Credit cards offer flexible spending with revolving credit and rewards, while Buy Now Pay Later (BNPL) provides short-term, interest-free installments but often lacks the extensive consumer protections of credit cards. BNPL is ideal for budget-conscious shoppers making specific purchases, whereas credit cards support broader financial management and credit-building opportunities. Choosing between them depends on individual spending habits, payment preferences, and financial goals.

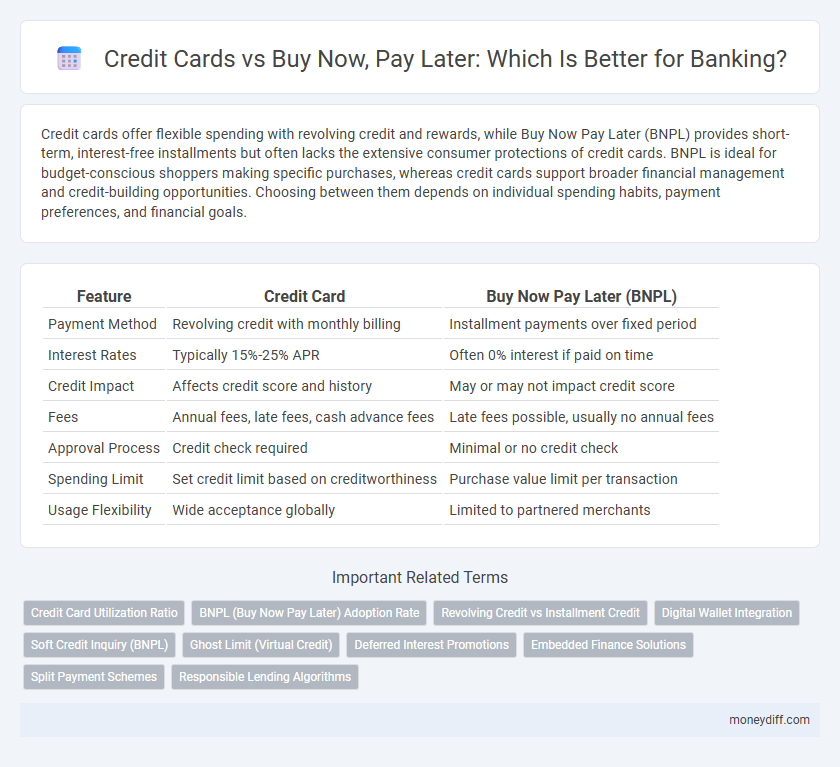

Table of Comparison

| Feature | Credit Card | Buy Now Pay Later (BNPL) |

|---|---|---|

| Payment Method | Revolving credit with monthly billing | Installment payments over fixed period |

| Interest Rates | Typically 15%-25% APR | Often 0% interest if paid on time |

| Credit Impact | Affects credit score and history | May or may not impact credit score |

| Fees | Annual fees, late fees, cash advance fees | Late fees possible, usually no annual fees |

| Approval Process | Credit check required | Minimal or no credit check |

| Spending Limit | Set credit limit based on creditworthiness | Purchase value limit per transaction |

| Usage Flexibility | Wide acceptance globally | Limited to partnered merchants |

Understanding Credit Cards and Buy Now Pay Later (BNPL)

Credit cards provide a revolving line of credit with interest charges applied to unpaid balances, enabling flexible payments and rewards programs, while Buy Now Pay Later (BNPL) services split purchases into installment payments typically without interest if paid on time. Credit cards impact credit scores through reported payment history and credit utilization, whereas BNPL usage may have limited credit reporting but can affect credit eligibility if mismanaged. Understanding the cost structures, repayment terms, and credit implications of both options is essential for effective financial management and maintaining healthy credit.

Key Differences Between Credit Cards and BNPL

Credit cards offer revolving credit with interest charged on unpaid balances, while Buy Now Pay Later (BNPL) provides short-term installment payments often interest-free if paid on time. Credit cards typically involve credit checks and impact credit scores, whereas BNPL services usually require minimal credit assessment and have limited effect on credit reports. Credit card usage can build credit history, whereas BNPL is primarily designed for convenience and short-term financing without extended credit benefits.

Interest Rates: Credit Card vs BNPL

Credit cards typically charge variable interest rates ranging from 15% to 25% APR, which accrue daily if balances are not paid in full each billing cycle. Buy Now Pay Later (BNPL) services often offer interest-free periods for short-term installments but impose high fees or interest rates exceeding 20% APR if payments are missed or extended beyond the promotional period. Understanding the differing interest structures between credit cards and BNPL options is crucial for consumers aiming to minimize borrowing costs and avoid unexpected financial charges.

Fees and Hidden Costs Comparison

Credit cards typically charge interest rates that range from 15% to 25% annually if balances are not paid in full, along with potential annual fees between $0 and $550 depending on the card type. Buy Now Pay Later (BNPL) services often advertise zero interest but may impose late fees ranging from $5 to $15 or a percentage of the missed payment, with some platforms charging service or account maintenance fees. Understanding the specific fee structures and potential hidden costs, such as penalty APRs on credit cards or missed payment penalties on BNPL, is crucial for consumers to avoid unexpected financial burdens.

Eligibility and Application Requirements

Credit card eligibility typically requires a good credit score, stable income, and a thorough credit history review, while Buy Now Pay Later (BNPL) services often have more lenient credit checks and faster approval processes. Credit card applications demand extensive documentation such as proof of income, identification, and credit reports, whereas BNPL options usually require minimal information and are integrated within online checkout systems for immediate use. Financial institutions favor credit cards for customers with established credit profiles, while BNPL platforms target younger or credit-invisible consumers seeking flexible payment solutions.

Impact on Credit Score and Financial Health

Credit cards directly influence credit scores by affecting credit utilization ratios and payment history, which are key factors in credit scoring models like FICO. Buy Now Pay Later (BNPL) services typically do not report to credit bureaus unless payments become delinquent, resulting in less direct impact on credit scores but potential risks to financial health if not managed carefully. Reliance on BNPL can lead to overspending and hidden fees, whereas responsible credit card use builds credit history and can improve long-term financial stability.

Flexibility and Spending Limits

Credit cards offer flexible spending limits that adjust based on creditworthiness, allowing users to make purchases up to their approved credit line and repay over time with interest. Buy Now Pay Later (BNPL) services provide fixed, short-term repayment plans with predefined spending limits typically set per transaction or account, emphasizing convenience but with less flexibility in extended credit usage. BNPL solutions often appeal to consumers seeking interest-free installments, while credit cards accommodate broader, long-term financial needs with variable credit limits.

Security and Consumer Protections

Credit cards offer robust fraud protection and secure encryption technologies to safeguard consumer data during transactions. Buy Now Pay Later services often lack the comprehensive regulatory oversight that credit cards enjoy, which may expose users to higher risks of unauthorized charges and limited dispute resolution options. Banks typically provide stronger consumer protections such as zero-liability policies and fraud monitoring, making credit cards a safer choice for secure online and in-store purchases.

Convenience and User Experience

Credit cards offer instant access to funds with widespread acceptance and seamless integration into existing banking apps, enhancing user convenience. Buy Now Pay Later (BNPL) services provide flexible payment options without traditional credit checks, simplifying checkout processes and appealing to budget-conscious consumers. Both methods improve user experience by catering to different spending habits and financial management preferences.

Choosing the Right Option for Your Banking Needs

Credit cards offer revolving credit with rewards, interest rates, and credit score benefits, ideal for those seeking flexible spending and financial management. Buy Now Pay Later (BNPL) services provide interest-free, short-term installment plans, suitable for consumers aiming for budget-friendly payments without accumulating credit debt. Evaluating spending habits, repayment capacity, and credit impact helps determine the best choice between credit cards and BNPL for tailored banking solutions.

Related Important Terms

Credit Card Utilization Ratio

Credit card utilization ratio, the percentage of available credit used, directly impacts credit scores and borrowing capacity, making responsible management crucial compared to Buy Now Pay Later (BNPL) options, which typically do not affect credit utilization but may carry higher fees and limited credit reporting. Maintaining a utilization ratio below 30% optimizes credit health, whereas BNPL services provide short-term payment flexibility without influencing credit limits or utilization metrics.

BNPL (Buy Now Pay Later) Adoption Rate

Buy Now Pay Later (BNPL) adoption rates have surged globally, with market penetration exceeding 30% among millennials and Gen Z consumers, outpacing traditional credit card usage in online and in-store purchases. Regulatory bodies monitor BNPL growth closely as it reshapes consumer credit behavior by offering interest-free, flexible payment options that challenge conventional credit card debt models.

Revolving Credit vs Installment Credit

Credit cards offer revolving credit, allowing users to carry a balance month-to-month with variable interest rates, while Buy Now Pay Later (BNPL) services provide installment credit, requiring fixed payments over a set period without revolving balances. Revolving credit provides flexibility in repayment amounts and timing, whereas installment credit enforces structured payments reducing the risk of overspending.

Digital Wallet Integration

Credit cards offer seamless digital wallet integration, enabling instant payments through platforms like Apple Pay and Google Pay, while Buy Now Pay Later (BNPL) services are increasingly embedding into e-commerce digital wallets to provide flexible, interest-free installment options at checkout. Digital wallet compatibility enhances user convenience and security, making credit cards and BNPL essential for modern banking transactions and consumer financial management.

Soft Credit Inquiry (BNPL)

Soft credit inquiries, commonly associated with Buy Now Pay Later (BNPL) services, do not impact credit scores and allow consumers to access financing without affecting their credit history, unlike traditional credit card applications that typically involve hard inquiries. This makes BNPL an attractive option for consumers seeking flexible payment plans without the risk of lowering their credit score.

Ghost Limit (Virtual Credit)

Ghost Limit, a virtual credit feature, enhances flexibility in credit card usage by allowing users to spend beyond their physical card limit without immediate impact on their main credit line. Unlike traditional Buy Now Pay Later services that split payments into installments, Ghost Limit leverages existing credit infrastructure to provide real-time, seamless credit extensions with minimal credit checks and instant approval.

Deferred Interest Promotions

Credit card deferred interest promotions often require full payment within the promotional period to avoid accumulated interest charges, while Buy Now Pay Later (BNPL) plans typically offer interest-free installments but may impose high fees or interest if payments are missed. Banks strategically design deferred interest offers on credit cards to encourage larger purchases and maximize long-term interest revenue, contrasting with BNPL's short-term, fixed installment structure aimed at younger consumers.

Embedded Finance Solutions

Embedded finance solutions integrate credit card and Buy Now Pay Later (BNPL) options directly into banking platforms, enhancing customer convenience and optimizing payment flexibility. BNPL offers interest-free short-term installments, while credit cards provide revolving credit and rewards, allowing banks to tailor financing solutions to diverse consumer needs and improve user engagement.

Split Payment Schemes

Credit cards offer revolving credit with interest on unpaid balances, while Buy Now Pay Later (BNPL) schemes provide interest-free split payments over a short period, enhancing consumer flexibility. BNPL's fixed installment plans reduce the risk of debt accumulation compared to credit cards' variable payment requirements.

Responsible Lending Algorithms

Responsible lending algorithms in banking enhance risk assessment by analyzing credit card spending patterns and Buy Now Pay Later (BNPL) repayment behaviors to prevent over-indebtedness. These algorithms integrate real-time data and machine learning models to ensure personalized credit limits and repayment plans aligned with individual financial capacity.

Credit card vs Buy now pay later for banking. Infographic

moneydiff.com

moneydiff.com