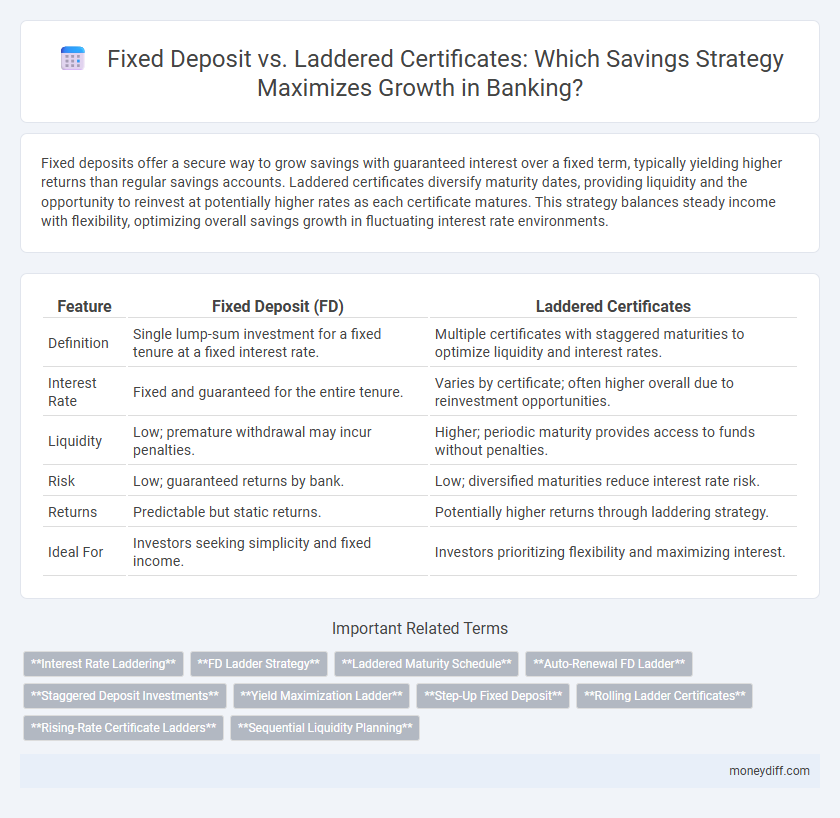

Fixed deposits offer a secure way to grow savings with guaranteed interest over a fixed term, typically yielding higher returns than regular savings accounts. Laddered certificates diversify maturity dates, providing liquidity and the opportunity to reinvest at potentially higher rates as each certificate matures. This strategy balances steady income with flexibility, optimizing overall savings growth in fluctuating interest rate environments.

Table of Comparison

| Feature | Fixed Deposit (FD) | Laddered Certificates |

|---|---|---|

| Definition | Single lump-sum investment for a fixed tenure at a fixed interest rate. | Multiple certificates with staggered maturities to optimize liquidity and interest rates. |

| Interest Rate | Fixed and guaranteed for the entire tenure. | Varies by certificate; often higher overall due to reinvestment opportunities. |

| Liquidity | Low; premature withdrawal may incur penalties. | Higher; periodic maturity provides access to funds without penalties. |

| Risk | Low; guaranteed returns by bank. | Low; diversified maturities reduce interest rate risk. |

| Returns | Predictable but static returns. | Potentially higher returns through laddering strategy. |

| Ideal For | Investors seeking simplicity and fixed income. | Investors prioritizing flexibility and maximizing interest. |

Understanding Fixed Deposits: A Traditional Savings Option

Fixed deposits are a traditional savings vehicle offering a fixed interest rate over a specified tenure, ensuring predictable returns with minimal risk. These deposits provide capital protection and interest payouts that can be monthly, quarterly, or at maturity, catering to conservative investors prioritizing stability. Understanding fixed deposits includes recognizing their lockdown period, penalties for early withdrawal, and suitability for individuals seeking guaranteed income without market exposure.

Laddered Certificates: An Innovative Approach to Savings Growth

Laddered certificates offer a strategic approach to savings growth by staggering maturity dates, providing regular access to funds and reducing interest rate risk compared to traditional fixed deposits. This method enhances liquidity management and allows savers to capitalize on fluctuating interest rates, optimizing returns over time. Financial experts recommend laddering certificates to balance stability with flexibility, making it an innovative alternative for maximizing savings growth in a volatile market.

How Interest Rates Differ: Fixed Deposits vs Laddered Certificates

Fixed deposits offer a fixed interest rate locked in for the entire term, providing predictable returns regardless of market fluctuations. Laddered certificates divide savings into multiple fixed deposits maturing at different intervals, allowing reinvestment at potentially higher rates as market interest rates change. This strategy mitigates interest rate risk by balancing stability and flexibility, often resulting in improved overall returns compared to a single fixed deposit.

Liquidity and Accessibility: Which Option Offers Greater Flexibility?

Fixed deposits typically lock funds for a fixed tenure, limiting liquidity since premature withdrawals often incur penalties, whereas laddered certificates break investments into multiple staggered maturities, enhancing accessibility by providing periodic access to portions of the principal. Laddered certificates offer greater flexibility, enabling savers to balance higher interest rates from longer terms with the ability to access funds without significant penalties. Investors prioritizing liquidity and flexible cash flow management tend to benefit more from a laddered approach compared to traditional fixed deposits.

Risk Management in Fixed Deposits and Laddered Certificates

Fixed deposits offer principal protection with guaranteed returns, minimizing risk through fixed interest rates and government insurance schemes up to specified limits. Laddered certificates diversify maturity dates, reducing interest rate risk and providing liquidity by staggering investments over time. This strategy balances risk and return, mitigating the impact of market fluctuations and reinvestment rate uncertainties.

Maximizing Returns: Strategies for Growing Your Savings

Fixed deposits offer guaranteed interest rates for a fixed term, providing steady and predictable returns, ideal for conservative savers seeking capital protection. Laddered certificates diversify maturity dates across multiple fixed deposits, enhancing liquidity and enabling reinvestment at potentially higher rates as market conditions change. Implementing a laddering strategy maximizes returns by balancing risk, optimizing interest accrual, and maintaining access to funds without penalty.

Maturity Periods: Aligning Savings Goals with Investment Timelines

Fixed deposits offer a fixed maturity period, providing guaranteed returns but limited flexibility, making them suitable for investors with clear, short-to-medium-term savings goals. Laddered certificates of deposit (CDs) stagger maturity dates, enabling access to funds at regular intervals while potentially capturing higher interest rates over time. Aligning savings goals with investment timelines through a laddered CD strategy optimizes liquidity and interest rate risk management compared to single fixed deposit investments.

Early Withdrawal Penalties: Comparing Limitations and Costs

Fixed deposits typically impose substantial early withdrawal penalties, often forfeiting accrued interest or charging fees that diminish overall returns. Laddered certificates, structured with staggered maturities, offer greater liquidity flexibility by limiting penalties to individual segments rather than the entire investment. This strategic approach minimizes the financial impact of premature access to funds, enhancing savings growth potential despite unforeseen cash needs.

Tax Implications: Earnings on Fixed Deposits and Laddered Certificates

Earnings from fixed deposits are fully taxable as per the investor's income tax slab, with tax deducted at source (TDS) if interest exceeds the threshold limit. Laddered certificates offer staggered maturity dates, potentially spreading out taxable interest income over multiple financial years, which can aid in managing tax liabilities. Understanding the tax treatment of interest income on both instruments is crucial for optimizing after-tax returns in savings growth strategies.

Choosing the Right Option: Factors to Consider for Your Financial Goals

Choosing between fixed deposits and laddered certificates depends on your liquidity needs, risk tolerance, and interest rate outlook. Fixed deposits offer higher interest rates for locking in funds over a specific term, ideal for stable, long-term savings goals. Laddered certificates provide flexibility by staggering maturity dates, optimizing cash flow and minimizing interest rate risk for balanced growth.

Related Important Terms

Interest Rate Laddering

Interest rate laddering in laddered certificates offers a strategic advantage by spreading investments across multiple fixed deposit terms, capturing varying interest rates to optimize returns and mitigate rate volatility. This approach provides enhanced liquidity management compared to a single fixed deposit, allowing savers to benefit from rising rates while maintaining periodic access to mature funds.

FD Ladder Strategy

The FD Ladder Strategy involves splitting a fixed deposit into multiple smaller deposits with staggered maturity dates, enabling better liquidity and potentially higher returns by reinvesting matured amounts at prevailing interest rates. This approach minimizes interest rate risk compared to a single fixed deposit, making it an effective savings growth tool in fluctuating market conditions.

Laddered Maturity Schedule

A laddered maturity schedule in fixed deposits spreads investments across multiple fixed deposit accounts with staggered maturities, enhancing liquidity and reducing interest rate risk by not locking all funds at a single rate or maturity date. This strategy allows savers to access portions of their investments periodically while potentially benefiting from fluctuating interest rates, promoting consistent savings growth and financial flexibility.

Auto-Renewal FD Ladder

Auto-Renewal FD Ladders enhance savings growth by systematically reinvesting maturing fixed deposits into new terms, maximizing interest compounding while maintaining liquidity across staggered maturity dates. This strategy reduces reinvestment risk and leverages fluctuating interest rates, outperforming traditional single-term fixed deposits for optimized portfolio diversification in banking.

Staggered Deposit Investments

Staggered deposit investments through laddered certificates diversify maturity dates to optimize liquidity and interest rate returns, reducing reinvestment risk compared to a single fixed deposit. This strategy enables savers to capitalize on varying interest rate cycles and provides regular access to funds while maximizing overall savings growth.

Yield Maximization Ladder

Laddered certificates maximize yield by staggering maturity dates, allowing reinvestment at potentially higher rates while maintaining liquidity and reducing interest rate risk. In contrast, fixed deposits lock in a single rate for a fixed period, which may limit growth if rates rise during the term.

Step-Up Fixed Deposit

Step-Up Fixed Deposits offer increasing interest rates at predetermined intervals, enhancing returns compared to traditional fixed deposits and providing a predictable growth pattern. Laddered certificates strategically stagger maturities to maintain liquidity, but Step-Up Fixed Deposits maximize long-term savings growth by leveraging higher yields over time.

Rolling Ladder Certificates

Rolling Ladder Certificates optimize savings growth by staggering maturity dates, allowing investors to reinvest at varying interest rates while maintaining liquidity and minimizing interest rate risk. Compared to traditional Fixed Deposits, this strategy offers enhanced flexibility and potentially higher returns through periodic reinvestment opportunities.

Rising-Rate Certificate Ladders

Rising-rate certificate ladders enhance savings growth by structuring fixed deposits into staggered maturities with increasing interest rates, allowing investors to capitalize on anticipated rate hikes and maintain liquidity. This strategy diversifies interest rate risk while optimizing returns compared to a traditional single-term fixed deposit.

Sequential Liquidity Planning

Sequential liquidity planning in fixed deposits ensures a single maturity date, limiting access to funds until term completion, while laddered certificates distribute maturity across intervals, providing regular access to cash flow and minimizing interest rate risk. Laddering allows systematic reinvestment opportunities and improved flexibility in managing savings growth against unforeseen financial needs.

Fixed Deposit vs Laddered Certificates for savings growth. Infographic

moneydiff.com

moneydiff.com