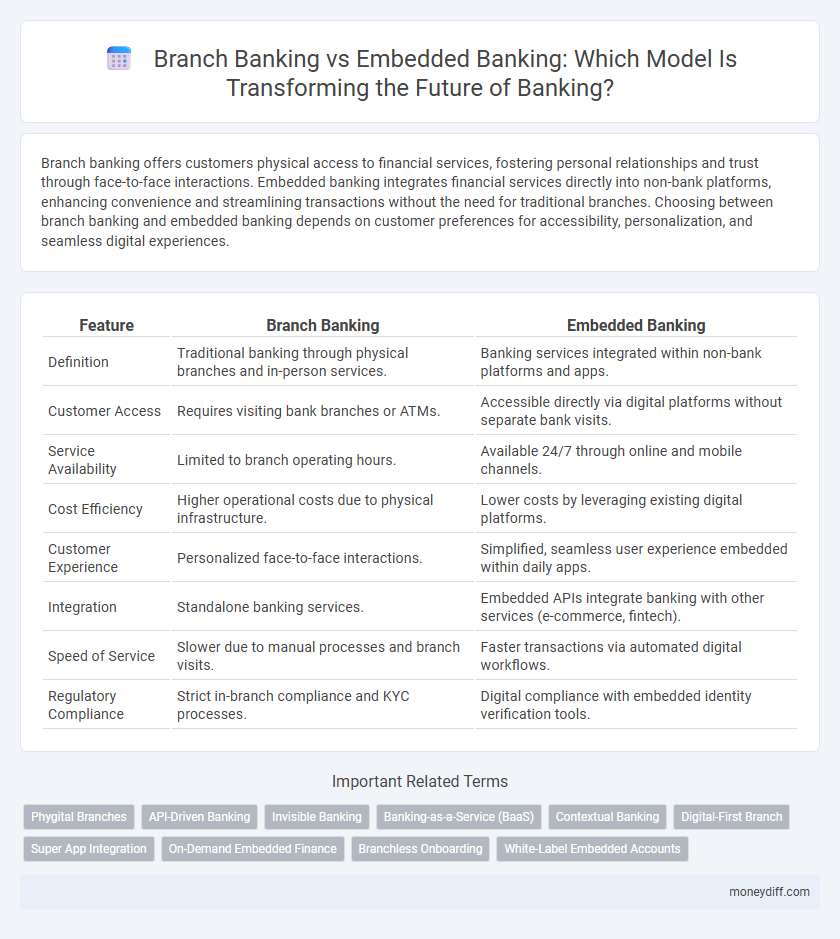

Branch banking offers customers physical access to financial services, fostering personal relationships and trust through face-to-face interactions. Embedded banking integrates financial services directly into non-bank platforms, enhancing convenience and streamlining transactions without the need for traditional branches. Choosing between branch banking and embedded banking depends on customer preferences for accessibility, personalization, and seamless digital experiences.

Table of Comparison

| Feature | Branch Banking | Embedded Banking |

|---|---|---|

| Definition | Traditional banking through physical branches and in-person services. | Banking services integrated within non-bank platforms and apps. |

| Customer Access | Requires visiting bank branches or ATMs. | Accessible directly via digital platforms without separate bank visits. |

| Service Availability | Limited to branch operating hours. | Available 24/7 through online and mobile channels. |

| Cost Efficiency | Higher operational costs due to physical infrastructure. | Lower costs by leveraging existing digital platforms. |

| Customer Experience | Personalized face-to-face interactions. | Simplified, seamless user experience embedded within daily apps. |

| Integration | Standalone banking services. | Embedded APIs integrate banking with other services (e-commerce, fintech). |

| Speed of Service | Slower due to manual processes and branch visits. | Faster transactions via automated digital workflows. |

| Regulatory Compliance | Strict in-branch compliance and KYC processes. | Digital compliance with embedded identity verification tools. |

Understanding Branch Banking: Traditional Bank Operations

Branch banking operates through physical locations where customers access services such as deposits, withdrawals, loan consultations, and financial advising, emphasizing personalized interactions. Traditional bank operations rely heavily on in-branch staff, secure infrastructure, and established workflows to manage transactions and customer relationships. This model supports trust-building and complex services but faces challenges from digital transformation and changing consumer preferences.

What Is Embedded Banking? The New Financial Paradigm

Embedded banking integrates financial services directly into non-bank platforms, enabling seamless transactions without the need to visit traditional bank branches. This new financial paradigm leverages APIs to offer tailored banking solutions within apps or websites, improving user experience and accessibility. Compared to branch banking, embedded banking reduces operational costs and expands reach by embedding banking functionalities in everyday digital ecosystems.

Key Differences Between Branch and Embedded Banking

Branch banking operates through physical bank locations offering traditional in-person services such as teller transactions, loan applications, and financial advice, whereas embedded banking integrates financial services directly into non-bank platforms like e-commerce and software applications. Branch banking requires customer visits and focuses on comprehensive service offerings, while embedded banking emphasizes seamless, API-driven access to banking functionalities within third-party environments. Security protocols and regulatory compliance are central to both, but embedded banking leverages digital infrastructure for real-time data exchange and personalized user experiences.

Customer Experience: In-Person vs Digital Banking Services

Branch banking offers personalized, face-to-face interactions that build trust and provide tailored financial advice, enhancing customer satisfaction through direct support. Embedded banking integrates financial services seamlessly into digital platforms, delivering convenience, faster transactions, and 24/7 accessibility that meet the expectations of tech-savvy customers. The shift toward embedded banking prioritizes user-friendly interfaces and real-time service, significantly improving customer experience in the digital age.

Cost Implications: Operational Expenses in Both Models

Branch banking incurs significant operational expenses including rent, utilities, and staffing costs required to maintain physical locations. Embedded banking reduces these costs by integrating financial services directly into third-party platforms, minimizing the need for physical infrastructure and associated overhead. The shift towards embedded banking enables financial institutions to optimize operational expenses through scalable, technology-driven models.

Accessibility and Convenience: Branch vs Embedded Solutions

Branch banking provides physical access to financial services through a network of local offices, offering personalized customer interactions but limited by location and operating hours. Embedded banking integrates financial services directly into non-banking platforms such as e-commerce or apps, enhancing accessibility and convenience by enabling users to perform transactions anytime within familiar ecosystems. Customers benefit from seamless payment processing, instant credit services, and tailored financial products without the need to visit a branch, significantly improving user experience in digital-first environments.

Security and Compliance Considerations

Branch banking offers established physical security protocols and direct regulatory oversight, ensuring compliance with stringent financial regulations such as KYC and AML. Embedded banking integrates financial services within third-party platforms, necessitating advanced cybersecurity measures and continuous monitoring to mitigate risks related to data breaches and fraud. Compliance frameworks for embedded banking require seamless integration with existing regulatory standards while maintaining transparency and customer data protection across digital ecosystems.

Technology Integration in Modern Banking

Branch banking relies on physical locations to deliver services, limiting scalability and speed in integrating advanced technologies such as AI-driven analytics and real-time transaction processing. Embedded banking leverages APIs and cloud-based platforms to seamlessly integrate financial services into non-banking environments, enabling faster deployment of innovative digital experiences and personalized customer interactions. Technology integration in embedded banking accelerates automation, reduces operational costs, and enhances data-driven decision-making compared to traditional branch banking models.

Impact on Financial Inclusion and Reach

Branch banking offers physical access points that enhance financial inclusion by serving underserved and rural populations with personalized support, enabling direct financial literacy and trust-building. Embedded banking integrates financial services into non-banking platforms, significantly expanding reach through digital channels and meeting customers in their daily digital environments, which reduces barriers related to geography and infrastructure. Combining branch and embedded banking strategies maximizes financial inclusion by blending physical accessibility with digital convenience, broadening service delivery to diverse customer segments.

Future Trends: The Evolution of Banking Models

Branch banking is gradually evolving as digital transformation drives customer preference towards seamless, on-demand financial services. Embedded banking integrates banking functions directly into non-bank platforms through APIs, enabling personalized, real-time financial experiences within everyday apps. Future trends emphasize a hybrid model where traditional branch infrastructure coexists with embedded solutions, optimizing accessibility, efficiency, and user engagement in the banking ecosystem.

Related Important Terms

Phygital Branches

Phygital branches combine the physical presence of traditional branch banking with the seamless digital experiences of embedded banking, enhancing customer engagement and operational efficiency. This hybrid model leverages advanced technologies such as AI-driven kiosks and mobile app integrations to provide personalized financial services while maintaining face-to-face interactions.

API-Driven Banking

API-driven banking enables embedded banking to integrate seamless financial services directly within non-bank platforms, offering personalized customer experiences and real-time transactions without the constraints of traditional branch banking. Branch banking relies on physical locations and legacy systems, limiting scalability and agility compared to the flexible, data-rich APIs that power embedded banking ecosystems.

Invisible Banking

Invisible banking in embedded banking integrates financial services seamlessly into non-banking platforms, eliminating the need for physical branches and enhancing customer convenience through real-time transactions. Branch banking relies on physical locations and face-to-face interactions, limiting scalability and immediacy compared to the frictionless, API-driven experiences offered by embedded banking solutions.

Banking-as-a-Service (BaaS)

Branch banking requires substantial physical infrastructure and operational costs, often limiting scalability and customer reach, whereas Embedded Banking leverages Banking-as-a-Service (BaaS) platforms to seamlessly integrate financial services into non-bank environments, enabling faster innovation and broader access. BaaS ecosystems facilitate agile deployment of banking products within digital platforms, enhancing customer experience and reducing entry barriers compared to traditional branch networks.

Contextual Banking

Branch banking offers traditional in-person services through physical locations, providing personalized customer interactions and established trust within local communities. Embedded banking integrates financial services directly into non-banking platforms, enabling seamless contextual banking experiences by embedding payments, lending, or accounts into everyday digital activities.

Digital-First Branch

Digital-first branches integrate advanced technology to provide seamless, personalized customer experiences, reducing the need for physical interactions compared to traditional branch banking. Embedded banking leverages APIs to incorporate financial services directly within non-bank platforms, enhancing convenience and accessibility beyond the limitations of physical branches.

Super App Integration

Branch banking relies on physical locations for customer interactions, limiting accessibility and scalability, whereas embedded banking integrates financial services directly into Super Apps, offering seamless, real-time transactions and enhanced user experience. Super App integration leverages APIs to embed banking features like payments, loans, and account management within platforms users frequently engage with, driving convenience and expanding customer reach beyond traditional branch networks.

On-Demand Embedded Finance

On-demand embedded finance integrates banking services directly into non-banking platforms, enabling seamless customer access without the need for physical branches, which significantly reduces operational costs and enhances user experience. Branch banking relies on traditional in-person visits and infrastructure, limiting scalability and agility compared to the instant, API-driven solutions offered by embedded banking models.

Branchless Onboarding

Branchless onboarding in embedded banking streamlines customer acquisition by integrating banking services directly within non-bank platforms, reducing reliance on physical branch visits and enhancing user convenience. This approach leverages advanced APIs and digital identity verification, enabling faster, seamless account openings compared to traditional branch banking models.

White-Label Embedded Accounts

White-label embedded accounts integrate banking services directly into third-party platforms, enabling seamless financial transactions without traditional branch visits, while branch banking relies on physical locations and direct customer interaction. This modern approach enhances customer experience by offering personalized banking solutions through familiar digital environments, reducing operational costs and expanding market reach.

Branch banking vs Embedded banking for banking. Infographic

moneydiff.com

moneydiff.com