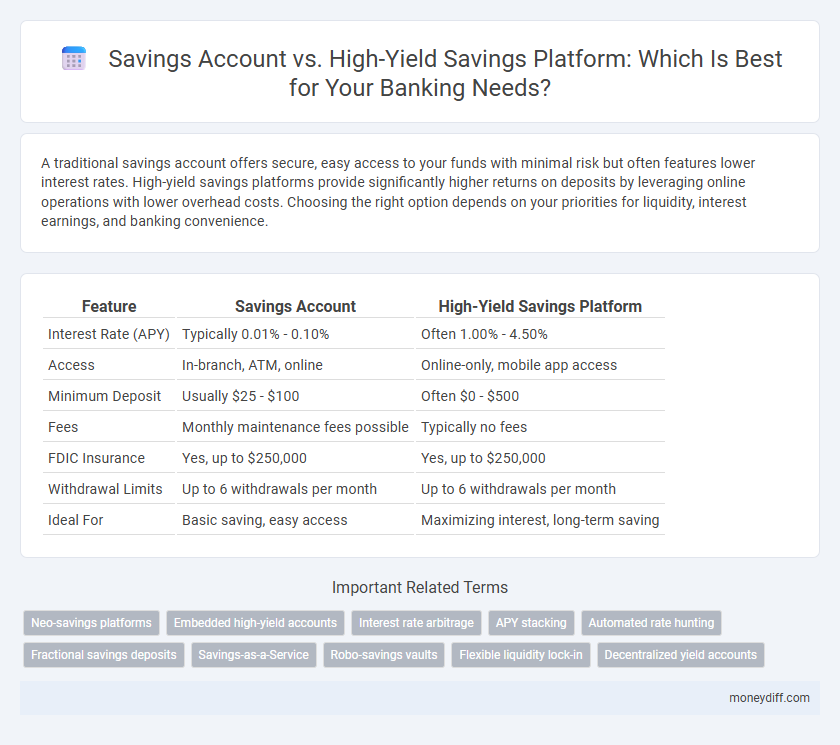

A traditional savings account offers secure, easy access to your funds with minimal risk but often features lower interest rates. High-yield savings platforms provide significantly higher returns on deposits by leveraging online operations with lower overhead costs. Choosing the right option depends on your priorities for liquidity, interest earnings, and banking convenience.

Table of Comparison

| Feature | Savings Account | High-Yield Savings Platform |

|---|---|---|

| Interest Rate (APY) | Typically 0.01% - 0.10% | Often 1.00% - 4.50% |

| Access | In-branch, ATM, online | Online-only, mobile app access |

| Minimum Deposit | Usually $25 - $100 | Often $0 - $500 |

| Fees | Monthly maintenance fees possible | Typically no fees |

| FDIC Insurance | Yes, up to $250,000 | Yes, up to $250,000 |

| Withdrawal Limits | Up to 6 withdrawals per month | Up to 6 withdrawals per month |

| Ideal For | Basic saving, easy access | Maximizing interest, long-term saving |

Introduction: Savings Accounts vs High-Yield Savings Platforms

Savings accounts typically offer lower interest rates, averaging around 0.01% to 0.10% APY, providing secure but modest growth for deposited funds. High-yield savings platforms leverage online-only banking models to deliver significantly higher interest rates, often above 3.50% APY, enhancing potential returns without compromising FDIC insurance. Choosing between these options depends on factors like interest earnings, accessibility, and customer service preferences.

Key Differences Explained

Savings accounts offered by traditional banks typically provide lower interest rates, averaging around 0.05% to 0.10% APY, while high-yield savings platforms can offer rates exceeding 4.00% APY, significantly boosting savings growth. High-yield accounts often feature fewer fees and minimum balance requirements compared to conventional savings accounts, enhancing cost-effectiveness for customers. Accessibility varies as traditional banks provide in-person services and ATM networks, whereas high-yield digital platforms emphasize online management and limited physical branches.

Interest Rates Comparison

High-yield savings accounts typically offer interest rates that are 5 to 20 times higher than traditional savings accounts, often ranging from 3.5% to 5.0% APY compared to 0.01% to 0.10% APY for standard bank savings accounts. These elevated rates stem from online-only platforms' lower overhead costs, allowing them to pass savings directly to customers in the form of higher returns. Choosing a high-yield savings platform can significantly boost earnings on deposits without increasing risk, making it a compelling option for maximizing interest income.

Accessibility and Account Management

Savings accounts typically offer easier accessibility through widespread branch networks and extensive ATM availability, allowing customers to manage funds conveniently in person or via mobile banking apps. High-yield savings platforms prioritize online and mobile account management tools, often providing faster digital fund transfers, real-time balance updates, and lower fees but may lack physical branch support. Effective account management on high-yield platforms includes automated savings features, goal tracking, and enhanced security protocols tailored for tech-savvy users seeking optimized returns.

Fees and Minimum Balance Requirements

Traditional savings accounts often have lower minimum balance requirements but may charge monthly maintenance fees that can erode interest earnings. High-yield savings platforms typically require higher minimum deposits but offer significantly better interest rates while reducing or eliminating monthly fees. Evaluating fee structures and balance thresholds is crucial for maximizing returns and minimizing costs in both account types.

Safety and FDIC Insurance

Savings accounts at traditional banks offer FDIC insurance up to $250,000 per depositor, ensuring full protection and safety of funds. High-yield savings platforms, often partnered with multiple insured banks, provide the same FDIC insurance coverage, sometimes spreading deposits across institutions to maximize insured limits. Both options guarantee federal safety standards, but high-yield platforms may offer enhanced returns while maintaining equal security.

Digital Features and User Experience

High-yield savings platforms offer advanced digital features such as real-time balance updates, mobile check deposits, and automated savings tools that significantly enhance user experience compared to traditional savings accounts. User interfaces on high-yield platforms prioritize intuitive navigation, personalized insights, and seamless integration with budgeting apps, facilitating more effective money management. In contrast, conventional savings accounts often lack these sophisticated digital conveniences, leading to less engaging and slower online banking interactions.

Pros and Cons of Traditional Savings Accounts

Traditional savings accounts offer easy access and FDIC insurance up to $250,000, providing a secure place to store funds with minimal risk. However, these accounts typically yield low interest rates, often below the inflation rate, which can erode purchasing power over time. Limited earning potential and lower APYs make them less competitive compared to high-yield savings platforms that offer significantly higher returns.

Pros and Cons of High-Yield Savings Platforms

High-yield savings platforms offer significantly higher interest rates compared to traditional savings accounts, enabling faster growth of deposited funds with minimal risk. However, they may have limited access to funds, longer withdrawal processing times, and sometimes require higher minimum balances to avoid fees. While ideal for maximizing interest earnings, these platforms might lack the branch accessibility and instant liquidity provided by conventional banks.

Which Option Is Best for Your Money Goals?

Savings accounts typically offer lower interest rates but provide easy access and federal insurance protection through the FDIC. High-yield savings platforms deliver significantly higher annual percentage yields (APYs), which can accelerate growth on your deposits, ideal for long-term savings goals. Choosing the best option depends on your need for liquidity versus maximizing interest earnings aligned with your financial objectives.

Related Important Terms

Neo-savings platforms

Neo-savings platforms offer significantly higher interest rates compared to traditional savings accounts, leveraging digital technology to reduce operational costs and pass savings to customers. These platforms provide seamless mobile access, instant fund transfers, and personalized financial insights, making them a superior choice for maximizing returns on deposits.

Embedded high-yield accounts

Embedded high-yield savings accounts integrate directly within everyday banking platforms, offering interest rates up to 4.5%, significantly surpassing traditional savings accounts' average rates of around 0.06%. These accounts enable seamless transfers and real-time access to funds while maximizing returns through automated interest compounding and minimal fees.

Interest rate arbitrage

High-yield savings platforms typically offer interest rates 3 to 5 times greater than conventional savings accounts, enabling significant interest rate arbitrage opportunities for depositors seeking higher returns. By leveraging these platforms, customers can maximize passive income while maintaining liquidity and minimizing risk compared to traditional banking options.

APY stacking

High-yield savings platforms offer significantly higher APYs compared to traditional savings accounts, enabling customers to maximize interest earnings through APY stacking by combining multiple accounts. This strategy leverages varying promotional rates and compound interest features to boost overall returns on savings efficiently.

Automated rate hunting

High-yield savings platforms leverage automated rate hunting algorithms to continuously scan and compare market interest rates, ensuring customers receive optimal returns on their deposits compared to traditional savings accounts with fixed, often lower, rates. This technology-driven approach maximizes yield efficiency while maintaining liquidity and security in banking.

Fractional savings deposits

Savings accounts typically offer lower interest rates with whole-dollar deposits, while high-yield savings platforms utilize fractional savings deposits to maximize interest earnings by allowing users to invest small, incremental amounts across diversified financial products. Fractional savings deposits enable more frequent, automated contributions that compound faster, enhancing overall savings growth compared to traditional banking methods.

Savings-as-a-Service

Savings-as-a-Service platforms offer higher interest rates and automated optimization compared to traditional savings accounts, leveraging real-time data analytics and AI to maximize returns while maintaining liquidity. These digital solutions provide seamless integration with multiple financial products and personalized financial insights, enhancing user experience and financial growth beyond standard banking savings options.

Robo-savings vaults

Robo-savings vaults offered by high-yield savings platforms automate savings by using algorithms to analyze spending patterns and transfer optimal amounts into high-interest accounts, significantly outperforming traditional savings accounts with their lower interest rates and manual management. These platforms enhance financial growth by combining AI-driven insights with competitive APYs, providing a seamless and efficient way for users to maximize savings potential.

Flexible liquidity lock-in

Savings accounts typically offer easy access to funds with minimal liquidity lock-in, allowing customers to withdraw money anytime without penalties. High-yield savings platforms often impose flexible liquidity lock-in periods, balancing higher interest rates with temporary restrictions on withdrawals to maximize returns.

Decentralized yield accounts

Decentralized yield accounts offer significantly higher interest rates compared to traditional savings accounts by leveraging blockchain technology and decentralized finance (DeFi) protocols, providing enhanced liquidity and transparency. These platforms reduce reliance on centralized banks, minimizing fees while offering competitive returns through algorithmic asset management and peer-to-peer lending mechanisms.

Savings account vs High-yield savings platform for banking. Infographic

moneydiff.com

moneydiff.com