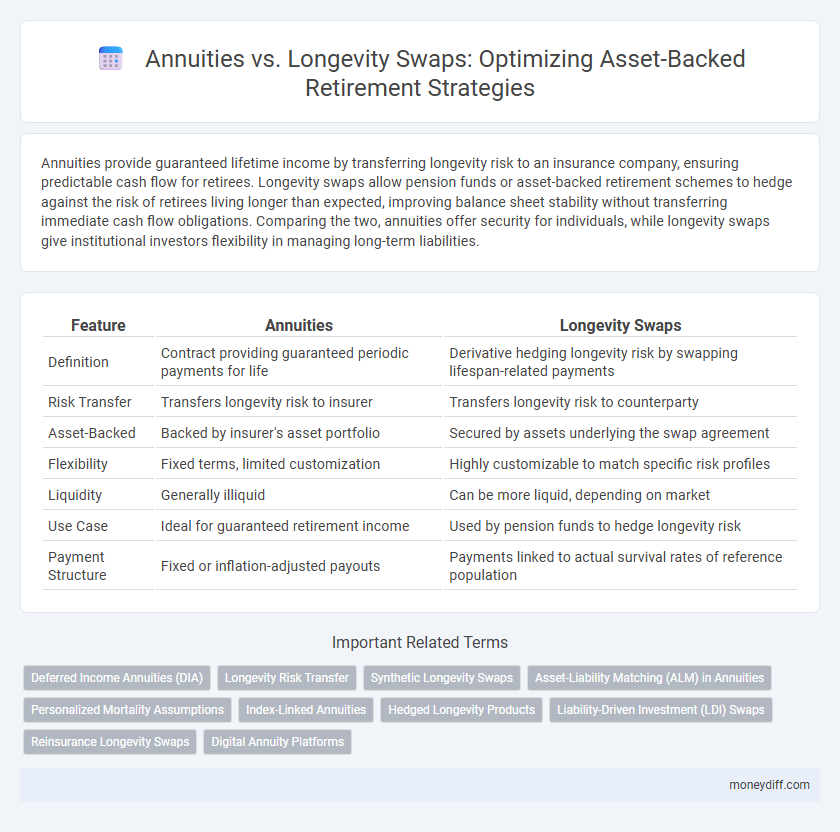

Annuities provide guaranteed lifetime income by transferring longevity risk to an insurance company, ensuring predictable cash flow for retirees. Longevity swaps allow pension funds or asset-backed retirement schemes to hedge against the risk of retirees living longer than expected, improving balance sheet stability without transferring immediate cash flow obligations. Comparing the two, annuities offer security for individuals, while longevity swaps give institutional investors flexibility in managing long-term liabilities.

Table of Comparison

| Feature | Annuities | Longevity Swaps |

|---|---|---|

| Definition | Contract providing guaranteed periodic payments for life | Derivative hedging longevity risk by swapping lifespan-related payments |

| Risk Transfer | Transfers longevity risk to insurer | Transfers longevity risk to counterparty |

| Asset-Backed | Backed by insurer's asset portfolio | Secured by assets underlying the swap agreement |

| Flexibility | Fixed terms, limited customization | Highly customizable to match specific risk profiles |

| Liquidity | Generally illiquid | Can be more liquid, depending on market |

| Use Case | Ideal for guaranteed retirement income | Used by pension funds to hedge longevity risk |

| Payment Structure | Fixed or inflation-adjusted payouts | Payments linked to actual survival rates of reference population |

Understanding Annuities: Foundations of Retirement Income

Annuities provide a guaranteed income stream by pooling assets and distributing payments based on life expectancy, offering a reliable foundation for retirement income. They transfer longevity risk to the insurer, ensuring individuals do not outlive their savings, which is crucial for asset-backed retirement strategies. Understanding the structure and benefits of annuities helps retirees optimize their financial security compared to alternatives like longevity swaps.

What Are Longevity Swaps? A Primer for Retirees

Longevity swaps are financial derivatives that transfer longevity risk from pension funds or retirees to counterparties, allowing stable income streams regardless of lifespan variability. These swaps involve exchanging fixed payments for variable payments based on actual survival rates, effectively hedging against the risk of outliving assets. By incorporating longevity swaps into asset-backed retirement strategies, retirees can achieve more predictable income without depending solely on annuity products.

Key Differences Between Annuities and Longevity Swaps

Annuities provide a guaranteed income stream backed by insurance companies, transferring longevity risk from individuals to the insurer, while longevity swaps are derivative contracts between financial institutions that hedge against the risk of retirees living longer than expected without transferring individual longevity risk. Annuities typically offer fixed or variable payouts based on actuarial assumptions, whereas longevity swaps enable pension funds or insurers to manage portfolio-level longevity exposure through customized risk-sharing agreements. The key difference lies in annuities delivering direct retirement income to individuals versus longevity swaps serving as financial instruments for institutional risk management in asset-backed retirement solutions.

Risk Management: How Each Strategy Protects Retirement Assets

Annuities provide guaranteed lifetime income by transferring longevity risk to insurers, ensuring stable cash flows regardless of market fluctuations. Longevity swaps allow pension funds to hedge longevity risk by exchanging uncertain future payouts for fixed payments, thereby protecting assets from the financial impact of retirees living longer than expected. Both strategies mitigate longevity risk but differ in liquidity and counterparty exposure, with annuities offering simplicity and swaps providing customization for asset-backed retirement portfolios.

Asset-Backed Security: Ensuring a Sustainable Payout

Asset-backed securities (ABS) in retirement planning pool underlying assets to generate predictable cash flows, enhancing payout sustainability compared to traditional annuities and longevity swaps. Unlike annuities that depend on insurer solvency or longevity swaps subject to counterparty risk, ABS diversifies asset risk by securitizing diversified asset portfolios, providing stable income streams linked directly to asset performance. This structure offers retirees more transparency and control over payout durability, aligning cash flows with asset returns for long-term retirement security.

Flexibility and Control: Comparing Product Features

Annuities offer guaranteed lifetime income with limited flexibility, locking assets into predefined payout schedules. Longevity swaps provide enhanced control by allowing customization of cash flows and risk transfer tailored to specific asset-backed retirement needs. Investors seeking adaptable solutions favor longevity swaps for managing longevity risk while maintaining portfolio liquidity and dynamic asset allocation.

Cost Structures: Fees, Expenses, and Transparency

Annuities typically involve upfront fees, management expenses, and embedded insurance costs that can reduce net returns, with varying transparency depending on the provider. Longevity swaps generally feature fee structures based on negotiated spreads over reference rates, often offering more transparent cost allocation without embedded insurance layers. Understanding these cost structures is essential for optimizing asset-backed retirement income strategies while maintaining clear visibility on fee impact.

Suitability: Which Retirement Profiles Benefit Most?

Annuities suit retirees seeking guaranteed lifetime income with low tolerance for investment risk, particularly those with moderate assets needing predictable cash flow. Longevity swaps benefit institutional investors or high-net-worth individuals aiming to hedge longevity risk while maintaining investment flexibility and potentially higher returns. Retirement profiles with complex asset pools and desires for bespoke risk management strategies find longevity swaps more suitable than traditional annuities.

Regulatory Considerations for Asset-Backed Retirement Products

Regulatory considerations for asset-backed retirement products differ significantly between annuities and longevity swaps, with annuities subject to stricter insurance regulations and reserve requirements under frameworks like Solvency II and the NAIC model laws. Longevity swaps, classified as derivative instruments, fall under financial market regulations such as EMIR in the EU and Dodd-Frank in the US, requiring robust risk management and counterparty credit risk disclosure. Compliance with capital adequacy, reporting standards, and consumer protection laws remains paramount to ensure the stability and transparency of asset-backed retirement solutions.

Making the Right Choice: Strategy Alignment with Retirement Goals

Selecting between annuities and longevity swaps hinges on aligning one's retirement strategy with long-term income security and risk tolerance. Annuities offer guaranteed lifetime income, reducing longevity risk, while longevity swaps provide customizable risk management by transferring longevity risk to counterparty investors. Evaluating asset-backed retirement portfolios requires balancing guaranteed cash flow stability with flexibility to match individual retirement goals.

Related Important Terms

Deferred Income Annuities (DIA)

Deferred Income Annuities (DIA) provide guaranteed future retirement income by converting assets into a steady cash flow starting at a later date, effectively managing longevity risk without market volatility. Compared to longevity swaps, DIAs transfer longevity and investment risks to the insurer, ensuring predictable payouts backed by the insurer's credit strength rather than requiring ongoing counterparty risk management.

Longevity Risk Transfer

Longevity swaps effectively transfer longevity risk by exchanging uncertain pension liabilities for fixed payments, providing asset-backed retirement solutions that hedge against participants living longer than expected. These instruments complement traditional annuities by allowing institutions to manage long-term liabilities without fully assuming longevity exposure, enhancing financial stability and capital efficiency.

Synthetic Longevity Swaps

Synthetic longevity swaps offer customizable risk transfer solutions by exchanging longevity risk without actual annuity buy-ins, enhancing asset-backed retirement strategies through increased flexibility and capital efficiency. Unlike traditional annuities, synthetic swaps enable pension funds and insurers to hedge longevity risk synthetically using derivative contracts aligned with their specific longevity exposures.

Asset-Liability Matching (ALM) in Annuities

Annuities provide precise Asset-Liability Matching (ALM) by transferring longevity risk to insurers, ensuring predictable cash flows aligned with retirees' lifespan through carefully structured asset portfolios. In contrast, longevity swaps offer customizable risk transfer without full insurance guarantees, requiring sophisticated ALM strategies to manage mismatch risks and market exposures in asset-backed retirement solutions.

Personalized Mortality Assumptions

Personalized mortality assumptions enhance the accuracy of asset-backed retirement solutions by tailoring annuity pricing and longevity swap terms to individual risk profiles, reducing mismatches between projected and actual lifespans. This approach optimizes asset allocation strategies and improves the sustainability of retirement income streams while mitigating longevity risk for both insurers and retirees.

Index-Linked Annuities

Index-linked annuities offer a guaranteed income that adjusts with inflation, providing retirees with protection against purchasing power erosion in asset-backed retirement portfolios. Compared to longevity swaps, index-linked annuities transfer longevity and inflation risks to the insurer, enhancing predictability and stability of retirement income streams.

Hedged Longevity Products

Hedged longevity products such as longevity swaps offer customizable risk transfer solutions compared to traditional annuities, enabling pension funds and insurers to mitigate longevity risk by exchanging uncertain future liabilities for fixed cash flows tied to mortality indices. These asset-backed instruments provide enhanced capital efficiency and flexibility, aligning asset-liability management with evolving demographic trends and improving the sustainability of retirement funding.

Liability-Driven Investment (LDI) Swaps

Liability-Driven Investment (LDI) swaps, such as longevity swaps, offer a dynamic hedge against life expectancy risks by transferring mortality liabilities from pension funds to counterparties, providing flexibility compared to traditional annuities. Unlike annuities, LDI longevity swaps enable asset-backed retirement strategies to manage longevity risk on a mark-to-market basis, optimizing capital efficiency and aligning asset liabilities with pension obligations more precisely.

Reinsurance Longevity Swaps

Reinsurance longevity swaps provide asset-backed retirement portfolios with effective risk transfer by exchanging uncertain longevity liabilities for fixed cash flows, enhancing predictability and capital efficiency compared to traditional annuities. These swaps allow pension funds and insurers to hedge longevity risk while maintaining asset liquidity and optimizing balance sheet stability.

Digital Annuity Platforms

Digital Annuity Platforms leverage blockchain technology to streamline annuity issuance, enhancing transparency and reducing operational costs compared to traditional longevity swaps. These platforms enable secure, automated asset-backed retirement solutions by digitizing contract management and facilitating faster, more efficient payout processes.

Annuities vs Longevity Swaps for asset-backed retirement Infographic

moneydiff.com

moneydiff.com