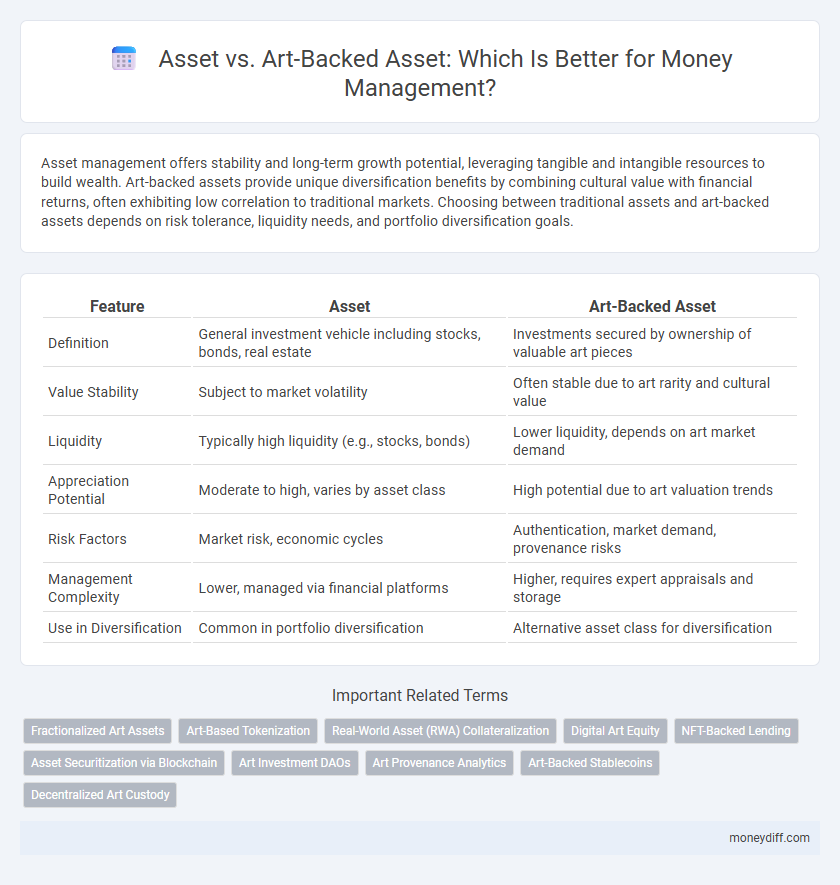

Asset management offers stability and long-term growth potential, leveraging tangible and intangible resources to build wealth. Art-backed assets provide unique diversification benefits by combining cultural value with financial returns, often exhibiting low correlation to traditional markets. Choosing between traditional assets and art-backed assets depends on risk tolerance, liquidity needs, and portfolio diversification goals.

Table of Comparison

| Feature | Asset | Art-Backed Asset |

|---|---|---|

| Definition | General investment vehicle including stocks, bonds, real estate | Investments secured by ownership of valuable art pieces |

| Value Stability | Subject to market volatility | Often stable due to art rarity and cultural value |

| Liquidity | Typically high liquidity (e.g., stocks, bonds) | Lower liquidity, depends on art market demand |

| Appreciation Potential | Moderate to high, varies by asset class | High potential due to art valuation trends |

| Risk Factors | Market risk, economic cycles | Authentication, market demand, provenance risks |

| Management Complexity | Lower, managed via financial platforms | Higher, requires expert appraisals and storage |

| Use in Diversification | Common in portfolio diversification | Alternative asset class for diversification |

Introduction to Assets and Art-Backed Assets

Assets represent valuable resources owned by individuals or entities, including financial instruments, property, and commodities used for wealth accumulation and risk management. Art-backed assets specifically leverage valuable artworks as collateral to secure loans or investment portfolios, combining tangible cultural value with financial utility. This alternative asset class offers diversification benefits and potential appreciation linked to the art market's unique dynamics.

Defining Traditional Assets

Traditional assets encompass physical items such as real estate, stocks, bonds, and cash equivalents, serving as foundational elements in diversified investment portfolios. These assets provide liquidity, income generation through dividends or interest, and potential capital appreciation, forming the core of conventional money management strategies. Understanding traditional assets is crucial for assessing risk, return, and portfolio allocation compared to alternative options like art-backed assets.

Understanding Art-Backed Assets

Art-backed assets represent a unique category of investment, where tangible artworks serve as collateral, offering an alternative to traditional assets like stocks and bonds. These assets combine cultural value with financial potential, providing diversification and inflation protection in a portfolio. Understanding art-backed assets involves assessing factors such as provenance, market trends, and liquidity, which differ significantly from conventional asset management principles.

Risk Profiles: Asset vs Art-Backed Asset

Traditional assets, such as stocks and bonds, typically exhibit moderate to high liquidity and established risk profiles influenced by market volatility and economic cycles. Art-backed assets present unique risk characteristics, including valuation subjectivity, limited liquidity, and sensitivity to art market trends, which may offer diversification benefits but require specialized knowledge for effective management. Understanding these distinct risk profiles is crucial for portfolio optimization and risk mitigation in money management strategies.

Liquidity Comparison for Money Management

Asset liquidity varies significantly between traditional assets and art-backed assets, with traditional assets like stocks and bonds offering higher liquidity due to established markets and faster transaction times. Art-backed assets often have lower liquidity, as they require specialized appraisal, longer selling periods, and fewer standardized marketplaces. Investors prioritizing quick access to funds typically prefer traditional assets for money management strategies focused on liquidity.

Valuation Methods: Standard Assets vs Art-Backed Assets

Standard assets rely on market-based valuation methods such as price-to-earnings ratios, discounted cash flows, and comparables analysis to determine worth, offering transparency and liquidity. Art-backed assets require specialized appraisals, provenance verification, and condition assessments, making their valuation more subjective and less liquid. The unique characteristics and market volatility of art necessitate bespoke valuation approaches, contrasting with the quantifiable metrics used for traditional financial assets.

Diversification Benefits in Asset Allocation

Asset allocation involving traditional assets like stocks and bonds provides diversification by spreading risk across various markets and sectors, reducing portfolio volatility. Art-backed assets introduce non-correlated returns and inflation-hedging benefits, enhancing overall portfolio resilience against economic fluctuations. Incorporating both asset types in money management strategies maximizes diversification benefits, balancing liquidity and long-term value preservation.

Regulatory and Legal Considerations

Asset management involving traditional assets is typically governed by well-established securities laws and financial regulations, ensuring clear compliance frameworks. Art-backed assets, however, face complex regulatory and legal considerations due to the unique valuation challenges, provenance verification, and intellectual property rights involved. Investors must navigate evolving global regulations on asset classification, anti-money laundering (AML) measures, and cross-border transaction restrictions when managing art-backed assets.

Historical Performance and Market Trends

Asset investments generally offer stable historical performance with traditional market trends driven by economic cycles and interest rates. Art-backed assets provide diversification benefits through lower correlation with conventional markets, often exhibiting resilience in inflationary periods and unique appreciation patterns. Historical data reveals that art-backed assets tend to outperform during economic downturns, balancing portfolios against volatility in standard financial assets.

Choosing the Right Asset Type for Your Portfolio

Selecting the right asset type for your portfolio depends on your risk tolerance and investment goals, with traditional assets like stocks and bonds offering liquidity and steady returns. Art-backed assets provide unique diversification benefits through tangible value and potential appreciation tied to the art market but involve higher valuation complexity and lower liquidity. Balancing standard financial instruments with art-backed assets can enhance portfolio resilience by integrating both market-driven performance and tangible asset security.

Related Important Terms

Fractionalized Art Assets

Fractionalized art assets enable investors to own shares of high-value artworks, providing liquidity and diversification compared to traditional assets like stocks or real estate. This innovative approach combines the stability of tangible art with the flexibility of asset tokenization, optimizing portfolio risk management and enhancing potential returns.

Art-Based Tokenization

Art-based tokenization transforms physical art pieces into digital assets by creating fractional ownership through blockchain technology, enabling enhanced liquidity and diversification in money management. Compared to traditional assets, art-backed tokens offer unique portfolio stability due to their intrinsic cultural value and limited supply.

Real-World Asset (RWA) Collateralization

Real-world asset (RWA) collateralization enhances financial security by leveraging tangible assets such as real estate or commodities, offering lower volatility and increased liquidity compared to traditional art-backed assets. This approach optimizes money management by providing transparent valuation and easier regulatory compliance, fostering investor confidence in asset-backed lending and decentralized finance platforms.

Digital Art Equity

Digital art equity represents a unique asset class combining blockchain technology with art ownership, offering transparent liquidity and fractional investment opportunities. Unlike traditional art-backed assets, digital art equity provides enhanced market accessibility and verifiable provenance, transforming money management through decentralized, high-value digital collectibles.

NFT-Backed Lending

NFT-backed lending transforms traditional asset management by collateralizing unique digital assets, offering increased liquidity and flexibility compared to conventional art-backed assets. This innovative financial approach leverages blockchain technology to authenticate NFTs, enabling efficient valuation and secure loans that enhance capital access in decentralized markets.

Asset Securitization via Blockchain

Asset securitization via blockchain enhances transparency and liquidity by tokenizing traditional assets, enabling fractional ownership and real-time trading. Compared to art-backed assets, blockchain-based asset securitization offers standardized, programmable contracts that reduce intermediaries and increase efficiency in money management.

Art Investment DAOs

Art Investment DAOs leverage blockchain technology to tokenize and democratize ownership of art-backed assets, enhancing liquidity and accessibility compared to traditional asset investments. These decentralized autonomous organizations allow collective management and fractional investment in high-value artworks, providing a novel strategy for diversified portfolio growth and risk mitigation.

Art Provenance Analytics

Art Provenance Analytics enhances the value of art-backed assets by providing verified historical ownership data, which reduces investment risk and increases market transparency. Traditional assets lack this intricate traceability, making art-backed assets uniquely advantageous for diversified money management strategies.

Art-Backed Stablecoins

Art-backed stablecoins offer a unique blend of traditional asset stability and innovative blockchain technology, using fine art as underlying collateral to reduce volatility compared to conventional cryptocurrencies. This fusion provides investors with enhanced portfolio diversification, combining the tangible value of art assets with the liquidity and accessibility of digital stablecoins.

Decentralized Art Custody

Decentralized art custody leverages blockchain technology to securely manage art-backed assets, enhancing transparency and reducing the risks associated with traditional asset management. Unlike conventional assets, art-backed assets in decentralized custody provide enhanced liquidity and fractional ownership opportunities, optimizing money management strategies.

Asset vs Art-backed Asset for money management. Infographic

moneydiff.com

moneydiff.com