Real estate ownership traditionally involves high entry costs, limited liquidity, and complex legal processes, making it less accessible for many investors. Tokenized real estate leverages blockchain technology to fractionalize property assets, enabling smaller investments, increased transparency, and easier transferability. This digital approach democratizes real estate investment by providing greater flexibility and reducing barriers to entry.

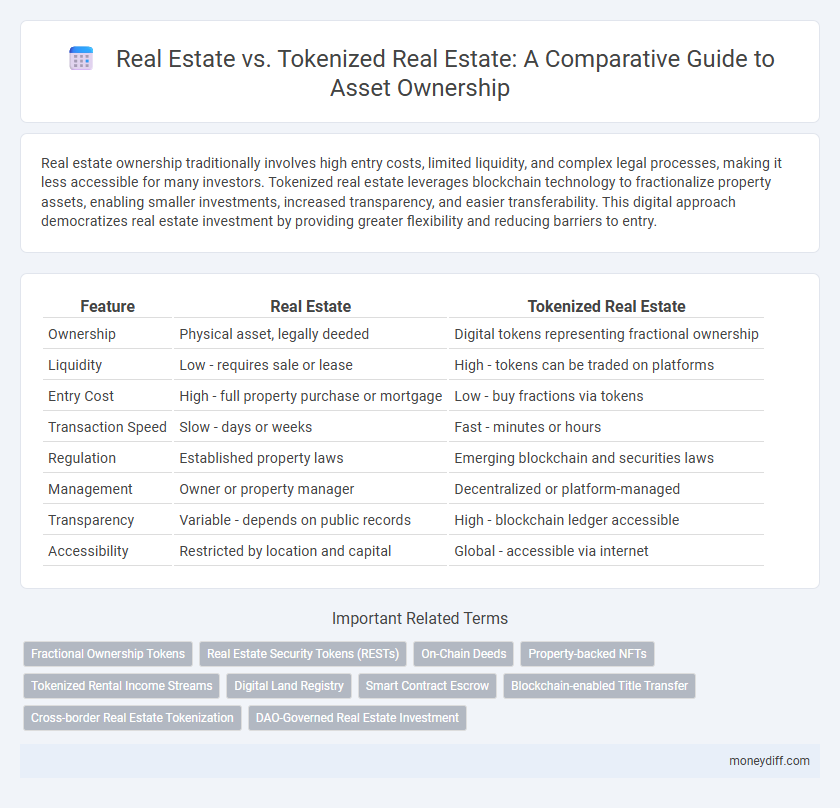

Table of Comparison

| Feature | Real Estate | Tokenized Real Estate |

|---|---|---|

| Ownership | Physical asset, legally deeded | Digital tokens representing fractional ownership |

| Liquidity | Low - requires sale or lease | High - tokens can be traded on platforms |

| Entry Cost | High - full property purchase or mortgage | Low - buy fractions via tokens |

| Transaction Speed | Slow - days or weeks | Fast - minutes or hours |

| Regulation | Established property laws | Emerging blockchain and securities laws |

| Management | Owner or property manager | Decentralized or platform-managed |

| Transparency | Variable - depends on public records | High - blockchain ledger accessible |

| Accessibility | Restricted by location and capital | Global - accessible via internet |

Understanding Traditional Real Estate Ownership

Traditional real estate ownership involves acquiring physical property rights through deeds, providing tangible control and legal protections over land or buildings. This form of ownership requires extensive paperwork, involves higher transaction costs, and often lacks liquidity compared to digital alternatives. While offering stability and established legal frameworks, traditional real estate can limit access for smaller investors due to its high entry barriers and complex management requirements.

What is Tokenized Real Estate?

Tokenized real estate refers to the digital representation of ownership in a property through blockchain-based tokens, allowing fractional ownership and easier transferability compared to traditional real estate. This method enhances liquidity by enabling investors to buy and sell smaller shares of the asset on decentralized platforms, reducing entry barriers and increasing market accessibility. Smart contracts automate transactions and compliance, ensuring transparency, security, and efficiency in asset management.

Key Differences Between Real Estate and Tokenized Real Estate

Real estate ownership involves direct possession of physical property, often requiring significant capital, lengthy transactions, and complex legal processes. Tokenized real estate represents property ownership through blockchain-based digital tokens, allowing fractional ownership, increased liquidity, and faster, transparent transactions. This innovation reduces barriers to entry and enhances accessibility compared to traditional real estate investment.

Accessibility: Fractional Ownership and Investment

Real estate ownership traditionally requires substantial capital, limiting accessibility for many investors. Tokenized real estate leverages blockchain technology to enable fractional ownership, allowing investors to purchase shares of a property with lower entry costs. This democratization of investment broadens market participation and enhances liquidity for asset holders.

Liquidity in Real Estate Markets vs Tokenized Assets

Traditional real estate markets often face challenges with liquidity due to lengthy transaction processes, high entry costs, and regulatory complexities, limiting quick asset turnover. Tokenized real estate transforms ownership into digital tokens on blockchain platforms, enabling fractional ownership and faster, more accessible trading. This innovation significantly enhances liquidity by allowing investors to buy or sell fractions of properties with reduced barriers and increased market participation.

Security and Transparency: Blockchain’s Role

Real estate ownership through tokenized assets leverages blockchain technology to enhance security by providing an immutable and transparent ledger, significantly reducing fraud and unauthorized transfers. Traditional real estate transactions often involve multiple intermediaries and opaque processes, increasing the risk of errors and delays. Blockchain's decentralized verification ensures real-time, accurate records of ownership and transaction history, improving trust and transparency for investors and stakeholders.

Legal and Regulatory Considerations

Real estate ownership involves well-established legal frameworks, including title deeds, property rights, and regulatory compliance subject to local jurisdiction. Tokenized real estate introduces new legal complexities, such as securities law applicability, smart contract enforcement, and the need for clear regulatory guidelines on digital asset ownership. Understanding these distinctions is crucial for investors navigating property rights, transferability, and compliance risks in both traditional and tokenized asset environments.

Cost Structures and Transaction Fees

Traditional real estate ownership involves high upfront costs, including property taxes, maintenance, and real estate agent fees, which can significantly reduce net returns. Tokenized real estate offers a cost-efficient alternative by minimizing transaction fees through blockchain technology, enabling fractional ownership with lower entry costs and reduced administrative expenses. This shift in cost structures enhances liquidity and accessibility while maintaining compliance with regulatory frameworks, making asset ownership more scalable and flexible.

Potential Risks and Drawbacks

Real estate ownership involves risks such as market volatility, illiquidity, and high transaction costs, while tokenized real estate faces regulatory uncertainties, limited adoption, and potential cybersecurity threats. Traditional real estate transactions are often governed by established legal frameworks, whereas tokenized assets depend on blockchain technology, which may lack comprehensive legal recognition. Investors must weigh the stability of physical property against the technological and regulatory challenges inherent in digital asset ownership.

Future Trends in Real Estate Asset Ownership

Tokenized real estate is rapidly transforming asset ownership by enabling fractional ownership, increased liquidity, and enhanced transparency through blockchain technology. Traditional real estate assets face limitations in accessibility and transferability, whereas tokenization offers global investor reach and automated smart contracts reducing transaction costs. Future trends indicate widespread adoption of tokenized assets as regulatory frameworks evolve, driving a paradigm shift toward decentralized and democratized real estate investment.

Related Important Terms

Fractional Ownership Tokens

Fractional Ownership Tokens in tokenized real estate enable investors to acquire precise, divisible shares of valuable properties, enhancing liquidity and accessibility compared to traditional real estate ownership. This blockchain-based approach offers secure, transparent transactions and reduces entry barriers, revolutionizing asset ownership and portfolio diversification.

Real Estate Security Tokens (RESTs)

Real Estate Security Tokens (RESTs) offer fractional ownership and increased liquidity compared to traditional real estate assets, enabling investors to trade property shares on blockchain platforms with enhanced transparency and lower transaction costs. RESTs also provide regulatory compliance and automated governance through smart contracts, revolutionizing asset ownership by integrating real estate with digital financial markets.

On-Chain Deeds

Real estate ownership traditionally relies on physical deeds recorded in government registries, creating limitations in transparency and transfer speed. Tokenized real estate leverages on-chain deeds stored on blockchain, enhancing security, enabling fractional ownership, and facilitating instant, transparent transactions.

Property-backed NFTs

Property-backed NFTs revolutionize asset ownership by transforming traditional real estate into easily transferable, divisible digital tokens on blockchain platforms. Unlike conventional real estate, tokenized properties offer enhanced liquidity, lower entry barriers, and transparent proof of ownership, enabling broader market participation and streamlined asset management.

Tokenized Rental Income Streams

Tokenized real estate allows investors to own fractional shares of rental properties, enabling diversified and liquid income streams through blockchain technology. Unlike traditional real estate, tokenized rental income generates seamless, transparent payouts and reduces barriers to entry for global investors.

Digital Land Registry

Tokenized real estate offers enhanced transparency and efficiency compared to traditional real estate by utilizing a digital land registry that securely records ownership and transaction history on a blockchain. This digital approach reduces fraud risk, accelerates transfer processes, and enables fractional ownership, making asset management more accessible and liquid.

Smart Contract Escrow

Real estate ownership traditionally involves complex escrow processes managed by intermediaries, which can delay transactions and increase costs. Tokenized real estate leverages smart contract escrow to automate fund release and ownership transfer, enhancing transparency, security, and efficiency in asset transactions.

Blockchain-enabled Title Transfer

Tokenized real estate leverages blockchain technology to enable secure, transparent, and instantaneous title transfers, significantly reducing the friction and delays associated with traditional real estate transactions. This blockchain-enabled mechanism enhances asset ownership verification, minimizes fraud risks, and lowers costs compared to conventional title deeds in the real estate market.

Cross-border Real Estate Tokenization

Cross-border real estate tokenization enables fractional ownership and seamless transfer of property assets across international markets, significantly reducing transaction costs and legal complexities compared to traditional real estate ownership. Blockchain technology ensures transparent, immutable records, enhancing liquidity and accessibility for global investors in tokenized property assets.

DAO-Governed Real Estate Investment

DAO-governed real estate investment leverages blockchain technology to tokenize property assets, enabling fractional ownership and transparent governance through decentralized autonomous organizations. This model enhances liquidity and democratizes access compared to traditional real estate investments, where asset control and decision-making remain centralized.

Real Estate vs Tokenized Real Estate for asset ownership Infographic

moneydiff.com

moneydiff.com