Mobile banking apps offer streamlined features focused on essential financial transactions like transfers, bill payments, and account monitoring, ensuring ease of use and quick access. Banking super apps integrate these functions with additional services such as investments, insurance, loans, and lifestyle management, creating an all-in-one platform for comprehensive financial control. Choosing between the two depends on whether users prioritize simplicity and speed or prefer an extensive ecosystem to manage diverse financial needs in a single app.

Table of Comparison

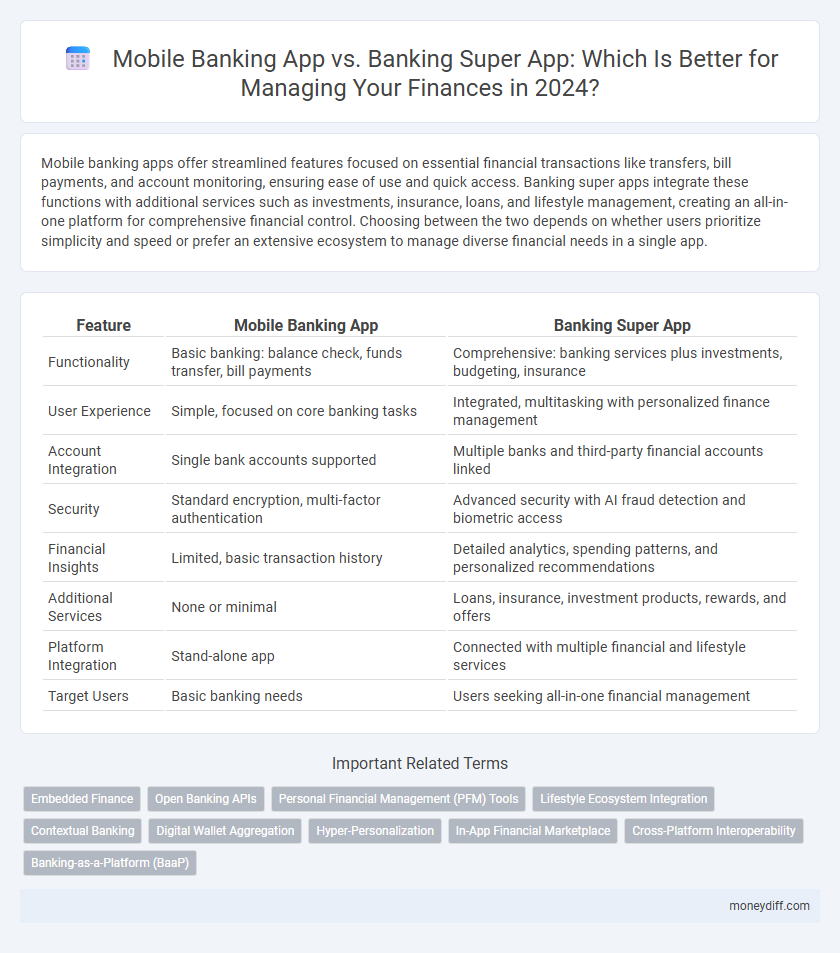

| Feature | Mobile Banking App | Banking Super App |

|---|---|---|

| Functionality | Basic banking: balance check, funds transfer, bill payments | Comprehensive: banking services plus investments, budgeting, insurance |

| User Experience | Simple, focused on core banking tasks | Integrated, multitasking with personalized finance management |

| Account Integration | Single bank accounts supported | Multiple banks and third-party financial accounts linked |

| Security | Standard encryption, multi-factor authentication | Advanced security with AI fraud detection and biometric access |

| Financial Insights | Limited, basic transaction history | Detailed analytics, spending patterns, and personalized recommendations |

| Additional Services | None or minimal | Loans, insurance, investment products, rewards, and offers |

| Platform Integration | Stand-alone app | Connected with multiple financial and lifestyle services |

| Target Users | Basic banking needs | Users seeking all-in-one financial management |

Understanding Mobile Banking Apps: Features and Functions

Mobile banking apps provide secure access to essential financial services such as balance inquiries, fund transfers, bill payments, and transaction history tracking. Advanced features include biometric authentication, real-time alerts, and personalized budgeting tools designed to enhance user control and financial management. These apps prioritize convenience and security, enabling customers to manage their accounts anytime and anywhere through seamless mobile interfaces.

What Is a Banking Super App? Key Components Explained

A banking super app integrates multiple financial services such as payments, investments, loans, and insurance within a single platform, offering seamless user experience and enhanced convenience compared to traditional mobile banking apps. Key components include unified account management, real-time transaction tracking, personalized financial insights, and embedded third-party services through APIs. Advanced security protocols and AI-driven customer support further distinguish banking super apps by providing comprehensive, multi-functional digital banking solutions.

Comparing User Experience: Mobile Banking App vs Super App

Mobile banking apps offer streamlined interfaces focused on essential services like account management, fund transfers, and bill payments, ensuring quick accessibility and ease of use. Banking super apps integrate a broader ecosystem, combining financial services with lifestyle features such as investments, insurance, and personalized financial insights, enhancing user engagement but potentially increasing complexity. User experience in super apps benefits from comprehensive functionality and unified access, while mobile banking apps prioritize simplicity and speed for routine transactions.

Security and Privacy in Mobile Banking and Super Apps

Mobile banking apps implement robust encryption protocols and multi-factor authentication to safeguard user data and financial transactions. Banking super apps enhance security by integrating biometric verification, real-time fraud detection, and comprehensive privacy controls across multiple financial services within a single platform. These advanced security measures ensure that both mobile banking apps and super apps maintain high standards of data confidentiality and user protection in managing finances.

Financial Management Tools: Budgeting and Analytics Comparison

Mobile banking apps primarily offer basic financial management tools such as transaction tracking and simple budget categories, which cater to routine expense monitoring. Banking super apps provide more advanced budgeting features, real-time spending analytics, and personalized financial insights powered by AI, enabling users to optimize savings and investments effectively. Integration with multiple financial services, including loans, insurance, and wealth management, distinguishes banking super apps as comprehensive platforms for holistic financial well-being.

Integration of Services: Standalone vs All-in-One Solutions

Mobile banking apps typically offer standalone services focused on core functions like balance checking, transfers, and bill payments. Banking super apps integrate multiple financial services--including loans, investments, insurance, and budgeting tools--into a unified platform, providing a seamless user experience. This all-in-one approach enhances convenience and enables comprehensive financial management within a single interface.

Cost and Fees: Are Super Apps More Economical?

Mobile banking apps often charge fees for specific transactions such as transfers or bill payments, while banking super apps typically consolidate multiple financial services under one platform, reducing overall costs with lower or waived fees due to economies of scale. Super apps integrate services like payments, investments, and insurance, often providing bundled pricing models that enhance cost efficiency for users. Customers can save significantly on fees by using super apps that leverage digital ecosystems and partnerships to minimize operational expenses.

Customization and Personalization in Financial Apps

Banking Super Apps offer advanced customization and personalization features by integrating multiple financial services within a single platform, allowing users to tailor their experience based on spending habits and financial goals. Mobile Banking Apps typically provide basic personalization options such as customizable alerts and transaction categorization but lack the comprehensive, AI-driven insights found in Super Apps. Enhanced data analytics and machine learning in Banking Super Apps enable real-time financial advice and predictive notifications, improving user engagement and financial management efficiency.

Accessibility and Inclusivity: Which App Suits Your Needs?

Mobile banking apps provide streamlined access to essential financial services with user-friendly interfaces tailored for quick transactions and account management. Banking super apps offer comprehensive financial ecosystems that integrate payments, investments, loans, and budgeting tools, designed to support diverse user needs across multiple demographics. Accessibility features such as voice commands, multilingual support, and customizable interfaces in super apps enhance inclusivity for users with disabilities or limited digital literacy.

Future Trends: The Evolution of Digital Banking Apps

Mobile banking apps are evolving towards comprehensive banking super apps that integrate payments, investments, insurance, and personalized financial management tools within a single platform. Future trends indicate the widespread adoption of AI-powered features, enhanced cybersecurity measures, and seamless interoperability with third-party fintech services to deliver a holistic user experience. This evolution drives increased user engagement and transforms how customers manage their finances digitally.

Related Important Terms

Embedded Finance

Mobile banking apps offer essential financial services like balance checks and fund transfers, while banking super apps integrate embedded finance features such as investment options, insurance, and seamless third-party service access, providing a comprehensive financial management ecosystem. Embedded finance within super apps enhances user experience by enabling real-time credit, payments, and personalized financial products directly within a single platform.

Open Banking APIs

Mobile banking apps provide basic account management and transaction capabilities, whereas banking super apps leverage Open Banking APIs to integrate multiple financial services, offering personalized insights, third-party product access, and seamless money management within a single platform. Open Banking APIs enable secure data sharing and real-time financial aggregation, transforming super apps into comprehensive financial ecosystems beyond traditional banking functionalities.

Personal Financial Management (PFM) Tools

Mobile banking apps primarily offer essential Personal Financial Management (PFM) tools like balance tracking, transaction history, and basic budgeting features. Banking super apps provide advanced PFM capabilities, integrating comprehensive expense analysis, financial goal setting, investment tracking, and personalized insights within a single platform for holistic finance management.

Lifestyle Ecosystem Integration

Mobile banking apps primarily facilitate basic transactions and account management, while banking super apps offer a comprehensive lifestyle ecosystem integration, combining financial services with shopping, investments, insurance, and personalized financial advice. This seamless integration enhances user engagement by providing holistic financial management and lifestyle benefits within a single platform.

Contextual Banking

Mobile banking apps provide essential services like balance checks, transfers, and bill payments, offering convenience and security in financial management. Banking super apps enhance this experience by integrating contextual banking features such as personalized financial insights, investment tracking, and seamless third-party service access within a single platform, delivering a comprehensive and adaptive digital finance ecosystem.

Digital Wallet Aggregation

Mobile Banking Apps typically offer basic features such as account monitoring and fund transfers, whereas Banking Super Apps provide advanced digital wallet aggregation, enabling users to manage multiple wallets, payment methods, and financial services within a single platform. This comprehensive integration enhances user convenience by consolidating various digital financial tools, streamlining transaction processes, and allowing for seamless multi-channel financial management.

Hyper-Personalization

Mobile Banking Apps offer essential financial functions tailored to general user needs, while Banking Super Apps leverage AI-driven hyper-personalization to provide customized financial insights, expenditure tracking, and proactive investment advice. These advanced platforms integrate multiple banking services into one interface, enhancing user experience by predicting behavior and optimizing financial decisions based on real-time data analytics.

In-App Financial Marketplace

Mobile Banking Apps typically offer core banking functions such as transfers, bill payments, and account monitoring, while Banking Super Apps integrate an in-app financial marketplace, enabling users to access a broad range of services like investment products, insurance, loans, and wealth management from multiple providers within a single platform. The in-app financial marketplace enhances user experience by providing personalized financial recommendations, seamless product comparison, and instant onboarding, driving higher customer engagement and retention.

Cross-Platform Interoperability

Mobile banking apps provide essential financial services optimized for specific platforms, ensuring smooth basic transactions but often lack seamless cross-platform interoperability and integration with diverse financial tools. Banking super apps enable comprehensive financial management by integrating multiple services within a single platform, offering robust cross-platform functionality that enhances user experience across devices and ecosystems.

Banking-as-a-Platform (BaaP)

Mobile Banking Apps provide essential financial services such as account management, fund transfers, and bill payments, while Banking Super Apps leverage Banking-as-a-Platform (BaaP) to integrate third-party financial products and services, offering a comprehensive ecosystem for personalized wealth management, lending, insurance, and investment options. BaaP enhances user experience by enabling seamless access to multiple financial solutions within one platform, driving greater customer engagement and operational efficiency for banks.

Mobile Banking App vs Banking Super App for managing finances. Infographic

moneydiff.com

moneydiff.com