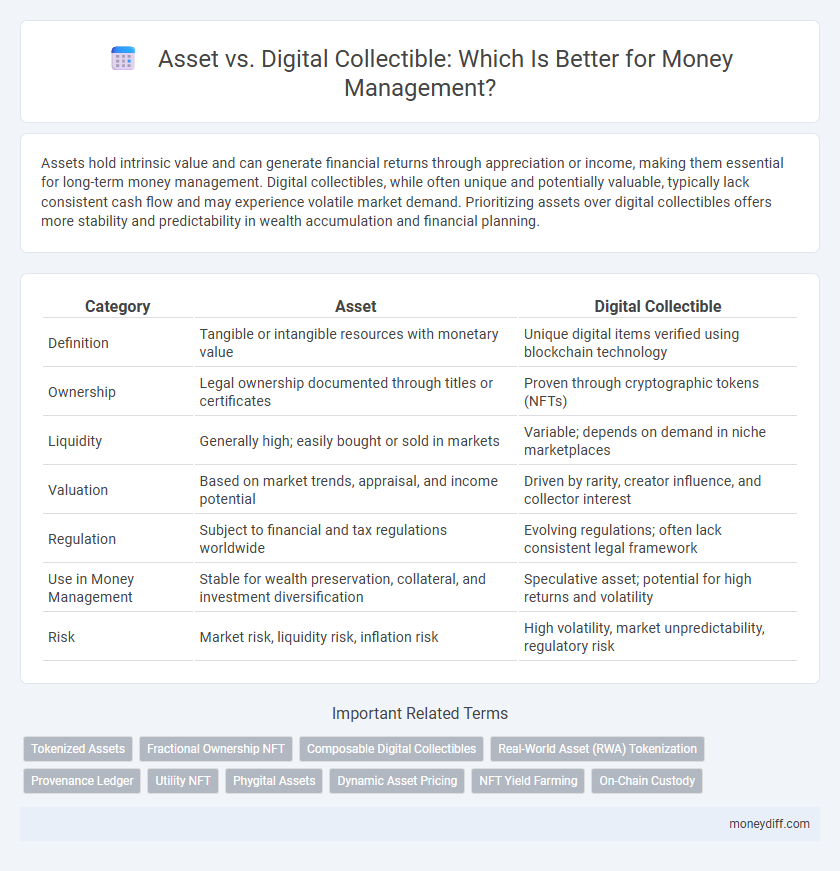

Assets hold intrinsic value and can generate financial returns through appreciation or income, making them essential for long-term money management. Digital collectibles, while often unique and potentially valuable, typically lack consistent cash flow and may experience volatile market demand. Prioritizing assets over digital collectibles offers more stability and predictability in wealth accumulation and financial planning.

Table of Comparison

| Category | Asset | Digital Collectible |

|---|---|---|

| Definition | Tangible or intangible resources with monetary value | Unique digital items verified using blockchain technology |

| Ownership | Legal ownership documented through titles or certificates | Proven through cryptographic tokens (NFTs) |

| Liquidity | Generally high; easily bought or sold in markets | Variable; depends on demand in niche marketplaces |

| Valuation | Based on market trends, appraisal, and income potential | Driven by rarity, creator influence, and collector interest |

| Regulation | Subject to financial and tax regulations worldwide | Evolving regulations; often lack consistent legal framework |

| Use in Money Management | Stable for wealth preservation, collateral, and investment diversification | Speculative asset; potential for high returns and volatility |

| Risk | Market risk, liquidity risk, inflation risk | High volatility, market unpredictability, regulatory risk |

Understanding Assets: Definition and Types

Assets represent valuable resources owned by individuals or entities, encompassing tangible items like real estate and machinery, as well as intangible forms such as patents and digital collectibles. Digital collectibles, a subset of intangible assets, are unique, blockchain-verified digital items that hold value based on scarcity and demand. Understanding the distinct characteristics and classifications of assets is crucial for effective money management and building a diversified investment portfolio.

What Are Digital Collectibles?

Digital collectibles, also known as non-fungible tokens (NFTs), represent unique digital assets secured on a blockchain, distinguishing them from traditional fungible assets like stocks or cash. These collectibles provide verifiable ownership and provenance, making them valuable for collectors and investors in digital art, gaming, and virtual real estate. Unlike conventional assets, digital collectibles offer enhanced liquidity and transferability through decentralized marketplaces, transforming money management strategies in the digital economy.

Key Differences: Assets vs Digital Collectibles

Assets represent tangible or intangible resources with measurable financial value and utility for wealth accumulation, including stocks, real estate, and bonds. Digital collectibles, such as NFTs, hold value primarily due to uniqueness and scarcity but lack traditional income generation or liquidity features found in assets. Key differences include asset fungibility, potential for passive income, regulatory frameworks, and market stability compared to the speculative, non-fungible nature of digital collectibles.

Evaluating Value: Tangible and Intangible Factors

Evaluating value in asset management involves assessing both tangible elements such as physical condition, ownership rights, and market liquidity, alongside intangible factors like brand reputation, historical significance, and emotional attachment. Digital collectibles rely heavily on blockchain provenance, uniqueness, and community-driven demand, creating market value that fluctuates with digital scarcity and social trends. Understanding these distinct valuation criteria enables more strategic money management by balancing traditional asset stability with the speculative potential of digital collectibles.

Risk and Volatility: Which Is Safer?

Assets typically have established market values and regulatory oversight, making them generally less volatile and safer for money management compared to digital collectibles. Digital collectibles, such as NFTs, often experience rapid price fluctuations and lack standardized valuation frameworks, increasing their risk profile. Investors prioritizing stability and lower volatility usually prefer traditional assets over digital collectibles for safeguarding their wealth.

Liquidity Comparison: Asset vs Digital Collectible

Assets such as stocks and bonds typically offer higher liquidity due to established markets and regulatory frameworks, enabling quick conversion to cash. Digital collectibles, including NFTs, often face lower liquidity as their market is less mature, prices can be volatile, and buyer interest varies significantly. Effective money management requires assessing the liquidity differences to balance portfolio flexibility and potential returns.

Legal and Regulatory Considerations

Assets and digital collectibles differ significantly in legal and regulatory frameworks, affecting money management strategies. Traditional assets are subject to well-established financial regulations such as securities laws, taxation policies, and compliance requirements, providing clearer legal protections. Digital collectibles, often classified as non-fungible tokens (NFTs), face evolving regulatory scrutiny regarding ownership rights, anti-money laundering (AML) rules, and consumer protections, necessitating careful legal assessment before integration into financial portfolios.

Portfolio Diversification: Integrating Both

Integrating traditional assets and digital collectibles enhances portfolio diversification by spreading investment risk across varied asset classes with different market behaviors. Traditional assets like stocks, bonds, and real estate offer stability and predictable returns, while digital collectibles such as NFTs provide exposure to emerging markets with high growth potential. Balancing these asset types optimizes risk-adjusted returns and adapts to evolving financial landscapes.

Long-Term Growth Prospects

Assets typically offer more stable long-term growth prospects due to their tangible value and regulatory frameworks, making them reliable for money management strategies focused on wealth preservation. Digital collectibles, while potentially lucrative, carry higher volatility and speculative risk, often lacking the consistent appreciation characteristics of traditional assets. Investors prioritizing sustained capital appreciation and risk mitigation generally prefer assets over digital collectibles for long-term financial planning.

Choosing the Right Option for Your Money Management Strategy

Asset selection in money management hinges on understanding the fundamental differences between traditional assets and digital collectibles, with traditional assets offering stability and predictable returns compared to the high volatility and speculative nature of digital collectibles. Evaluating liquidity, risk tolerance, and long-term financial goals is essential when deciding between assets like stocks, bonds, and real estate versus NFTs or cryptocurrencies. Prioritizing diversification and aligning choices with your overall investment strategy ensures optimized portfolio performance and financial security.

Related Important Terms

Tokenized Assets

Tokenized assets represent real-world assets on blockchain platforms, enabling fractional ownership and improved liquidity compared to traditional assets. Unlike digital collectibles, which primarily hold aesthetic or entertainment value, tokenized assets provide tangible financial benefits such as income generation and portfolio diversification in money management.

Fractional Ownership NFT

Fractional Ownership NFTs transform traditional asset management by enabling divisible, transparent stakes in high-value investments, enhancing liquidity and accessibility for diverse investors. Unlike conventional digital collectibles, these NFTs leverage blockchain technology to streamline asset allocation, reduce entry barriers, and provide verifiable ownership rights in real-time financial portfolios.

Composable Digital Collectibles

Composable digital collectibles represent a new class of assets that enable modular ownership and flexible monetization, distinguishing them from traditional static digital assets by allowing parts to be combined, partitioned, or evolved over time. Their interoperability and programmable features enhance money management strategies by unlocking dynamic revenue streams and providing transparent provenance within decentralized finance ecosystems.

Real-World Asset (RWA) Tokenization

Real-World Asset (RWA) tokenization transforms physical assets like real estate, commodities, or equipment into digital tokens, enabling fractional ownership and enhanced liquidity in money management. Unlike traditional digital collectibles, RWAs represent tangible value backed by real-world assets, offering investors a more stable and transparent investment vehicle.

Provenance Ledger

Provenance Ledger enhances money management by verifying asset ownership and transaction history, ensuring transparency and trust beyond traditional asset tracking. Digital collectibles rely on blockchain provenance for authenticity, but assets recorded on Provenance Ledger offer comprehensive financial accountability and regulatory compliance.

Utility NFT

Utility NFTs represent a transformative evolution in digital asset management by combining ownership verification with functional benefits, such as exclusive access, staking rewards, or governance rights, enhancing their value beyond mere collectibles. Unlike traditional digital collectibles, Utility NFTs provide dynamic financial applications and utility within decentralized finance (DeFi) ecosystems, making them powerful tools for optimized money management and asset diversification.

Phygital Assets

Phygital assets combine tangible physical items with digital representations, enhancing money management by enabling seamless tracking, ownership verification, and liquidity across blockchain platforms. Unlike purely digital collectibles, phygital assets bridge real-world value and digital scarcity, offering diversified investment opportunities and improved asset security through tokenization.

Dynamic Asset Pricing

Dynamic asset pricing enables real-time adjustment of asset values based on market demand and supply, enhancing accuracy in money management compared to static digital collectibles. Unlike digital collectibles with fixed or slowly evolving prices, assets with dynamic pricing reflect current market conditions, providing a more effective tool for portfolio optimization and risk assessment.

NFT Yield Farming

NFT yield farming leverages digital collectibles as innovative asset classes, enabling users to stake NFTs for passive income generation and enhanced portfolio diversification. This approach transforms traditional asset management by integrating blockchain-based digital collectibles with DeFi protocols to maximize returns and liquidity.

On-Chain Custody

On-chain custody offers enhanced security and transparency for managing digital assets compared to traditional asset custody, ensuring verifiable ownership and immutable transaction records. Digital collectibles leverage blockchain technology to provide unique, tamper-proof ownership proof, optimizing money management through decentralized and trustless custody solutions.

Asset vs Digital Collectible for money management. Infographic

moneydiff.com

moneydiff.com