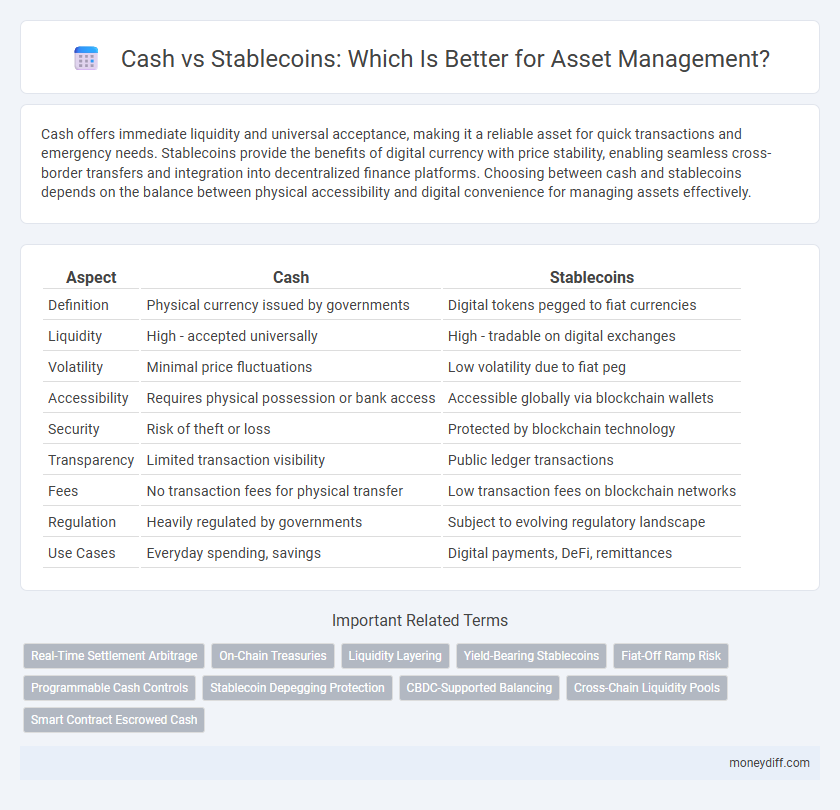

Cash offers immediate liquidity and universal acceptance, making it a reliable asset for quick transactions and emergency needs. Stablecoins provide the benefits of digital currency with price stability, enabling seamless cross-border transfers and integration into decentralized finance platforms. Choosing between cash and stablecoins depends on the balance between physical accessibility and digital convenience for managing assets effectively.

Table of Comparison

| Aspect | Cash | Stablecoins |

|---|---|---|

| Definition | Physical currency issued by governments | Digital tokens pegged to fiat currencies |

| Liquidity | High - accepted universally | High - tradable on digital exchanges |

| Volatility | Minimal price fluctuations | Low volatility due to fiat peg |

| Accessibility | Requires physical possession or bank access | Accessible globally via blockchain wallets |

| Security | Risk of theft or loss | Protected by blockchain technology |

| Transparency | Limited transaction visibility | Public ledger transactions |

| Fees | No transaction fees for physical transfer | Low transaction fees on blockchain networks |

| Regulation | Heavily regulated by governments | Subject to evolving regulatory landscape |

| Use Cases | Everyday spending, savings | Digital payments, DeFi, remittances |

Understanding Cash and Stablecoins as Financial Assets

Cash represents traditional fiat currency issued by governments, offering high liquidity and widespread acceptance as a financial asset. Stablecoins are digital assets pegged to fiat currencies, combining the stability of cash with blockchain technology for faster, transparent transactions. Both assets serve as low-volatility stores of value, with stablecoins enabling programmable finance and global access without intermediaries.

Core Differences Between Cash and Stablecoins

Cash represents physical currency issued and regulated by central banks, providing legal tender with broad acceptance for daily transactions and immediate liquidity. Stablecoins are digital assets pegged to fiat currencies or other assets, offering blockchain-based transparency, faster cross-border transfers, and programmable features, yet they rely on smart contracts and custodial mechanisms for stability. Key differences include tangibility, regulatory framework, transaction speed, and technological integration within financial ecosystems.

Liquidity and Accessibility: Cash vs Stablecoins

Cash offers immediate liquidity and universal acceptance for everyday transactions, making it a reliable asset for quick access to funds. Stablecoins provide digital liquidity with faster cross-border transactions and 24/7 availability on blockchain platforms, enhancing accessibility in decentralized finance. The choice between cash and stablecoins depends on the need for physical usability versus digital efficiency and global reach.

Security Risks: Physical Cash vs Digital Stablecoins

Physical cash carries risks such as theft, loss, and damage, making it vulnerable to physical security breaches. Digital stablecoins offer enhanced security through blockchain technology, providing encryption and traceability, but they are susceptible to cyberattacks, hacking, and regulatory vulnerabilities. Choosing between cash and stablecoins requires assessing physical theft risks versus digital security challenges and compliance considerations.

Inflation Impact on Cash and Stablecoin Value

Cash holdings face significant erosion in purchasing power due to inflation, resulting in decreased real asset value over time. Stablecoins, often pegged to fiat currencies, aim to maintain stable value but may still be affected by counterparty risk and regulatory changes impacting their stability. Investors seeking to preserve asset value during inflationary periods may consider stablecoins for liquidity while diversifying to mitigate potential volatility and systemic risks.

Transaction Speed and Costs: Comparing Cash and Stablecoins

Cash transactions often involve higher costs and slower processing times due to physical handling and banking hours, limiting efficiency for rapid exchanges. Stablecoins operate on blockchain technology, enabling near-instantaneous settlements with minimal transaction fees across global networks. The comparison highlights stablecoins as a more cost-effective and faster medium for asset transfers in digital economies.

Regulatory Environment for Cash and Stablecoins

Regulatory frameworks for cash emphasize anti-money laundering (AML) and know-your-customer (KYC) requirements, ensuring transparency and reducing illicit activities. Stablecoins face evolving regulations aiming to address concerns about consumer protection, systemic risk, and monetary sovereignty, with jurisdictions increasingly instituting licensing and reserve requirements. The contrasting regulatory scrutiny impacts the adoption and operational use of cash and stablecoins as digital or physical assets.

Stability and Volatility: How Do Cash and Stablecoins Compare?

Cash offers unparalleled stability as a government-backed fiat currency with minimal price fluctuations, making it a reliable store of value for everyday transactions. Stablecoins, pegged to fiat currencies, aim to maintain value stability while leveraging blockchain technology for faster and borderless transfers, yet they face risks from regulatory changes and underlying collateral volatility. While cash remains the benchmark for low volatility, stablecoins provide a growing alternative with scalability and transactional efficiency, albeit with some inherent market and systemic risks.

Use Cases for Cash vs Stablecoins in Asset Management

Cash provides immediate liquidity and is widely accepted for everyday transactions and short-term asset management needs, making it essential for operational expenses and emergency funds. Stablecoins offer programmable digital assets with faster settlement times, low transaction costs, and global accessibility, enabling efficient cross-border transfers, automated asset allocation, and decentralized finance (DeFi) applications. Combining cash and stablecoins enhances portfolio flexibility by balancing traditional liquidity with blockchain-enabled innovations in asset management.

Future Outlook: The Evolving Role of Cash and Stablecoins in Portfolios

Cash remains a foundational asset in portfolios due to its liquidity and stability, but stablecoins are gaining traction for their blockchain-based efficiency and faster transaction capabilities. The growing adoption of decentralized finance (DeFi) platforms and regulatory clarity around stablecoins are reshaping their role as viable cash alternatives. Future asset allocation strategies increasingly integrate stablecoins to optimize yield opportunities and enhance cross-border payment efficiency while maintaining low volatility.

Related Important Terms

Real-Time Settlement Arbitrage

Cash offers immediate liquidity but often lacks the efficiency of real-time settlement, creating arbitrage opportunities in volatile markets. Stablecoins enable near-instantaneous transactions on blockchain networks, minimizing settlement delays and reducing the risk of price discrepancies during asset exchanges.

On-Chain Treasuries

On-chain treasuries increasingly favor stablecoins over cash due to their programmability, transparency, and faster settlement times, which enhance liquidity management and reduce counterparty risk. Stablecoins like USDC and DAI provide decentralized protocols with stable-value assets that can be seamlessly integrated into smart contracts, optimizing asset efficiency and governance flexibility.

Liquidity Layering

Cash offers immediate liquidity and universally accepted settlement, making it a foundational asset for short-term obligations, while stablecoins provide programmable liquidity layers with faster cross-border transactions and smart contract integration, enhancing operational efficiency in decentralized finance ecosystems. The layering of liquidity through stablecoins bridges traditional cash assets with blockchain networks, enabling seamless asset transfer and reduced friction in global financial flows.

Yield-Bearing Stablecoins

Yield-bearing stablecoins offer enhanced liquidity and consistent returns by generating interest through decentralized finance protocols, making them a strategic asset for investors seeking stable value with yield potential. In contrast, holding cash provides minimal or no yield, often losing value against inflation, whereas yield-bearing stablecoins optimize asset growth within the stablecoin ecosystem.

Fiat-Off Ramp Risk

Cash provides immediate liquidity with minimal off-ramp risk due to its universal acceptance as fiat currency, while stablecoins, despite offering blockchain-based transaction efficiency, carry inherent fiat off-ramp risks including regulatory hurdles and exchange liquidity constraints. Choosing between cash and stablecoins requires assessing the stability of the redemption process and potential delays or costs involved in converting stablecoins back to fiat currency.

Programmable Cash Controls

Programmable cash controls embedded in stablecoins enable automated compliance, real-time transaction monitoring, and conditional spending, offering superior asset management compared to traditional cash. This digital programmability ensures enhanced security, transparency, and efficiency in controlling asset liquidity and access rights.

Stablecoin Depegging Protection

Stablecoins provide enhanced depegging protection compared to cash by maintaining value stability through algorithmic mechanisms and collateral backing, reducing volatility risks. This protection ensures reliable asset liquidity and predictable pricing, critical for asset management and financial planning.

CBDC-Supported Balancing

Cash provides tangible liquidity and universal acceptance but limited digital integration, whereas CBDC-supported stablecoins offer programmable money features with enhanced security and real-time settlement. Balancing these assets involves leveraging CBDC-backed stablecoins for efficient digital transactions while maintaining cash for accessibility and privacy in asset portfolios.

Cross-Chain Liquidity Pools

Cash offers immediate liquidity but lacks interoperability across multiple blockchains, whereas stablecoins enable seamless participation in cross-chain liquidity pools by maintaining consistent value and facilitating decentralized asset transfers. Leveraging stablecoins in cross-chain pools enhances asset diversification, reduces transaction friction, and increases access to global decentralized finance markets.

Smart Contract Escrowed Cash

Smart Contract Escrowed Cash combines the stability of traditional cash with blockchain technology, enabling secure, automated transactions without counterparty risk. Unlike stablecoins, it offers transparent, on-chain custody and real-time verification, enhancing trust and reducing settlement times in digital asset exchanges.

Cash vs Stablecoins for asset. Infographic

moneydiff.com

moneydiff.com