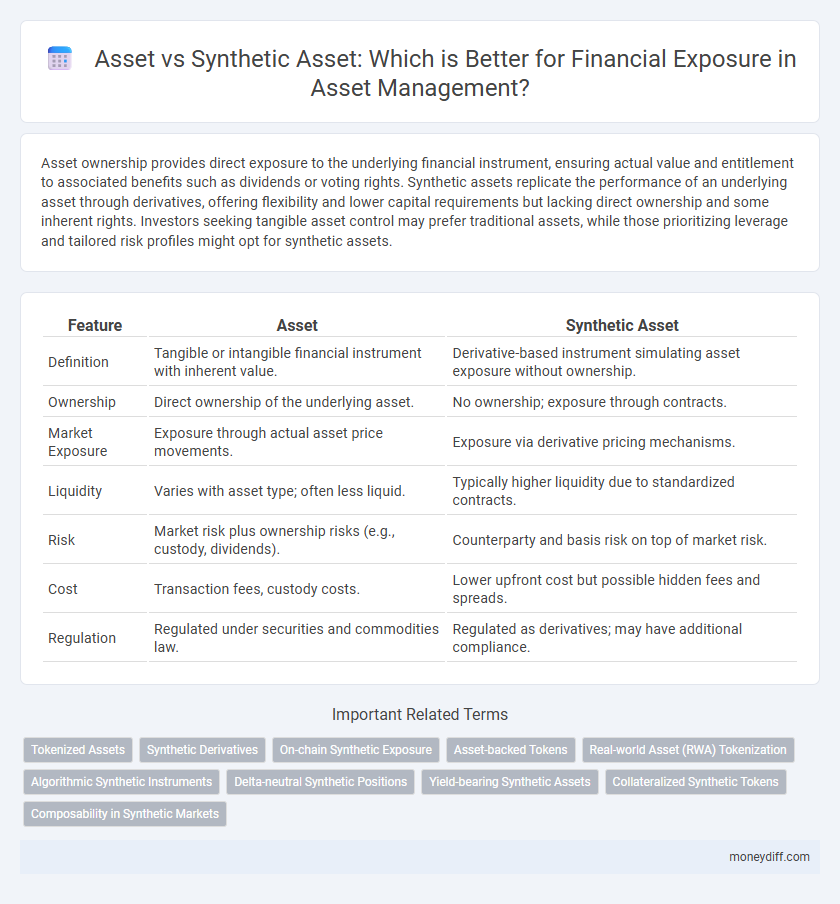

Asset ownership provides direct exposure to the underlying financial instrument, ensuring actual value and entitlement to associated benefits such as dividends or voting rights. Synthetic assets replicate the performance of an underlying asset through derivatives, offering flexibility and lower capital requirements but lacking direct ownership and some inherent rights. Investors seeking tangible asset control may prefer traditional assets, while those prioritizing leverage and tailored risk profiles might opt for synthetic assets.

Table of Comparison

| Feature | Asset | Synthetic Asset |

|---|---|---|

| Definition | Tangible or intangible financial instrument with inherent value. | Derivative-based instrument simulating asset exposure without ownership. |

| Ownership | Direct ownership of the underlying asset. | No ownership; exposure through contracts. |

| Market Exposure | Exposure through actual asset price movements. | Exposure via derivative pricing mechanisms. |

| Liquidity | Varies with asset type; often less liquid. | Typically higher liquidity due to standardized contracts. |

| Risk | Market risk plus ownership risks (e.g., custody, dividends). | Counterparty and basis risk on top of market risk. |

| Cost | Transaction fees, custody costs. | Lower upfront cost but possible hidden fees and spreads. |

| Regulation | Regulated under securities and commodities law. | Regulated as derivatives; may have additional compliance. |

Understanding Assets: Definition and Types

Assets represent tangible or intangible resources owned by an individual or entity that hold economic value and can generate future benefits. Traditional assets include physical items like real estate, stocks, and bonds, while synthetic assets are financial instruments created through derivatives to replicate the value of underlying assets without actual ownership. Understanding the distinction between these types helps in managing financial exposure and risk by aligning investment strategies with asset characteristics and market conditions.

What Are Synthetic Assets?

Synthetic assets replicate the financial exposure of traditional assets without ownership of the underlying asset itself, often created using derivatives such as options, futures, or swaps. These instruments allow investors to gain targeted market exposure, hedge risks, or achieve specific payoff profiles while avoiding direct asset management complexities and custody issues. Synthetic assets enhance market flexibility by enabling customized investment strategies and improved capital efficiency.

Key Differences: Assets vs Synthetic Assets

Assets represent actual ownership of physical or financial instruments such as stocks, bonds, or real estate, providing direct exposure to underlying market values. Synthetic assets replicate the economic benefits and risks of real assets through derivatives like options, futures, or swaps without requiring ownership of the underlying asset. Key differences include ownership rights, regulatory treatment, and liquidity profiles, with synthetic assets offering greater flexibility and often lower capital requirements compared to traditional assets.

Risk Factors in Asset and Synthetic Asset Exposure

Traditional asset exposure involves direct ownership, which carries risks such as market volatility, liquidity constraints, and counterparty default. Synthetic asset exposure, created through derivatives like swaps and options, introduces complexities including model risk, tracking errors, and increased counterparty credit risk. Both asset types require careful risk management to mitigate potential losses arising from market fluctuations and structural vulnerabilities.

Benefits of Investing in Traditional Assets

Investing in traditional assets such as stocks, bonds, and real estate provides tangible ownership and regulatory protections that synthetic assets lack, offering greater security and legal recourse. These assets often deliver dividends, interest, or rental income, contributing to steady cash flow and long-term wealth accumulation. Traditional assets also benefit from established market infrastructure and transparency, enhancing liquidity and price discovery for investors.

Advantages of Using Synthetic Assets for Financial Exposure

Synthetic assets offer enhanced flexibility by enabling investors to gain exposure to a wide range of underlying assets without owning the physical asset, reducing transaction costs and increasing liquidity. They allow for tailored risk management and leverage opportunities, providing precise financial strategies that traditional assets might not offer. This innovation improves market access and facilitates diversification, boosting portfolio efficiency and risk-adjusted returns.

Potential Drawbacks of Assets and Synthetic Assets

Physical assets present risks such as liquidity constraints and maintenance costs, potentially reducing their investment efficiency. Synthetic assets may introduce counterparty risk and complex valuation challenges due to their reliance on derivatives and contractual agreements. Both asset classes face market volatility, but synthetic assets often carry higher exposure to systemic risks stemming from their layered financial structures.

Cost Considerations: Assets Versus Synthetic Assets

Traditional assets typically incur costs such as purchase price, storage, maintenance, and transaction fees, which can significantly impact overall investment expenses. Synthetic assets, created through derivatives like options or swaps, often reduce upfront capital requirements and enable flexible exposure with potentially lower ongoing costs. However, synthetic assets may involve counterparty risk and complex management strategies that can influence long-term cost efficiency compared to physical asset ownership.

Regulatory and Compliance Aspects

Regulatory frameworks distinguish between traditional assets and synthetic assets by imposing stricter compliance requirements on synthetic derivatives due to their complexity and counterparty risks. Synthetic assets often require enhanced transparency and reporting standards to ensure market stability and protect investors from potential liquidity issues. Compliance mandates may include rigorous risk assessment protocols and alignment with securities regulations to prevent market manipulation and systemic risks.

Choosing the Right Approach for Financial Exposure

Choosing between a traditional asset and a synthetic asset for financial exposure depends on risk tolerance, liquidity needs, and cost considerations. Synthetic assets, created through derivatives and contracts, offer customizable exposure and potential capital efficiency but carry counterparty risk and complexity. Traditional assets provide direct ownership and transparency, appealing to investors valuing simplicity and security in their portfolios.

Related Important Terms

Tokenized Assets

Tokenized assets represent real-world financial instruments on a blockchain, offering direct ownership and regulatory compliance, whereas synthetic assets replicate underlying asset performance through derivatives without actual ownership. Tokenized assets provide transparent, divisible, and secure exposure with reduced counterparty risk compared to synthetic assets in decentralized finance ecosystems.

Synthetic Derivatives

Synthetic derivatives replicate the financial exposure of assets without requiring direct ownership, allowing investors to gain targeted market exposure with enhanced flexibility and lower capital requirements. These instruments, such as options and swaps, effectively manage risk and optimize portfolio strategies by mirroring underlying asset performance through contractual agreements.

On-chain Synthetic Exposure

On-chain synthetic exposure enables investors to gain financial exposure to underlying assets without owning them directly, using decentralized protocols that mint synthetic assets pegged to real-world values. This approach offers increased liquidity, fractional ownership, and 24/7 accessibility while mitigating counterparty risks associated with traditional financial assets.

Asset-backed Tokens

Asset-backed tokens represent ownership in tangible financial assets, providing direct exposure to real-world value such as real estate or commodities, unlike synthetic assets which derive value from derivatives or contracts without underlying physical backing. These tokens enhance transparency, liquidity, and reduce counterparty risk by leveraging blockchain technology to tokenize tangible assets.

Real-world Asset (RWA) Tokenization

Real-world asset (RWA) tokenization transforms physical assets like real estate, commodities, and equities into blockchain-based digital tokens, enabling fractional ownership, increased liquidity, and enhanced transparency compared to synthetic assets that derive value from derivatives or contracts. Tokenized RWAs provide direct exposure to tangible assets without the counterparty risks and complexities often associated with synthetic asset structures.

Algorithmic Synthetic Instruments

Algorithmic Synthetic Instruments replicate financial assets using algorithms to provide exposure without owning the underlying asset, enhancing liquidity and reducing counterparty risk. These synthetic assets enable precise market tracking and customizable exposure, offering efficient alternatives to traditional asset ownership in diverse trading strategies.

Delta-neutral Synthetic Positions

Delta-neutral synthetic positions replicate the payoff of traditional assets by combining options and derivatives to maintain zero net delta exposure, enabling investors to hedge or speculate without owning the underlying asset. This approach allows for flexible financial exposure while minimizing directional risk inherent in direct asset ownership.

Yield-bearing Synthetic Assets

Yield-bearing synthetic assets provide exposure to financial instruments without direct ownership, enabling investors to access returns through derivative-based products like options, futures, or tokenized contracts. These synthetic assets often offer enhanced liquidity, customizable risk profiles, and efficient capital allocation compared to traditional yield-bearing assets such as bonds or dividend-paying stocks.

Collateralized Synthetic Tokens

Collateralized synthetic tokens represent financial exposure by replicating underlying asset value through smart contracts and collateral pools, enabling efficient market access without direct ownership. These tokens mitigate counterparty risk by over-collateralization while providing liquidity and flexibility compared to traditional physical assets.

Composability in Synthetic Markets

Synthetic assets enable greater composability in financial markets by allowing diverse financial exposures to be created, combined, and integrated seamlessly through smart contracts, unlike traditional assets that require direct ownership and are limited by physical constraints. This programmability fosters innovation and interoperability, making synthetic assets a powerful tool for constructing complex, customizable financial products within decentralized ecosystems.

Asset vs Synthetic Asset for financial exposure. Infographic

moneydiff.com

moneydiff.com