Wire transfers rely on traditional banking networks, typically involving intermediaries that can slow down transactions and incur higher fees. Blockchain transfers use decentralized ledgers to enable faster, more transparent, and often lower-cost fund movements across borders. Choosing between the two depends on factors like transaction speed, cost, security, and the need for regulatory compliance.

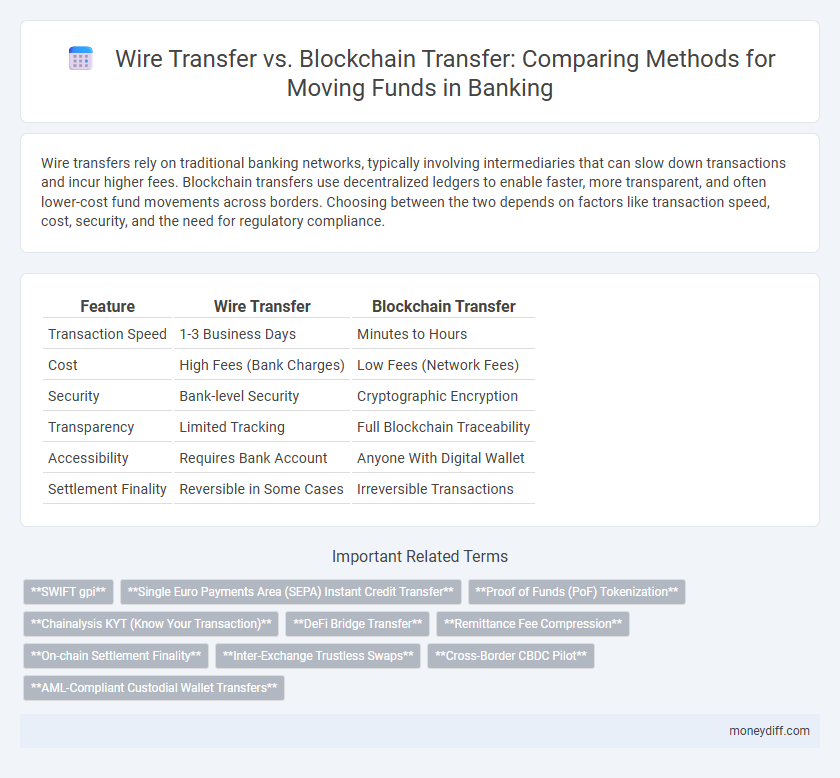

Table of Comparison

| Feature | Wire Transfer | Blockchain Transfer |

|---|---|---|

| Transaction Speed | 1-3 Business Days | Minutes to Hours |

| Cost | High Fees (Bank Charges) | Low Fees (Network Fees) |

| Security | Bank-level Security | Cryptographic Encryption |

| Transparency | Limited Tracking | Full Blockchain Traceability |

| Accessibility | Requires Bank Account | Anyone With Digital Wallet |

| Settlement Finality | Reversible in Some Cases | Irreversible Transactions |

Understanding Wire Transfers and Blockchain Transfers

Wire transfers leverage traditional banking networks such as SWIFT and Fedwire, enabling secure, settled electronic fund movements typically completed within 1-3 business days. Blockchain transfers utilize decentralized digital ledgers that record transactions across multiple nodes, offering near-instant settlement, enhanced transparency, and reduced reliance on intermediaries. Understanding differences in clearance times, transaction fees, settlement finality, and security protocols is crucial for selecting the optimal transfer method based on speed, cost efficiency, and compliance needs.

Speed of Fund Transfers: Wire vs. Blockchain

Wire transfers typically process within 1 to 3 business days depending on the banks and countries involved, while blockchain transfers can settle in minutes due to decentralized ledger technology. Blockchain's 24/7 operation enables near-instantaneous fund movement regardless of time zones, contrasting with wire transfers limited by banking hours and holidays. Transaction finality on blockchain reduces settlement risk and speeds up liquidity compared to traditional wire systems reliant on intermediary banks.

Transaction Costs: Comparing Wire and Blockchain Fees

Wire transfer fees typically range from $15 to $50 per transaction, with additional costs for international or urgent transfers. Blockchain transfers often have lower fees, influenced by network congestion and cryptocurrency used, usually between a few cents to several dollars. Transaction speed and cost transparency also differ, with blockchain offering near-instant settlements and more predictable fees compared to traditional wire transfers.

Security and Fraud Prevention in Transfers

Wire transfers rely on traditional banking networks with established regulatory oversight, offering secure, encrypted channels but remain vulnerable to phishing and identity theft due to centralized control. Blockchain transfers leverage decentralized ledgers and cryptographic algorithms, significantly reducing risks of fraud and unauthorized alterations by enabling transparent, immutable transaction records. Enhanced security features in blockchain technology enable real-time verification and traceability, providing superior fraud prevention compared to conventional wire transfer methods.

Global Accessibility: Reach of Wire and Blockchain Networks

Wire transfers rely on established banking networks like SWIFT, enabling fund transfers across more than 200 countries and territories with traditional financial institutions as intermediaries. Blockchain transfers utilize decentralized ledgers accessible globally, allowing nearly instant transactions without intermediaries, with participation growing across thousands of nodes worldwide. The blockchain's borderless infrastructure offers broader accessibility in regions underserved by conventional banking, while wire transfers maintain widespread acceptance in regulated financial systems.

Traceability and Transparency of Transactions

Wire transfers rely on centralized banking systems with limited transparency, making transaction traceability dependent on intermediary banks and account statements. Blockchain transfers offer enhanced traceability and transparency through decentralized ledgers that provide immutable records accessible to all network participants. This intrinsic visibility reduces fraud risk and accelerates dispute resolution by enabling real-time transaction verification.

Regulatory Compliance and Legal Considerations

Wire transfers are subject to strict regulatory compliance frameworks such as AML (Anti-Money Laundering) and KYC (Know Your Customer) policies enforced by banks and financial institutions worldwide. Blockchain transfers, while offering increased transparency and traceability through immutable ledger technology, face evolving legal considerations due to differing jurisdictional regulations and the lack of standardized frameworks. Both methods require rigorous adherence to financial regulations to prevent fraud, money laundering, and ensure lawful fund movement across borders.

Currency Conversion and Cross-Border Transfers

Wire transfers often involve traditional banking intermediaries, leading to higher currency conversion fees and longer processing times for cross-border transfers. Blockchain transfers use decentralized ledgers and stablecoins to reduce currency conversion costs by enabling near-instant settlements with minimal intermediary involvement. Banks and financial institutions increasingly leverage blockchain technology to offer faster, more cost-effective international fund transfers, enhancing cross-border payment efficiency.

User Experience: Ease of Use and Accessibility

Wire transfers offer widely accessible services through established banking systems, making them familiar and straightforward for most users, though processing times can be longer. Blockchain transfers provide a more seamless, instant transaction experience with decentralized platforms accessible globally via digital wallets, reducing the need for intermediary banks. The ease of use in blockchain transfers is enhanced by transparent tracking and lower fees, but may require users to understand digital asset management and secure key custody.

Choosing the Right Transfer Method for Your Needs

Wire transfers offer reliable and widely accepted methods for moving funds quickly across banks, especially for domestic payments and large amounts. Blockchain transfers provide enhanced security and transparency through decentralized ledger technology, making them ideal for cross-border transactions and reducing intermediary costs. Evaluating factors such as transaction speed, fees, security, and accessibility helps determine the best method for your specific financial needs.

Related Important Terms

SWIFT gpi

SWIFT gpi accelerates international wire transfers by providing real-time tracking, transparency, and same-day payment settlement across thousands of banks globally. Unlike blockchain transfers, which rely on decentralized ledgers and varying settlement times, SWIFT gpi offers standardized messaging with enhanced compliance, making it the preferred choice for secure and efficient cross-border fund movement in the banking industry.

Single Euro Payments Area (SEPA) Instant Credit Transfer

SEPA Instant Credit Transfer enables rapid euro transactions across participating European countries within seconds, providing near-real-time fund availability with low transaction costs and strong regulatory oversight compared to traditional wire transfers. Blockchain transfers offer enhanced transparency and decentralization but currently face scalability issues and regulatory uncertainties, making SEPA Instant payments more efficient for everyday euro transactions within the Eurozone.

Proof of Funds (PoF) Tokenization

Proof of Funds (PoF) tokenization leverages blockchain technology to provide immutable, transparent verification of fund availability, enhancing security and reducing fraud in transfers compared to traditional wire transfers that rely on centralized intermediaries and manual verification. Blockchain-based PoF tokenization facilitates real-time fund validation and seamless auditing, streamlining compliance and accelerating cross-border transactions with greater efficiency.

Chainalysis KYT (Know Your Transaction)

Chainalysis KYT enhances compliance in both wire transfers and blockchain transfers by providing real-time transaction monitoring and risk scoring, enabling banks to detect suspicious activities and prevent fraud. This technology is particularly vital for blockchain transfers, where transparency and traceability are complex, ensuring regulatory adherence and secure fund movement.

DeFi Bridge Transfer

DeFi bridge transfers leverage blockchain technology to enable faster, cost-efficient cross-chain asset transactions compared to traditional wire transfers that rely on intermediary banks and centralized networks. With decentralized protocols, DeFi bridges reduce counterparty risk, eliminate delays, and provide greater transparency for international fund movement within the banking ecosystem.

Remittance Fee Compression

Wire transfers typically incur higher remittance fees due to intermediary banks and cross-border processing costs, whereas blockchain transfers significantly compress remittance fees by eliminating intermediaries and leveraging decentralized ledgers for near-instant settlement. The cost-efficiency of blockchain transfers makes them increasingly preferred for cross-border payments, enabling users to retain more funds during international money movement.

On-chain Settlement Finality

On-chain settlement finality in blockchain transfers ensures irreversible and transparent confirmation of funds movement within minutes, vastly reducing counterparty risk compared to traditional wire transfers, which depend on multiple intermediaries and can experience delays or reversals. This immediate and verifiable settlement on distributed ledgers enhances security and trust in cross-border fund transfers, optimizing operational efficiency in banking transactions.

Inter-Exchange Trustless Swaps

Inter-exchange trustless swaps leverage blockchain transfer technology, enabling secure peer-to-peer fund movement without intermediary reliance, reducing settlement times and counterparty risk compared to traditional wire transfers. Wire transfers depend on centralized banking networks with longer processing durations and higher vulnerability to fraud, limiting their efficiency in decentralized trustless swap scenarios.

Cross-Border CBDC Pilot

Cross-border CBDC pilot programs demonstrate that blockchain transfers offer enhanced transparency, reduced settlement times, and lower costs compared to traditional wire transfers, which often involve multiple intermediaries and delayed processing. Central banks employing blockchain for digital currency settlements improve security and efficiency, facilitating seamless international fund movements in compliance with regulatory standards.

AML-Compliant Custodial Wallet Transfers

AML-compliant custodial wallet transfers via blockchain leverage advanced cryptographic protocols and real-time transaction monitoring, enhancing transparency and reducing fraud risk compared to traditional wire transfers. Wire transfers rely on intermediary banks and legacy AML checks, which can introduce delays and limited traceability, whereas blockchain transfers enable immutable audit trails and faster compliance verification.

Wire Transfer vs Blockchain Transfer for moving funds. Infographic

moneydiff.com

moneydiff.com