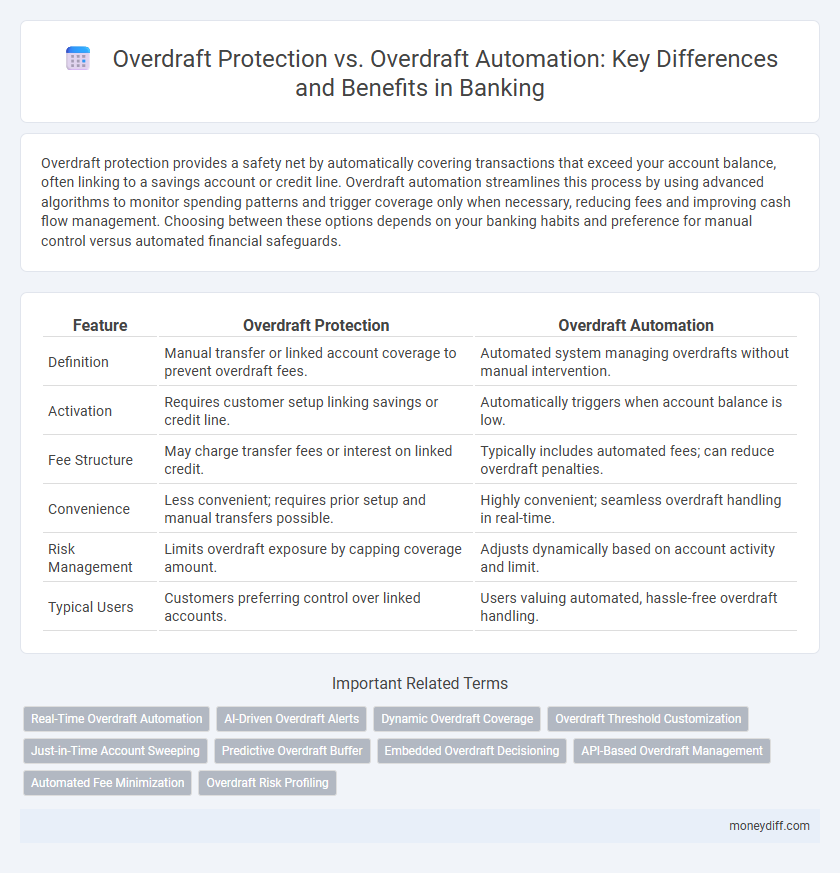

Overdraft protection provides a safety net by automatically covering transactions that exceed your account balance, often linking to a savings account or credit line. Overdraft automation streamlines this process by using advanced algorithms to monitor spending patterns and trigger coverage only when necessary, reducing fees and improving cash flow management. Choosing between these options depends on your banking habits and preference for manual control versus automated financial safeguards.

Table of Comparison

| Feature | Overdraft Protection | Overdraft Automation |

|---|---|---|

| Definition | Manual transfer or linked account coverage to prevent overdraft fees. | Automated system managing overdrafts without manual intervention. |

| Activation | Requires customer setup linking savings or credit line. | Automatically triggers when account balance is low. |

| Fee Structure | May charge transfer fees or interest on linked credit. | Typically includes automated fees; can reduce overdraft penalties. |

| Convenience | Less convenient; requires prior setup and manual transfers possible. | Highly convenient; seamless overdraft handling in real-time. |

| Risk Management | Limits overdraft exposure by capping coverage amount. | Adjusts dynamically based on account activity and limit. |

| Typical Users | Customers preferring control over linked accounts. | Users valuing automated, hassle-free overdraft handling. |

Understanding Overdraft Protection in Banking

Overdraft protection in banking safeguards account holders from declined transactions or insufficient funds fees by linking a secondary account or a line of credit to cover shortfalls. This service ensures seamless transaction processing, preventing interruptions due to lack of funds. Understanding the distinction between overdraft protection and automatic overdraft coverage helps customers manage their finances effectively and avoid costly penalties.

What Is Overdraft Automation?

Overdraft automation is a banking feature that automatically transfers funds from a linked account, such as a savings or line of credit, to cover transactions that exceed the checking account balance. This process helps prevent overdraft fees and ensures transactions are approved without manual intervention. Unlike overdraft protection that may require prior setup or opt-in, overdraft automation seamlessly manages insufficient funds in real-time to maintain account solvency.

Key Differences Between Overdraft Protection and Automation

Overdraft protection is a banking service that prevents declined transactions or fees by linking accounts or providing a predetermined credit limit, while overdraft automation involves the use of algorithms and AI to dynamically manage and cover overdrafts based on customer behavior and account activity. Overdraft protection typically relies on manually set limits or linked accounts such as savings or credit lines, whereas automation continuously analyzes transaction patterns to optimize coverage and reduce costs. Banks implementing overdraft automation benefit from enhanced fraud detection, personalized customer experiences, and lower operational risks compared to static protection methods.

Benefits of Overdraft Protection

Overdraft protection offers a safety net by automatically covering transactions that exceed the account balance, preventing declined payments and costly overdraft fees. It ensures seamless access to funds, maintaining account holder reputation and financial stability. This service improves customer satisfaction by reducing transaction disruptions and providing peace of mind during unexpected expenses.

Advantages of Overdraft Automation

Overdraft automation enhances banking efficiency by automatically managing transactions to prevent overdrafts without manual intervention, ensuring seamless account balances and reducing penalty fees. This technology leverages real-time data analysis to optimize fund transfers across linked accounts, improving customer satisfaction through immediate coverage. By minimizing overdraft occurrences, banks can reduce operational costs while offering a more user-friendly banking experience.

Costs and Fees: Protection vs Automation

Overdraft Protection often involves upfront fees or transfer charges from linked accounts, which can accumulate with frequent usage, while Overdraft Automation leverages real-time monitoring and AI to minimize unnecessary overdraft events, thereby reducing incidental costs. Protection services typically charge flat fees per transaction, whereas automated systems may offer tiered or predictive fee structures that align more closely with individual spending behavior. Banks implementing overdraft automation benefit from lower operational costs and fewer customer disputes associated with unexpected fees, promoting a more cost-effective and transparent overdraft management solution.

Risk Management in Overdraft Strategies

Overdraft protection and overdraft automation both play crucial roles in risk management by minimizing unauthorized account overdrafts and associated fees. Overdraft protection provides a safety net by linking accounts or lines of credit to cover shortfalls, reducing financial exposure during unexpected expenses. Overdraft automation uses algorithms to monitor and manage transactions in real-time, reducing the likelihood of overdrafts and enabling proactive risk control in banking operations.

Impact on Account Holder’s Credit Score

Overdraft protection typically minimizes bounced transactions by linking a savings account or credit card to cover shortages, thereby preventing negative marks on the account holder's credit report. Overdraft automation, which automatically approves overdraft transactions within preset limits, can lead to frequent overdraft usage and potential fees but does not directly affect credit scores unless the associated accounts become delinquent. Maintaining responsible account management with either option helps preserve credit standing by avoiding missed payments or account closures reported to credit bureaus.

Choosing the Right Overdraft Solution

Choosing the right overdraft solution depends on understanding the benefits of overdraft protection and overdraft automation. Overdraft protection offers a safety net by linking accounts or lines of credit to prevent declined transactions, while overdraft automation uses algorithms to manage and approve overdrafts intelligently, reducing fees and enhancing customer experience. Banks must evaluate factors such as cost, customer behavior, and technology capabilities to implement the most effective overdraft strategy.

Future Trends in Overdraft Services

Future trends in overdraft services emphasize enhanced automation powered by AI and machine learning, enabling real-time transaction monitoring and dynamic risk assessment. Overdraft automation improves customer experience by reducing fees and providing personalized alerts, whereas traditional overdraft protection remains more static and manually managed. Banks increasingly adopt predictive analytics to anticipate overdraft events and offer proactive solutions, driving a shift from reactive overdraft protection to intelligent overdraft automation.

Related Important Terms

Real-Time Overdraft Automation

Real-time overdraft automation in banking provides instant transaction approval by dynamically managing funds across accounts to prevent overdraft fees, enhancing customer experience compared to traditional overdraft protection that relies on manual or delayed interventions. This automated system leverages API integrations and AI-driven algorithms to monitor account balances continuously, ensuring seamless fund transfers and reducing financial friction for account holders.

AI-Driven Overdraft Alerts

AI-driven overdraft alerts enhance overdraft protection by providing real-time notifications that help customers avoid fees and maintain account balances seamlessly. Integrating AI automation with overdraft systems improves accuracy in predicting potential shortfalls, enabling preemptive actions and personalized financial management.

Dynamic Overdraft Coverage

Dynamic Overdraft Coverage leverages real-time transaction analysis to automatically manage overdraft limits, reducing fees and enhancing customer convenience compared to traditional Overdraft Protection, which often requires manual activation or predefined limits. By integrating AI-driven algorithms, Dynamic Overdraft Coverage optimizes fund availability while minimizing overdraft occurrences and improving overall account management efficiency.

Overdraft Threshold Customization

Overdraft Protection offers customers a safety net by covering transactions up to a pre-set limit, while Overdraft Automation enhances this by enabling dynamic overdraft threshold customization based on individual account activity and risk profiles. Tailoring overdraft thresholds in automation systems improves customer experience by minimizing declined transactions and reducing fees, thus optimizing account management and financial stability.

Just-in-Time Account Sweeping

Overdraft Protection through Just-in-Time Account Sweeping automatically transfers funds from a linked savings or secondary account precisely when the checking account balance dips below zero, minimizing overdraft fees and improving cash flow management. Unlike traditional overdraft automation that may rely on preset limits or manual transfers, just-in-time sweeping ensures real-time liquidity by dynamically covering shortfalls only as they occur.

Predictive Overdraft Buffer

Predictive Overdraft Buffers leverage machine learning algorithms to analyze transaction patterns, offering proactive overdraft protection by automatically adjusting account limits before insufficient funds occur. This overdraft automation reduces fees and enhances customer experience by seamlessly preventing overdrafts without manual intervention.

Embedded Overdraft Decisioning

Embedded overdraft decisioning leverages real-time data analytics and AI algorithms to automatically assess transaction risks and approve or decline overdraft requests instantly, enhancing customer experience while reducing financial liability for banks. Overdraft automation streamlines this process by integrating seamless decision-making within digital banking platforms, minimizing manual intervention and increasing operational efficiency compared to traditional overdraft protection methods.

API-Based Overdraft Management

API-based overdraft management streamlines overdraft protection by enabling real-time transaction monitoring and instant credit line adjustments, reducing fees and enhancing customer experience. Automated overdraft solutions leverage machine learning algorithms through APIs to predict overdraft occurrences and dynamically authorize payments, minimizing default risks and operational costs.

Automated Fee Minimization

Overdraft automation uses advanced algorithms to monitor account activity in real-time, automatically transferring funds or triggering linked credit lines to minimize overdraft fees with precision. This approach significantly reduces costly manual interventions compared to traditional overdraft protection, ensuring seamless fee management and improved customer experience.

Overdraft Risk Profiling

Overdraft risk profiling utilizes advanced algorithms to assess a customer's spending patterns and financial behavior, enabling personalized overdraft protection that minimizes fees and prevents unauthorized transactions. Overdraft automation streamlines transaction approval processes but may lack the nuanced risk evaluation provided by dynamic profiling, potentially increasing exposure to overdraft risks.

Overdraft Protection vs Overdraft Automation for banking. Infographic

moneydiff.com

moneydiff.com