Physical branch banking offers personalized, face-to-face customer service, allowing clients to discuss complex financial needs directly with bank representatives. Digital-only banking provides 24/7 convenience and faster access to account management through mobile apps and online platforms. Customers prioritizing in-person guidance may prefer branches, while tech-savvy users value the efficiency and accessibility of digital banking services.

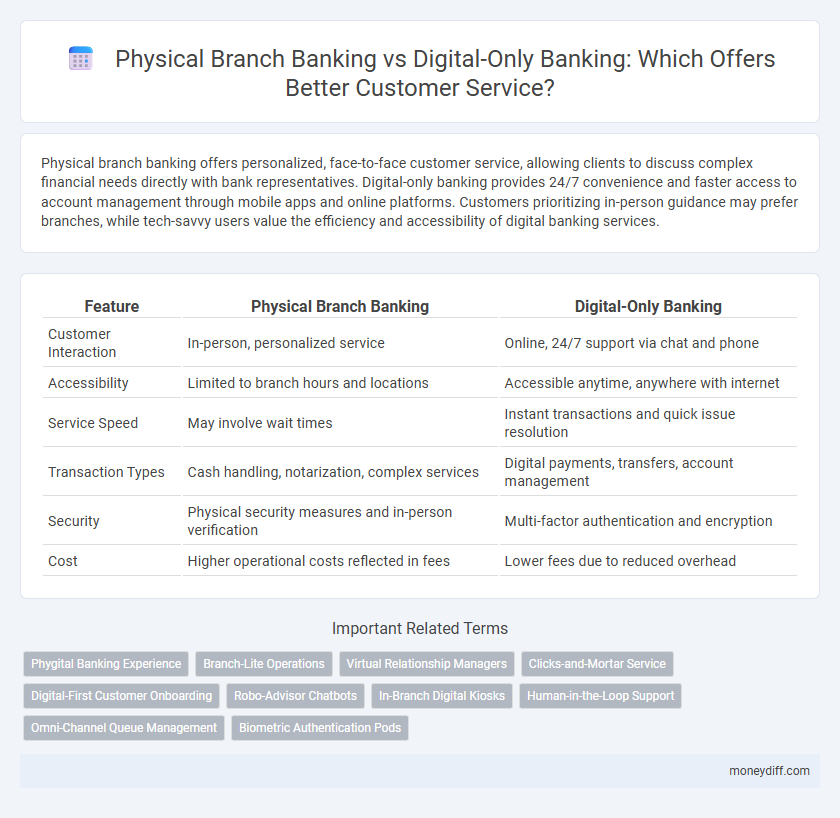

Table of Comparison

| Feature | Physical Branch Banking | Digital-Only Banking |

|---|---|---|

| Customer Interaction | In-person, personalized service | Online, 24/7 support via chat and phone |

| Accessibility | Limited to branch hours and locations | Accessible anytime, anywhere with internet |

| Service Speed | May involve wait times | Instant transactions and quick issue resolution |

| Transaction Types | Cash handling, notarization, complex services | Digital payments, transfers, account management |

| Security | Physical security measures and in-person verification | Multi-factor authentication and encryption |

| Cost | Higher operational costs reflected in fees | Lower fees due to reduced overhead |

Traditional Branch Banking: A Customer Service Haven

Traditional branch banking offers personalized customer service through face-to-face interactions, fostering trust and relationship-building often unattainable in digital-only environments. Branch staff provide tailored financial advice and immediate problem resolution, enhancing customer satisfaction and loyalty. Physical branches serve as vital access points for complex transactions and customers preferring in-person support, maintaining banking accessibility across diverse demographics.

Digital-Only Banking: Convenience Meets Technology

Digital-only banking leverages advanced technology to provide customers with seamless, 24/7 access to financial services through mobile apps and online platforms, eliminating the need for physical branch visits. Real-time transaction monitoring, instant fund transfers, and AI-driven customer support enhance convenience and personalization, meeting the demands of modern consumers. This technology-driven approach reduces operational costs and accelerates service delivery, making banking more efficient and accessible.

Personalized Assistance: In-Person vs Online Support

Physical branch banking offers personalized assistance through face-to-face interactions, enabling customers to receive tailored solutions and immediate problem resolution. Digital-only banking provides online support with chatbots and virtual agents, ensuring 24/7 availability but may lack the nuanced understanding found in human interactions. Customer preference often depends on the complexity of service needs and the value placed on convenience versus personalized guidance.

Accessibility: Branch Locations vs Mobile Access

Physical branch banking offers direct, in-person customer service and access to financial advisors at local branch locations, appealing to customers who prefer face-to-face interactions. Digital-only banking prioritizes convenience with 24/7 mobile access, enabling customers to manage accounts, transfer funds, and pay bills anytime from their smartphones or computers. While physical branches provide personal touch and immediate assistance, digital banking ensures broader accessibility, especially for tech-savvy users and those in remote areas without nearby branch access.

Transaction Speed: Teller Services vs Digital Processes

Physical branch banking offers personalized teller services that can expedite complex transactions through direct human interaction, yet may involve longer wait times during peak hours. Digital-only banking leverages automated processes and real-time transaction capabilities, significantly reducing processing times for routine activities such as transfers, deposits, and payments. Advanced digital platforms utilize AI-driven verification and instant fund transfers, enhancing transaction speed and overall customer service efficiency.

Security and Trust: Face-to-Face Interaction vs Online Security

Physical branch banking offers the advantage of face-to-face interaction, enhancing customer trust through personal relationships and immediate resolution of security concerns. Digital-only banking relies heavily on advanced encryption, multi-factor authentication, and continuous monitoring to protect customer data and prevent cyber threats. While in-person services provide tangible reassurance, robust online security protocols ensure digital platforms maintain high levels of trust for remote banking customers.

Handling Complex Issues: Physical Consultation vs Chat Support

Physical branch banking offers personalized face-to-face consultations that effectively address complex financial issues requiring detailed explanations and confidential discussions. Digital-only banking relies on chat support and AI-driven tools, which efficiently handle routine inquiries but may struggle with nuanced cases demanding human judgment and empathy. Customers facing intricate problems often benefit from the in-depth assistance available through in-person interactions at physical branches.

Customer Demographics: Preferences and Adaptability

Physical branch banking attracts older customers and those in rural areas who prefer face-to-face interactions and personalized service, reflecting a strong adaptability to traditional banking methods. Digital-only banking appeals primarily to younger, tech-savvy customers who value convenience, 24/7 access, and efficient self-service options, showing higher adaptability to mobile and online platforms. Banks must analyze customer demographics to tailor service delivery, balancing physical presence for engagement and digital solutions for efficiency.

Cost Implications: Maintenance Fees vs Digital Savings

Physical branch banking incurs significant maintenance fees, including real estate costs, utilities, and staffing expenses, driving up overall operational costs. Digital-only banking reduces these overheads dramatically by eliminating physical locations and relying on automated processes, resulting in considerable cost savings. These savings can be passed on to customers through lower fees and higher interest rates, enhancing competitive advantage in the banking sector.

The Future of Banking: Integrating Branch and Digital Services

Physical branch banking remains vital for personalized customer service and complex transactions, whereas digital-only banking offers convenience and 24/7 access through mobile apps and online platforms. The future of banking lies in hybrid models that seamlessly integrate in-branch expertise with advanced digital tools like AI-driven chatbots and biometric authentication. This integration enhances customer engagement, improves operational efficiency, and meets diverse consumer preferences in an evolving financial landscape.

Related Important Terms

Phygital Banking Experience

Phygital banking combines the personalized service and trust of physical branches with the convenience and accessibility of digital-only platforms, enhancing overall customer experience. This hybrid model leverages in-branch consultations alongside seamless mobile and online banking features to meet diverse customer needs efficiently.

Branch-Lite Operations

Branch-lite operations in banking combine limited physical locations with enhanced digital services, offering customers personalized assistance without the overhead of full-scale branches. This hybrid model improves efficiency and accessibility while maintaining essential face-to-face support for complex banking needs.

Virtual Relationship Managers

Virtual Relationship Managers in digital-only banking provide personalized customer service through AI-driven insights and 24/7 accessibility, enhancing client engagement without geographical limitations. In contrast, physical branch banking offers face-to-face interaction but lacks the continuous availability and data-driven customization enabled by virtual counterparts.

Clicks-and-Mortar Service

Clicks-and-mortar banking seamlessly integrates physical branch services with digital platforms, offering customers personalized in-person assistance alongside convenient online access. This hybrid approach enhances customer service by combining face-to-face interactions for complex needs with 24/7 digital transactions, optimizing overall banking efficiency and satisfaction.

Digital-First Customer Onboarding

Digital-first customer onboarding streamlines account creation through intuitive mobile apps and AI-driven verification, reducing wait times and enhancing user experience compared to traditional physical branch processes. This approach leverages biometric authentication and real-time document scanning to ensure secure, convenient access to banking services without the need for in-person visits.

Robo-Advisor Chatbots

Robo-advisor chatbots in digital-only banking provide 24/7 personalized financial advice, using AI to analyze customer data for tailored investment strategies without the limitations of physical branches. These chatbots enhance customer service efficiency by handling routine inquiries and transactions instantly, reducing wait times and operational costs compared to traditional branch banking.

In-Branch Digital Kiosks

In-branch digital kiosks enhance customer service by combining the personalized support of physical branch banking with the efficiency and convenience of digital-only banking, allowing customers to perform transactions, access account information, and receive tailored assistance without waiting for teller availability. These kiosks leverage advanced touch-screen interfaces and real-time data integration to streamline banking operations, reduce service times, and improve overall customer satisfaction in a hybrid banking environment.

Human-in-the-Loop Support

Physical branch banking offers personalized Human-in-the-Loop support allowing customers to interact directly with bank staff for complex transactions and tailored financial advice. Digital-only banking utilizes AI-driven chatbots augmented by human agents to provide efficient, real-time customer service while minimizing the need for in-person visits.

Omni-Channel Queue Management

Omni-channel queue management integrates physical branch banking and digital-only banking to streamline customer service by enabling seamless transitions between in-person visits and digital interactions across channels like mobile apps, online chat, and phone support. This approach enhances customer experience through real-time queue updates, personalized service prioritization, and reduced wait times, improving operational efficiency and customer satisfaction in banking environments.

Biometric Authentication Pods

Biometric authentication pods in physical branch banking provide enhanced security and personalized customer interactions through fingerprint or facial recognition, reducing fraud and wait times. Digital-only banking leverages remote biometric verification technologies to streamline account access and transactions while ensuring data privacy and compliance with regulatory standards.

Physical Branch Banking vs Digital-Only Banking for customer service. Infographic

moneydiff.com

moneydiff.com