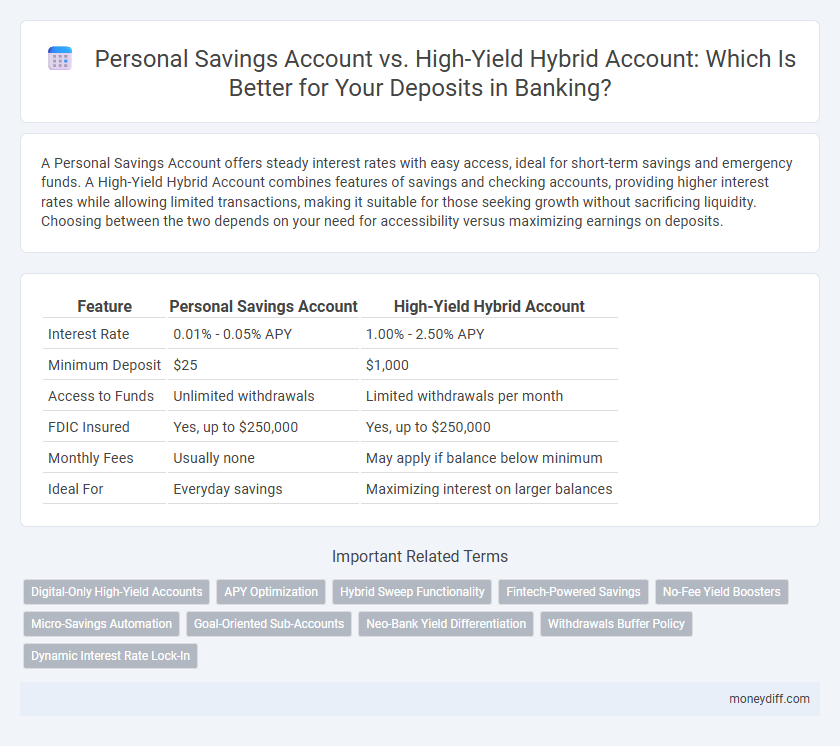

A Personal Savings Account offers steady interest rates with easy access, ideal for short-term savings and emergency funds. A High-Yield Hybrid Account combines features of savings and checking accounts, providing higher interest rates while allowing limited transactions, making it suitable for those seeking growth without sacrificing liquidity. Choosing between the two depends on your need for accessibility versus maximizing earnings on deposits.

Table of Comparison

| Feature | Personal Savings Account | High-Yield Hybrid Account |

|---|---|---|

| Interest Rate | 0.01% - 0.05% APY | 1.00% - 2.50% APY |

| Minimum Deposit | $25 | $1,000 |

| Access to Funds | Unlimited withdrawals | Limited withdrawals per month |

| FDIC Insured | Yes, up to $250,000 | Yes, up to $250,000 |

| Monthly Fees | Usually none | May apply if balance below minimum |

| Ideal For | Everyday savings | Maximizing interest on larger balances |

Understanding Personal Savings Accounts

Personal Savings Accounts offer a secure way to store funds with easy access and steady interest accrual, typically featuring low minimum balance requirements and FDIC insurance up to $250,000 per depositor. These accounts provide reliable liquidity for emergency funds with interest rates often ranging from 0.01% to 0.50%, making them suitable for conservative savers prioritizing safety over returns. Unlike High-Yield Hybrid Accounts, Personal Savings Accounts generally have fewer restrictions and no penalties for withdrawals, ensuring flexibility for everyday financial needs.

What Is a High-Yield Hybrid Account?

A high-yield hybrid account combines features of traditional savings and checking accounts, offering higher interest rates than standard personal savings accounts while allowing limited check writing and debit card access. These accounts typically provide tiered interest rates that increase with higher balances, making them ideal for depositors seeking both liquidity and enhanced earnings. Unlike personal savings accounts, high-yield hybrids often require minimum balance thresholds to unlock premium yields and may have transaction limits regulated by federal guidelines.

Interest Rates: Standard vs. High-Yield

Personal savings accounts typically offer standard interest rates ranging from 0.01% to 0.10%, providing predictable but modest growth on deposits. High-yield hybrid accounts combine features of savings and checking accounts, delivering significantly higher interest rates often between 1.50% and 4.00%, enhancing savings potential while maintaining flexibility. Choosing a high-yield hybrid account maximizes interest earnings on deposits compared to the limited returns of standard personal savings accounts.

Accessibility and Account Flexibility

Personal Savings Accounts provide easy accessibility with multiple withdrawal options and no restrictions on transfers, ideal for everyday savings needs. High-Yield Hybrid Accounts offer greater flexibility by combining features of both savings and checking accounts, allowing for higher interest rates while maintaining limited transaction capabilities. Both account types support mobile and online banking, but hybrid accounts often include perks like linked checking and overdraft protection, enhancing overall account management.

Minimum Balance Requirements

Personal Savings Accounts typically require a lower minimum balance, often around $100, making them accessible for everyday savers. High-Yield Hybrid Accounts usually demand higher minimum balances, frequently exceeding $1,000, to unlock superior interest rates and combined benefits of savings and checking. Understanding these minimum balance thresholds is essential for optimizing interest earnings while avoiding fees in deposit account management.

Fees and Account Maintenance Costs

Personal Savings Accounts typically feature low or no monthly maintenance fees, making them ideal for customers seeking straightforward, cost-effective deposit options. High-Yield Hybrid Accounts often charge higher fees or require minimum balances to avoid maintenance costs, reflecting their premium interest rates and added features. Understanding fee structures and maintenance costs is essential for choosing between standard savings accounts and high-yield alternatives to maximize deposit growth.

Safety and Insurance: FDIC or NCUA Coverage

Personal Savings Accounts and High-Yield Hybrid Accounts both offer FDIC or NCUA insurance coverage, ensuring deposits are protected up to $250,000 per depositor, per insured bank or credit union. FDIC coverage applies to accounts held at banks, while NCUA insurance safeguards deposits in credit unions, providing equal safety and security. Choosing between these accounts should emphasize the same federal insurance protections guaranteeing funds against bank failures.

Online Banking Features and Mobile Access

High-yield hybrid accounts offer superior online banking features compared to traditional personal savings accounts, including real-time balance updates, advanced budgeting tools, and seamless integration with financial apps. Mobile access for hybrid accounts is optimized for on-the-go deposits, instant transfers, and biometric security, ensuring enhanced convenience and security. Personal savings accounts typically provide basic online access but lack the robust digital tools and user experience found in hybrid high-yield platforms.

Suitability for Different Financial Goals

Personal Savings Accounts suit individuals seeking easy access to funds with steady, albeit lower, interest rates, ideal for emergency funds or short-term savings. High-Yield Hybrid Accounts combine features of savings and checking accounts, offering higher interest rates and limited transaction flexibility, making them optimal for medium to long-term financial goals that benefit from growth and liquidity. Selecting between these accounts depends on prioritizing immediate access versus maximizing interest earnings aligned with specific savings objectives.

Which Account Is Right for You?

A Personal Savings Account offers stable interest rates with easy access to funds, making it ideal for those seeking liquidity and low risk. High-Yield Hybrid Accounts combine features of checking and savings, providing higher interest rates while allowing limited transactions, suitable for individuals aiming to maximize returns without sacrificing accessibility. Evaluate your need for frequent access versus higher yields to determine the most appropriate deposit account.

Related Important Terms

Digital-Only High-Yield Accounts

Digital-only high-yield hybrid accounts offer significantly higher interest rates compared to traditional personal savings accounts, leveraging low overhead to maximize returns on deposits. These accounts combine the liquidity of savings with higher yield opportunities, making them ideal for customers seeking growth alongside easy digital access.

APY Optimization

Personal Savings Accounts typically offer a lower APY, around 0.01% to 0.10%, whereas High-Yield Hybrid Accounts can provide significantly higher APYs, often ranging from 1.00% to 4.50%, optimizing deposit growth through better interest rates. Maximizing returns requires evaluating liquidity needs since High-Yield Hybrid Accounts combine features of savings and checking accounts, enabling both higher interest earnings and flexible access to funds.

Hybrid Sweep Functionality

Personal Savings Accounts offer standard interest rates suitable for routine deposits, while High-Yield Hybrid Accounts maximize returns by automatically sweeping funds between checking and savings to optimize liquidity and yield. Hybrid sweep functionality ensures idle balances are transferred seamlessly, enhancing interest earnings without sacrificing immediate access to funds.

Fintech-Powered Savings

Fintech-powered savings solutions transform traditional personal savings accounts by offering high-yield hybrid accounts that combine competitive interest rates with seamless digital access and automated financial management tools. These hybrid accounts leverage advanced algorithms and real-time data analytics to optimize deposit growth, providing customers with improved liquidity and higher returns compared to conventional savings options.

No-Fee Yield Boosters

Personal Savings Accounts offer steady interest rates with no monthly fees, ensuring a reliable, no-cost way to grow deposits, while High-Yield Hybrid Accounts combine competitive yield boosters with flexible access to funds, maximizing earnings without penalty charges. Both account types present no-fee yield enhancements, making them ideal for depositor convenience and optimized financial growth.

Micro-Savings Automation

Personal Savings Accounts offer basic micro-savings automation features that facilitate regular deposits with minimal effort, but High-Yield Hybrid Accounts combine these automated features with significantly higher interest rates, maximizing growth potential for small, recurring deposits. Integrating AI-driven micro-savings tools in High-Yield Hybrid Accounts enhances deposit frequency and optimizes interest accumulation compared to traditional personal savings.

Goal-Oriented Sub-Accounts

Goal-oriented sub-accounts within high-yield hybrid accounts offer targeted savings options that maximize interest earnings compared to standard personal savings accounts, making them ideal for managing specific financial goals efficiently. These sub-accounts enable users to allocate funds with distinct objectives while benefiting from competitive rates and flexible access, optimizing both growth potential and budget control in banking portfolios.

Neo-Bank Yield Differentiation

Neo-bank high-yield hybrid accounts offer significantly higher interest rates compared to traditional personal savings accounts, leveraging cutting-edge fintech to optimize fund allocation between liquid savings and investment vehicles. This yield differentiation enables customers to maximize returns on deposits while maintaining the flexibility and convenience of instant access typical of personal savings accounts.

Withdrawals Buffer Policy

Personal Savings Accounts typically offer more flexible withdrawal options with fewer restrictions, making them ideal for regular access to funds, while High-Yield Hybrid Accounts often implement stricter Withdrawals Buffer Policies to maintain higher interest rates by limiting the number of withdrawals or requiring advance notice. Understanding these withdrawal limitations is crucial for depositors seeking to balance accessibility with optimized returns on their savings.

Dynamic Interest Rate Lock-In

Dynamic interest rate lock-in in Personal Savings Accounts offers stable, predictable earnings with fixed rates, while High-Yield Hybrid Accounts adapt to market fluctuations by adjusting rates periodically to maximize returns. Depositors seeking consistent growth may prefer the former, whereas those aiming for higher yields amid rate volatility benefit from the flexible lock-in features of hybrid accounts.

Personal Savings Account vs High-Yield Hybrid Account for deposits. Infographic

moneydiff.com

moneydiff.com