A savings account typically offers a stable interest rate with federal insurance protection, providing safety for your funds while earning modest returns. High-yield digital wallets often provide significantly higher interest rates but may lack comparable insurance coverage, posing a higher risk. Choosing between the two depends on your priority for security versus potential earnings, with digital wallets catering to those seeking greater interest and savings accounts suited for risk-averse individuals.

Table of Comparison

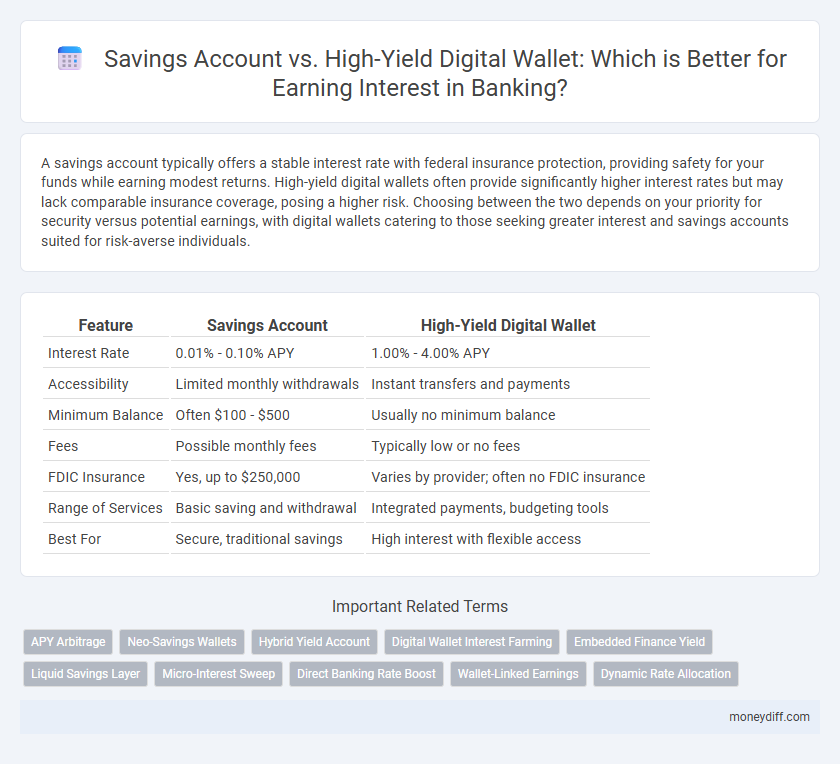

| Feature | Savings Account | High-Yield Digital Wallet |

|---|---|---|

| Interest Rate | 0.01% - 0.10% APY | 1.00% - 4.00% APY |

| Accessibility | Limited monthly withdrawals | Instant transfers and payments |

| Minimum Balance | Often $100 - $500 | Usually no minimum balance |

| Fees | Possible monthly fees | Typically low or no fees |

| FDIC Insurance | Yes, up to $250,000 | Varies by provider; often no FDIC insurance |

| Range of Services | Basic saving and withdrawal | Integrated payments, budgeting tools |

| Best For | Secure, traditional savings | High interest with flexible access |

Understanding Savings Accounts and High-Yield Digital Wallets

Savings accounts typically offer stable interest rates regulated by banks, providing secure and predictable earnings with federal insurance protection up to $250,000 by the FDIC. High-yield digital wallets leverage online platforms with competitive interest rates, often exceeding traditional savings accounts, by investing in financial technology and low overhead costs. Understanding the differences in liquidity, interest compounding frequency, and risk exposure is essential for maximizing returns while maintaining access to funds.

Interest Rate Comparison: Traditional vs Digital Options

Traditional savings accounts typically offer interest rates ranging from 0.01% to 0.10%, providing low but stable returns backed by federal insurance. High-yield digital wallets and online savings platforms feature significantly higher annual percentage yields (APYs), often between 3% and 5%, driven by lower overhead costs and advanced financial technology. Consumers seeking to maximize interest earnings should weigh the enhanced rates of digital options against the security and accessibility of traditional banking products.

Accessibility and Convenience for Everyday Banking

Savings accounts typically offer easy access through branch visits and ATM withdrawals, making them convenient for everyday banking needs. High-yield digital wallets provide seamless, 24/7 access via mobile apps, enabling instant transfers and payments without physical bank visits. While savings accounts may involve slower transaction processes, digital wallets prioritize speed and user-friendly interfaces for enhanced accessibility.

Safety and Security of Your Deposits

Savings accounts in traditional banks are insured by the FDIC up to $250,000, providing a high level of safety and security for your deposits. High-yield digital wallets may offer competitive interest rates but often lack equivalent government-backed insurance, increasing the risk to your funds. Choosing a savings account ensures your money is protected against bank failures, making it a safer option for long-term security.

Minimum Balance Requirements: What You Need to Know

Savings accounts typically require a minimum balance to avoid fees and earn interest, often starting at $500 or more, depending on the bank. High-yield digital wallets usually have lower or no minimum balance requirements, making them accessible for users with smaller funds while still offering competitive interest rates. Understanding these minimum balance thresholds is crucial to maximizing returns and avoiding penalties in both traditional and digital savings options.

Fees and Hidden Charges: A Side-by-Side Analysis

Savings accounts typically charge minimal or no maintenance fees, offering transparent fee structures regulated by banking authorities, whereas high-yield digital wallets may impose variable fees such as transaction fees, service charges, or withdrawal limits that can reduce overall interest earnings. Digital wallets often lack standardized disclosure requirements, increasing the risk of hidden charges that can erode returns, unlike traditional savings accounts where fees are clearly stated and monitored. Evaluating fee schedules and terms of service is essential for accurately comparing net interest gains between these two interest-earning options.

Withdrawal Limits and Flexibility

Savings accounts typically impose daily or monthly withdrawal limits regulated by federal guidelines, which may restrict access to funds and reduce flexibility. High-yield digital wallets often offer greater withdrawal frequency and lower or no minimum limits, enabling more flexible access to interest-earning balances. Evaluating the withdrawal policies is crucial for optimizing liquidity while earning competitive interest rates.

Account Opening Process: Ease and Speed

Opening a savings account typically requires visiting a bank branch or completing a detailed online form, which can take several days for verification. High-yield digital wallets offer a streamlined, fully digital account opening process that often completes within minutes using biometric authentication or instant identity verification. This ease and speed make digital wallets a more convenient option for quickly accessing interest-earning accounts.

Mobile App and Online Banking Features

High-yield digital wallets often offer superior interest rates compared to traditional savings accounts, leveraging advanced mobile app interfaces for seamless balance tracking and instant transaction notifications. Online banking features in digital wallets include real-time fund transfers, budgeting tools, and automated savings plans, enhancing user control over finances. Conversely, savings accounts typically provide FDIC insurance and branch access but may lack the intuitive, feature-rich mobile experience of digital wallets.

Which Option Is Best for Your Financial Goals?

Savings accounts in traditional banks typically offer lower interest rates, around 0.01% to 0.10%, with FDIC insurance providing security for deposits up to $250,000. High-yield digital wallets can offer interest rates ranging from 3% to 6%, often through partnerships with fintech platforms, but may lack federal insurance and involve higher liquidity risks. Choosing the best option depends on your financial goals: prioritize safety and guaranteed returns with savings accounts or opt for higher earnings with digital wallets while managing potential risks.

Related Important Terms

APY Arbitrage

Savings accounts typically offer lower APYs ranging from 0.01% to 0.10%, whereas high-yield digital wallets can provide significantly higher returns, often exceeding 3.5% APY, enabling effective APY arbitrage by leveraging the interest rate differential. Maximizing earnings involves transferring funds from traditional savings accounts to high-yield digital wallets, optimizing the interest accrual based on superior APY rates.

Neo-Savings Wallets

Neo-savings wallets offer higher interest rates compared to traditional savings accounts by leveraging digital platforms and lower overhead costs, providing users with faster access to funds and enhanced financial management tools. These digital wallets often integrate seamless mobile interfaces and automated savings features, making them an efficient alternative for maximizing interest earnings while maintaining liquidity.

Hybrid Yield Account

Hybrid Yield Accounts combine the stability of traditional savings accounts with the higher interest rates typically offered by high-yield digital wallets, delivering optimized returns on deposits. These accounts leverage digital banking technology to provide competitive APYs while maintaining FDIC insurance and easy liquidity, making them a smart choice for maximizing interest earnings.

Digital Wallet Interest Farming

High-yield digital wallets often provide significantly higher interest rates compared to traditional savings accounts by leveraging advanced algorithms and decentralized finance protocols for interest farming. These digital wallets enable users to optimize returns through automated asset allocation and staking strategies, outperforming conventional bank savings rates.

Embedded Finance Yield

High-yield digital wallets leveraging embedded finance yield offer significantly higher interest rates compared to traditional savings accounts, often exceeding 4-5% APY versus the average 0.05-0.10% APY found in conventional banks. These digital wallets integrate financial services directly into platforms, enabling seamless interest accrual on funds with greater liquidity and fewer fees.

Liquid Savings Layer

A traditional savings account typically offers lower interest rates but provides FDIC insurance and easy access to funds, making it a secure and liquid savings layer for emergency needs. High-yield digital wallets often deliver significantly higher interest rates and instant liquidity through mobile platforms, though they may lack federal insurance, requiring careful risk evaluation for short-term savings.

Micro-Interest Sweep

A high-yield digital wallet leveraging micro-interest sweep technology automatically transfers small balances into higher-yield savings opportunities, maximizing interest earnings compared to traditional savings accounts with fixed low rates. This innovation enables continuous compounding on incremental deposits, enhancing overall returns through seamless automation and optimal fund allocation.

Direct Banking Rate Boost

Savings accounts typically offer lower interest rates averaging around 0.05% to 0.10%, whereas high-yield digital wallets leverage direct banking rate boosts that can exceed 4.0% APY, providing significantly higher returns on idle funds with greater liquidity and ease of access. Implementing direct banking rate boosts in digital wallets allows users to maximize interest earnings while benefiting from lower fees and seamless integration with online financial services.

Wallet-Linked Earnings

High-yield digital wallets linked to savings accounts offer superior interest rates, often exceeding traditional bank savings rates by 2-4% annually, leveraging flexible, real-time access to funds while minimizing fees. These wallet-linked earnings optimize liquidity and compound growth through seamless integration with everyday transactions, appealing to tech-savvy users seeking higher returns without sacrificing accessibility.

Dynamic Rate Allocation

Savings accounts provide stable interest rates set by banks, typically ranging from 0.01% to 0.50%, while high-yield digital wallets leverage dynamic rate allocation that adjusts based on market conditions, often offering rates between 3% and 6%. This dynamic rate allocation allows digital wallets to optimize earnings by automatically reallocating funds to higher-yielding assets, outperforming traditional fixed-rate savings accounts in fluctuating interest environments.

Savings Account vs High-Yield Digital Wallet for earning interest. Infographic

moneydiff.com

moneydiff.com