fee loans, savings accounts, and financial education, driving improved financial wellness through technology-driven, localized banking experiences.

Credit Union vs Community Fintech Bank for money management. Infographic

moneydiff.com

moneydiff.com