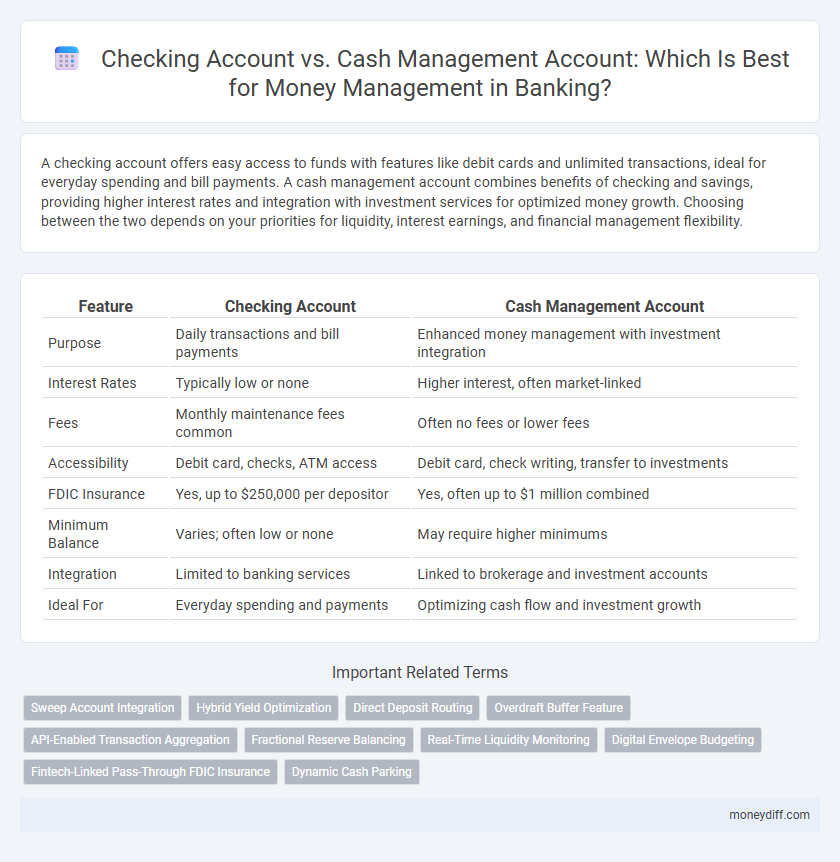

A checking account offers easy access to funds with features like debit cards and unlimited transactions, ideal for everyday spending and bill payments. A cash management account combines benefits of checking and savings, providing higher interest rates and integration with investment services for optimized money growth. Choosing between the two depends on your priorities for liquidity, interest earnings, and financial management flexibility.

Table of Comparison

| Feature | Checking Account | Cash Management Account |

|---|---|---|

| Purpose | Daily transactions and bill payments | Enhanced money management with investment integration |

| Interest Rates | Typically low or none | Higher interest, often market-linked |

| Fees | Monthly maintenance fees common | Often no fees or lower fees |

| Accessibility | Debit card, checks, ATM access | Debit card, check writing, transfer to investments |

| FDIC Insurance | Yes, up to $250,000 per depositor | Yes, often up to $1 million combined |

| Minimum Balance | Varies; often low or none | May require higher minimums |

| Integration | Limited to banking services | Linked to brokerage and investment accounts |

| Ideal For | Everyday spending and payments | Optimizing cash flow and investment growth |

Understanding Checking Accounts

Checking accounts provide convenient access to funds through debit cards, checks, and ATM withdrawals, making them ideal for everyday transactions. They often feature no or low minimum balance requirements and may offer overdraft protection to avoid declined payments. Unlike cash management accounts, checking accounts typically do not earn high interest but prioritize liquidity and ease of access for money management.

What Is a Cash Management Account?

A Cash Management Account (CMA) is a versatile financial tool offered by investment firms and fintech companies that combines features of checking, savings, and investment accounts to provide seamless money management. CMAs typically offer higher interest rates than traditional checking accounts, unlimited check writing, debit card access, and easy liquidity, making them ideal for users seeking both growth and spending flexibility. Unlike standard checking accounts provided by banks, CMAs aggregate balances across multiple asset classes, often including brokerage accounts, enhancing both convenience and yield on idle cash.

Key Differences Between Checking and Cash Management Accounts

Checking accounts primarily offer unlimited transactions and easy access to funds via checks, debit cards, and ATMs, making them ideal for everyday expenses. Cash management accounts combine features of checking, savings, and investment accounts, providing higher interest rates, integrated cash flow management, and often FDIC insurance through partner banks. Unlike checking accounts, cash management accounts typically offer enhanced liquidity options with limited check-writing capabilities and investment sweep features.

Account Fees and Monthly Charges

Checking accounts typically have low or no monthly fees, but may charge for overdrafts, paper statements, or insufficient funds. Cash management accounts often come with higher minimum balances yet offer waived fees for services like ATM withdrawals and check writing. Comparing account fees and monthly charges helps optimize money management by aligning with spending habits and banking needs.

Accessibility: ATMs, Checks, and Digital Banking

Checking accounts offer broad accessibility with unlimited ATM withdrawals, physical checks for in-person payments, and comprehensive digital banking platforms enabling real-time transactions and bill payments. Cash management accounts provide similar ATM access but often include fewer check-writing privileges, focusing more on integrated investment and cash services through advanced digital interfaces. Both account types support mobile banking apps, but cash management accounts tend to offer enhanced cash flow tools and higher withdrawal limits tailored for business or high-net-worth users.

Interest Rates and Earning Potential

Checking accounts typically offer lower interest rates, often close to zero, limiting the earning potential on idle funds. Cash management accounts usually provide higher interest rates, sometimes comparable to high-yield savings accounts, maximizing returns on balances while maintaining liquidity. Choosing a cash management account can enhance overall money management by combining competitive interest earnings with flexible access to funds.

Account Security and FDIC/SIPC Insurance

Checking accounts offer FDIC insurance up to $250,000 per depositor, providing protection for funds in the event of bank failure. Cash management accounts typically combine FDIC insurance through partner banks or SIPC coverage for brokerage accounts, safeguarding assets like cash, stocks, and bonds. Understanding the specific insurance coverage and account structure is crucial for optimizing security and risk management in personal finance.

Integrating Accounts for Optimal Money Management

Integrating checking accounts and cash management accounts allows for seamless money management by combining the liquidity and accessibility of checking accounts with the higher interest rates and cash optimization features of cash management accounts. This integration enables automated transfers, real-time balance tracking, and consolidated financial oversight, helping users maximize returns while maintaining easy access to funds. Leveraging digital tools and account linking enhances overall financial efficiency and streamlines cash flow management.

Which Account Suits Your Money Management Style?

Checking accounts offer unlimited check writing and easy access to funds, ideal for everyday transactions and bill payments, while cash management accounts provide higher interest rates and integrated investment features, suited for those seeking both liquidity and growth. Assessing your money management style involves prioritizing either convenience and transaction volume or maximizing earnings and diversified cash handling. For frequent spending and bill management, checking accounts offer straightforward access, whereas cash management accounts benefit users focused on optimizing returns without sacrificing liquidity.

How to Choose Between Checking and Cash Management Accounts

Choosing between a checking account and a cash management account depends on your financial needs and transaction habits. Checking accounts offer easy access to funds through debit cards and checks, making them ideal for everyday expenses and bill payments. Cash management accounts typically provide higher interest rates and integrated investment features, suitable for those seeking to optimize returns while maintaining liquidity.

Related Important Terms

Sweep Account Integration

Checking accounts offer straightforward money management with ease of access and basic features, while cash management accounts provide enhanced benefits including sweep account integration that automatically transfers excess funds into higher-yield investments, optimizing liquidity and maximizing returns. Sweep accounts linked to cash management accounts enable seamless cash flow management by reducing idle balances and improving interest earnings without sacrificing access to funds.

Hybrid Yield Optimization

Hybrid Yield Optimization leverages the combined features of Checking Accounts and Cash Management Accounts to maximize liquidity and interest earnings, offering users seamless access to funds with higher yields than traditional accounts. This approach integrates real-time transaction capabilities with strategic investment of idle cash into high-yield instruments, optimizing overall money management performance.

Direct Deposit Routing

Direct deposit routing for checking accounts typically uses a traditional bank routing number linked to consumer deposits, while cash management accounts often utilize specialized routing numbers associated with brokerage firms or fintech providers, enabling seamless integration of investment and cash flow management. Understanding the differences in direct deposit routing between these accounts ensures optimal fund accessibility and efficient cash handling for comprehensive money management.

Overdraft Buffer Feature

A Checking Account typically offers an overdraft buffer feature that allows short-term coverage of transactions exceeding the available balance, reducing the risk of declined payments and associated fees. In contrast, Cash Management Accounts often integrate this buffer with higher interest-earning potential and seamless transfers, providing greater liquidity and optimized cash flow management for account holders.

API-Enabled Transaction Aggregation

API-enabled transaction aggregation in cash management accounts offers seamless integration with multiple financial platforms, enabling real-time consolidation of balances and spending across various accounts, unlike traditional checking accounts that often lack such advanced connectivity. This technology enhances visibility and control over cash flow, facilitating optimized money management for businesses and individuals.

Fractional Reserve Balancing

A checking account offers immediate access to funds with standard deposit insurance, but operates under fractional reserve banking, meaning only a fraction of deposits are held in reserve while the rest are loaned out, potentially impacting liquidity during high withdrawal demands. A cash management account combines banking and investment features, leveraging multiple banks' FDIC insurance coverage and often employing fractional reserve principles across partner institutions to optimize liquidity and yield, enhancing overall money management efficiency.

Real-Time Liquidity Monitoring

Checking accounts provide basic real-time liquidity monitoring with instant access to funds for daily transactions, while cash management accounts offer enhanced tools such as integrated dashboards and automated alerts for comprehensive, real-time cash flow tracking and optimized fund allocation. Cash management accounts often combine features of checking and investment accounts, allowing seamless liquidity management alongside higher yield opportunities.

Digital Envelope Budgeting

Checking accounts offer basic transaction capabilities and limited budgeting tools, while cash management accounts provide integrated digital envelope budgeting features that enable users to allocate funds into customizable categories for precise financial control. Enhanced with real-time tracking and automated transfers, cash management accounts optimize money management by combining banking, investing, and budgeting functions in a single platform.

Fintech-Linked Pass-Through FDIC Insurance

Fintech-linked cash management accounts offer pass-through FDIC insurance, allowing users to spread deposits across multiple partner banks to maximize coverage, unlike traditional checking accounts that typically provide insurance only up to $250,000 per bank. This feature enhances money management by combining high liquidity with increased security, making cash management accounts preferable for customers seeking both FDIC protection and seamless fintech integration.

Dynamic Cash Parking

Checking accounts offer traditional money management with easy access and ATM withdrawals, while cash management accounts provide dynamic cash parking by automatically sweeping excess funds into higher-yielding investments, optimizing liquidity and returns. Cash management accounts integrate features like FDIC insurance protection, seamless bill pay, and investment options, making them ideal for maximizing idle cash efficiency compared to standard checking accounts.

Checking Account vs Cash Management Account for money management. Infographic

moneydiff.com

moneydiff.com