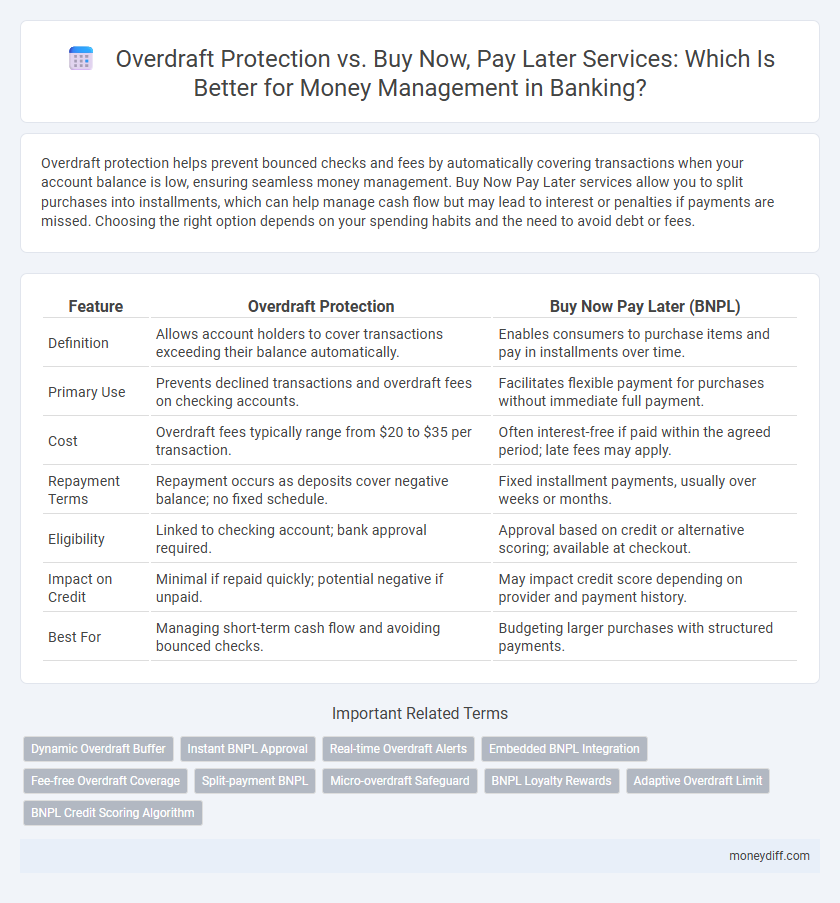

Overdraft protection helps prevent bounced checks and fees by automatically covering transactions when your account balance is low, ensuring seamless money management. Buy Now Pay Later services allow you to split purchases into installments, which can help manage cash flow but may lead to interest or penalties if payments are missed. Choosing the right option depends on your spending habits and the need to avoid debt or fees.

Table of Comparison

| Feature | Overdraft Protection | Buy Now Pay Later (BNPL) |

|---|---|---|

| Definition | Allows account holders to cover transactions exceeding their balance automatically. | Enables consumers to purchase items and pay in installments over time. |

| Primary Use | Prevents declined transactions and overdraft fees on checking accounts. | Facilitates flexible payment for purchases without immediate full payment. |

| Cost | Overdraft fees typically range from $20 to $35 per transaction. | Often interest-free if paid within the agreed period; late fees may apply. |

| Repayment Terms | Repayment occurs as deposits cover negative balance; no fixed schedule. | Fixed installment payments, usually over weeks or months. |

| Eligibility | Linked to checking account; bank approval required. | Approval based on credit or alternative scoring; available at checkout. |

| Impact on Credit | Minimal if repaid quickly; potential negative if unpaid. | May impact credit score depending on provider and payment history. |

| Best For | Managing short-term cash flow and avoiding bounced checks. | Budgeting larger purchases with structured payments. |

Understanding Overdraft Protection: Features and Benefits

Overdraft protection is a banking service that automatically covers transactions when an account lacks sufficient funds, preventing declined payments and overdraft fees. It typically links to a savings account, credit card, or line of credit to provide a safety net for urgent expenses, enhancing financial stability. This service offers immediate funds access, reduces embarrassment from declined transactions, and helps maintain a positive banking relationship.

What is Buy Now Pay Later (BNPL)? A Quick Overview

Buy Now Pay Later (BNPL) is a payment option allowing consumers to purchase items immediately and defer payments over a set period, often interest-free if paid on time. BNPL services are integrated with merchants at checkout, offering flexible installments that help manage cash flow without increasing credit card debt. Unlike overdraft protection, which covers insufficient funds by drawing from linked accounts, BNPL facilitates planned purchases by splitting costs into manageable payments.

How Overdraft Protection Works in Modern Banking

Overdraft Protection in modern banking allows customers to cover transactions exceeding their account balance by linking to a backup funding source like a savings account, credit card, or line of credit, reducing declined transactions and fees. This service automatically transfers funds to prevent overdraft fees, ensuring seamless payment processing and maintaining account status. Compared to Buy Now Pay Later (BNPL) services, Overdraft Protection focuses on managing short-term shortfalls within the banking ecosystem, offering immediate liquidity without delayed repayment structures.

Comparing Overdraft Fees vs BNPL Interest and Charges

Overdraft protection typically incurs fees ranging from $10 to $35 per transaction, which can accumulate rapidly with frequent use, while Buy Now Pay Later (BNPL) services often offer interest-free installment plans but may charge late fees or higher interest rates if payments are missed. Consumers must evaluate overdraft fees, which are flat and immediate, against BNPL's potential for deferred, possibly interest-bearing debt. Effectively managing money requires understanding that recurring overdraft fees can quickly exceed BNPL charges when installments are paid on time.

Impact on Credit Score: Overdraft vs BNPL

Overdraft protection typically has minimal direct impact on credit scores unless the overdraft amount is unpaid and sent to collections, which can negatively affect credit. Buy Now Pay Later (BNPL) services may report timely or missed payments to credit bureaus, influencing credit scores positively or negatively based on payment behavior. Consumers should monitor how their use of overdraft and BNPL services is reported to credit agencies for effective credit management.

Flexibility and Convenience: Which Option Wins?

Overdraft protection offers immediate access to funds during account shortfalls, ensuring seamless transaction completion with minimal fees, while Buy Now Pay Later (BNPL) services provide structured payment plans that enhance budget control without incurring interest if paid timely. BNPL optimizes convenience for planned purchases by breaking payments into installments, whereas overdraft protection excels in unplanned expense scenarios requiring flexible short-term credit. For customers prioritizing consistent cash flow management and spontaneous spending needs, overdraft protection delivers superior flexibility, whereas BNPL is advantageous for managing larger expenses via scheduled payments.

Financial Risks of Relying on Overdraft Protection

Overdraft protection can lead to significant financial risks such as accumulating high fees and worsening debt due to repeated overdrafts, which may negatively impact credit scores. Unlike Buy Now Pay Later services that often offer fixed payment plans and clearer cost structures, overdraft protection frequently results in unpredictable charges and potential account restrictions. Relying on overdraft protection as a money management tool increases vulnerability to financial instability and complicates budgeting efforts.

Potential Pitfalls of Buy Now Pay Later Services

Buy Now Pay Later (BNPL) services often come with hidden fees and high interest rates that can accumulate quickly, leading to unexpected debt. These services may encourage impulsive spending, undermining effective money management and budgeting. Unlike overdraft protection, BNPL lacks comprehensive safeguards against overdrawing accounts, increasing the risk of financial strain.

Choosing the Right Tool for Managing Cash Flow

Overdraft protection provides a safety net by covering transactions that exceed your bank account balance, helping avoid insufficient funds fees, while Buy Now Pay Later (BNPL) services allow deferred payment for purchases, aiding in budgeting large expenses over time. Effective cash flow management depends on understanding your spending patterns and selecting overdraft protection for short-term liquidity or BNPL for planned, interest-free installments. Evaluating fees, repayment terms, and your financial discipline are critical in choosing the most suitable option to maintain financial stability.

Smart Money Management: Overdraft Protection or BNPL?

Overdraft Protection offers a safety net by automatically covering transactions when account balances fall short, preventing costly fees and maintaining credit stability. In contrast, Buy Now Pay Later (BNPL) services enable consumers to split purchases into interest-free installments, promoting flexible budgeting but potentially encouraging overspending. Selecting the optimal solution hinges on balancing immediate financial security with controlled spending habits to enhance overall money management.

Related Important Terms

Dynamic Overdraft Buffer

Dynamic Overdraft Buffer enhances traditional overdraft protection by automatically adjusting limits based on real-time account activity and spending patterns, reducing overdraft fees and improving cash flow management. Buy Now Pay Later services offer flexible installment payments but lack the adaptive financial safeguards provided by the dynamic buffer, making the latter more effective for proactive overdraft control and avoiding unexpected penalties.

Instant BNPL Approval

Instant Buy Now Pay Later (BNPL) approval streamlines money management by allowing consumers to make purchases immediately without waiting for credit checks, unlike overdraft protection which only covers insufficient funds on existing accounts. BNPL services enhance cash flow flexibility by deferring payments with transparent terms, whereas overdraft protection incurs fees and interest rates that can accumulate quickly.

Real-time Overdraft Alerts

Real-time overdraft alerts provide immediate notifications to help customers avoid fees and manage account balances effectively, enhancing traditional overdraft protection by preventing overspending before it occurs. In contrast, Buy Now Pay Later services offer deferred payment options but lack instant balance monitoring, increasing the risk of unnoticed overspending without real-time financial updates.

Embedded BNPL Integration

Embedded Buy Now Pay Later (BNPL) integration offers seamless installment payments directly within banking apps, enhancing user control over cash flow without incurring overdraft fees typically associated with Overdraft Protection. This digital embedding of BNPL solutions promotes smarter money management by providing transparent, manageable repayment options, reducing reliance on costly overdraft interventions.

Fee-free Overdraft Coverage

Fee-free overdraft coverage offers seamless transactions by preventing declined payments without incurring extra charges, unlike Buy Now Pay Later services which may involve interest or late fees. This makes overdraft protection a cost-effective solution for managing short-term cash flow and avoiding financial penalties.

Split-payment BNPL

Split-payment Buy Now Pay Later (BNPL) services offer a structured repayment plan by dividing purchases into manageable installments without immediate interest, providing an alternative to traditional overdraft protection that often incurs fees and impacts credit scores. BNPL enhances cash flow management by allowing consumers to stagger payments over time while avoiding the high costs and potential penalties associated with overdraft fees from banks.

Micro-overdraft Safeguard

Micro-overdraft safeguard offers a low-cost buffer that prevents small negative balances by automatically covering transactions up to a predefined limit, reducing overdraft fees and improving financial stability for consumers. Buy Now Pay Later services provide short-term, interest-free installment options but may encourage overspending without the protective cap that micro-overdraft safeguards enforce.

BNPL Loyalty Rewards

Buy Now Pay Later (BNPL) services often include loyalty rewards programs that incentivize timely payments and repeat usage, providing consumers with discounts, cashback, or points that enhance money management benefits compared to traditional Overdraft Protection. These loyalty rewards foster better financial habits while offering cost-saving opportunities absent in most Overdraft Protection plans.

Adaptive Overdraft Limit

Adaptive Overdraft Limit enhances traditional overdraft protection by dynamically adjusting credit limits based on real-time spending behavior and account activity, reducing the risk of declined transactions and fees. In contrast to Buy Now Pay Later services, which defer payments with fixed installment plans, adaptive overdraft offers flexible, on-demand credit access that helps maintain cash flow and improves overall money management efficiency.

BNPL Credit Scoring Algorithm

Buy Now Pay Later (BNPL) credit scoring algorithms leverage machine learning models analyzing transaction history, repayment behavior, and real-time income data to assess borrower risk more dynamically than traditional overdraft protection. These algorithms optimize credit decisions by integrating alternative financial data, reducing default rates and enhancing personalized lending in digital banking platforms.

Overdraft Protection vs Buy Now Pay Later Service for money management. Infographic

moneydiff.com

moneydiff.com