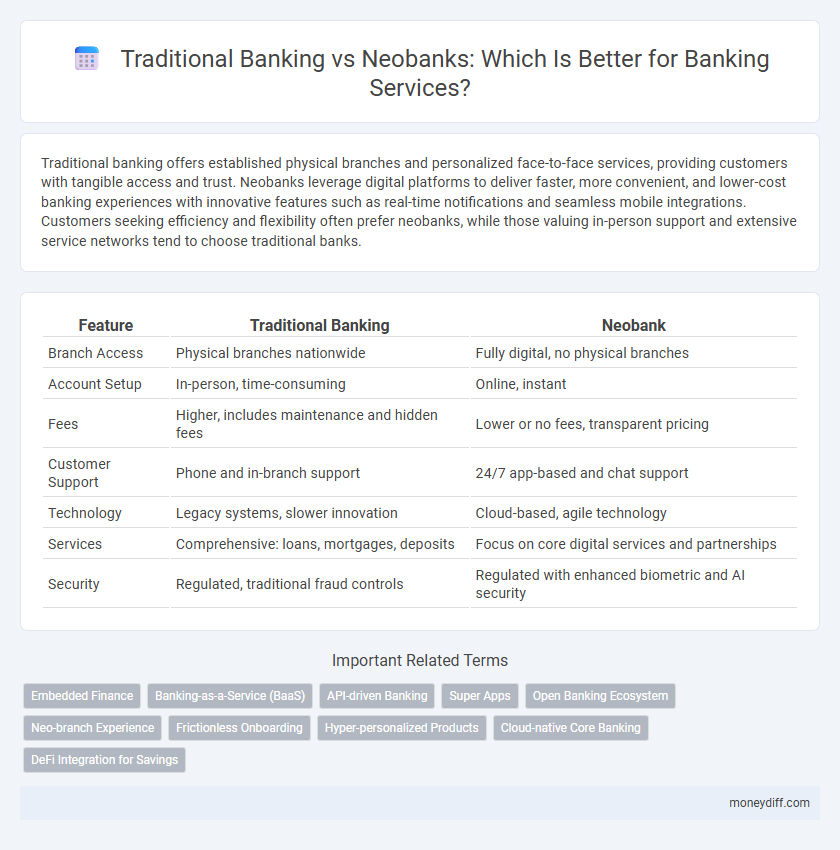

Traditional banking offers established physical branches and personalized face-to-face services, providing customers with tangible access and trust. Neobanks leverage digital platforms to deliver faster, more convenient, and lower-cost banking experiences with innovative features such as real-time notifications and seamless mobile integrations. Customers seeking efficiency and flexibility often prefer neobanks, while those valuing in-person support and extensive service networks tend to choose traditional banks.

Table of Comparison

| Feature | Traditional Banking | Neobank |

|---|---|---|

| Branch Access | Physical branches nationwide | Fully digital, no physical branches |

| Account Setup | In-person, time-consuming | Online, instant |

| Fees | Higher, includes maintenance and hidden fees | Lower or no fees, transparent pricing |

| Customer Support | Phone and in-branch support | 24/7 app-based and chat support |

| Technology | Legacy systems, slower innovation | Cloud-based, agile technology |

| Services | Comprehensive: loans, mortgages, deposits | Focus on core digital services and partnerships |

| Security | Regulated, traditional fraud controls | Regulated with enhanced biometric and AI security |

Understanding Traditional Banking Institutions

Traditional banking institutions operate through physical branches, offering a broad range of services including savings accounts, loans, and in-person customer support. They are regulated by government agencies ensuring security and compliance with financial laws, providing a trusted environment for depositors. Despite slower adoption of digital technologies, traditional banks benefit from established reputations and extensive networks for cash access and complex financial products.

What Are Neobanks? Key Features Explained

Neobanks are digital-only banks that operate without physical branches, offering services primarily through mobile apps and online platforms. Key features include low fees, user-friendly interfaces, real-time transaction notifications, and seamless integration with financial technology tools. These banks leverage advanced data analytics and AI to provide personalized banking experiences, often appealing to tech-savvy customers seeking convenience and transparency.

Account Opening: Digital Vs Branch Experience

Traditional banking requires customers to visit a branch for account opening, involving paperwork and in-person verification, which can be time-consuming. Neobanks offer a fully digital account opening process through mobile apps or websites, enabling instant verification using biometric data and AI-driven KYC. This digital approach significantly reduces onboarding time and enhances user convenience compared to conventional branch-based experiences.

Fees and Charges: Comparing Costs

Traditional banking often involves higher fees and charges, including maintenance fees, ATM withdrawal fees, and overdraft penalties, which can accumulate significantly over time. Neobanks typically offer lower or no monthly fees, minimal charges on transactions, and reduced overdraft costs, leveraging digital platforms to minimize operational expenses. This cost efficiency makes neobanks an attractive option for customers seeking affordable banking services without sacrificing convenience.

Accessibility and Customer Support

Traditional banking offers extensive physical branch networks providing in-person services, which can be essential for customers seeking face-to-face assistance, but often limits accessibility due to fixed locations and business hours. Neobanks leverage digital platforms, enabling 24/7 access to banking services via mobile apps and online portals, enhancing convenience for users regardless of location. Customer support in neobanks typically utilizes chatbots and remote assistance, offering rapid responses but lacking the personal touch found in traditional face-to-face interactions.

Security Measures: Traditional Banks Versus Neobanks

Traditional banks implement comprehensive security measures including physical branch security, multi-factor authentication, and fraud detection systems backed by longstanding regulatory frameworks. Neobanks rely heavily on advanced digital encryption, biometric authentication, and real-time transaction monitoring to protect user data in a fully online environment. Both banking models prioritize customer security but differ in execution, with traditional banks emphasizing physical safeguards and neobanks focusing on innovative cybersecurity technologies.

Range of Banking Services Offered

Traditional banking offers a comprehensive range of services including in-person account management, loans, mortgages, and investment products through physical branches and extensive ATM networks. Neobanks focus primarily on digital-first solutions, providing streamlined mobile banking, budgeting tools, and real-time transaction notifications, but often lack personalized services such as in-branch consultations and complex loan facilities. Both models cater to different customer needs, with traditional banks excelling in service variety and neobanks prioritizing convenience and tech-driven efficiency.

Technology and User Experience

Traditional banking relies on legacy systems with physical branches, which often result in slower transactions and limited digital features compared to neobanks. Neobanks leverage advanced technology stacks such as cloud computing, AI-driven analytics, and seamless mobile interfaces, enhancing real-time transaction processing and personalized user experiences. The superior integration of fintech innovations in neobanks drives increased accessibility, faster onboarding, and intuitive app designs, setting new standards in banking convenience.

Trust, Regulation, and Consumer Protection

Traditional banking institutions benefit from established trust through longstanding regulatory oversight and robust consumer protection laws, offering customers a sense of security with federal insurance such as FDIC coverage. Neobanks, while innovative and digital-first, often operate under different regulatory frameworks or partnerships with traditional banks, which can affect the degree of direct consumer protection and trust perception. Regulation complexity and the evolving nature of neobank compliance highlight the importance for consumers to evaluate institutional stability and protective measures before choosing banking services.

Which Suits You Best? Choosing Your Ideal Banking Partner

Traditional banking offers extensive branch networks, in-person customer service, and established financial products ideal for those who prefer face-to-face interactions and physical banking locations. Neobanks provide fully digital platforms with lower fees, faster account setup, and innovative features perfect for tech-savvy users who prioritize convenience and mobile-first experiences. Assess your banking preferences, such as need for personal support versus digital agility, to choose the ideal banking partner tailored to your lifestyle and financial goals.

Related Important Terms

Embedded Finance

Traditional banking relies on physical branches and legacy systems for financial services, whereas neobanks leverage embedded finance to seamlessly integrate banking capabilities within non-financial apps and platforms, enhancing user experience and accessibility. Embedded finance enables neobanks to offer personalized, real-time financial products such as payments, lending, and insurance directly through digital ecosystems, challenging conventional banking models with increased flexibility and innovation.

Banking-as-a-Service (BaaS)

Traditional banking relies on established infrastructure and physical branches, often limiting agility in adopting Banking-as-a-Service (BaaS) platforms. Neobanks leverage cloud-based BaaS ecosystems to offer seamless, customizable, and scalable banking services, enhancing customer experience through digital-first innovation.

API-driven Banking

API-driven banking platforms in neobanks enable seamless integration with third-party services, offering real-time data access and enhanced customization compared to traditional banking systems reliant on legacy infrastructure. This API-centric approach allows neobanks to innovate rapidly, streamline user experiences, and provide dynamic financial products tailored to modern consumer demands.

Super Apps

Traditional banking often relies on physical branches and legacy systems, limiting integration with super apps that provide seamless, multi-service financial experiences. Neobanks leverage advanced APIs and digital platforms to embed banking services within super apps, enhancing user convenience and offering real-time, personalized financial management tools.

Open Banking Ecosystem

Traditional banking relies on established physical branches and legacy systems, limiting seamless integration within the open banking ecosystem, while neobanks leverage APIs and digital platforms to offer real-time financial data sharing and innovative services. The open banking framework enables neobanks to provide personalized banking experiences by securely connecting with third-party fintech applications, enhancing customer control over financial data compared to conventional banks.

Neo-branch Experience

Neobanks offer a digital-first banking experience with seamless mobile interfaces, real-time transaction updates, and personalized financial insights, contrasting traditional banks' reliance on physical branches and slower service delivery. The neo-branch experience eliminates long queues and paperwork by providing instant account opening, 24/7 customer support, and integrated fintech solutions tailored to modern user preferences.

Frictionless Onboarding

Traditional banking often involves lengthy paperwork and physical branch visits, causing friction in the onboarding process, whereas neobanks leverage digital platforms and automated verification systems to enable seamless, frictionless onboarding in minutes. This digital-first approach enhances customer experience by reducing wait times and simplifying identity verification through advanced technologies like biometric authentication and AI-driven KYC processes.

Hyper-personalized Products

Traditional banking offers standardized products with limited customization, whereas neobanks leverage advanced data analytics and AI to deliver hyper-personalized banking services tailored to individual spending habits and financial goals. This data-driven personalization enhances customer experience by providing bespoke financial solutions such as customized savings plans, real-time budgeting tools, and targeted offers.

Cloud-native Core Banking

Cloud-native core banking systems enable neobanks to offer faster, more scalable, and cost-effective services compared to traditional banking infrastructures reliant on legacy systems. By leveraging cloud technologies, neobanks achieve real-time processing, enhanced customer experience, and seamless integration with digital financial ecosystems.

DeFi Integration for Savings

Traditional banking relies on centralized systems with limited access to decentralized finance (DeFi) integration, resulting in slower savings growth and reduced transparency. Neobanks leverage blockchain technology to seamlessly integrate DeFi protocols, enabling users to earn higher interest rates on savings through automated, peer-to-peer lending and yield farming opportunities.

Traditional Banking vs Neobank for banking services. Infographic

moneydiff.com

moneydiff.com