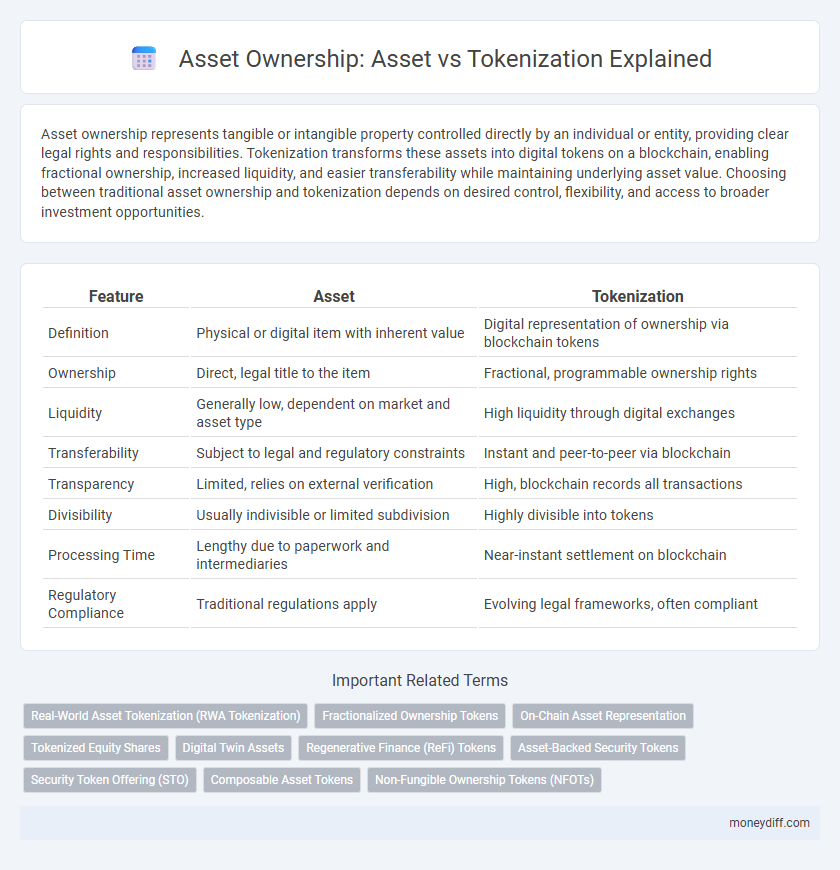

Asset ownership represents tangible or intangible property controlled directly by an individual or entity, providing clear legal rights and responsibilities. Tokenization transforms these assets into digital tokens on a blockchain, enabling fractional ownership, increased liquidity, and easier transferability while maintaining underlying asset value. Choosing between traditional asset ownership and tokenization depends on desired control, flexibility, and access to broader investment opportunities.

Table of Comparison

| Feature | Asset | Tokenization |

|---|---|---|

| Definition | Physical or digital item with inherent value | Digital representation of ownership via blockchain tokens |

| Ownership | Direct, legal title to the item | Fractional, programmable ownership rights |

| Liquidity | Generally low, dependent on market and asset type | High liquidity through digital exchanges |

| Transferability | Subject to legal and regulatory constraints | Instant and peer-to-peer via blockchain |

| Transparency | Limited, relies on external verification | High, blockchain records all transactions |

| Divisibility | Usually indivisible or limited subdivision | Highly divisible into tokens |

| Processing Time | Lengthy due to paperwork and intermediaries | Near-instant settlement on blockchain |

| Regulatory Compliance | Traditional regulations apply | Evolving legal frameworks, often compliant |

Understanding Asset Ownership: Traditional vs Tokenized

Traditional asset ownership relies on physical documentation and centralized registries to verify and transfer property rights, often involving lengthy processes and intermediaries. Tokenization converts assets into digital tokens on a blockchain, enabling fractional ownership, improved liquidity, and faster, transparent transactions. This shift enhances asset accessibility while reducing costs and complexity associated with traditional ownership models.

What is Tokenization? Transforming Assets into Digital Tokens

Tokenization is the process of converting ownership rights of real-world assets into digital tokens on a blockchain, enabling more efficient, transparent, and secure transactions. These digital tokens represent fractional ownership, allowing assets like real estate, art, or commodities to be divided and traded easily without traditional intermediaries. Tokenization enhances liquidity and accessibility by breaking down high-value assets into smaller, tradable units recognized on decentralized platforms.

Key Differences: Asset Ownership vs Tokenized Ownership

Asset ownership refers to holding physical or legal rights directly tied to tangible or intangible properties, providing full control and legal recognition under traditional frameworks. Tokenized ownership represents assets through blockchain-based digital tokens, allowing fractional ownership, increased liquidity, and easier transferability without the need for intermediaries. Key differences include the nature of legal recognition, ease of transfer, and the ability to divide ownership into smaller units for tokenized assets compared to conventional asset ownership.

Legal Frameworks: Asset vs Tokenized Ownership Rights

Legal frameworks governing asset ownership differ significantly from those applied to tokenized ownership rights, with traditional assets relying on established property laws and registries, while tokenized assets operate within emerging blockchain regulations and smart contracts. Tokenization introduces programmable features and fractional ownership, challenging existing legal definitions and requiring updated regulatory clarity to ensure enforceability and protection of rights. Jurisdictions are increasingly adapting legislation to address issues like custody, transferability, and dispute resolution specific to tokenized ownership versus conventional asset rights.

Security and Transparency: Blockchain in Tokenized Assets

Tokenization transforms physical assets into digital tokens, leveraging blockchain technology to enhance security and transparency in ownership records. Each tokenized asset is recorded on an immutable ledger, ensuring tamper-proof verification and reducing the risk of fraud or double-spending. This blockchain-based framework fosters trust among investors by providing real-time tracking and clear ownership history.

Liquidity and Accessibility: Comparing Asset and Tokenization

Tokenization enhances liquidity by converting physical assets into digital tokens that can be easily traded on blockchain platforms, enabling fractional ownership and lowering entry barriers for investors. Traditional assets often face limited accessibility due to high capital requirements and regulatory constraints, restricting participation to institutional investors or wealthy individuals. Tokenized assets democratize access to investment opportunities, increasing market liquidity and enabling real-time settlement across global markets.

Costs and Efficiency: Asset Management vs Tokenized Solutions

Traditional asset management often incurs higher costs due to intermediaries, complex paperwork, and manual reconciliation processes, leading to inefficiencies and delays. Tokenized solutions leverage blockchain technology to automate ownership transfers, reduce transaction fees, and enable real-time settlement, significantly lowering operational expenses. This digital approach enhances transparency, streamlines compliance, and improves liquidity, making asset management more cost-effective and efficient.

Risks and Challenges: Asset Ownership vs Tokenization

Asset ownership traditionally involves legal complexities, high transaction costs, and limited liquidity, which can hinder efficient transfer and verification. Tokenization introduces challenges such as regulatory uncertainties, smart contract vulnerabilities, and potential cybersecurity threats, raising concerns over asset control and compliance. Both models face risks related to valuation accuracy, fraud prevention, and maintaining clear ownership records in decentralized environments.

Use Cases: Real-World Asset Tokenization Examples

Real-world asset tokenization enables fractional ownership and increased liquidity in markets such as real estate, art, and commodities by converting physical assets into digital tokens on blockchain platforms. Examples include tokenized real estate projects allowing investors to buy shares of properties, art marketplaces offering digital shares in high-value artworks, and commodity-backed tokens representing gold or oil reserves. This innovation reduces entry barriers, streamlines transactions, and provides transparent proof of ownership, transforming traditional asset management.

Future Trends: The Evolution of Asset Ownership Through Tokenization

Asset ownership is rapidly evolving as tokenization transforms traditional methods by enabling fractional ownership, enhanced liquidity, and global accessibility. Future trends indicate a growing shift towards blockchain-based tokenization platforms that streamline asset transfer and reduce reliance on intermediaries. This digital transformation fosters increased transparency, security, and efficiency in managing real estate, art, and financial assets.

Related Important Terms

Real-World Asset Tokenization (RWA Tokenization)

Real-World Asset Tokenization (RWA Tokenization) transforms tangible assets like real estate, commodities, and artwork into digital tokens, enabling fractional ownership and enhanced liquidity on blockchain networks. Unlike traditional asset ownership, tokenization reduces barriers to entry, increases transparency, and facilitates faster, more secure transactions through smart contracts.

Fractionalized Ownership Tokens

Fractionalized ownership tokens enable investors to hold partial stakes in high-value assets, enhancing liquidity and accessibility in markets like real estate and art. These tokens provide transparent, blockchain-based records of ownership, reducing barriers and increasing market efficiency compared to traditional asset ownership models.

On-Chain Asset Representation

On-chain asset representation enables precise and transparent ownership tracking by embedding asset information directly into blockchain ledgers, ensuring immutable and verifiable records. Tokenization converts physical or intangible assets into digital tokens, facilitating fractional ownership and seamless transferability while maintaining secure on-chain provenance.

Tokenized Equity Shares

Tokenized equity shares represent ownership in a company through digital tokens on a blockchain, enabling fractional ownership, increased liquidity, and faster settlement compared to traditional asset ownership. This tokenization enhances transparency, reduces intermediaries, and allows global access to equity investments previously limited to institutional investors.

Digital Twin Assets

Digital Twin Assets leverage tokenization to represent real-world asset ownership through secure, blockchain-based tokens, enhancing transparency and liquidity in asset management. Unlike traditional assets, tokenization of Digital Twins enables fractional ownership, simplified transfer processes, and improved traceability across digital and physical ecosystems.

Regenerative Finance (ReFi) Tokens

Regenerative Finance (ReFi) tokens represent an innovative approach to asset ownership by embedding environmental and social impact directly into tokenized assets, ensuring transparent tracking of ecological regeneration efforts. Tokenization transforms traditional assets into accessible, tradeable digital units that facilitate fractional ownership and liquidity while aligning investor incentives with sustainable outcomes through ReFi protocols.

Asset-Backed Security Tokens

Asset-backed security tokens represent ownership stakes tied directly to physical or financial assets, providing transparency and liquidity through blockchain technology. These tokens enable fractional ownership, regulatory compliance, and efficient transferability, distinguishing them from traditional assets by enhancing accessibility and security in investment processes.

Security Token Offering (STO)

Security Token Offerings (STOs) represent a regulated method of asset tokenization, allowing investors to gain ownership in real-world assets through blockchain-based tokens that comply with securities laws. Unlike traditional assets, STOs combine the benefits of digital liquidity and fractional ownership while ensuring legal security and investor protection.

Composable Asset Tokens

Composable Asset Tokens enable modular ownership by representing distinct asset components as interoperable digital tokens, facilitating fractionalization and enhanced liquidity. This tokenization approach transforms traditional asset management by allowing seamless aggregation, transfer, and combination of ownership rights across diverse asset types.

Non-Fungible Ownership Tokens (NFOTs)

Non-Fungible Ownership Tokens (NFOTs) provide a distinct digital representation of unique assets, enabling precise proof of ownership and transferability on blockchain platforms. Unlike traditional asset ownership, NFOTs embed immutable metadata and provenance details, enhancing security, transparency, and fractionalization possibilities in asset management.

Asset vs Tokenization for ownership. Infographic

moneydiff.com

moneydiff.com