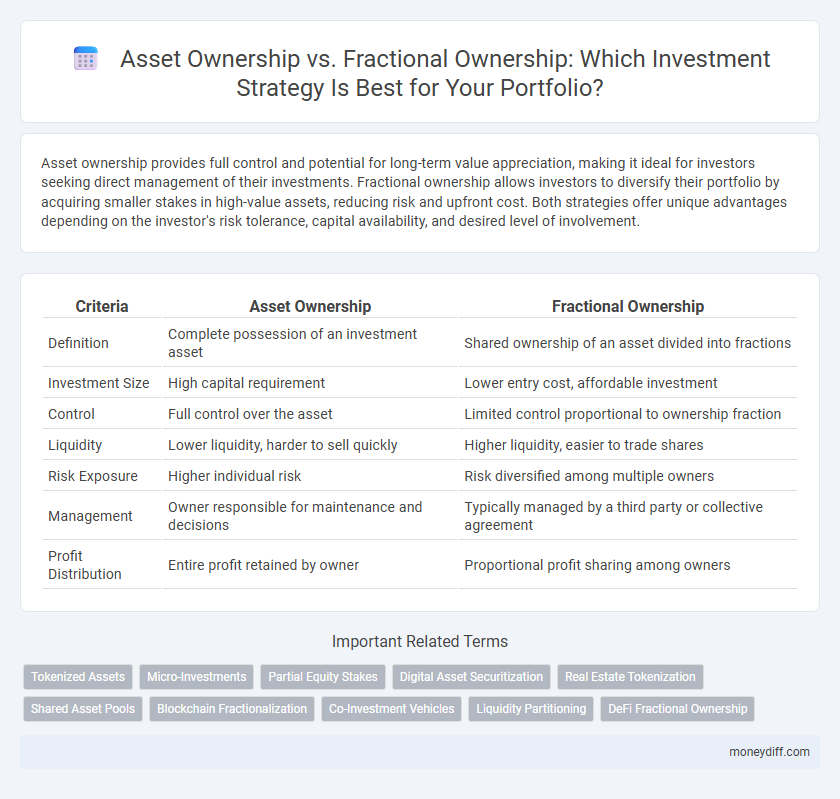

Asset ownership provides full control and potential for long-term value appreciation, making it ideal for investors seeking direct management of their investments. Fractional ownership allows investors to diversify their portfolio by acquiring smaller stakes in high-value assets, reducing risk and upfront cost. Both strategies offer unique advantages depending on the investor's risk tolerance, capital availability, and desired level of involvement.

Table of Comparison

| Criteria | Asset Ownership | Fractional Ownership |

|---|---|---|

| Definition | Complete possession of an investment asset | Shared ownership of an asset divided into fractions |

| Investment Size | High capital requirement | Lower entry cost, affordable investment |

| Control | Full control over the asset | Limited control proportional to ownership fraction |

| Liquidity | Lower liquidity, harder to sell quickly | Higher liquidity, easier to trade shares |

| Risk Exposure | Higher individual risk | Risk diversified among multiple owners |

| Management | Owner responsible for maintenance and decisions | Typically managed by a third party or collective agreement |

| Profit Distribution | Entire profit retained by owner | Proportional profit sharing among owners |

Understanding Traditional Asset Ownership

Traditional asset ownership involves holding full legal title and control over tangible or intangible assets such as real estate, stocks, or bonds, providing investors with direct rights and responsibilities. This approach allows for complete decision-making authority, including the ability to sell, lease, or leverage the asset without external interference. Investors benefit from full capital appreciation and income generation, but also bear the entire risk and management burden associated with the asset.

What Is Fractional Ownership?

Fractional ownership allows multiple investors to share equity in a high-value asset, such as real estate or aircraft, significantly lowering the cost barrier to entry. This investment strategy enables diversification within an asset class by allocating smaller capital portions to each investor, enhancing liquidity compared to sole ownership. Asset management in fractional ownership demands clear agreements on usage rights, maintenance responsibilities, and resale protocols to protect each party's interests.

Key Differences Between Asset and Fractional Ownership

Asset ownership grants investors full control and responsibility over a single investment vehicle, including all associated risks and benefits. Fractional ownership divides this control among multiple investors, enabling diversified exposure with lower capital requirements but shared decision-making. Key differences include asset liquidity, management burden, and potential for personalized investment strategies.

Pros and Cons of Traditional Asset Ownership

Traditional asset ownership offers full control and direct management of investments, enabling decision-making without external interference. However, it requires significant capital investment and entails higher risks related to liquidity and asset maintenance. Investors face potential challenges in diversification and may experience slower portfolio growth compared to fractional ownership models.

Advantages and Disadvantages of Fractional Ownership

Fractional ownership allows investors to buy a portion of high-value assets like real estate or luxury goods, reducing entry costs and diversifying portfolios without full asset acquisition. Advantages include lower capital requirements, increased liquidity, and shared maintenance expenses, while disadvantages encompass limited control, potential conflicts among co-owners, and complexities in resale or transfer. This investment strategy suits those seeking exposure to expensive assets with mitigated financial risk but requires careful consideration of legal agreements and management structures.

Risk Assessment: Asset vs Fractional Ownership

Asset ownership involves direct control and full responsibility, which can lead to higher risks such as liquidity constraints, maintenance costs, and market volatility impact. Fractional ownership diversifies risk by distributing the investment among multiple parties, reducing individual exposure and enhancing liquidity through shared management. Evaluating risk requires analyzing asset type, market conditions, and ownership model to determine optimal investment security and potential returns.

Profit Potential: Comparative Returns

Asset ownership typically offers direct control and full profit potential from appreciation, rental income, or resale gains, maximizing returns for investors with sufficient capital. Fractional ownership allows investors to access high-value assets with lower upfront costs, though profits are proportionally divided among stakeholders, potentially limiting individual returns. Comparing returns, full asset ownership often yields higher absolute profits, while fractional ownership provides diversified exposure and liquidity advantages.

Liquidity Factors in Investment Strategies

Asset ownership offers direct control and typically higher liquidity, allowing investors to buy or sell the entire asset quickly in response to market changes. Fractional ownership divides an asset into smaller shares, which may limit liquidity due to the dependency on secondary markets or specific platforms for trading. Investors seeking agile portfolio adjustments often favor assets with higher liquidity, while fractional ownership suits those prioritizing lower entry costs despite potential liquidity constraints.

Diversification Opportunities Explained

Asset ownership provides direct control and full value capture, allowing investors to manage and optimize individual holdings for maximum return. Fractional ownership offers access to diversified portfolios by pooling resources across multiple assets, reducing risk and enhancing exposure to varied markets. This strategy balances risk and reward, enabling investors to leverage the benefits of broad asset class diversification without the need for large capital outlays.

Choosing the Right Ownership Model for Your Investment Goals

Selecting between asset ownership and fractional ownership depends on investment goals, risk tolerance, and capital availability. Asset ownership offers full control and potential tax benefits, ideal for long-term investors seeking direct management and appreciation. Fractional ownership provides diversified exposure with lower entry costs and reduced responsibilities, suitable for investors prioritizing liquidity and risk mitigation.

Related Important Terms

Tokenized Assets

Tokenized assets provide a seamless bridge between traditional asset ownership and fractional investment, enabling investors to buy, sell, and trade small portions of high-value assets such as real estate, art, or equity with enhanced liquidity and transparency. This contrasts with traditional fractional ownership, which often involves complex legal structures and limited transferability, making tokenization a more efficient and accessible strategy in modern investment portfolios.

Micro-Investments

Micro-investments allow investors to acquire fractional ownership of high-value assets, enabling diversified portfolios with lower capital requirements. This strategy enhances liquidity and accessibility compared to traditional full-asset ownership, optimizing potential returns while mitigating individual investment risk.

Partial Equity Stakes

Partial equity stakes in asset investment strategies offer targeted exposure to high-value assets without full ownership risks, enhancing portfolio diversification and liquidity. Fractional ownership distributes financial responsibilities and returns among multiple investors, optimizing capital allocation while maintaining access to asset appreciation.

Digital Asset Securitization

Digital asset securitization enables investors to acquire fractional ownership in high-value assets through tokenization, enhancing liquidity and accessibility compared to traditional whole-asset investments. By leveraging blockchain technology, fractional ownership structures reduce barriers to entry, increase portfolio diversification, and streamline asset management processes in a transparent and secure environment.

Real Estate Tokenization

Asset ownership in real estate offers full control and direct equity, while fractional ownership via real estate tokenization allows investors to diversify portfolios with smaller capital outlays by purchasing digital shares of a property. Real estate tokenization enhances liquidity and transparency by leveraging blockchain technology, making it easier to buy, sell, and manage fractional interests in otherwise illiquid assets.

Shared Asset Pools

Shared asset pools offer investors diversified exposure by combining fractional ownership stakes across various asset classes, enhancing liquidity and reducing individual risk. Unlike full asset ownership, fractional investment in shared pools enables access to high-value assets with lower capital outlay and streamlined management through collective governance structures.

Blockchain Fractionalization

Blockchain fractionalization enables investors to own precise portions of high-value assets, enhancing liquidity and diversification compared to traditional full asset ownership. This innovative approach reduces entry barriers, allowing broader market participation and streamlined asset management through secure, transparent digital ledgers.

Co-Investment Vehicles

Co-investment vehicles enable investors to directly invest alongside lead sponsors in high-value assets, enhancing portfolio diversification and reducing fees compared to fractional ownership models. This strategy offers greater transparency, control, and alignment of interests in asset management, making it a preferred choice for sophisticated investors seeking tailored exposure.

Liquidity Partitioning

Liquidity partitioning in asset ownership enables investors to circumvent the immobility of traditional assets by dividing ownership into fractional shares, which can be traded independently to increase market liquidity. Fractional ownership enhances portfolio flexibility and risk management by allowing proportional investment and quicker liquidation compared to whole asset holdings.

DeFi Fractional Ownership

DeFi fractional ownership enables investors to acquire partial shares of high-value digital assets, enhancing liquidity and lowering entry barriers compared to traditional asset investments. This strategy leverages blockchain technology to provide transparent, secure, and decentralized management of ownership rights, optimizing portfolio diversification and reducing risk exposure.

Asset vs Fractional Ownership for investment strategy. Infographic

moneydiff.com

moneydiff.com