ATM withdrawal requires a physical debit or credit card to access cash, providing a traditional and widely accepted method for quick fund access. Cardless cash allows users to withdraw money using a mobile app or PIN, enhancing convenience and security by eliminating the need to carry a card. Both options offer flexible solutions for accessing cash, with cardless cash reducing the risk of card theft and ATM withdrawal maintaining familiarity and ease of use.

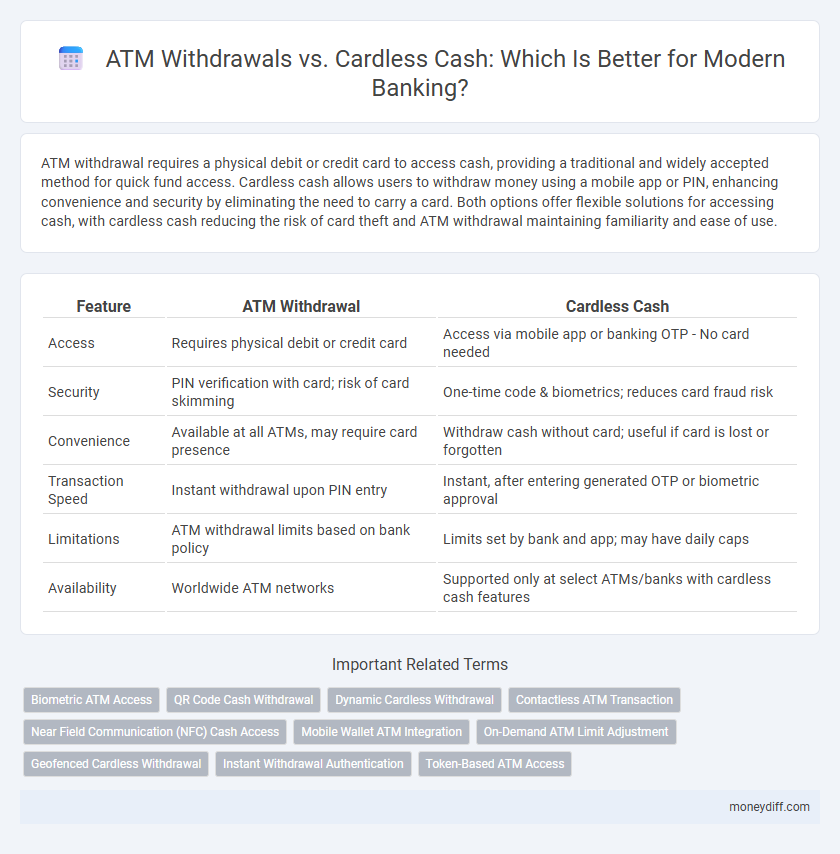

Table of Comparison

| Feature | ATM Withdrawal | Cardless Cash |

|---|---|---|

| Access | Requires physical debit or credit card | Access via mobile app or banking OTP - No card needed |

| Security | PIN verification with card; risk of card skimming | One-time code & biometrics; reduces card fraud risk |

| Convenience | Available at all ATMs, may require card presence | Withdraw cash without card; useful if card is lost or forgotten |

| Transaction Speed | Instant withdrawal upon PIN entry | Instant, after entering generated OTP or biometric approval |

| Limitations | ATM withdrawal limits based on bank policy | Limits set by bank and app; may have daily caps |

| Availability | Worldwide ATM networks | Supported only at select ATMs/banks with cardless cash features |

Understanding ATM Withdrawals vs Cardless Cash: An Overview

ATM withdrawals require a physical debit or credit card to access funds instantly from an account through the automated teller machine, ensuring secure and convenient cash dispensing. Cardless cash enables users to withdraw money without a card by using a mobile app or digital code, enhancing flexibility and reducing the risk of card loss or theft. Both methods provide quick access to cash, but cardless cash leverages biometric authentication and real-time transaction tracking for improved security and user experience.

How Traditional ATM Withdrawals Work

Traditional ATM withdrawals require customers to insert their debit or credit card into the ATM machine, enter a secure PIN, and select the withdrawal amount from their bank account. The ATM connects to the bank's network to verify account balance and authenticate the transaction before dispensing cash. This process relies on physical cards and secure PIN verification for access to funds, making it a widely used method for quick cash access.

Exploring Cardless Cash: Definition and Process

Cardless cash withdrawals enable customers to access funds from ATMs without using a physical debit or credit card by utilizing mobile banking apps or secure OTPs (One-Time Passwords). The process typically involves generating a withdrawal code or QR scanner verification within the bank's app, which is then entered or scanned at the ATM to authorize the transaction. This technology enhances security by reducing card skimming risks and adds convenience for users who may forget or misplace their cards.

Security Features: ATM Withdrawal vs Cardless Cash

ATM withdrawals rely on physical cards and PIN authentication, which can be vulnerable to card skimming and PIN theft. Cardless cash transactions utilize encrypted mobile authentication methods, reducing the risk of card cloning and shoulder surfing attacks. Biometric verification and one-time codes in cardless cash systems enhance security by ensuring only the authorized user can access funds without requiring a physical card.

Accessibility and Convenience: Which Method Wins?

ATM withdrawal offers widespread accessibility with millions of machines globally, enabling users to quickly access cash anytime using their debit or credit cards. Cardless cash enhances convenience by eliminating the need to carry a physical card, allowing secure withdrawals via mobile apps or SMS codes, ideal for forgotten cards or emergency situations. While ATM withdrawal remains standard for accessibility, cardless cash increasingly wins in convenience through seamless, contactless transactions and enhanced security features.

Transaction Limits and Fees: Comparing Both Options

ATM withdrawal typically involves predefined daily transaction limits set by the bank, often ranging from $300 to $1,000, with fees varying based on the ATM network and account type. Cardless cash transactions usually feature lower or customizable limits, offering enhanced security by eliminating the physical card, and may incur reduced or no fees depending on the bank's policy. Comparing both options reveals that cardless cash is ideal for secure, smaller transactions, while traditional ATM withdrawals are better suited for higher cash needs but potentially higher fee exposure.

Situational Use Cases for ATM Withdrawal vs Cardless Cash

ATM withdrawal is ideal for users who require immediate access to cash with a physical card in hand, especially in locations with a high density of ATMs. Cardless cash proves beneficial for those who forget or lose their cards, enabling cash access via secure mobile app authentication and PIN entry, particularly useful in emergency or spontaneous scenarios. Both methods enhance customer convenience, with cardless cash offering increased security and flexibility in evolving digital banking landscapes.

User Experience: Assessing Ease of Use

ATM withdrawal offers a familiar and straightforward process where users insert their card and enter a PIN, ensuring quick access to cash. Cardless cash enhances convenience by allowing withdrawals via mobile app authentication or QR codes, eliminating the need for a physical card. Both methods prioritize security, but cardless cash delivers a seamless digital experience optimized for smartphone users.

Potential Risks and Fraud Prevention

ATM withdrawals entail risks such as card skimming, PIN theft, and physical card loss, which can lead to unauthorized transactions and financial fraud. Cardless cash withdrawals mitigate these risks by eliminating the need for a physical card, but they require robust authentication methods like biometric verification or one-time passcodes to prevent identity theft and phishing attacks. Implementing multi-factor authentication and real-time transaction monitoring enhances fraud prevention in both withdrawal methods, safeguarding customer accounts and sensitive banking data.

Future Trends: The Evolution of Cash Withdrawal Methods

Future trends in cash withdrawal methods highlight the growing adoption of cardless cash technology, driven by increased mobile banking and biometric authentication. Banks are investing in secure, contactless solutions that enhance user convenience and reduce fraud risks compared to traditional ATM withdrawals. Integration of AI and blockchain is expected to further revolutionize cash access, providing seamless and instant withdrawal experiences.

Related Important Terms

Biometric ATM Access

Biometric ATM access enhances security by using fingerprint or facial recognition for withdrawals, reducing fraud risks compared to traditional card-based transactions. Cardless cash withdrawals leverage mobile authentication combined with biometrics, offering convenient and secure banking without the need for physical cards.

QR Code Cash Withdrawal

QR code cash withdrawal eliminates the need for a physical card by allowing customers to access funds through secure, real-time QR code scanning at ATMs, enhancing transaction speed and reducing the risk of card skimming fraud. This method leverages mobile banking apps with encrypted QR codes, offering a seamless, contactless alternative to traditional card-based ATM withdrawals while maintaining robust security protocols.

Dynamic Cardless Withdrawal

Dynamic Cardless Withdrawal enables customers to securely access cash from ATMs using unique, time-sensitive codes generated via mobile banking apps, eliminating the need for physical cards and reducing fraud risk. This innovative method enhances convenience and security by allowing real-time transaction control and instant code revocation.

Contactless ATM Transaction

Contactless ATM transactions enable secure, cardless cash withdrawals by using mobile devices with NFC technology, reducing the risk of card skimming and enhancing user convenience. This method streamlines access to funds while maintaining high security standards through biometric verification and real-time transaction alerts.

Near Field Communication (NFC) Cash Access

Near Field Communication (NFC) cash access enhances ATM withdrawal convenience by enabling cardless transactions through secure smartphone authentication, reducing the risk of card skimming and theft. This technology streamlines access to cash, supporting faster, contactless withdrawals while maintaining high security standards in banking operations.

Mobile Wallet ATM Integration

Mobile Wallet ATM integration enables seamless cardless cash withdrawal by linking smartphones directly to ATM networks, enhancing security and convenience compared to traditional ATM withdrawal requiring physical cards. This technology leverages tokenization and biometric authentication to reduce fraud risks and accelerate transaction times, improving the overall banking experience.

On-Demand ATM Limit Adjustment

On-demand ATM limit adjustment enhances flexibility by allowing customers to instantly increase their withdrawal limits for traditional ATM transactions or cardless cash requests, ensuring access to higher cash amounts when needed. This dynamic control leverages real-time banking app features to boost security and convenience, reducing the risk of declined transactions while accommodating urgent cash needs.

Geofenced Cardless Withdrawal

Geofenced cardless cash withdrawal enhances security and convenience by allowing customers to withdraw money from ATMs within a predefined geographic area using a mobile app, eliminating the need for a physical card. This technology reduces fraud risks associated with stolen cards and provides seamless access to cash while maintaining strict location-based controls dictated by banks.

Instant Withdrawal Authentication

Instant Withdrawal Authentication enhances security for both ATM Withdrawal and Cardless Cash transactions by utilizing biometric verification, one-time passcodes, or mobile app approvals, ensuring rapid and secure access to funds. Cardless Cash methods eliminate the need for physical cards, reducing fraud risk while maintaining instant withdrawal capabilities through encrypted authentication protocols.

Token-Based ATM Access

Token-based ATM access enhances security by using encrypted, time-sensitive tokens instead of physical cards, reducing risks of card skimming and theft during withdrawals. This technology simplifies cash access for users without requiring a card, leveraging mobile authentication and dynamic QR codes to enable seamless, secure cardless cash transactions.

ATM Withdrawal vs Cardless Cash for banking. Infographic

moneydiff.com

moneydiff.com