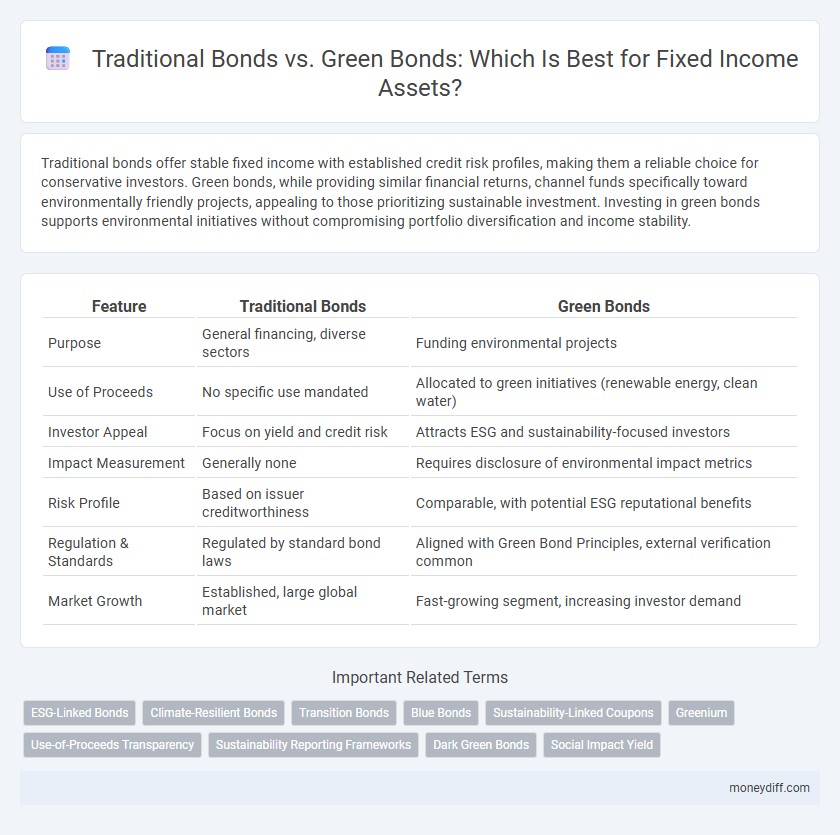

Traditional bonds offer stable fixed income with established credit risk profiles, making them a reliable choice for conservative investors. Green bonds, while providing similar financial returns, channel funds specifically toward environmentally friendly projects, appealing to those prioritizing sustainable investment. Investing in green bonds supports environmental initiatives without compromising portfolio diversification and income stability.

Table of Comparison

| Feature | Traditional Bonds | Green Bonds |

|---|---|---|

| Purpose | General financing, diverse sectors | Funding environmental projects |

| Use of Proceeds | No specific use mandated | Allocated to green initiatives (renewable energy, clean water) |

| Investor Appeal | Focus on yield and credit risk | Attracts ESG and sustainability-focused investors |

| Impact Measurement | Generally none | Requires disclosure of environmental impact metrics |

| Risk Profile | Based on issuer creditworthiness | Comparable, with potential ESG reputational benefits |

| Regulation & Standards | Regulated by standard bond laws | Aligned with Green Bond Principles, external verification common |

| Market Growth | Established, large global market | Fast-growing segment, increasing investor demand |

Overview of Fixed Income Assets

Fixed income assets primarily consist of traditional bonds, which offer predictable interest payments and principal repayment at maturity. Green bonds represent a growing segment within fixed income, specifically earmarked to finance environmentally sustainable projects while providing comparable risk and return profiles as traditional bonds. Investors increasingly favor green bonds for their dual benefits of steady income and positive environmental impact, enhancing portfolio diversification and sustainability goals.

Understanding Traditional Bonds

Traditional bonds are fixed income securities issued by governments or corporations to raise capital, characterized by predetermined interest payments and principal repayment at maturity. These bonds often finance general operations or specific projects without environmental considerations, reflecting broader market risk factors and credit ratings. Investors prioritize yield stability and creditworthiness, making traditional bonds a cornerstone for income-focused portfolios.

What Are Green Bonds?

Green bonds are fixed income securities specifically issued to fund projects with positive environmental benefits, such as renewable energy, clean transportation, and sustainable water management. Unlike traditional bonds, which finance a broad range of activities, green bonds are explicitly earmarked for environmentally friendly initiatives and often come with certification standards like the Climate Bonds Standard to ensure transparency and impact. Investors in green bonds seek both stable returns and the opportunity to contribute to environmental sustainability while supporting corporate social responsibility goals.

Key Similarities Between Traditional and Green Bonds

Traditional bonds and green bonds both serve as fixed income assets that provide regular interest payments and return principal at maturity, appealing to risk-averse investors seeking predictable cash flows. Both bond types typically feature similar credit ratings, maturities, and market structures, enabling comparable portfolio diversification and liquidity. Investors benefit from established regulatory frameworks and transparent issuance processes in both traditional and green bond markets, fostering confidence and standardized reporting.

Major Differences: Traditional Bonds vs Green Bonds

Traditional bonds fund general corporate or government activities without specific environmental criteria, focusing primarily on credit risk and return. Green bonds allocate proceeds exclusively to environmentally sustainable projects, offering investors a way to support climate-friendly initiatives while potentially benefiting from tax incentives. The key differences lie in the use-of-proceeds, impact reporting requirements, and investor appeal linked to sustainability goals.

Risk Factors in Traditional and Green Bonds

Traditional bonds carry credit risk, interest rate risk, and inflation risk due to reliance on issuer creditworthiness and market fluctuations. Green bonds, while also exposed to these risks, face additional challenges such as environmental project execution risk and regulatory uncertainties tied to green certification standards. Both fixed income assets demand thorough risk assessment, but green bonds offer potential risk mitigation through alignment with sustainable development goals.

Return Potential and Yield Comparison

Traditional bonds typically offer stable returns with yields reflecting prevailing interest rates and credit risk, making them a reliable fixed income choice. Green bonds, while often providing slightly lower yields due to their focus on environmentally sustainable projects, attract investors seeking long-term value aligned with ESG criteria. Yield comparisons reveal that green bonds can exhibit comparable return potential over time, benefiting from growing market demand and regulatory support for sustainable investments.

Impact Investing: The Role of Green Bonds

Green bonds play a crucial role in impact investing by directing fixed income capital towards environmentally sustainable projects, such as renewable energy and climate resilience infrastructure. Unlike traditional bonds, green bonds offer investors a measurable positive environmental impact alongside financial returns, aligning investment objectives with global sustainability goals. The growing issuance of green bonds reflects increasing market demand for responsible investment products that support the transition to a low-carbon economy.

Market Trends and Growth of Green Bonds

Green bonds have experienced rapid growth, with the global market surpassing $500 billion in issuance by 2023, driven by increasing investor demand for sustainable fixed income assets and regulatory support for environmental projects. Traditional bonds continue to dominate the fixed income landscape, but the expanding platform for green finance reflects a shift toward financing renewable energy, climate resilience, and carbon reduction initiatives. This trend aligns with corporate ESG commitments and government policies fostering transparency and impact measurement, positioning green bonds as a pivotal segment in fixed income markets.

Choosing Between Traditional and Green Bonds for Your Portfolio

Choosing between traditional bonds and green bonds involves evaluating both financial returns and environmental impact. Traditional bonds typically offer stable, predictable income with proven creditworthiness, while green bonds finance projects that address climate change and sustainability, potentially appealing to socially responsible investors. Incorporating green bonds into a fixed income portfolio can enhance diversification and align investment goals with environmental, social, and governance (ESG) criteria.

Related Important Terms

ESG-Linked Bonds

Traditional bonds offer predictable fixed income streams primarily focused on credit risk and interest rate factors, whereas green bonds integrate environmental, social, and governance (ESG) criteria, channeling capital specifically toward sustainable projects with measurable impact. ESG-linked bonds enhance portfolio diversification by aligning fixed income investments with climate goals, often featuring performance metrics tied to environmental targets that appeal to responsible investors and regulators.

Climate-Resilient Bonds

Climate-resilient bonds, a subset of green bonds, specifically fund projects that enhance infrastructure and communities to withstand climate change impacts, offering fixed income investors both environmental impact and financial stability. Traditional bonds do not prioritize climate risk mitigation, making climate-resilient green bonds increasingly attractive for sustainable portfolio diversification and long-term risk-adjusted returns.

Transition Bonds

Transition bonds serve as a crucial fixed income asset bridging traditional bonds and green bonds by funding companies shifting towards sustainable practices without full green certification; they offer investors exposure to environmentally responsible projects while managing risks related to ecological transition. These bonds support the decarbonization of high-impact sectors by facilitating capital flow for sustainability improvements, aligning financial returns with environmental impact goals in fixed income portfolios.

Blue Bonds

Blue bonds, a subset of green bonds, specifically finance marine and aquatic ecosystem conservation projects, providing fixed income investors with environmentally focused investment opportunities in ocean sustainability. Compared to traditional bonds, blue bonds offer targeted ecological benefits while maintaining competitive risk-adjusted returns aligned with fixed income asset strategies.

Sustainability-Linked Coupons

Traditional bonds offer fixed coupon payments without direct environmental incentives, whereas green bonds incorporate sustainability-linked coupons that adjust based on the issuer's achievement of specific environmental targets, enhancing investor alignment with ESG goals. This mechanism promotes corporate accountability in reducing carbon footprints and supports the transition to a low-carbon economy within fixed income portfolios.

Greenium

Green bonds often carry a "greenium," a premium reflected in lower yields compared to traditional bonds due to investor demand for sustainable assets. This greenium highlights the growing preference for environmentally focused fixed income instruments, driving increased liquidity and potentially lower financing costs for issuers.

Use-of-Proceeds Transparency

Traditional bonds typically allocate funds without stringent disclosure on environmental impact, while green bonds mandate detailed Use-of-Proceeds transparency, ensuring investments directly finance environmentally beneficial projects. This transparency enhances investor confidence by providing verifiable reporting on the allocation and impact of funds, aligning financial goals with sustainability criteria.

Sustainability Reporting Frameworks

Traditional bonds primarily rely on standard financial disclosures, while green bonds emphasize adherence to sustainability reporting frameworks such as the Green Bond Principles and the Sustainability Accounting Standards Board (SASB) to ensure environmental impact transparency. These frameworks guide issuers in detailing use of proceeds, project evaluation, and ongoing monitoring, enhancing investor confidence in the bond's alignment with environmental goals.

Dark Green Bonds

Dark Green Bonds, a subset of green bonds, finance projects with the highest environmental benefits such as renewable energy and conservation initiatives, offering investors targeted impact within fixed income portfolios. These bonds typically provide comparable yields to traditional bonds while aligning with ESG criteria, making them an attractive choice for sustainable asset allocation and risk-adjusted returns.

Social Impact Yield

Traditional bonds typically offer steady fixed income with predictable returns but minimal direct social impact, whereas green bonds channel capital into environmentally sustainable projects, generating measurable social impact yield alongside financial returns. Investors seeking to align fixed income portfolios with social and environmental objectives increasingly favor green bonds for their potential to deliver both yield and positive societal outcomes.

Traditional Bonds vs Green Bonds for fixed income assets. Infographic

moneydiff.com

moneydiff.com