Wire transfers offer secure, large-sum transfers typically settled within one to three business days, suitable for high-value or international transactions. Real-time payment networks enable instant, 24/7 fund transfers with immediate confirmation, enhancing convenience for everyday banking and urgent payments. Choosing between the two depends on the transaction size, urgency, and cost considerations within the banking ecosystem.

Table of Comparison

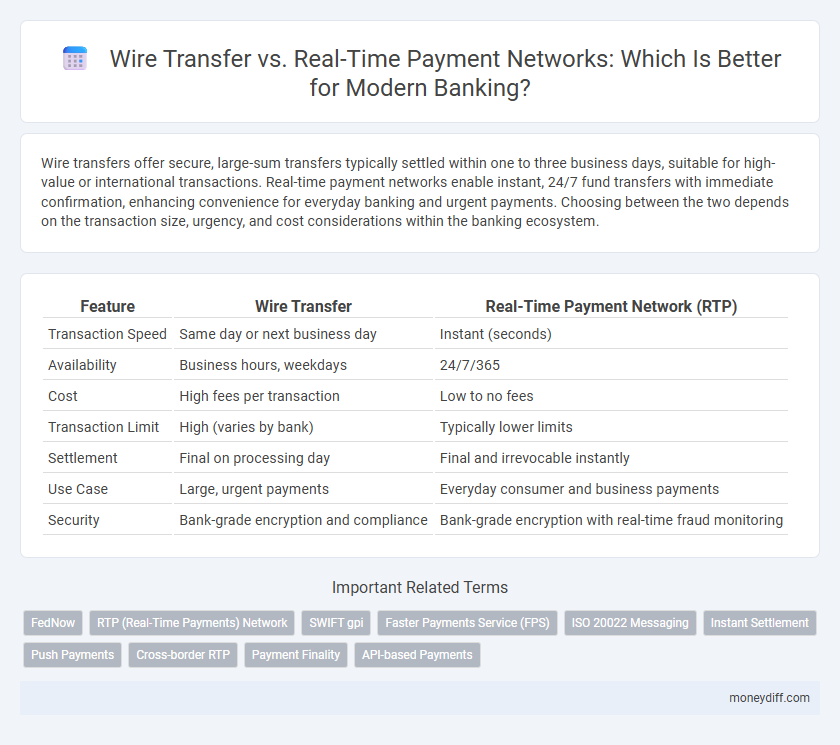

| Feature | Wire Transfer | Real-Time Payment Network (RTP) |

|---|---|---|

| Transaction Speed | Same day or next business day | Instant (seconds) |

| Availability | Business hours, weekdays | 24/7/365 |

| Cost | High fees per transaction | Low to no fees |

| Transaction Limit | High (varies by bank) | Typically lower limits |

| Settlement | Final on processing day | Final and irrevocable instantly |

| Use Case | Large, urgent payments | Everyday consumer and business payments |

| Security | Bank-grade encryption and compliance | Bank-grade encryption with real-time fraud monitoring |

Understanding Wire Transfers in Banking

Wire transfers in banking enable secure, electronic funds transfers between financial institutions, often used for high-value or international payments. These transactions typically require intermediary banks and can take one to several business days to complete due to verification and settlement processes. Understanding wire transfer protocols, including SWIFT codes and payment instructions, is essential for accurate and timely execution.

What Is a Real-Time Payment (RTP) Network?

A Real-Time Payment (RTP) network is a digital infrastructure enabling instant money transfers between bank accounts, typically processed within seconds. Unlike traditional wire transfers that may take several hours or days, RTP networks provide immediate settlement and real-time transaction confirmation, enhancing liquidity and cash flow management. Major RTP systems, such as The Clearing House's RTP in the U.S. and the Faster Payments Service in the U.K., support 24/7 availability and support additional data capabilities like remittance information for streamlined reconciliation.

Key Differences: Wire Transfers vs RTP

Wire transfers utilize batch processing and can take several hours to settle, while Real-Time Payment (RTP) networks enable instantaneous fund transfers 24/7, enhancing transaction speed and liquidity management. Wire transfers often involve higher fees and require detailed recipient information, whereas RTP systems simplify payments through standardized messaging protocols and lower costs. Security protocols differ as well, with wire transfers relying on legacy systems like SWIFT, and RTP leveraging modern API-based infrastructures for real-time fraud detection and transaction monitoring.

Speed and Settlement: Instant vs Traditional Transfers

Real-time payment networks enable instant fund transfers and immediate settlement, ensuring fast availability of funds for both senders and recipients. Wire transfers typically involve traditional processing times ranging from several minutes to multiple hours or even days, depending on the banks and jurisdictions involved. The speed advantage of real-time payments significantly improves cash flow efficiency and reduces settlement risk compared to conventional wire transfers.

Security Features: Comparing Wire and RTP

Wire transfers utilize secure encrypted channels and multi-factor authentication protocols to protect large-value transactions, offering robust fraud detection systems tailored for high-value wire payments. Real-time payment networks (RTP) employ tokenization, end-to-end encryption, and immediate transaction alerts, ensuring rapid fraud response and reduced settlement risk. Both systems prioritize security, but wire transfers are traditionally favored for high-value, cross-border payments, while RTP excels in instant, lower-value domestic transfers with continuous monitoring.

Cost Comparison: Fees in Wire Transfers vs RTP

Wire transfers typically involve higher fees, ranging from $20 to $50 per transaction for domestic transfers, while Real-Time Payment (RTP) networks charge significantly lower fees, often under $1 per transaction. The RTP system reduces overhead by processing payments instantly through automated clearinghouses, minimizing intermediary costs. Banks benefit from RTP by lowering operational expenses and passing these savings to customers, making RTP a cost-effective alternative to traditional wire transfers.

Accessibility and Availability for Consumers

Wire transfers offer broad accessibility through well-established banking networks but often involve processing delays and limited operating hours. Real-time payment networks provide immediate fund transfers, accessible 24/7, enhancing availability for consumers who require instant access to funds. Consumers benefit from real-time networks' continuous uptime, while wire transfers remain crucial for high-value or international transactions despite limited availability outside business hours.

Use Cases: When to Use Wire vs RTP

Wire transfers are ideal for large-value transactions that require guaranteed settlement and are commonly used in real estate closings, international payments, and corporate fund transfers due to their high security and finality. Real-time payment networks (RTP) excel in use cases needing instant settlement and continuous availability, such as peer-to-peer payments, bill payments, and small business transactions that demand liquidity and speed. Choosing between wire transfers and RTP depends on factors like transaction size, urgency, settlement certainty, and operational hours, with wire transfers favored for high-value and cross-border payments and RTP preferred for immediate domestic transactions.

Cross-Border Payments: Wire Transfers vs RTP

Cross-border payments through wire transfers remain the dominant method due to their broad acceptance and established international network, facilitating secure transfer of large sums across currencies. Real-time payment networks (RTP) offer faster settlement times, typically seconds to minutes, enhancing liquidity and operational efficiency, but their adoption is limited by regional availability and lack of universal interoperability. Financial institutions weigh the trade-off between wire transfers' global reach and RTP's speed and convenience when optimizing for cross-border payment solutions.

Future of Banking: RTP Adoption Trends

Real-time payment (RTP) networks are rapidly transforming the banking landscape by enabling instant fund transfers with 24/7 availability, outpacing traditional wire transfers that often involve delays and higher fees. Financial institutions increasingly adopt RTP systems to enhance customer experience and streamline liquidity management, as evidenced by a 35% annual growth in RTP transactions across North America and Europe. Future banking strategies prioritize RTP integration to capitalize on demand for faster payments, regulatory support, and the rise of digital banking platforms driving seamless, real-time financial interactions.

Related Important Terms

FedNow

FedNow enables real-time payment settlements within seconds, offering banks and customers instant funds availability compared to traditional wire transfers that can take hours or even days. This real-time payment network enhances liquidity management and reduces settlement risk, providing a significant advantage for financial institutions seeking faster transaction processing.

RTP (Real-Time Payments) Network

The Real-Time Payments (RTP) network enables instantaneous fund transfers and settlement, providing enhanced speed and transparency compared to traditional wire transfers that often require hours or days to process. RTP's 24/7 availability and messaging capabilities improve liquidity management and customer experience, positioning it as the preferred solution for modern banking transactions.

SWIFT gpi

SWIFT gpi revolutionizes international wire transfers with fast tracking, transparency, and end-to-end payment visibility, enhancing liquidity management for banks and corporate clients. Real-time payment networks offer instant domestic settlements but lack the global reach and standardized reporting features that SWIFT gpi provides for cross-border transactions.

Faster Payments Service (FPS)

The Faster Payments Service (FPS) enables near-instantaneous fund transfers between bank accounts within the UK, significantly reducing the processing time compared to traditional wire transfers that can take several hours or even days. FPS offers enhanced convenience for both retail and business customers by supporting transactions up to PS250,000, facilitating real-time payments and improving cash flow management in banking operations.

ISO 20022 Messaging

ISO 20022 messaging enhances both wire transfers and real-time payment networks by standardizing data formats, enabling improved interoperability and richer transaction information. Real-time payment networks leverage ISO 20022 to provide faster settlement and immediate fund availability compared to traditional wire transfers, which typically have longer clearing times despite increasing adoption of ISO 20022 for enhanced compliance and reporting.

Instant Settlement

Wire transfers typically involve batch processing with settlement times ranging from a few hours to several days, while real-time payment networks enable instant settlement by processing transactions continuously and immediately. This instant settlement capability enhances liquidity management and reduces counterparty risk, making real-time payments more efficient for urgent fund transfers in banking.

Push Payments

Wire transfers are traditional push payment methods that enable secure, high-value funds transfer between banks but often involve longer processing times and higher fees. Real-time payment networks offer instant, 24/7 push payments with immediate fund availability, enhancing liquidity and customer experience in retail and commercial banking.

Cross-border RTP

Cross-border Real-time Payment Networks (RTP) offer instantaneous settlement and enhanced transparency compared to traditional wire transfers, which often involve delayed processing and higher fees. RTP systems leverage advanced APIs and blockchain technology to enable secure, cost-effective, and compliant international transactions, improving liquidity management for banks and customers globally.

Payment Finality

Wire transfers provide payment finality typically within one to two business days through traditional clearing systems, ensuring irreversible settlement upon completion. Real-time payment networks achieve immediate payment finality by processing transactions instantly, enabling funds to be available for use within seconds and reducing settlement risk.

API-based Payments

API-based payments within banking accelerate fund transfers by enabling seamless integration with wire transfer systems and real-time payment networks, offering enhanced security and traceability. Real-time payment networks provide instant settlement and 24/7 availability, while wire transfers typically involve batch processing with longer settlement times, making APIs crucial for optimizing transaction efficiency and customer experience.

Wire transfer vs Real-time payment network for banking. Infographic

moneydiff.com

moneydiff.com