Traditional banks offer extensive branch networks and personalized customer service, benefiting those who prefer face-to-face interactions and established financial products. Neobanks provide a fully digital experience with lower fees and innovative mobile features, appealing to tech-savvy users seeking convenience and speed. Choosing between traditional banks and neobanks depends on individual preferences for physical presence versus digital accessibility.

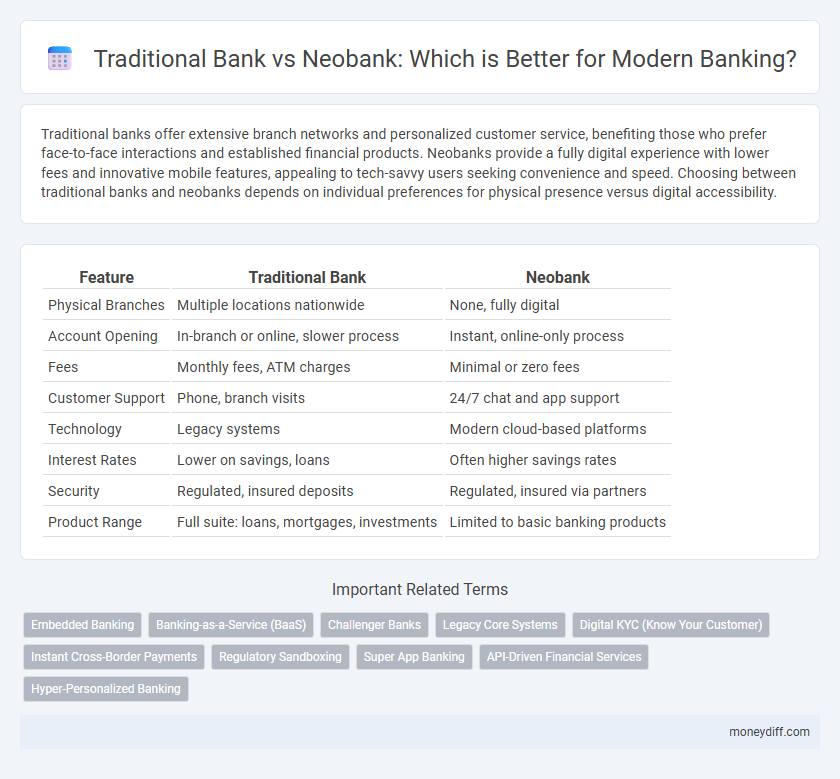

Table of Comparison

| Feature | Traditional Bank | Neobank |

|---|---|---|

| Physical Branches | Multiple locations nationwide | None, fully digital |

| Account Opening | In-branch or online, slower process | Instant, online-only process |

| Fees | Monthly fees, ATM charges | Minimal or zero fees |

| Customer Support | Phone, branch visits | 24/7 chat and app support |

| Technology | Legacy systems | Modern cloud-based platforms |

| Interest Rates | Lower on savings, loans | Often higher savings rates |

| Security | Regulated, insured deposits | Regulated, insured via partners |

| Product Range | Full suite: loans, mortgages, investments | Limited to basic banking products |

Understanding Traditional Banks and Neobanks

Traditional banks operate through physical branches offering extensive in-person services, regulatory compliance, and established financial products such as loans, mortgages, and savings accounts. Neobanks are digital-only financial institutions that provide streamlined, app-based experiences with lower fees, real-time transactions, and advanced budgeting tools. Understanding the regulatory frameworks, customer service models, and technological infrastructure differentiates traditional banks from neobanks in modern banking.

Key Differences Between Traditional Banks and Neobanks

Traditional banks operate through physical branches and offer a broad range of financial products, while neobanks function entirely online, leveraging mobile apps for seamless, low-cost banking services. Conventional banks typically have higher fees and slower account setup processes due to regulatory requirements, whereas neobanks provide faster onboarding, minimal fees, and user-friendly interfaces. Security measures in traditional banks are well-established, but neobanks enhance security through innovative technologies like biometric authentication and real-time fraud monitoring.

Account Opening: Process and Requirements

Traditional banks require in-person visits for account opening, often demanding extensive documentation such as proof of identity, address, and income verification, which can extend the approval timeline. Neobanks streamline the process with fully digital account openings completed within minutes using mobile apps, relying on advanced identity verification technologies like biometric scans and AI-driven KYC protocols. This digital-first approach minimizes paperwork and accelerates access to banking services, appealing to tech-savvy customers seeking convenience and speed.

Access to Financial Products and Services

Traditional banks offer a wide range of financial products and services, including savings accounts, loans, credit cards, and investment options, supported by extensive branch networks and personalized customer service. Neobanks primarily provide digital-first solutions with streamlined access to basic banking services like checking accounts, payments, and budgeting tools, often lacking the breadth of lending and investment products available at traditional banks. Customers seeking comprehensive financial solutions and face-to-face support typically prefer traditional banks, while tech-savvy users value neobanks for convenience and low-fee structures.

Fees and Charges: Comparing Cost Structures

Traditional banks often impose higher fees for account maintenance, overdrafts, and ATM usage due to their extensive branch networks and legacy systems. Neobanks typically offer lower or no monthly fees, reduced or waived overdraft charges, and free access to digital services, benefiting from lower operational costs. The cost structure of neobanks provides a more affordable banking experience, especially for tech-savvy customers seeking transparent fee policies.

Security and Trust: How Safe Are Your Funds?

Traditional banks provide robust security measures backed by longstanding regulatory oversight, including FDIC insurance protecting deposits up to $250,000. Neobanks, while often offering innovative digital security features like multi-factor authentication and biometric login, may lack direct federal insurance and rely on partner banks for fund protection. Understanding each institution's security protocols and regulatory compliance is crucial to assessing the safety and trustworthiness of your funds.

Technology and User Experience

Traditional banks rely on legacy systems that often result in slower transaction processing and limited digital integration, while neobanks leverage cloud-based platforms to offer seamless, real-time banking experiences. Neobanks provide intuitive mobile apps with innovative features such as AI-driven financial insights, instant account management, and personalized notifications that enhance user engagement. Advanced technology architectures of neobanks also enable lower operational costs and faster scalability compared to the heavier infrastructure of traditional banks.

Customer Support: Availability and Responsiveness

Traditional banks often provide customer support through multiple channels including in-branch assistance, phone support, and limited online chat, with availability typically restricted to business hours. Neobanks prioritize 24/7 customer support via mobile apps, live chat, and social media, offering faster response times and real-time problem resolution. The enhanced responsiveness and continuous accessibility of neobanks cater to the expectations of digitally-savvy customers seeking immediate assistance.

Accessibility: Physical Branches vs. Digital Presence

Traditional banks offer extensive networks of physical branches, providing customers with in-person services and immediate assistance, which benefits individuals who prioritize face-to-face interactions. Neobanks operate exclusively online with no physical branches, leveraging mobile apps and digital platforms to deliver convenient, 24/7 banking access, ideal for tech-savvy users and those in remote locations. The contrast in accessibility highlights traditional banks' strength in local presence versus neobanks' emphasis on seamless digital experiences and broader geographical reach.

Choosing the Right Banking Option for Your Needs

Traditional banks offer extensive branch networks and personalized customer service, ideal for customers valuing in-person interactions and comprehensive financial products. Neobanks provide seamless digital experiences with lower fees and innovative features, appealing to tech-savvy users and those seeking convenience. Evaluating factors like transaction frequency, service preferences, and fee structures helps choose the best banking option tailored to individual financial needs.

Related Important Terms

Embedded Banking

Traditional banks typically offer embedded banking solutions through partnerships with fintechs, integrating their financial products into third-party platforms to enhance customer reach. Neobanks, built on digital-first infrastructures, excel in embedded banking by seamlessly embedding banking services directly into various apps and ecosystems, providing real-time, personalized financial experiences.

Banking-as-a-Service (BaaS)

Traditional banks often face challenges integrating Banking-as-a-Service (BaaS) platforms due to legacy infrastructure and regulatory complexities, limiting their agility in offering digital-first solutions. Neobanks leverage BaaS to rapidly deploy modular financial services, enabling seamless customer experiences and faster innovation cycles in the digital banking landscape.

Challenger Banks

Challenger banks, a subset of neobanks, leverage digital-first platforms to offer streamlined banking services with lower fees and faster account setup compared to traditional banks that rely on physical branches and legacy systems. These agile fintech-driven institutions emphasize user-friendly mobile apps, real-time transaction monitoring, and personalized financial products tailored to digitally-savvy customers seeking convenience and innovation.

Legacy Core Systems

Legacy core systems in traditional banks often result in slower transaction processing and limited integration capabilities compared to the agile, cloud-native architectures of neobanks that enable real-time updates and seamless digital experiences. These outdated infrastructures pose challenges in scalability and innovation, placing traditional banks at a disadvantage in meeting modern customer expectations for speed and convenience.

Digital KYC (Know Your Customer)

Traditional banks rely on manual and branch-based KYC processes that often involve physical document verification, resulting in longer onboarding times. Neobanks leverage advanced digital KYC technologies such as AI-driven identity verification and biometric authentication to enable faster, seamless, and paperless customer onboarding experiences.

Instant Cross-Border Payments

Traditional banks often rely on slower, legacy systems for cross-border payments, leading to delays and higher fees, whereas neobanks leverage advanced digital platforms and blockchain technology to enable instant cross-border transactions with reduced costs. This technological edge allows neobanks to provide real-time currency conversion and faster fund transfers, significantly enhancing the customer experience in international banking.

Regulatory Sandboxing

Regulatory sandboxing allows neobanks to test innovative financial products and services in a controlled environment with relaxed regulatory requirements, accelerating their market entry and fostering technological advancements. Traditional banks, bound by stricter regulatory frameworks, often face longer compliance processes, limiting their ability to rapidly adapt and innovate compared to neobanks benefiting from sandbox trials.

Super App Banking

Traditional banks offer comprehensive financial services through physical branches and established regulatory frameworks, while neobanks leverage technology-driven platforms to provide seamless, app-based banking experiences. Super App banking integrates multiple financial services, such as payments, loans, investments, and insurance, within a single digital interface, enhancing convenience and real-time financial management for users.

API-Driven Financial Services

Traditional banks often rely on legacy systems with limited API integration, resulting in slower innovation and less flexible financial services compared to neobanks, which leverage fully API-driven platforms to offer seamless, customizable, and real-time banking experiences. Neobanks utilize open banking APIs to enable instant account provisioning, real-time transaction data access, and integration with third-party fintech applications, driving superior customer engagement and operational efficiency.

Hyper-Personalized Banking

Traditional banks often struggle to offer hyper-personalized banking services due to legacy systems and standardized product portfolios, limiting real-time customization and user experience. Neobanks leverage advanced data analytics, AI, and mobile-first platforms to deliver hyper-personalized financial solutions tailored to individual spending habits, financial goals, and risk profiles at scale.

Traditional bank vs Neobank for banking. Infographic

moneydiff.com

moneydiff.com