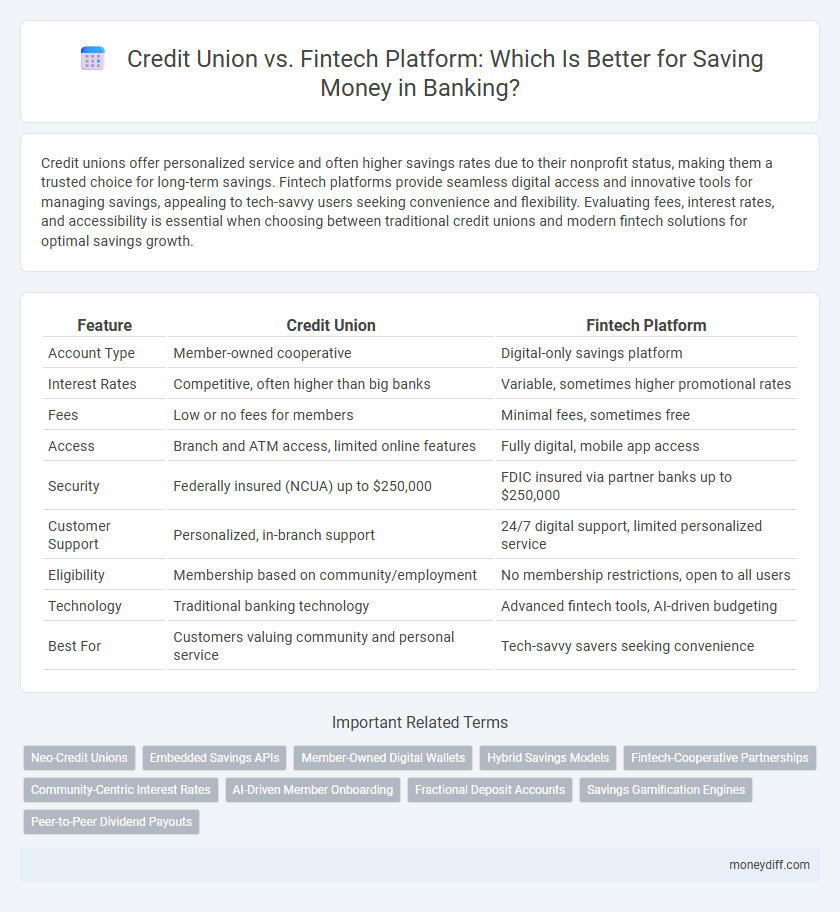

Credit unions offer personalized service and often higher savings rates due to their nonprofit status, making them a trusted choice for long-term savings. Fintech platforms provide seamless digital access and innovative tools for managing savings, appealing to tech-savvy users seeking convenience and flexibility. Evaluating fees, interest rates, and accessibility is essential when choosing between traditional credit unions and modern fintech solutions for optimal savings growth.

Table of Comparison

| Feature | Credit Union | Fintech Platform |

|---|---|---|

| Account Type | Member-owned cooperative | Digital-only savings platform |

| Interest Rates | Competitive, often higher than big banks | Variable, sometimes higher promotional rates |

| Fees | Low or no fees for members | Minimal fees, sometimes free |

| Access | Branch and ATM access, limited online features | Fully digital, mobile app access |

| Security | Federally insured (NCUA) up to $250,000 | FDIC insured via partner banks up to $250,000 |

| Customer Support | Personalized, in-branch support | 24/7 digital support, limited personalized service |

| Eligibility | Membership based on community/employment | No membership restrictions, open to all users |

| Technology | Traditional banking technology | Advanced fintech tools, AI-driven budgeting |

| Best For | Customers valuing community and personal service | Tech-savvy savers seeking convenience |

Credit Unions vs Fintech Platforms: An Overview

Credit unions offer member-owned, non-profit financial services with competitive savings rates and personalized customer support, emphasizing community-focused benefits and financial education. Fintech platforms provide digital-first solutions featuring seamless account access, innovative budgeting tools, and rapid fund transfers, targeting tech-savvy users seeking convenience and high-yield savings options. Comparing credit unions and fintech platforms reveals trade-offs between traditional trust and regulatory protections versus technology-driven agility and user experience optimization.

Membership and Accessibility

Credit unions offer exclusive membership based on specific criteria such as geographic location, employer, or community affiliation, providing personalized services and often lower fees for members. Fintech platforms deliver broader accessibility with digital-only interfaces, allowing users nationwide to open savings accounts without membership restrictions or physical branch visits. Membership exclusivity in credit unions may limit eligibility, while fintech platforms prioritize ease of access and convenience through technology-driven solutions.

Account Types and Features

Credit unions offer traditional savings accounts, certificates of deposit (CDs), and money market accounts with competitive interest rates and member-focused services, often providing lower fees and personalized support. Fintech platforms provide high-yield savings accounts and automated savings features, leveraging AI for goal-based saving and instant transfers, yet they may lack the in-person service and broader financial products found at credit unions. Account accessibility differs as fintech platforms prioritize mobile-first experiences, while credit unions emphasize community involvement and physical branch access.

Interest Rates and Yield Comparison

Credit unions typically offer higher interest rates on savings accounts compared to many fintech platforms, due to their non-profit structure and member-focused model. Fintech platforms often provide competitive yields through innovative investment strategies and lower operational costs but can expose savers to variable returns and higher risk. Evaluating the annual percentage yield (APY) alongside fees and liquidity options is essential for an informed comparison between credit union savings accounts and fintech alternatives.

Fees and Cost Structure

Credit unions typically offer lower fees and more transparent cost structures due to their member-owned, nonprofit model, making savings accounts more cost-effective compared to fintech platforms. Fintech platforms often have higher fees associated with advanced digital services and convenience features, which can impact overall savings growth. Evaluating the fee schedules and potential hidden costs is essential when choosing between a credit union and a fintech platform for maximizing savings.

Security and Regulatory Protections

Credit unions offer robust security measures backed by federal insurance through the National Credit Union Share Insurance Fund (NCUSIF), protecting members' deposits up to $250,000. Fintech platforms provide innovative savings solutions but often operate under varied regulatory frameworks, which may affect the consistency of consumer protection and security standards. Regulatory oversight ensures credit unions adhere to stringent compliance requirements, while fintech firms continue to enhance security protocols amid evolving cybersecurity threats.

Digital Experience and Technology

Credit unions offer personalized digital banking experiences, emphasizing member-focused services with secure online platforms tailored for savings management. Fintech platforms leverage advanced technology such as AI-driven financial insights, seamless mobile interfaces, and real-time transaction tracking to enhance user engagement and maximize savings growth. Both options provide robust digital solutions, but fintech platforms prioritize innovation and convenience, while credit unions emphasize trust and community-driven benefits.

Customer Support and Service Quality

Credit unions offer personalized customer support with dedicated representatives who understand individual member needs, often resulting in higher satisfaction and loyalty. Fintech platforms leverage AI-driven chatbots and 24/7 digital assistance to provide quick, efficient responses, but may lack the human touch critical for complex inquiries. Service quality in credit unions typically emphasizes trust and community engagement, whereas fintech prioritizes convenience and technologically advanced interfaces.

Community Focus vs. Innovation

Credit unions prioritize community-focused financial services by offering personalized support and member-driven benefits that foster local economic growth. Fintech platforms emphasize innovation through advanced technology, providing users with seamless, automated savings tools and real-time financial insights. The choice between credit unions and fintech platforms hinges on valuing community engagement versus cutting-edge digital experiences for savings optimization.

Which Option Is Best for Your Savings Goals?

Credit unions offer personalized service, lower fees, and higher interest rates on savings accounts due to their member-owned structure, making them ideal for risk-averse savers seeking stability. Fintech platforms provide advanced digital tools, instant access, and innovative features such as automated savings and real-time budgeting, appealing to tech-savvy users prioritizing convenience and fast growth. Choosing the best option depends on your savings goals, whether you value customer service and trust or technological innovation and flexibility.

Related Important Terms

Neo-Credit Unions

Neo-credit unions leverage advanced digital platforms to offer personalized savings products with lower fees and higher interest rates compared to traditional credit unions, while fintech platforms provide seamless, user-friendly interfaces and innovative features for goal-based savings. Both prioritize financial inclusion but neo-credit unions combine cooperative governance with digital efficiency, appealing to members seeking community-driven benefits alongside cutting-edge technology.

Embedded Savings APIs

Embedded Savings APIs in fintech platforms enable seamless integration of automated savings features directly within user-friendly apps, offering flexible, real-time options that often surpass traditional credit union savings products in accessibility and innovation. Credit unions provide personalized member services and trusted financial advice, but may lack the agile, API-driven embedded savings solutions that fintech platforms leverage to enhance user engagement and financial wellness.

Member-Owned Digital Wallets

Member-owned digital wallets offered by credit unions provide enhanced security and personalized service through cooperative governance, ensuring savings benefits are reinvested in members' financial well-being. Fintech platforms deliver seamless, tech-driven savings solutions with advanced features like AI-based budgeting tools, yet often lack the community-centric ownership model that fosters member trust and long-term value.

Hybrid Savings Models

Hybrid savings models combine the personalized service and community focus of credit unions with the advanced technology and user-friendly interfaces of fintech platforms, offering members enhanced interest rates and seamless digital access. By leveraging AI-driven tools and traditional financial security, these models optimize savings growth while maintaining trust and regulatory compliance.

Fintech-Cooperative Partnerships

Fintech-cooperative partnerships leverage innovative technology platforms to enhance credit union savings products, offering members seamless digital experiences and personalized financial tools. These collaborations drive increased savings growth by combining the trust and community focus of credit unions with fintech's data-driven insights and automation capabilities.

Community-Centric Interest Rates

Credit unions offer community-centric interest rates by reinvesting profits into member savings accounts, often providing higher returns compared to traditional banks, fostering local economic growth. Fintech platforms leverage technology to offer competitive, personalized interest rates but typically lack the deep community ties and cooperative benefits that credit unions provide.

AI-Driven Member Onboarding

Credit unions leverage AI-driven member onboarding to deliver personalized, secure savings account setups, enhancing member trust and compliance with regulatory standards. Fintech platforms utilize AI to streamline onboarding processes through data analytics and automated verification, offering faster, user-friendly savings account access but with varying degrees of regulatory oversight.

Fractional Deposit Accounts

Credit unions offer fractional deposit accounts with personalized member services and federally insured savings, providing a trusted, community-focused approach to saving. Fintech platforms leverage technology to provide seamless fractional deposit accounts with higher interest rates and real-time digital management, appealing to tech-savvy users seeking flexible, low-barrier saving options.

Savings Gamification Engines

Credit unions leverage savings gamification engines to enhance member engagement by offering rewards and interactive challenges that promote consistent saving habits. Fintech platforms integrate advanced gamification features using AI-driven personalized incentives and real-time analytics to optimize user motivation and increase savings retention rates.

Peer-to-Peer Dividend Payouts

Credit unions offer member-owned peer-to-peer dividend payouts derived from collective profits, promoting community-focused savings growth. Fintech platforms leverage automated algorithms to distribute peer-to-peer dividends with real-time tracking and enhanced digital transparency, appealing to tech-savvy savers.

Credit Union vs Fintech Platform for savings Infographic

moneydiff.com

moneydiff.com