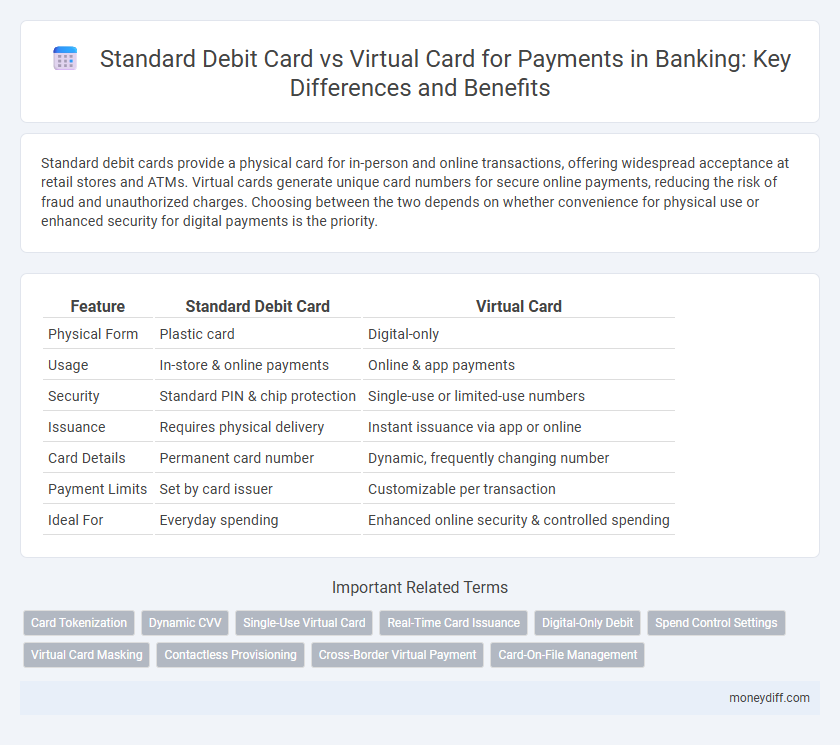

Standard debit cards provide a physical card for in-person and online transactions, offering widespread acceptance at retail stores and ATMs. Virtual cards generate unique card numbers for secure online payments, reducing the risk of fraud and unauthorized charges. Choosing between the two depends on whether convenience for physical use or enhanced security for digital payments is the priority.

Table of Comparison

| Feature | Standard Debit Card | Virtual Card |

|---|---|---|

| Physical Form | Plastic card | Digital-only |

| Usage | In-store & online payments | Online & app payments |

| Security | Standard PIN & chip protection | Single-use or limited-use numbers |

| Issuance | Requires physical delivery | Instant issuance via app or online |

| Card Details | Permanent card number | Dynamic, frequently changing number |

| Payment Limits | Set by card issuer | Customizable per transaction |

| Ideal For | Everyday spending | Enhanced online security & controlled spending |

Introduction: Understanding Debit and Virtual Cards

Standard debit cards provide physical access to funds linked directly to a bank account, enabling in-person and online transactions with a secure PIN or signature verification. Virtual cards generate unique, digitally-based card numbers for online purchases, enhancing security by minimizing exposure of actual bank details and reducing fraud risk. Both card types connect to the primary bank account but differ in usage environments, convenience, and security features tailored for evolving payment needs.

Key Features of Standard Debit Cards

Standard debit cards provide physical access to funds linked directly to a checking or savings account, allowing cardholders to make in-store purchases, withdraw cash from ATMs, and complete online transactions securely. These cards typically feature EMV chip technology for enhanced security, PIN protection, and contactless payment capabilities, ensuring versatile usage across various payment terminals. Standard debit cards often include rewards programs, spending alerts, and fraud monitoring services to help users manage their finances effectively while minimizing risks associated with unauthorized transactions.

Key Features of Virtual Debit Cards

Virtual debit cards offer enhanced security through unique, temporary card numbers that reduce fraud risks during online transactions. These cards provide instant issuance and easy management via mobile banking apps, enabling quick controls such as setting spending limits or freezing cards. Unlike standard debit cards, virtual cards do not require a physical form, facilitating seamless and contactless payments across various e-commerce platforms.

Security Differences: Physical vs Virtual Cards

Physical debit cards expose users to risks like theft, loss, and skimming fraud due to their tangible nature, while virtual cards enhance security by generating unique, temporary card numbers for each transaction, minimizing exposure to unauthorized use. Virtual cards reduce the risk of data breaches and enable instant cancellation without disrupting linked accounts, offering advanced fraud protection compared to standard debit cards. Banking institutions increasingly promote virtual cards for secure online payments, leveraging tokenization and dynamic CVV features to prevent cyber theft.

Ease of Use: In-Store and Online Payments

Standard debit cards offer convenient in-store payments with physical swipe or chip transactions accepted at most merchants. Virtual cards excel in online payments by providing instant issuance and enhanced security through temporary card details for each transaction. Both card types streamline digital and in-person payments, yet virtual cards prioritize swift integration with e-commerce platforms and fraud mitigation.

Cost and Fees Comparison

Standard debit cards often incur ATM withdrawal fees, annual maintenance charges, and point-of-sale transaction fees depending on the bank's policy, whereas virtual cards typically have lower or no issuance fees and reduced transaction costs due to their digital-only nature. Virtual cards minimize expenses by eliminating physical card production and distribution, making them a cost-effective solution for online payments. Comparing cost structures, virtual cards provide greater savings for frequent online transactions, while standard debit cards may involve higher cumulative fees for in-person and ATM usage.

Accessibility and Issuance Process

Standard debit cards offer widespread acceptance for in-person and online payments, providing physical access to ATMs and point-of-sale terminals, while virtual cards are primarily designed for secure online transactions with instant issuance. Virtual cards eliminate the need for physical delivery, enabling immediate use upon approval, whereas standard debit cards require a production and shipping period that may take several days. Accessibility for virtual cards is limited to digital platforms, in contrast to standard debit cards, which support both digital and physical payment channels.

International Usage and Acceptance

Standard debit cards offer widespread international acceptance at ATMs and merchants globally, supporting currencies and providing physical card convenience. Virtual cards, designed primarily for secure online transactions, have growing international acceptance but may face limitations at physical points of sale and some ATMs. Both cards enhance payment flexibility, yet standard debit cards remain the preferred choice for comprehensive international usage due to broader acceptance and versatility.

Fraud Protection and Privacy Considerations

Standard debit cards expose users to potential fraud through physical theft or skimming, while virtual cards minimize risk by generating unique, single-use numbers for each transaction, enhancing fraud protection. Virtual cards offer superior privacy by limiting merchants' access to actual account details, reducing the chances of data breaches and unauthorized charges. Enhanced encryption and temporary usage make virtual cards a preferred choice for secure online payments and safeguarding personal financial information.

Which Card Is Best for Your Money Management Needs?

Standard debit cards provide physical access to funds, making them ideal for everyday in-store purchases and ATM withdrawals, while virtual cards enhance online transaction security by generating temporary card numbers that minimize fraud risk. For money management, virtual cards offer superior control over spending limits and merchant-specific use, helping users track and restrict expenses more precisely. Choosing the best card depends on your payment habits: standard debit cards suit regular, diverse transactions, whereas virtual cards are optimal for secure, budget-conscious online shopping.

Related Important Terms

Card Tokenization

Standard debit cards store physical card data, increasing exposure to fraud during in-person or online payments, whereas virtual cards use card tokenization to generate unique, single-use tokens that protect the actual card information, enhancing security and reducing the risk of unauthorized transactions. Card tokenization ensures sensitive data is replaced by encrypted tokens during payment processing, making virtual cards a safer option for secure digital payments and minimizing the impact of data breaches.

Dynamic CVV

Standard debit cards feature a fixed CVV number printed on the card, which can be vulnerable to fraud during online transactions, whereas virtual cards with dynamic CVV codes generate a unique security code for each payment, significantly enhancing protection against unauthorized use. The dynamic CVV mechanism in virtual cards reduces the risk of data breaches and card cloning, making them a superior choice for secure digital payments in banking.

Single-Use Virtual Card

Standard debit cards provide physical and digital access to funds for multiple transactions, offering convenience but increased exposure to fraud. Single-use virtual cards generate unique transaction numbers for one-time payments, significantly enhancing security by minimizing the risk of unauthorized charges in digital banking environments.

Real-Time Card Issuance

Standard debit cards typically require physical production and mailing, resulting in delayed usage, while virtual cards enable real-time issuance, allowing immediate access to funds and seamless digital payments. Real-time card issuance enhances customer convenience, reduces fraud risk with instant activation, and supports instant transactions across e-commerce and contactless payment platforms.

Digital-Only Debit

Digital-only debit cards enable seamless, secure payments through virtual card numbers linked directly to bank accounts, reducing fraud risk compared to standard physical debit cards. These virtual cards offer immediate transaction control and enhanced privacy for online banking, making them ideal for digital-focused consumers.

Spend Control Settings

Standard debit cards offer limited spend control settings, typically restricting transactions through daily limits or merchant category blocks, whereas virtual cards provide advanced spend control features, including customizable single-use numbers, real-time transaction alerts, and predefined spending limits per transaction to enhance security and budgeting. Virtual cards' dynamic nature allows users to manage payments with granular control, reducing fraud risk and improving expense tracking compared to traditional debit cards.

Virtual Card Masking

Virtual cards enhance transaction security by using dynamic card numbers that mask the actual debit card details, reducing the risk of fraud during online payments. Unlike standard debit cards, virtual card masking generates unique, temporary numbers for each transaction, ensuring sensitive banking information remains confidential.

Contactless Provisioning

Standard debit cards enable seamless contactless payments through embedded EMV chips and NFC technology, widely accepted at physical retail locations, while virtual cards offer enhanced security for online transactions by generating unique card numbers without a physical form, limiting exposure during contactless provisioning. Both card types integrate with mobile wallets like Apple Pay and Google Pay to facilitate quick, contactless payments, but virtual cards provide added control through instant issuance and transaction-specific limits.

Cross-Border Virtual Payment

Cross-border virtual payments via virtual cards offer enhanced security and real-time transaction control compared to standard debit cards, which often face higher fraud risks and currency conversion fees. Virtual cards streamline international transactions with instant issuance and dynamic spending limits, making them ideal for global e-commerce and remote business expenses.

Card-On-File Management

Standard debit cards provide physical card-on-file management with direct access to funds and widespread acceptance at point-of-sale terminals, enabling easy in-store and ATM transactions. Virtual cards enhance security by storing card details digitally, allowing controlled single-use or limited-time payments, which reduces fraud risk in online and recurring transactions.

Standard Debit Card vs Virtual Card for payments. Infographic

moneydiff.com

moneydiff.com