Mutual funds provide diversified exposure across various sectors and asset classes, making them ideal for long-term, risk-balanced portfolio building. Thematic funds concentrate investments in specific trends or industries, offering targeted growth potential but higher volatility. Combining both can enhance portfolio resilience by blending broad market stability with the upside of focused thematic opportunities.

Table of Comparison

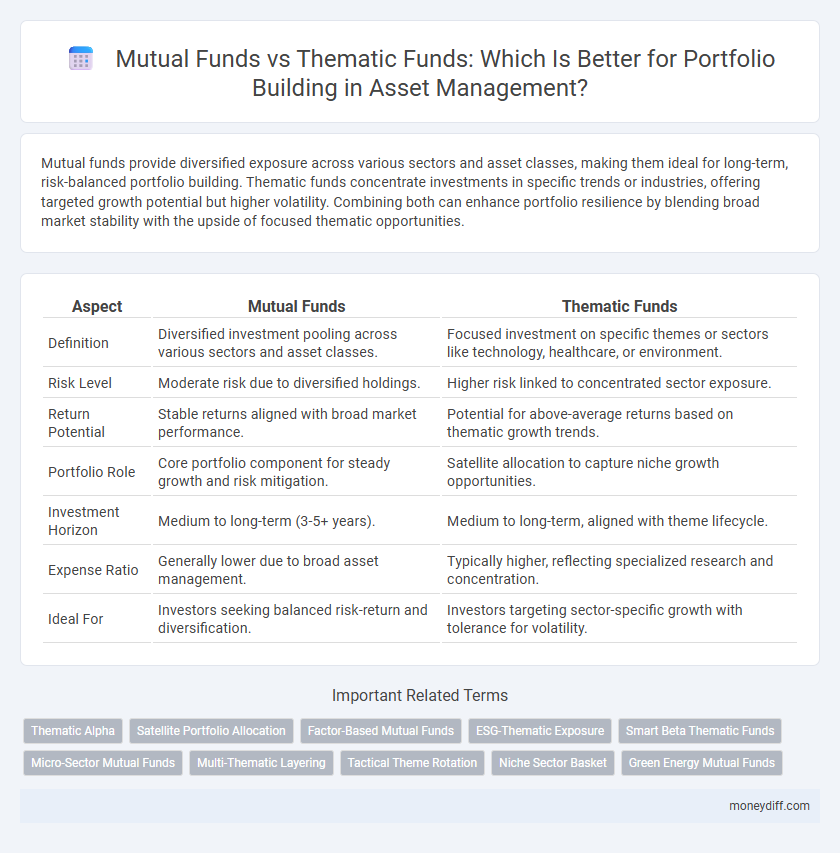

| Aspect | Mutual Funds | Thematic Funds |

|---|---|---|

| Definition | Diversified investment pooling across various sectors and asset classes. | Focused investment on specific themes or sectors like technology, healthcare, or environment. |

| Risk Level | Moderate risk due to diversified holdings. | Higher risk linked to concentrated sector exposure. |

| Return Potential | Stable returns aligned with broad market performance. | Potential for above-average returns based on thematic growth trends. |

| Portfolio Role | Core portfolio component for steady growth and risk mitigation. | Satellite allocation to capture niche growth opportunities. |

| Investment Horizon | Medium to long-term (3-5+ years). | Medium to long-term, aligned with theme lifecycle. |

| Expense Ratio | Generally lower due to broad asset management. | Typically higher, reflecting specialized research and concentration. |

| Ideal For | Investors seeking balanced risk-return and diversification. | Investors targeting sector-specific growth with tolerance for volatility. |

Understanding Mutual Funds: Core Concepts

Mutual funds pool investors' money to invest in diversified portfolios managed by professionals, offering access to equities, bonds, and money market instruments. They emphasize risk diversification, liquidity, and systematic investment plans (SIPs) for disciplined wealth accumulation. Understanding expense ratios, fund objectives, and tracking net asset value (NAV) is essential for evaluating mutual funds' performance and suitability within a portfolio.

Thematic Funds Explained: Focused Investment Strategies

Thematic funds concentrate on specific sectors, trends, or themes such as technology, healthcare, or renewable energy, offering investors targeted exposure to high-growth areas. Unlike mutual funds that diversify across various sectors and asset classes, thematic funds leverage focused investment strategies to capitalize on emerging market opportunities. This approach allows for concentrated portfolio building, with potential for higher returns linked to the performance of the chosen theme.

Diversification Benefits: Mutual vs Thematic Funds

Mutual funds offer broad diversification across sectors and asset classes, reducing overall portfolio risk by spreading investments widely. Thematic funds concentrate on specific trends or industries, providing targeted exposure but with higher volatility due to sector-specific risks. Combining both fund types can optimize portfolio diversification by balancing stability from mutual funds with growth potential from thematic funds.

Risk Profile Comparison: Mutual Funds and Thematic Funds

Mutual funds generally offer diversified portfolios, lowering risk through broad exposure across multiple sectors and asset classes, making them suitable for conservative to moderate risk investors. Thematic funds concentrate investments in specific themes or sectors, which can lead to higher volatility and risk but also the potential for greater returns, attracting investors with a higher risk tolerance. Evaluating risk profiles of both fund types involves assessing investment horizon, market conditions, and individual risk appetite to align portfolio objectives efficiently.

Performance Trends: Historical Returns Analysis

Mutual funds have demonstrated consistent long-term performance with diversified portfolios that mitigate risk, often delivering average annual returns between 7-10% over the past decade. Thematic funds, focused on specific sectors or trends like technology or clean energy, show higher volatility but potential for superior returns, sometimes exceeding 15% during bullish market phases. Historical returns analysis reveals mutual funds as more stable for steady growth, whereas thematic funds present opportunities for higher gains aligned with market cycles and emerging trends.

Cost Structure: Fees and Expense Ratios

Mutual funds generally have a lower fee structure with average expense ratios ranging from 0.50% to 1.0%, making them cost-effective for broad diversification. Thematic funds often carry higher expense ratios, typically between 1.0% and 2.0%, reflecting their specialized investment strategies and active management. Investors should evaluate fees and expense ratios carefully, as higher costs can significantly impact long-term portfolio returns.

Portfolio Allocation: Integrating Funds for Growth

Mutual funds offer broad diversification across multiple asset classes and sectors, making them ideal for stabilizing portfolio risk while ensuring steady growth. Thematic funds target specific trends or industries, providing concentrated exposure that can enhance returns but also increase volatility. Integrating both fund types in a portfolio allows for balanced allocation, combining the stability of mutual funds with the high-growth potential of thematic investments to optimize long-term wealth accumulation.

Suitability for Different Investors

Mutual funds offer broad diversification and are suitable for investors seeking balanced risk and long-term growth through professionally managed portfolios across various asset classes. Thematic funds target specific sectors or trends, appealing to investors with higher risk tolerance and a keen interest in capitalizing on emerging market opportunities. Portfolio building benefits from combining mutual funds for stability and thematic funds for focused exposure, aligning with individual investment goals and risk profiles.

Tax Efficiency: Mutual vs Thematic Investments

Mutual funds generally offer better tax efficiency due to their diversified portfolios and favorable capital gains treatment under tax laws, especially long-term equity funds with benefits like indexation and lower tax rates on gains held over one year. Thematic funds, while potentially delivering higher returns through concentrated sector exposure, may incur higher short-term capital gains tax because of frequent portfolio rebalancing and sector volatility. Investors prioritizing tax-efficient portfolio building often prefer diversified mutual funds to manage tax liabilities while achieving steady growth.

Making the Right Choice: Factors to Consider

Mutual funds offer diversified exposure across sectors and asset classes, providing risk mitigation and steady growth potential, while thematic funds focus on specific trends or sectors, delivering targeted growth but with higher volatility. Investors should assess their risk tolerance, investment horizon, and objectives, considering factors like expense ratios, fund performance, and underlying asset allocation. Evaluating the fund manager's expertise and the alignment of the thematic fund's focus with long-term market trends is crucial for making the right portfolio choice.

Related Important Terms

Thematic Alpha

Thematic funds offer targeted exposure to specific sectors or trends, potentially delivering higher thematic alpha compared to diversified mutual funds by capitalizing on niche market opportunities. Mutual funds provide broad diversification and risk mitigation, but thematic funds can outperform by leveraging concentrated investments aligned with emerging themes and market cycles.

Satellite Portfolio Allocation

Mutual funds offer diversified exposure across broad market sectors, making them ideal for core portfolio allocation, while thematic funds target specific trends or sectors, providing concentrated growth opportunities suited for satellite portfolio allocation. Allocating 10-20% of a portfolio to thematic funds within the satellite segment can enhance returns by capitalizing on emerging themes without compromising overall portfolio stability.

Factor-Based Mutual Funds

Factor-Based Mutual Funds leverage specific investment factors such as value, momentum, and quality to enhance portfolio diversification and risk-adjusted returns, offering a more systematic approach compared to Thematic Funds that focus on sector-specific or trend-based investments. These funds analyze quantitative factors to capitalize on long-term market inefficiencies, making them suitable for investors seeking disciplined exposure beyond conventional thematic trends.

ESG-Thematic Exposure

Mutual funds offer diversified exposure across various sectors, while thematic funds focus specifically on ESG (Environmental, Social, and Governance) themes, providing concentrated investment in sustainable companies. Incorporating ESG-thematic funds into a portfolio enhances alignment with ethical investing goals and targets long-term value creation through responsible asset allocation.

Smart Beta Thematic Funds

Smart Beta Thematic Funds combine strategy-driven indexing with thematic investing, offering active risk management and sector-specific exposure that enhances diversification in portfolio building. Compared to traditional mutual funds, these funds leverage factor-based smart beta strategies to capture targeted market trends while minimizing volatility and tracking error.

Micro-Sector Mutual Funds

Micro-sector mutual funds target niche market segments with specialized investment strategies, offering higher growth potential and diversification within a portfolio compared to broader thematic funds that focus on larger, overarching trends. Investors seeking concentrated exposure to specific industries or emerging opportunities benefit from micro-sector funds' precise asset allocation and sector-specific risk management.

Multi-Thematic Layering

Mutual funds offer diversified exposure across broad market segments, while thematic funds target specific trends or sectors, enabling concentrated growth potential. Multi-thematic layering in portfolio building combines various thematic funds to optimize risk-adjusted returns by capturing multiple market themes simultaneously.

Tactical Theme Rotation

Mutual funds offer diversified exposure across sectors and asset classes, providing stability for long-term portfolio growth, while thematic funds concentrate on specific trends or sectors, enabling tactical theme rotation to capitalize on market shifts. Tactical theme rotation within thematic funds leverages sector momentum and emerging trends, optimizing risk-adjusted returns in dynamic markets.

Niche Sector Basket

Mutual funds offer diversified exposure across broader asset classes, while thematic funds concentrate investments in niche sector baskets such as technology, healthcare, or clean energy, targeting specific market trends. Thematic funds provide higher growth potential and risk by focusing on specialized sectors within a portfolio, appealing to investors seeking concentrated thematic plays rather than broad market coverage.

Green Energy Mutual Funds

Green Energy Mutual Funds offer diversified exposure to renewable energy sectors such as solar, wind, and bioenergy, reducing risk compared to thematic funds that concentrate on niche green technologies. Including Green Energy Mutual Funds in a portfolio enhances sustainability goals while benefiting from expert fund management and regulatory compliance.

Mutual Funds vs Thematic Funds for portfolio building Infographic

moneydiff.com

moneydiff.com