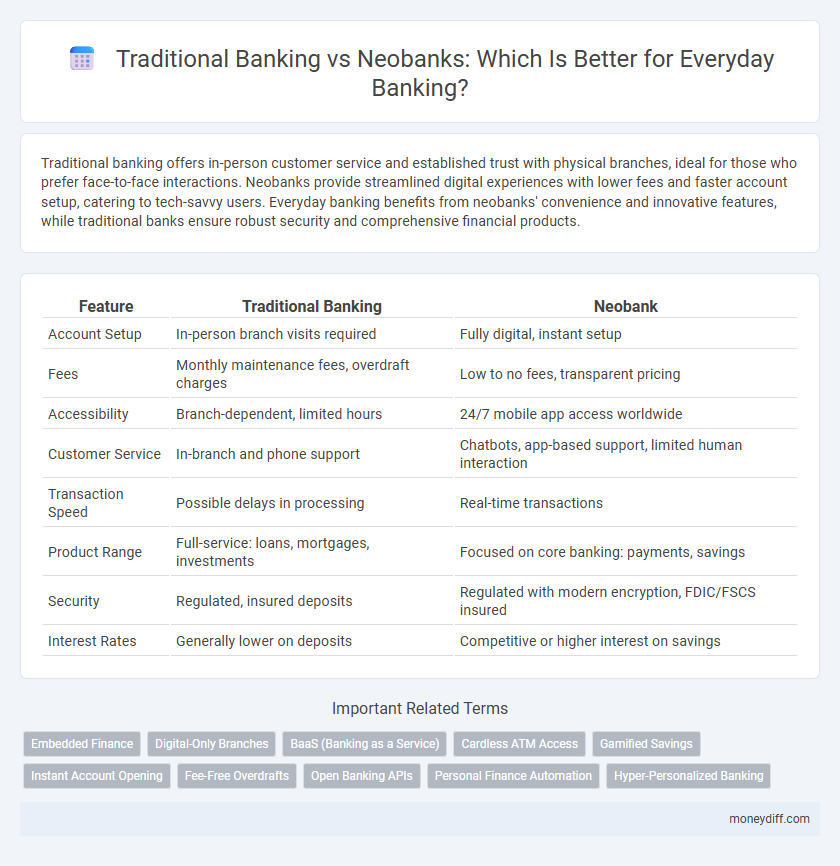

Traditional banking offers in-person customer service and established trust with physical branches, ideal for those who prefer face-to-face interactions. Neobanks provide streamlined digital experiences with lower fees and faster account setup, catering to tech-savvy users. Everyday banking benefits from neobanks' convenience and innovative features, while traditional banks ensure robust security and comprehensive financial products.

Table of Comparison

| Feature | Traditional Banking | Neobank |

|---|---|---|

| Account Setup | In-person branch visits required | Fully digital, instant setup |

| Fees | Monthly maintenance fees, overdraft charges | Low to no fees, transparent pricing |

| Accessibility | Branch-dependent, limited hours | 24/7 mobile app access worldwide |

| Customer Service | In-branch and phone support | Chatbots, app-based support, limited human interaction |

| Transaction Speed | Possible delays in processing | Real-time transactions |

| Product Range | Full-service: loans, mortgages, investments | Focused on core banking: payments, savings |

| Security | Regulated, insured deposits | Regulated with modern encryption, FDIC/FSCS insured |

| Interest Rates | Generally lower on deposits | Competitive or higher interest on savings |

Understanding Traditional Banks and Neobanks

Traditional banks offer in-person branch services, extensive ATM networks, and a wide range of financial products while adhering to established regulatory frameworks. Neobanks operate entirely online, providing streamlined digital platforms with lower fees and faster account setup but limited physical presence. Understanding the differences in customer experience, cost structure, and service accessibility is essential for choosing the right everyday banking solution.

Account Opening: Digital vs In-Person Processes

Traditional banking typically requires customers to open accounts in person, involving physical paperwork, identity verification at branches, and longer processing times. Neobanks streamline account opening through fully digital processes that use biometric authentication and instant document uploads, allowing customers to open accounts within minutes via mobile apps. This digital-first approach reduces onboarding friction, enhances user convenience, and enables faster access to banking services compared to traditional methods.

Fees and Transparency: Comparing Costs

Traditional banking often involves multiple fees, including maintenance charges, ATM fees, and overdraft penalties, which can significantly increase the cost of everyday banking. Neobanks typically offer lower fees or fee-free services, emphasizing transparent pricing and digital-first management to reduce hidden costs. Customers seeking cost-efficient banking experiences benefit from neobanks' clear fee structures and minimal charges compared to conventional banks.

Accessibility and Convenience for Daily Use

Traditional banking offers physical branches and ATMs, enabling direct interaction and cash services, which may benefit customers preferring in-person assistance. Neobanks provide 24/7 access through mobile apps with streamlined digital interfaces, facilitating instant transfers, bill payments, and budgeting tools without the need for branch visits. The convenience of real-time notifications and minimal fees in neobanks enhances everyday banking accessibility for tech-savvy users seeking efficient financial management.

Mobile Apps and Online Banking Features

Traditional banks offer mobile apps with essential features like account management, bill payments, and ATM locators, but their interfaces often lack the intuitive design and speed found in neobank apps. Neobanks prioritize seamless digital experiences, providing real-time transaction alerts, advanced budgeting tools, and instant card freezing through highly responsive and user-friendly mobile platforms. Enhanced online banking features in neobanks, such as integrated financial analytics and personalized spending insights, cater to tech-savvy customers seeking convenience and smarter money management.

Security Measures and Customer Protection

Traditional banking institutions leverage established security protocols such as multi-factor authentication, encrypted transactions, and in-branch identity verification to protect customer assets, benefiting from longstanding regulatory oversight. Neobanks employ advanced biometric authentication, real-time fraud detection powered by AI, and instant transaction alerts, offering cutting-edge digital protection tailored for mobile-first users. Both models prioritize customer protection through FDIC insurance and compliance with financial regulations, but neobanks emphasize seamless, low-friction security experiences aligned with modern digital banking needs.

Customer Service: Human Touch vs Digital Support

Traditional banking offers personalized customer service through in-branch representatives, providing direct human interaction for resolving complex issues and building trust. Neobanks rely on digital support channels such as chatbots and mobile apps, enabling 24/7 accessibility and faster response times but lacking face-to-face communication. Customers valuing hands-on assistance may prefer traditional banks, while tech-savvy users benefit from neobanks' seamless digital support experience.

Interest Rates and Savings Opportunities

Traditional banks often offer lower interest rates on savings accounts due to higher operational costs, while neobanks provide competitive or higher rates by leveraging digital-only platforms. Neobanks frequently feature goal-based savings tools and automated interest compounding that maximize users' earnings potential. Customers prioritizing growth in savings may find neobanks more advantageous, whereas those valuing physical branch access might prefer traditional banks despite lower returns.

ATM Access and Global Usability

Traditional banking provides extensive ATM networks allowing customers to withdraw cash conveniently worldwide without extra fees. Neobanks often rely on partner ATM networks that may limit free withdrawals and incur higher charges outside select regions. For global usability, traditional banks support multiple currencies and international transactions seamlessly, whereas neobanks focus on digital transactions with varying degrees of global acceptance and currency support.

Which Option Fits Your Lifestyle?

Traditional banking offers extensive branch networks and in-person services ideal for customers valuing face-to-face interactions and cash handling, while neobanks provide streamlined, app-based experiences with lower fees and advanced digital tools suited to tech-savvy users seeking convenience. Consider lifestyle factors such as travel frequency, preference for physical branches, and comfort with digital-only platforms to determine which banking model aligns with your daily financial management needs. Evaluation of service accessibility, fee structures, and technological features helps identify whether traditional banks or neobanks offer the optimal fit for your everyday banking habits.

Related Important Terms

Embedded Finance

Embedded finance revolutionizes everyday banking by integrating financial services directly into non-bank platforms, offering greater convenience and personalized user experiences compared to traditional banking. Neobanks leverage embedded finance to seamlessly embed payment, lending, and savings features within popular apps, reducing reliance on conventional brick-and-mortar branches and enhancing customer engagement through real-time digital solutions.

Digital-Only Branches

Neobanks operate exclusively through digital-only branches, offering streamlined, user-friendly mobile apps and 24/7 online customer support that significantly reduce overhead costs compared to traditional banking. These digital-first platforms provide faster account setup, lower fees, and enhanced integration with financial technology tools, transforming everyday banking experiences through convenience and accessibility.

BaaS (Banking as a Service)

Traditional banking relies on physical branches and legacy systems, limiting agility and innovation in everyday banking services, while neobanks leverage Banking as a Service (BaaS) platforms to offer seamless, API-driven digital banking experiences with faster onboarding and personalized features. BaaS empowers neobanks to integrate core banking functionalities, payments, and compliance into their apps, providing enhanced convenience and cost-efficiency compared to conventional banking models.

Cardless ATM Access

Traditional banks typically require physical debit or credit cards for ATM withdrawals, while neobanks offer cardless ATM access through mobile apps using QR codes or biometric authentication, enhancing convenience and security. This innovative feature aligns with the growing demand for contactless transactions and seamless digital banking experiences in everyday financial activities.

Gamified Savings

Traditional banking offers stable, in-person services with limited digital engagement, whereas neobanks leverage gamified savings features to enhance user interaction and encourage consistent saving habits through rewards and challenges. Gamified savings tools in neobanks increase financial literacy and motivation, making everyday banking more engaging compared to conventional banks' standard savings accounts.

Instant Account Opening

Traditional banking typically involves lengthy processes for account opening, requiring physical branch visits and extensive paperwork, resulting in delays that can take several days. Neobanks leverage digital platforms to offer instant account opening within minutes, enhancing customer convenience and enabling immediate access to banking services.

Fee-Free Overdrafts

Traditional banking often imposes fee-free overdraft limits that are low or carry hidden fees, restricting customer flexibility in managing short-term financial shortfalls. Neobanks typically offer more generous fee-free overdraft options or no overdraft fees at all, enhancing cost efficiency and ease of everyday banking transactions.

Open Banking APIs

Traditional banking relies on legacy systems with limited integration capabilities, restricting seamless access to financial data and services, whereas neobanks leverage Open Banking APIs to provide real-time data sharing, personalized experiences, and streamlined financial management through interconnected platforms. Open Banking APIs enable neobanks to offer enhanced payment solutions, instant account aggregation, and innovative financial products, transforming everyday banking into a more agile and customer-centric experience.

Personal Finance Automation

Traditional banks often require manual management of personal finances, leading to time-consuming tasks, whereas neobanks leverage advanced personal finance automation tools, including real-time budgeting, expense tracking, and AI-driven financial insights, enhancing efficiency and user experience for everyday banking. Neobanks integrate seamless digital platforms with automated savings and spending analysis, empowering customers to optimize their financial health without the need for in-person visits.

Hyper-Personalized Banking

Traditional banking offers standardized services with limited customization, while neobanks leverage advanced data analytics and AI to deliver hyper-personalized banking experiences, tailoring product recommendations, spending insights, and financial management tools to individual customer behaviors and preferences. Neobanks' ability to provide real-time, tailored financial advice enhances customer engagement and satisfaction, transforming everyday banking into a more intuitive and responsive service.

Traditional Banking vs Neobank for everyday banking. Infographic

moneydiff.com

moneydiff.com