Retail banks offer a wide network of branches and personalized in-person services, providing convenience and trust for managing personal accounts. Challenger banks leverage digital-first platforms with lower fees and innovative features, appealing to tech-savvy users seeking streamlined banking experiences. Choosing between the two depends on your preference for traditional customer support versus cutting-edge digital tools and cost efficiency.

Table of Comparison

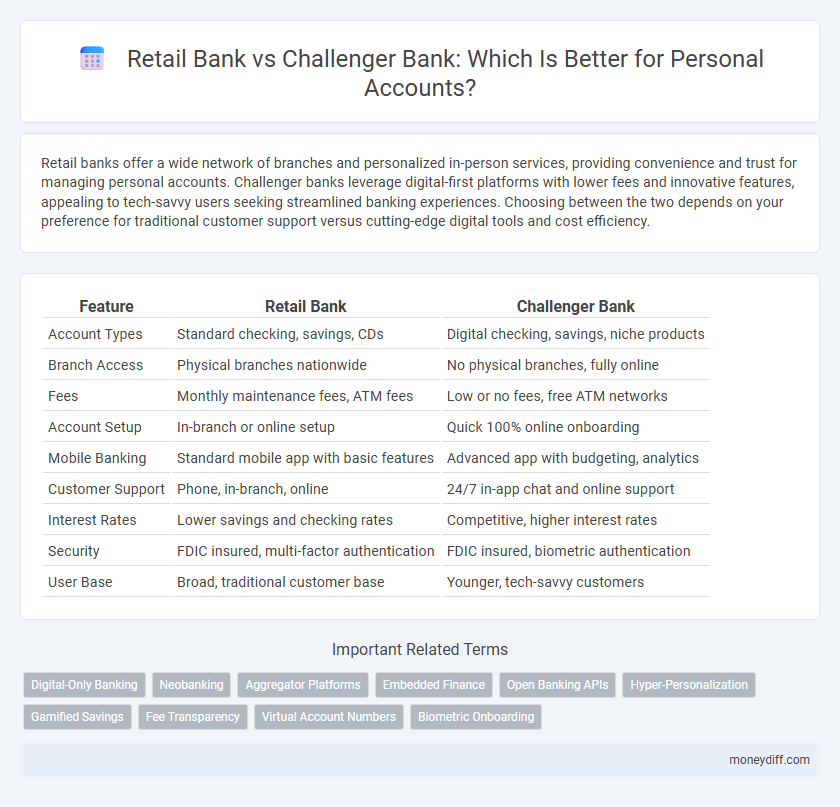

| Feature | Retail Bank | Challenger Bank |

|---|---|---|

| Account Types | Standard checking, savings, CDs | Digital checking, savings, niche products |

| Branch Access | Physical branches nationwide | No physical branches, fully online |

| Fees | Monthly maintenance fees, ATM fees | Low or no fees, free ATM networks |

| Account Setup | In-branch or online setup | Quick 100% online onboarding |

| Mobile Banking | Standard mobile app with basic features | Advanced app with budgeting, analytics |

| Customer Support | Phone, in-branch, online | 24/7 in-app chat and online support |

| Interest Rates | Lower savings and checking rates | Competitive, higher interest rates |

| Security | FDIC insured, multi-factor authentication | FDIC insured, biometric authentication |

| User Base | Broad, traditional customer base | Younger, tech-savvy customers |

Overview of Retail Banks and Challenger Banks

Retail banks are traditional financial institutions offering a wide range of personal banking services, including savings accounts, checking accounts, mortgages, and loans, with established branch networks and customer service infrastructure. Challenger banks operate primarily online, leveraging innovative technology to provide streamlined, user-friendly digital banking experiences with lower fees and faster account setup. Retail banks emphasize stability and comprehensive services, while challenger banks focus on convenience, agility, and personalized digital solutions for personal accounts.

Key Differences in Account Features

Retail banks typically offer a wide range of personal account features such as in-branch services, extensive ATM networks, and comprehensive customer support. Challenger banks prioritize digital-first experiences, featuring streamlined mobile apps, lower fees, and faster account opening processes. While retail banks emphasize traditional security measures, challenger banks integrate innovative technology like AI-driven fraud detection and real-time spending notifications.

Digital Experience and Mobile Banking

Retail banks offer extensive branch networks but often lag behind challenger banks in providing seamless digital experiences and intuitive mobile banking apps. Challenger banks prioritize user-friendly interfaces, real-time notifications, and simplified account management through their advanced mobile platforms. This focus on digital innovation enables challenger banks to deliver faster onboarding and more personalized financial services for personal account holders.

Fees and Charges Comparison

Retail banks typically impose higher fees and charges on personal accounts, including monthly maintenance fees, overdraft charges, and ATM usage fees, reflecting their extensive branch networks and legacy systems. Challenger banks offer lower fees, often providing fee-free or reduced-cost services by leveraging digital platforms and streamlined operations, appealing to cost-conscious customers. Comparing fee structures reveals challenger banks as more economical choices for personal account holders seeking minimal charges and greater transparency.

Interest Rates and Savings Options

Retail banks typically offer lower interest rates on personal savings accounts due to their extensive branch networks and broader service offerings. Challenger banks, leveraging digital platforms, provide higher interest rates and innovative savings options like round-up features and goal-based accounts to attract tech-savvy customers. Savings options in challenger banks often include flexible withdrawal terms and competitive rates, enhancing overall returns compared to traditional retail bank accounts.

Customer Service and Support Channels

Retail banks typically offer extensive customer service through physical branches, phone support, and online chat, providing personalized assistance and in-person consultations for personal accounts. Challenger banks rely heavily on digital platforms, offering 24/7 customer support via mobile apps and online chat, with limited or no physical branches, emphasizing convenience and rapid issue resolution. The choice between retail and challenger banks for personal accounts often depends on customer preference for face-to-face interaction versus streamlined digital support channels.

Security Measures and Trustworthiness

Retail banks offer robust security measures such as multi-factor authentication, fraud detection systems, and insured deposits through entities like the FDIC, enhancing trustworthiness with established regulatory compliance. Challenger banks emphasize innovative security technologies like biometric verification and real-time transaction alerts, often integrating advanced encryption protocols to protect personal accounts. Trustworthiness in retail banks benefits from longstanding reputations and physical branch presence, while challenger banks rely on transparent policies and rapid customer feedback to build confidence.

Accessibility and ATM Networks

Retail banks typically offer extensive ATM networks and widespread branch accessibility, ensuring convenient cash withdrawals and in-person services for personal account holders across urban and rural areas. Challenger banks primarily operate digitally with limited or no proprietary ATMs, often relying on partnerships with third-party networks to provide fee-free access, which may restrict immediate physical access for customers in certain locations. Accessibility differences impact customer experiences, with retail banks favoring traditional in-person interactions and challenger banks emphasizing mobile-first, technology-driven convenience.

Innovation and Technology Integration

Challenger banks leverage advanced technology stacks and AI-driven personalization to deliver seamless mobile experiences and faster onboarding for personal accounts, surpassing traditional retail banks that often rely on legacy systems. Retail banks increasingly adopt APIs and cloud-based platforms to enhance digital services but face challenges in agility compared to challenger banks. Innovations such as biometric authentication and open banking integrations are more rapidly implemented by challenger banks, driving superior customer engagement and tailored financial products.

Choosing the Right Bank for Your Needs

Retail banks offer extensive branch networks, diverse financial products, and personalized customer service, ideal for individuals seeking traditional banking with physical accessibility. Challenger banks provide innovative digital platforms, lower fees, and faster account setup, appealing to tech-savvy users who prioritize convenience and cost-efficiency. Assessing factors like service preferences, fee structures, and technological features helps determine the best personal account provider tailored to individual banking needs.

Related Important Terms

Digital-Only Banking

Retail banks typically offer a full range of financial services with physical branches, while challenger banks operate exclusively online, providing seamless digital-only banking experiences with features like instant account setup, real-time notifications, and lower fees. Digital-only challenger banks leverage innovative technology and user-friendly apps to attract tech-savvy customers seeking convenient personal account management without traditional branch visits.

Neobanking

Neobanks offer streamlined digital experiences for personal accounts with lower fees, faster onboarding, and real-time transaction monitoring compared to traditional retail banks, which maintain extensive branch networks and broader service portfolios. The agility of challenger banks enables personalized financial tools and seamless mobile access, attracting tech-savvy customers seeking innovative banking solutions.

Aggregator Platforms

Aggregator platforms streamline the comparison between retail banks and challenger banks by providing real-time data on interest rates, fees, and customer reviews for personal accounts. Their advanced algorithms enhance consumer decision-making by offering personalized recommendations based on transaction history and spending habits.

Embedded Finance

Retail banks leverage extensive branch networks and established trust to integrate embedded finance solutions seamlessly within personal accounts, offering services like real-time payments and personalized financial management tools. Challenger banks focus on agile, API-driven platforms that enable innovative embedded finance features such as instant credit, embedded lending, and integrated insurance products, enhancing user experience with digital-first banking solutions.

Open Banking APIs

Retail banks leverage established Open Banking APIs to offer a comprehensive range of personal account services, ensuring secure data sharing and seamless integration with third-party financial apps. Challenger banks utilize advanced Open Banking APIs to provide innovative, user-centric features such as real-time transaction tracking and personalized financial insights, often delivering faster onboarding and enhanced digital experiences.

Hyper-Personalization

Retail banks leverage extensive customer data and legacy systems to offer tailored personal accounts, whereas challenger banks prioritize hyper-personalization through advanced AI-driven analytics and seamless digital interfaces, enabling real-time customization of financial products and services. Challenger banks enhance user engagement by integrating behavioral insights and predictive modeling, delivering uniquely personalized experiences that traditional retail banks often struggle to match.

Gamified Savings

Retail banks offer traditional personal accounts with standard interest rates and minimal interactive features, while challenger banks leverage gamified savings tools that encourage users to save through rewards, challenges, and real-time progress tracking, enhancing customer engagement. Gamified savings in challenger banks utilize behavioral economics principles, driving higher savings rates and improved financial literacy compared to conventional retail banking models.

Fee Transparency

Retail banks typically offer personal accounts with clearly outlined fee structures detailed in their terms and monthly statements, providing customers with reliable transparency on charges such as maintenance fees, overdrafts, and ATM usage. Challenger banks often enhance fee transparency by using mobile apps and real-time notifications, enabling users to monitor and manage their account fees instantly, often with fewer hidden charges or minimum balance requirements.

Virtual Account Numbers

Retail banks typically offer virtual account numbers that enhance security for personal accounts through well-established infrastructures and integrated fraud protection systems. Challenger banks provide innovative virtual account number services with real-time transaction controls and seamless mobile app integration, appealing to tech-savvy customers seeking flexible and transparent banking solutions.

Biometric Onboarding

Retail banks leverage established biometric onboarding systems such as fingerprint and facial recognition to enhance security and streamline account opening processes, often integrating these with in-branch verification. Challenger banks prioritize advanced biometric methods like AI-powered liveness detection and voice recognition within fully digital platforms, offering faster, contactless onboarding experiences for personal accounts.

Retail Bank vs Challenger Bank for personal accounts Infographic

moneydiff.com

moneydiff.com