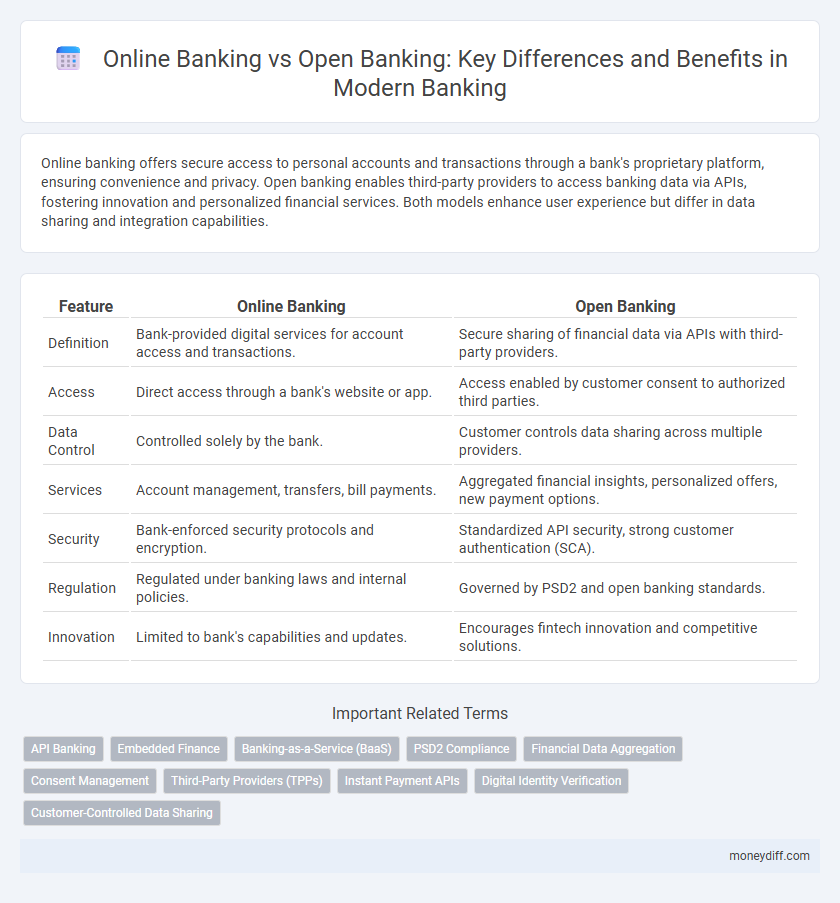

Online banking offers secure access to personal accounts and transactions through a bank's proprietary platform, ensuring convenience and privacy. Open banking enables third-party providers to access banking data via APIs, fostering innovation and personalized financial services. Both models enhance user experience but differ in data sharing and integration capabilities.

Table of Comparison

| Feature | Online Banking | Open Banking |

|---|---|---|

| Definition | Bank-provided digital services for account access and transactions. | Secure sharing of financial data via APIs with third-party providers. |

| Access | Direct access through a bank's website or app. | Access enabled by customer consent to authorized third parties. |

| Data Control | Controlled solely by the bank. | Customer controls data sharing across multiple providers. |

| Services | Account management, transfers, bill payments. | Aggregated financial insights, personalized offers, new payment options. |

| Security | Bank-enforced security protocols and encryption. | Standardized API security, strong customer authentication (SCA). |

| Regulation | Regulated under banking laws and internal policies. | Governed by PSD2 and open banking standards. |

| Innovation | Limited to bank's capabilities and updates. | Encourages fintech innovation and competitive solutions. |

Understanding Online Banking and Open Banking

Online banking enables customers to perform traditional banking activities such as balance checks, fund transfers, and bill payments through secured internet portals provided by banks. Open banking leverages APIs to allow third-party financial service providers access to customer data, fostering innovation and personalized financial products. Understanding the distinction between these systems is crucial for leveraging enhanced security features, improved user experience, and broader financial ecosystem integration.

Key Differences Between Online Banking and Open Banking

Online banking allows customers to access their bank accounts and perform transactions through a bank's secure website or app, maintaining a traditional, closed system controlled solely by the bank. Open banking, enabled by APIs and regulated by frameworks like PSD2 in Europe, facilitates secure sharing of financial data between banks and third-party providers, promoting innovation and competition. The key differences lie in data control, with online banking being bank-centric and closed, while open banking empowers customers to authorize data sharing with multiple authorized parties, enhancing financial service customization.

Benefits of Online Banking for Everyday Users

Online banking offers everyday users convenient 24/7 access to account management, bill payments, and fund transfers without visiting a branch. Enhanced security features such as multi-factor authentication and encryption protect sensitive financial data. Real-time transaction monitoring and instant notifications empower users to manage their finances efficiently and detect fraud swiftly.

How Open Banking Enhances Financial Services

Open banking enhances financial services by enabling secure data sharing between banks and third-party providers through standardized APIs, fostering innovation and personalized customer experiences. It allows consumers to access aggregated financial information, streamline payments, and benefit from tailored financial products beyond traditional banking limits. Enhanced transparency and competition drive improved financial inclusion and efficiency in service delivery.

Security Features: Online Banking vs Open Banking

Online banking employs multi-factor authentication, encryption, and secure login protocols to protect customer accounts, relying primarily on the bank's own security infrastructure. Open banking introduces API-based data sharing with third-party providers, necessitating advanced consent management and stringent access controls to safeguard sensitive information. Both systems prioritize encryption and compliance with regulations such as PSD2 and GDPR to enhance cybersecurity and protect user data from unauthorized breaches.

Customer Experience in Online vs Open Banking

Online banking provides customers with convenient access to traditional banking services such as account management, funds transfer, and bill payments through secure digital platforms. Open banking enhances customer experience by enabling third-party developers to create innovative financial applications that aggregate data from multiple accounts, offering personalized insights and seamless financial management. The integration of open banking APIs facilitates more tailored, transparent, and efficient services, driving greater customer engagement and satisfaction compared to conventional online banking interfaces.

Impact on Personal Money Management

Online banking provides secure digital access to personal accounts, enabling efficient fund transfers, bill payments, and transaction monitoring, which enhances day-to-day money management. Open banking leverages APIs to allow third-party financial apps to aggregate data from multiple accounts, offering personalized budgeting tools, spending analysis, and tailored financial advice. The integration of open banking APIs significantly improves financial visibility and empowerment by delivering a holistic view of personal finances beyond a single bank's platform.

Regulatory Frameworks Governing Both Systems

Online banking operates under established regulatory frameworks such as the Electronic Fund Transfer Act (EFTA) and the Payment Card Industry Data Security Standard (PCI DSS), ensuring secure access and transaction transparency. Open banking is governed by newer regulations like the European Union's Payment Services Directive 2 (PSD2) and the UK's Open Banking Implementation Entity (OBIE), promoting data sharing and competitive financial services through secure API access. Both systems require strict compliance with data protection laws including GDPR and must adhere to anti-money laundering (AML) and know your customer (KYC) standards to safeguard user information and financial integrity.

Future Trends: The Evolution of Digital Banking

Online banking continues to evolve with enhanced security measures and seamless user interfaces, driving widespread adoption among consumers for everyday financial management. Open banking accelerates the future of digital banking by enabling secure data sharing through APIs, fostering innovation in personalized services, and promoting competitive ecosystems between traditional banks and fintech startups. The convergence of these technologies signals a shift toward more integrated, data-driven financial experiences, emphasizing transparency, customer control, and real-time service delivery.

Choosing the Right Banking Solution for Your Needs

Online banking offers secure, user-friendly access to traditional banking services like account management, transfers, and bill payments through a bank's digital platform. Open banking enables third-party providers to access financial data via APIs, fostering personalized financial services and enhanced innovation while requiring careful consideration of data privacy and security. Choosing the right banking solution depends on the desired level of control, customization, and trust in technology partners.

Related Important Terms

API Banking

API banking enhances online banking by enabling secure data sharing and third-party integrations through open banking frameworks, fostering innovation and personalized financial services. Unlike traditional online banking, open banking leverages APIs to provide customers seamless access to multiple financial products and real-time account information across different institutions.

Embedded Finance

Embedded finance integrates banking services directly into non-bank platforms, enhancing customer experience by enabling seamless transactions within apps or websites. Online banking typically requires users to access a bank's portal separately, whereas embedded finance leverages open banking APIs to offer real-time financial services in ecosystems like e-commerce or fintech apps.

Banking-as-a-Service (BaaS)

Online banking provides customers with direct access to their accounts and basic financial services through digital platforms, while Open Banking, powered by Banking-as-a-Service (BaaS) APIs, enables third-party providers to offer innovative financial products by securely sharing banking data. BaaS accelerates the integration of advanced services like real-time payments, personalized financial management, and seamless account aggregation, transforming the traditional banking experience into a flexible ecosystem.

PSD2 Compliance

Online banking provides secure access to personal accounts and transactions through bank-operated platforms, ensuring compliance with PSD2 regulations by implementing strong customer authentication (SCA) measures. Open banking leverages PSD2 APIs to enable third-party providers to offer innovative financial services, promoting transparency and customer control while adhering to strict data protection and consent requirements.

Financial Data Aggregation

Online banking provides direct access to individual bank accounts for transactions and balance checks, whereas open banking enables secure financial data aggregation from multiple institutions through APIs, offering a comprehensive view of a customer's financial status. Open banking's data aggregation supports personalized financial services and improved risk assessment by consolidating data beyond a single bank's portfolio.

Consent Management

Online banking securely manages user consent through password-protected access and multi-factor authentication, ensuring authorized transactions within a single bank's ecosystem. Open banking relies on standardized APIs and explicit user consent to share data across multiple financial institutions, enhancing transparency and control over personal financial information.

Third-Party Providers (TPPs)

Online banking allows customers to access their accounts and perform transactions directly through their bank's secure platform, whereas open banking enables Third-Party Providers (TPPs) to securely access banking data via APIs, fostering innovation in financial services. TPPs enhance customer experience by offering personalized products, payment initiation, and account aggregation, expanding beyond traditional online banking capabilities.

Instant Payment APIs

Instant Payment APIs in open banking enable streamlined, real-time transaction processing by securely connecting third-party providers with banks, enhancing user experience beyond traditional online banking platforms. Unlike conventional online banking, which limits users to bank-specific interfaces, open banking facilitates interoperable services that support instant payments and broader financial ecosystem integration.

Digital Identity Verification

Online banking relies on traditional digital identity verification methods such as passwords and OTPs, while open banking enhances security by integrating biometric authentication and real-time identity validation through APIs. Open banking's use of standardized identity protocols like OAuth 2.0 enables seamless and secure customer onboarding, reducing fraud and improving user experience.

Customer-Controlled Data Sharing

Online banking provides customers with direct access to their accounts and transaction history through secure portals, while open banking enables customers to securely share their financial data with third-party providers via APIs, fostering personalized services and enhanced financial management. Customer-controlled data sharing in open banking empowers users to grant specific permissions, ensuring transparency and increased control over how their data is utilized across multiple financial platforms.

Online banking vs Open banking for banking. Infographic

moneydiff.com

moneydiff.com