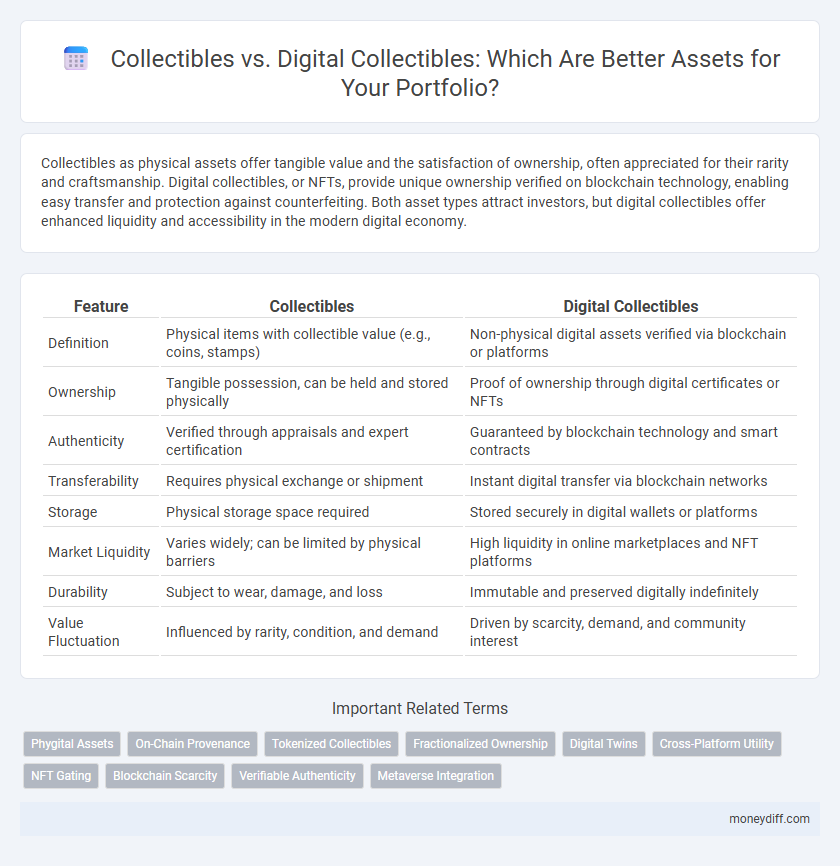

Collectibles as physical assets offer tangible value and the satisfaction of ownership, often appreciated for their rarity and craftsmanship. Digital collectibles, or NFTs, provide unique ownership verified on blockchain technology, enabling easy transfer and protection against counterfeiting. Both asset types attract investors, but digital collectibles offer enhanced liquidity and accessibility in the modern digital economy.

Table of Comparison

| Feature | Collectibles | Digital Collectibles |

|---|---|---|

| Definition | Physical items with collectible value (e.g., coins, stamps) | Non-physical digital assets verified via blockchain or platforms |

| Ownership | Tangible possession, can be held and stored physically | Proof of ownership through digital certificates or NFTs |

| Authenticity | Verified through appraisals and expert certification | Guaranteed by blockchain technology and smart contracts |

| Transferability | Requires physical exchange or shipment | Instant digital transfer via blockchain networks |

| Storage | Physical storage space required | Stored securely in digital wallets or platforms |

| Market Liquidity | Varies widely; can be limited by physical barriers | High liquidity in online marketplaces and NFT platforms |

| Durability | Subject to wear, damage, and loss | Immutable and preserved digitally indefinitely |

| Value Fluctuation | Influenced by rarity, condition, and demand | Driven by scarcity, demand, and community interest |

Understanding Collectibles as Tangible Assets

Collectibles as tangible assets hold intrinsic value due to their physicality, rarity, and historical significance, often appreciating over time through scarcity and condition. Unlike digital collectibles, physical assets like coins, stamps, and artwork require secure storage and maintenance to preserve their value. The tangibility of these collectibles provides a sense of ownership and authenticity that digital assets may lack, making them appealing for traditional investors seeking physical asset diversification.

What Are Digital Collectibles?

Digital collectibles are unique, blockchain-based assets that represent ownership of a specific digital item, such as art, music, or virtual goods. Unlike traditional physical collectibles, digital collectibles leverage non-fungible tokens (NFTs) to ensure authenticity, provenance, and scarcity in a secure digital environment. These assets provide new opportunities for ownership, trading, and monetization within digital ecosystems and marketplaces.

Historical Value: Collectibles vs Digital Collectibles

Traditional collectibles such as rare coins, vintage stamps, and antique toys possess tangible historical value rooted in their physical origins and provenance. Digital collectibles, often secured via blockchain technology as NFTs, derive their historical significance from recorded ownership and uniqueness rather than material age or condition. The valuation of physical collectibles heavily depends on their preservation and historical context, whereas digital collectibles gain value through digital scarcity and community recognition.

Liquidity and Market Accessibility

Physical collectibles often face limited liquidity due to geographic constraints and niche markets, making quick sales challenging. Digital collectibles leverage blockchain technology to enable instant transfers and access to a global marketplace, significantly enhancing liquidity. Market accessibility for digital assets is broad, allowing participation from diverse buyers and sellers without traditional barriers.

Storage, Security, and Maintenance Considerations

Collectibles require physical storage space, making protection from environmental damage and theft critical, whereas digital collectibles, stored on blockchain or secure servers, offer enhanced security with cryptographic verification but depend on digital infrastructure integrity. Physical assets demand regular maintenance and climate control to preserve value, while digital assets need ongoing software updates, cybersecurity measures, and backups to prevent data loss. Considering these factors, digital collectibles provide scalable security solutions, but physical collectibles hold tangible value requiring meticulous care and secure storage environments.

Transparency and Authenticity Verification

Physical collectibles offer tangible proof of ownership through serial numbers, certificates, or expert appraisals, but verifying authenticity often requires specialized knowledge and can be time-consuming. Digital collectibles leverage blockchain technology to provide transparent, immutable records of provenance, ownership history, and transaction details, significantly enhancing trust and reducing fraud risk. The decentralized nature of blockchain ensures authenticity verification is accessible and verifiable by anyone, making digital collectibles a more reliable asset class for transparency-conscious investors.

Market Volatility and Price Fluctuation

Collectibles often experience moderate market volatility due to their physical scarcity and long-established demand patterns, while digital collectibles face higher price fluctuations driven by rapid shifts in online trends and blockchain market dynamics. Traditional collectibles benefit from tangible attributes that provide intrinsic value stability, whereas digital collectibles' worth depends heavily on platform popularity and technological changes. Investors should consider the susceptibility of digital assets to speculative bubbles and regulatory developments, which can cause sharp and unpredictable price variations.

Legal and Regulatory Landscape

Collectibles as physical assets are subject to tangible property laws, with established regulations addressing ownership, transfer, and taxation. Digital collectibles, often represented as NFTs, face evolving legal frameworks related to intellectual property rights, digital ownership verification, and securities regulations. Regulatory agencies worldwide are increasingly scrutinizing digital collectibles to address issues of fraud, market manipulation, and consumer protection.

Portfolio Diversification Strategies

Physical collectibles such as rare coins, vintage toys, and art offer tangible asset value and historical significance, enriching portfolio diversification through physical ownership and scarcity. Digital collectibles, including NFTs and blockchain-based assets, provide liquidity, ease of transfer, and exposure to emerging decentralized markets, complementing traditional collectibles by adding digital innovation to asset allocation. Combining both asset classes enhances portfolio resilience by balancing physical rarity with digital accessibility, optimizing diversification strategies in modern investment portfolios.

Future Trends: Collectibles and Digital Collectibles as Assets

The future of assets lies in the convergence of traditional collectibles and digital collectibles, with blockchain technology enhancing provenance and liquidity for both. Digital collectibles, such as NFTs, are transforming ownership models by enabling fractionalized investments and global trading, surpassing physical limitations. The integration of augmented reality and metaverse platforms will further increase the value and utility of digital collectibles, positioning them as key assets in evolving investment portfolios.

Related Important Terms

Phygital Assets

Phygital assets combine physical collectibles with digital counterparts, enhancing value through blockchain authentication and augmented reality experiences. This hybrid model bridges traditional asset ownership with digital innovation, offering collectors increased liquidity and verifiable provenance.

On-Chain Provenance

On-chain provenance provides immutable verification for digital collectibles, ensuring transparent ownership history and authenticity through blockchain technology. Traditional collectibles lack this decentralized audit trail, making asset validation more prone to fraud and less accessible for global verification.

Tokenized Collectibles

Tokenized collectibles represent a revolutionary asset class by digitizing ownership through blockchain technology, enabling enhanced provenance, liquidity, and global accessibility compared to traditional physical collectibles. These digital assets leverage smart contracts to ensure transparency and secure transfer of ownership, making them popular among investors seeking verifiable and easily tradable collectibles.

Fractionalized Ownership

Fractionalized ownership enables investors to hold partial shares of high-value physical collectibles such as rare art, vintage cars, or memorabilia, enhancing liquidity and access. Digital collectibles, often minted as NFTs on blockchain platforms, inherently support fractional ownership by allowing seamless division and transparent tracking of asset shares.

Digital Twins

Digital twins represent a cutting-edge evolution of traditional collectibles by creating precise virtual replicas of physical assets, enhancing authenticity, provenance, and interactive experiences in the digital realm. These digital collectibles leverage blockchain technology to ensure verifiable ownership and immutability, transforming asset management and investment strategies within the collectibles market.

Cross-Platform Utility

Collectibles offer tangible value but are limited by physical ownership and real-world accessibility, whereas digital collectibles leverage blockchain technology to provide cross-platform utility, enabling seamless transfer and interaction across multiple virtual environments. The interoperability of digital collectibles enhances asset liquidity and user engagement by supporting diverse ecosystems without geographical constraints.

NFT Gating

Digital collectibles leverage NFT gating to provide exclusive access to content or events by verifying ownership on blockchain platforms, enhancing asset security and rarity. Traditional collectibles lack this capability, limiting authentication and engagement opportunities compared to the dynamic, programmable features embedded in NFT-based assets.

Blockchain Scarcity

Collectibles have traditionally held value through physical scarcity and rarity, while digital collectibles leverage blockchain technology to ensure provable scarcity and ownership via immutable ledger records. Blockchain scarcity enhances asset security by preventing duplication and enabling transparent verification of digital collectible authenticity and provenance.

Verifiable Authenticity

Collectibles offer physical proof of authenticity through certificates and expert verification, while digital collectibles leverage blockchain technology to provide immutable, verifiable ownership records. The integration of smart contracts in digital collectibles enhances security and transparency, reducing the risk of forgery compared to traditional assets.

Metaverse Integration

Collectibles in the form of physical assets offer tangible value but face limitations in metaverse integration, while digital collectibles leverage blockchain technology to enable seamless ownership, transfer, and interaction within virtual environments. Metaverse integration enhances digital collectibles by providing immersive experiences, greater liquidity, and programmable features that redefine asset utility and value in decentralized ecosystems.

Collectibles vs Digital Collectibles for asset. Infographic

moneydiff.com

moneydiff.com