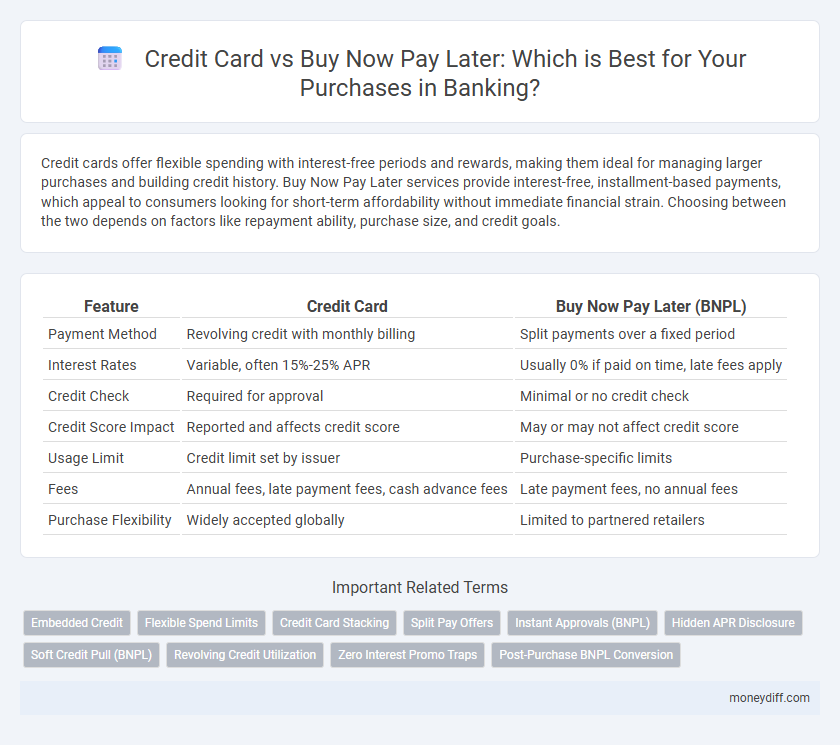

Credit cards offer flexible spending with interest-free periods and rewards, making them ideal for managing larger purchases and building credit history. Buy Now Pay Later services provide interest-free, installment-based payments, which appeal to consumers looking for short-term affordability without immediate financial strain. Choosing between the two depends on factors like repayment ability, purchase size, and credit goals.

Table of Comparison

| Feature | Credit Card | Buy Now Pay Later (BNPL) |

|---|---|---|

| Payment Method | Revolving credit with monthly billing | Split payments over a fixed period |

| Interest Rates | Variable, often 15%-25% APR | Usually 0% if paid on time, late fees apply |

| Credit Check | Required for approval | Minimal or no credit check |

| Credit Score Impact | Reported and affects credit score | May or may not affect credit score |

| Usage Limit | Credit limit set by issuer | Purchase-specific limits |

| Fees | Annual fees, late payment fees, cash advance fees | Late payment fees, no annual fees |

| Purchase Flexibility | Widely accepted globally | Limited to partnered retailers |

Understanding Credit Cards and Buy Now Pay Later (BNPL)

Credit cards offer revolving credit with interest rates ranging from 15% to 25% APR, enabling users to make purchases and pay over time while earning rewards such as cashback or travel points. Buy Now Pay Later (BNPL) services provide short-term financing with interest-free periods up to 30 or 60 days, targeting consumers seeking interest-free installments without credit checks. Understanding the differences in credit impact, fees, and repayment terms helps consumers choose between credit cards and BNPL options for managing purchase expenses.

Key Differences Between Credit Cards and BNPL

Credit cards offer revolving credit with interest charged on unpaid balances, enabling flexible repayment schedules but potentially higher long-term costs. Buy Now Pay Later (BNPL) services provide interest-free installment payments over a short period, often without affecting credit scores if paid on time. Unlike credit cards, BNPL typically lacks widespread acceptance and comprehensive consumer protections, making them suitable for smaller, planned purchases rather than ongoing credit needs.

How Each Option Affects Your Credit Score

Credit card usage impacts your credit score by influencing credit utilization rates and payment history, with timely payments boosting your score and high balances potentially lowering it. Buy Now Pay Later (BNPL) services often do not report to credit bureaus unless payments are missed, which means responsible use may not enhance your credit score, but defaults can harm it. Understanding these effects helps consumers choose the option that best supports their credit health while managing short-term financing needs.

Interest Rates and Fees: Which Costs More?

Credit cards typically charge interest rates ranging from 15% to 25% annually, along with potential fees such as annual charges, late payment penalties, and cash advance fees, which can significantly increase the overall cost. Buy Now Pay Later (BNPL) services often offer interest-free periods but may impose late fees or higher interest rates if payments are missed or extended beyond the promotional window. Comparing costs depends on usage patterns, but credit cards generally incur higher long-term interest expenses, while BNPL can be cheaper if payments are made on time within the interest-free period.

Payment Flexibility and Repayment Terms

Credit cards offer flexible payment options with variable repayment terms, allowing consumers to pay minimum amounts or the full balance each billing cycle, often incurring interest on carried balances. Buy Now Pay Later (BNPL) services typically provide fixed installment plans with no or low interest if paid on time, enabling predictable budgeting for specific purchases. BNPL's structured repayment schedules reduce the risk of accumulating long-term debt compared to revolving credit card balances.

Approval Processes: Credit Check vs. Easy Access

Credit cards require a thorough credit check to assess the applicant's creditworthiness, often affecting approval speed and eligibility. Buy Now Pay Later (BNPL) services typically offer easier access with minimal or no credit checks, enabling quicker approval and higher acceptance rates. This streamlined BNPL approval process appeals to consumers seeking fast, flexible purchasing options without impacting their credit score.

Rewards, Perks, and Cashback: Added Benefits

Credit cards often provide extensive rewards programs, including cashback, travel miles, and exclusive perks like concierge services and purchase protection, enhancing overall value for frequent users. Buy Now Pay Later (BNPL) options typically lack these rewards, focusing instead on interest-free installments without added incentives. Consumers seeking maximum benefits and long-term value tend to prefer credit cards for purchases due to their comprehensive rewards and perks ecosystems.

Risks of Debt Accumulation: Credit Card vs. BNPL

Credit cards often carry high-interest rates that can lead to rapid debt accumulation if balances are not paid in full each month. Buy Now Pay Later (BNPL) services may appear interest-free initially but can result in late fees and increased financial strain if multiple installments overlap. Both options require careful budget management to avoid the pitfalls of escalating debt and negative credit impacts.

Best Practices for Using Credit Cards and BNPL Responsibly

Managing credit cards and Buy Now Pay Later (BNPL) services responsibly involves monitoring spending limits and paying balances on time to avoid interest charges and fees. Credit cards offer benefits like rewards and credit building when used prudently, while BNPL requires careful assessment of repayment schedules to prevent debt accumulation. Combining thorough budgeting with awareness of each option's terms ensures sustainable financial health and maximizes purchasing power.

Choosing the Right Payment Method for Your Purchases

Credit cards offer flexible repayment options and rewards programs that can enhance buying power and provide purchase protection, making them ideal for managing larger or recurring expenses. Buy Now Pay Later (BNPL) services allow interest-free, short-term installment payments, which can improve cash flow and simplify budgeting for smaller, planned purchases. Assessing your financial habits, purchase frequency, and repayment capacity will help determine which payment method aligns best with your spending needs and credit management goals.

Related Important Terms

Embedded Credit

Embedded credit solutions integrate Buy Now Pay Later (BNPL) options directly within the merchant's platform, offering seamless purchasing experiences that often bypass the need for traditional credit card processing. This embedded approach enhances customer convenience and conversion rates by providing instant financing with flexible repayment terms while reducing reliance on credit card networks and associated fees.

Flexible Spend Limits

Credit cards offer flexible spend limits that adjust based on creditworthiness and payment history, allowing users to make larger or emergency purchases without immediate cash. Buy Now Pay Later plans typically provide fixed spending limits tied to specific transactions, limiting flexibility for varied purchase amounts or unexpected expenses.

Credit Card Stacking

Credit card stacking allows consumers to maximize purchasing power by using multiple credit cards simultaneously, offering higher cumulative credit limits compared to Buy Now Pay Later (BNPL) options that typically restrict spending to a single vendor or transaction. Unlike BNPL, credit card stacking provides greater flexibility and rewards like cashback, airline miles, and purchase protection, enhancing financial management and cost efficiency during large or diverse purchases.

Split Pay Offers

Credit cards provide flexible split payment options with interest-free periods and cashback rewards, making them ideal for managing larger purchases over time. Buy Now Pay Later (BNPL) services offer interest-free split pay offers with fixed installment plans, appealing to consumers seeking transparent repayment schedules without impacting credit scores.

Instant Approvals (BNPL)

Buy Now Pay Later (BNPL) services offer instant approvals, enabling consumers to complete purchases quickly without undergoing the traditional credit card application process that requires credit checks and longer approval times. This immediate access to credit enhances purchasing convenience and appeals to customers seeking fast, flexible payment options without impacting credit scores.

Hidden APR Disclosure

Credit cards often include hidden APR disclosures buried in lengthy terms, causing consumers to underestimate interest costs, while Buy Now Pay Later (BNPL) services typically offer clearer, upfront fee structures with fewer surprise charges. BNPL providers emphasize transparent payment schedules and fixed fees, reducing confusion around interest accrual compared to the variable rates frequently concealed in credit card agreements.

Soft Credit Pull (BNPL)

Buy Now Pay Later (BNPL) services typically perform a soft credit pull, which does not affect your credit score, making it a favorable option for consumers cautious about credit inquiries. In contrast, credit card applications often involve hard credit pulls that can temporarily lower your credit score and impact future lending decisions.

Revolving Credit Utilization

Credit cards offer revolving credit utilization, allowing consumers to carry a balance and make minimum payments while accruing interest, which can impact credit scores if utilization exceeds recommended limits of 30%. Buy Now Pay Later services typically operate as short-term installment plans without revolving credit, minimizing credit utilization impact but often lacking the credit-building benefits that credit cards provide.

Zero Interest Promo Traps

Credit cards often lure consumers with zero interest promotional periods but impose high deferred interest rates if the balance is not paid in full by the promo end date. Buy Now Pay Later services may appear interest-free, yet hidden fees and strict repayment schedules can lead to significant financial penalties and credit score impacts if missed.

Post-Purchase BNPL Conversion

Post-purchase BNPL conversion offers consumers enhanced flexibility by spreading payments over multiple installments without immediate interest, distinguishing it from traditional credit card transactions that often incur interest charges if balances are not paid in full. Retailers benefit from higher average order values and increased customer retention through seamless BNPL integration at checkout, optimizing conversion rates beyond conventional credit card usage.

Credit Card vs Buy Now Pay Later for purchases. Infographic

moneydiff.com

moneydiff.com