Checking accounts typically offer seamless transaction capabilities with unlimited check writing, debit card access, and easy bill payments, making them ideal for daily banking needs. Cash management accounts, while offering similar transactional features, often provide higher interest rates and integrated investment options, blending banking and wealth management. Choosing between the two depends on prioritizing straightforward transaction access versus enhanced financial growth opportunities.

Table of Comparison

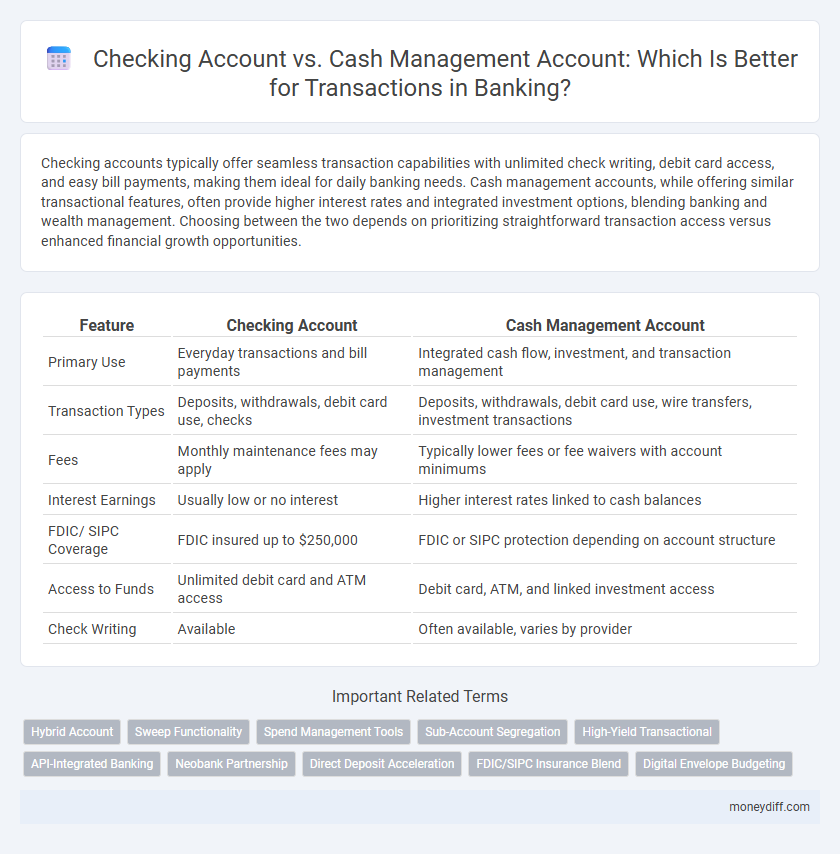

| Feature | Checking Account | Cash Management Account |

|---|---|---|

| Primary Use | Everyday transactions and bill payments | Integrated cash flow, investment, and transaction management |

| Transaction Types | Deposits, withdrawals, debit card use, checks | Deposits, withdrawals, debit card use, wire transfers, investment transactions |

| Fees | Monthly maintenance fees may apply | Typically lower fees or fee waivers with account minimums |

| Interest Earnings | Usually low or no interest | Higher interest rates linked to cash balances |

| FDIC/ SIPC Coverage | FDIC insured up to $250,000 | FDIC or SIPC protection depending on account structure |

| Access to Funds | Unlimited debit card and ATM access | Debit card, ATM, and linked investment access |

| Check Writing | Available | Often available, varies by provider |

Understanding Checking Accounts and Cash Management Accounts

Checking accounts provide easy access to funds for daily transactions, offering features like debit cards, check writing, and direct deposits, making them ideal for routine personal and business expenses. Cash management accounts combine banking and investment features by allowing transactions alongside tools for maximizing returns, often including higher interest rates and integrated financial management services. Selecting between the two depends on transaction frequency, cash flow needs, and preferences for earning interest or managing investments while maintaining liquidity.

Key Differences in Account Structure

Checking accounts typically offer unlimited transactions with features such as debit cards and check writing, designed primarily for everyday spending and bill payments. Cash management accounts integrate features of checking and investment accounts, often providing higher interest rates, limited transaction capabilities, and access to a broader range of financial services through brokerage platforms. The account structure of checking accounts emphasizes liquidity and ease of access, while cash management accounts focus on combining transactional convenience with investment growth opportunities.

Accessibility and Transaction Methods

Checking accounts typically offer unlimited access through physical checks, debit cards, and ATM withdrawals, making them ideal for daily, in-person transactions. Cash Management Accounts (CMAs) combine the features of checking and savings accounts, often providing access via debit cards, ACH transfers, and mobile payments, with enhanced integration for online and investment platform transactions. Both account types support electronic payments, but CMAs generally offer more flexibility for managing funds across multiple financial services.

Interest Rates and Earnings Potential

Checking accounts typically offer low or no interest rates, limiting earnings potential on deposited funds, whereas cash management accounts provide higher interest rates comparable to money market funds, maximizing returns on daily transaction balances. Cash management accounts often integrate features such as FDIC insurance through partner banks and offer liquidity with check-writing and debit card access, combining transactional convenience with interest earnings. Consumers seeking to optimize earnings on frequent transactions benefit from cash management accounts due to their superior interest-compounding and higher annual percentage yields (APYs).

Fee Structures and Minimum Balance Requirements

Checking accounts typically offer lower or no monthly fees but may require maintaining a minimum balance to avoid charges, while cash management accounts often charge higher fees due to premium services like integrated investment options and offer lower or no minimum balance requirements. Fee structures for checking accounts frequently include overdraft and ATM fees, whereas cash management accounts may have tiered fees based on transaction volume and asset levels. Choosing between these accounts depends on balancing fee sensitivity with the need for features such as higher interest rates or seamless cash-flow management.

ATM Access and Withdrawal Options

Checking accounts typically offer unlimited ATM access with fee reimbursements at a wide network of ATMs, making them ideal for everyday cash withdrawals and purchases. Cash management accounts also provide extensive ATM networks but often include additional features such as higher withdrawal limits and integration with investment services for seamless fund transfers. Both account types support debit card access, yet cash management accounts may offer enhanced flexibility for frequent and larger transactions.

Deposit Insurance and Account Security

Checking accounts are typically insured by the FDIC up to $250,000 per depositor, offering strong federal protection for deposited funds during transactions. Cash management accounts, often provided by brokerage firms, may hold funds in sweep accounts insured by the SIPC or FDIC, but the coverage can vary depending on the structure and participating banks. Understanding the specific deposit insurance policies and security measures of each account type is essential to safeguarding transaction funds against institutional failure or fraud.

Integration with Financial Tools and Apps

Checking accounts typically offer seamless integration with a wide range of financial tools and apps, enabling efficient management of everyday transactions and bill payments. Cash management accounts, often provided by fintech platforms, enhance this integration by combining features of checking and investment accounts, allowing users to automate savings and optimize cash flow. Both account types support real-time transaction tracking and sync effortlessly with budgeting, tax software, and payment platforms for streamlined financial management.

Suitability for Everyday Banking Needs

Checking accounts offer seamless access to funds through checks, debit cards, and ATM withdrawals, making them ideal for daily purchases and bill payments. Cash management accounts combine features of checking and savings, providing higher interest rates and integration with investment services, suited for those seeking both transactional convenience and wealth management. For everyday banking needs, checking accounts generally provide simpler, more direct access to funds without investment complexities.

Choosing the Right Account for Your Transactions

Choosing the right account for your transactions depends on your financial needs and transaction frequency. Checking accounts offer unlimited transactions, easy bill payments, and ATM access, making them ideal for everyday spending and frequent transactions. Cash management accounts combine features of checking and investment accounts, providing higher interest rates and integrated financial services, best suited for those seeking both liquidity and growth.

Related Important Terms

Hybrid Account

A hybrid account combines features of both checking accounts and cash management accounts, offering seamless transaction capabilities with higher interest rates and enhanced liquidity. It enables efficient cash flow management by providing unlimited check writing, debit card access, and investment options typically unavailable in standard checking accounts.

Sweep Functionality

Sweep functionality in Cash Management Accounts automatically transfers excess funds into higher-interest investment vehicles, optimizing liquidity and earnings, whereas Checking Accounts typically maintain fixed balances without such automated fund allocation. This feature enhances transactional efficiency and cash flow management by dynamically reallocating funds based on preset thresholds.

Spend Management Tools

Checking accounts offer basic spend management tools such as debit cards, online bill pay, and transaction alerts for everyday expenses, while cash management accounts integrate advanced features like automated budgeting, real-time spending analytics, and higher liquidity to optimize cash flow and expense tracking. These enhanced tools in cash management accounts provide businesses and individuals with greater control over transaction monitoring and financial planning compared to traditional checking accounts.

Sub-Account Segregation

Checking accounts offer basic transactional capabilities with limited sub-account segregation, typically consolidating funds in a single account for everyday expenses. Cash management accounts provide enhanced sub-account segregation, enabling users to allocate funds across multiple sub-accounts for budgeting, expense tracking, and optimized cash flow management within one unified platform.

High-Yield Transactional

High-yield checking accounts offer competitive interest rates with unlimited transactions, ideal for everyday banking needs, while cash management accounts combine features of checking and investment accounts, providing higher yields, seamless money transfers, and enhanced transaction capabilities. Both account types support high-volume transactions but cash management accounts typically integrate advanced financial tools and higher interest payouts, enhancing liquidity and earning potential.

API-Integrated Banking

Checking accounts primarily facilitate everyday transactions with features like direct deposits, debit card access, and bill payments, making them suitable for routine banking needs. Cash management accounts offer enhanced API-integrated banking capabilities, enabling seamless automation, real-time fund transfers, and consolidated transaction monitoring for more efficient financial operations.

Neobank Partnership

Neobank partnerships enhance transaction efficiency by integrating checking accounts with cash management accounts, offering seamless fund transfers, superior liquidity management, and real-time transaction tracking. This integration leverages advanced fintech APIs and digital banking platforms to optimize cash flow for businesses and individuals.

Direct Deposit Acceleration

Cash management accounts typically offer direct deposit acceleration, enabling funds to be available up to two days earlier than traditional checking accounts, which can improve cash flow efficiency for frequent transactions. While checking accounts provide standard access to payroll deposits, cash management accounts integrate investment features and enhanced liquidity, making them preferable for optimizing direct deposit timing and transactional flexibility.

FDIC/SIPC Insurance Blend

Checking accounts offer FDIC insurance protection up to $250,000 per depositor, providing security for cash deposits, while cash management accounts combine FDIC coverage with SIPC insurance, safeguarding both cash and investment securities up to applicable limits. This hybrid protection ensures that transactions involving deposits remain federally insured, while investments within cash management accounts benefit from broker-dealer safeguards against asset loss.

Digital Envelope Budgeting

Checking accounts offer basic transaction capabilities and limited budgeting tools, while cash management accounts provide advanced features like integrated digital envelope budgeting, enabling users to allocate funds into customizable spending categories for better financial control. Digital envelope budgeting within cash management accounts leverages real-time transaction tracking and automated fund segmentation, enhancing cash flow management and expense monitoring compared to traditional checking accounts.

Checking Account vs Cash Management Account for transactions. Infographic

moneydiff.com

moneydiff.com