A savings account offers stable, low-risk returns with government-backed security, ideal for conservative asset growth. A high-yield crypto account provides significantly higher interest rates but comes with increased volatility and risk exposure due to market fluctuations. Investors should weigh the trade-off between guaranteed safety and potential for accelerated gains when choosing the best option for expanding their asset portfolio.

Table of Comparison

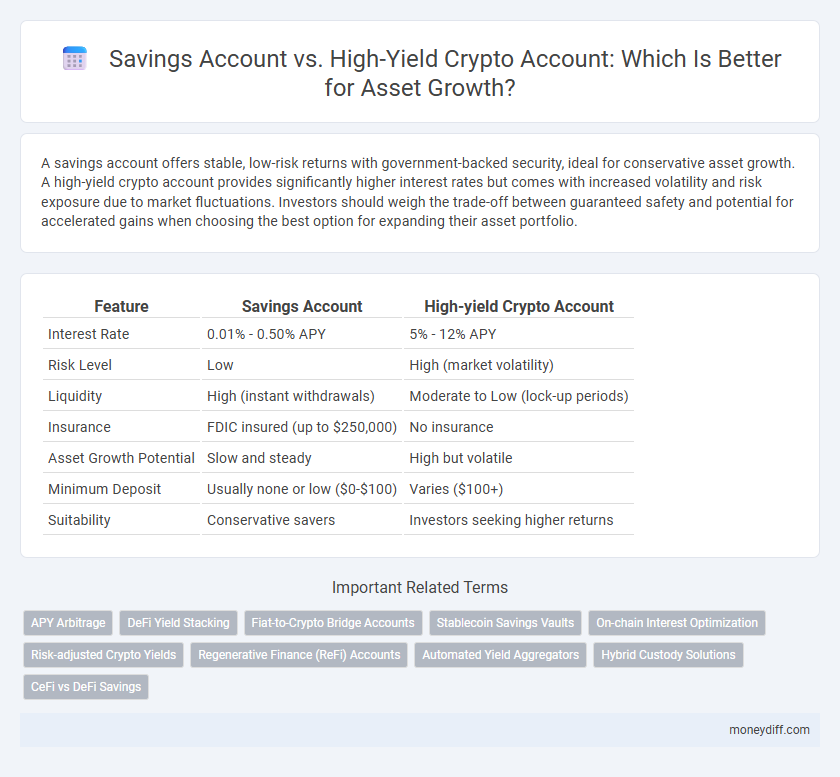

| Feature | Savings Account | High-yield Crypto Account |

|---|---|---|

| Interest Rate | 0.01% - 0.50% APY | 5% - 12% APY |

| Risk Level | Low | High (market volatility) |

| Liquidity | High (instant withdrawals) | Moderate to Low (lock-up periods) |

| Insurance | FDIC insured (up to $250,000) | No insurance |

| Asset Growth Potential | Slow and steady | High but volatile |

| Minimum Deposit | Usually none or low ($0-$100) | Varies ($100+) |

| Suitability | Conservative savers | Investors seeking higher returns |

Introduction: Traditional vs. Crypto Savings Options

Traditional savings accounts offer low-risk asset growth with fixed interest rates set by banks, typically ranging from 0.01% to 1.5% annually. High-yield crypto accounts provide significantly higher returns, often between 5% and 15%, by leveraging decentralized finance protocols, but they carry increased market volatility and regulatory risks. Investors must weigh the stability and insurance protection of conventional banks against the potential for accelerated growth and innovation found in crypto-based savings platforms.

Understanding Savings Accounts: Features & Security

Savings accounts typically offer lower interest rates but provide high security through FDIC insurance, ensuring principal protection and easy access to funds. These accounts feature fixed or variable interest rates, minimal fees, and liquidity that supports short-term asset growth with minimal risk. Unlike high-yield crypto accounts, savings accounts prioritize regulatory oversight and account holder protections, making them a safer choice for conservative asset growth.

What is a High-Yield Crypto Account?

A High-Yield Crypto Account allows users to earn significantly higher interest rates on cryptocurrency deposits compared to traditional savings accounts, often ranging between 5% to 12% APY. These accounts leverage blockchain technology and decentralized finance (DeFi) platforms to provide enhanced returns through staking, lending, or liquidity pooling. Unlike conventional savings accounts insured by institutions like the FDIC, high-yield crypto accounts involve higher risk but offer substantial asset growth potential for investors willing to engage with volatile digital assets.

Interest Rates Comparison: Savings vs. Crypto Accounts

Savings accounts typically offer annual interest rates ranging from 0.01% to 0.50%, providing low-risk asset growth with federal insurance protections. High-yield crypto accounts can deliver interest rates between 4% and 12%, leveraging blockchain technology but exposing assets to higher volatility and regulatory uncertainties. Comparing these options highlights a trade-off between the security of traditional savings and the potential for accelerated growth in crypto-linked assets.

Risk Factors: FDIC Insurance vs. Crypto Volatility

Savings accounts offer FDIC insurance coverage up to $250,000, providing secure asset protection against bank failures. High-yield crypto accounts lack federal insurance, exposing assets to market volatility and potential losses during rapid cryptocurrency price fluctuations. Investors must weigh the guaranteed security of traditional savings against the higher risk and potentially greater returns of crypto asset growth.

Accessibility & Liquidity: Withdrawing Your Funds

Savings accounts offer high liquidity and ease of access, allowing quick withdrawals without penalties, making them ideal for emergency funds. High-yield crypto accounts often impose withdrawal restrictions, varying lock-up periods, or network fees, which can delay access to funds. Evaluating the trade-off between immediate access in traditional savings and potential yield in crypto accounts is essential for optimal asset growth strategies.

Fees and Hidden Costs Explained

High-yield crypto accounts often offer significantly higher interest rates compared to traditional savings accounts but may come with complex fee structures and hidden costs such as network fees, withdrawal charges, or custodial fees that can erode overall returns. Savings accounts typically have transparent fee schedules with minimal or no maintenance fees, ensuring predictable growth despite lower interest rates. Careful evaluation of fee disclosures and comparison of net yields is essential to optimize asset growth when choosing between these financial products.

Regulatory Landscape: Compliance and Protection

Savings accounts operate under strict banking regulations enforced by bodies like the FDIC, providing government-backed insurance and consumer protections that ensure asset security. High-yield crypto accounts, while offering potentially higher returns, face a less mature regulatory environment with varying compliance standards from agencies such as the SEC and CFTC, creating higher risks around asset protection and fraud prevention. Investors must weigh the robust oversight and insured guarantees of traditional savings against the innovative but evolving compliance landscape in crypto asset growth options.

Tax Implications for Asset Growth

Savings accounts offer predictable interest income subject to standard income tax rates, leading to potentially higher tax liabilities on earnings. High-yield crypto accounts may provide superior returns but are often taxed as capital gains or ordinary income depending on jurisdiction, introducing complexity and potential tax advantages. Proper tax planning is essential for maximizing asset growth when choosing between traditional savings and crypto-based accounts.

Which Account Suits Your Asset Growth Goals?

Savings accounts offer low-risk, stable returns with annual interest rates typically around 0.01% to 0.5%, making them ideal for conservative asset growth and emergency funds. High-yield crypto accounts provide significantly higher interest rates, often ranging from 4% to over 12% APY, but carry increased volatility and regulatory risks due to the fluctuating nature of cryptocurrencies. Choosing between these accounts depends on your risk tolerance, time horizon, and whether you prioritize consistent growth or higher potential returns with greater asset value fluctuations.

Related Important Terms

APY Arbitrage

High-yield crypto accounts often offer APYs exceeding traditional savings accounts by multiple percentage points, enabling significant asset growth through APY arbitrage opportunities. Investors leveraging these differences can amplify returns, but must evaluate associated risks like volatility, security, and regulatory factors to optimize asset diversification and growth strategies.

DeFi Yield Stacking

High-yield crypto accounts leveraging DeFi yield stacking offer significantly higher returns compared to traditional savings accounts by compounding interest across multiple protocols simultaneously. This strategy amplifies asset growth potential through decentralized finance's liquidity farming and staking mechanisms, surpassing conventional banking yields.

Fiat-to-Crypto Bridge Accounts

Fiat-to-Crypto bridge accounts serve as pivotal assets for users aiming to grow wealth by seamlessly converting traditional savings into high-yield crypto investments, outperforming standard savings accounts with elevated interest rates and blockchain-backed security. These accounts optimize asset growth by integrating the stability of fiat currencies with the expansive earning potential of decentralized finance protocols.

Stablecoin Savings Vaults

Stablecoin savings vaults in high-yield crypto accounts offer significantly higher annual percentage yields compared to traditional savings accounts, leveraging decentralized finance protocols to maximize asset growth while maintaining stability through pegged cryptocurrencies. These vaults provide enhanced liquidity and compounding interest benefits, making them a strategic choice for asset diversification and long-term value accumulation in volatile markets.

On-chain Interest Optimization

High-yield crypto accounts leverage on-chain interest optimization protocols to maximize returns by utilizing decentralized finance (DeFi) strategies, often delivering rates significantly above traditional savings accounts. Savings accounts offer stable, low-risk asset growth but lack the dynamic yield enhancement found in blockchain-enabled interest aggregation and asset compounding mechanisms.

Risk-adjusted Crypto Yields

High-yield crypto accounts offer significantly higher returns compared to traditional savings accounts but come with increased volatility and regulatory risks, requiring careful risk-adjusted yield analysis. Evaluating crypto yields through metrics like Sharpe ratio and drawdown helps optimize asset growth by balancing potential gains against the inherent market fluctuations.

Regenerative Finance (ReFi) Accounts

High-yield crypto accounts, especially those focused on Regenerative Finance (ReFi), offer significantly higher interest rates and sustainable impact compared to traditional savings accounts, which typically deliver lower returns with limited social benefits. ReFi accounts leverage blockchain technology to fund environmental and social projects, driving asset growth while promoting regenerative economic models.

Automated Yield Aggregators

Automated yield aggregators optimize asset growth by dynamically reallocating funds between savings accounts and high-yield crypto accounts to maximize interest returns and minimize risk. These platforms leverage smart contract algorithms to identify the best yield opportunities, outperforming traditional fixed-rate savings accounts through continuous real-time adjustments.

Hybrid Custody Solutions

Hybrid custody solutions combine the security of traditional savings accounts with the high-yield potential of crypto accounts, enabling diversified asset growth strategies. These solutions enhance control over funds by integrating insured fiat deposits and regulated digital assets, offering balanced risk management and optimized returns.

CeFi vs DeFi Savings

Savings accounts in traditional CeFi platforms offer insured, stable interest rates often below inflation, prioritizing security over high returns, whereas high-yield crypto accounts in DeFi protocols provide significantly higher APYs by leveraging decentralized finance mechanisms but carry increased risks such as smart contract vulnerabilities and market volatility. Choosing between CeFi and DeFi savings depends on risk tolerance, with CeFi favored for asset preservation and DeFi suitable for aggressive asset growth through exposure to innovative financial products and liquidity mining.

Savings Account vs High-yield Crypto Account for asset growth. Infographic

moneydiff.com

moneydiff.com