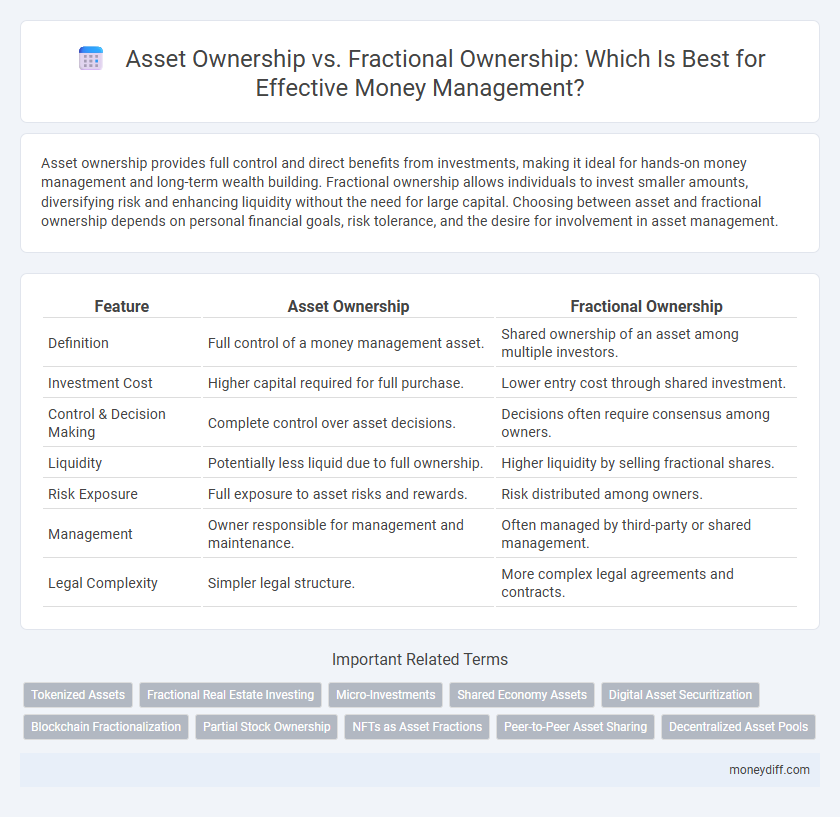

Asset ownership provides full control and direct benefits from investments, making it ideal for hands-on money management and long-term wealth building. Fractional ownership allows individuals to invest smaller amounts, diversifying risk and enhancing liquidity without the need for large capital. Choosing between asset and fractional ownership depends on personal financial goals, risk tolerance, and the desire for involvement in asset management.

Table of Comparison

| Feature | Asset Ownership | Fractional Ownership |

|---|---|---|

| Definition | Full control of a money management asset. | Shared ownership of an asset among multiple investors. |

| Investment Cost | Higher capital required for full purchase. | Lower entry cost through shared investment. |

| Control & Decision Making | Complete control over asset decisions. | Decisions often require consensus among owners. |

| Liquidity | Potentially less liquid due to full ownership. | Higher liquidity by selling fractional shares. |

| Risk Exposure | Full exposure to asset risks and rewards. | Risk distributed among owners. |

| Management | Owner responsible for management and maintenance. | Often managed by third-party or shared management. |

| Legal Complexity | Simpler legal structure. | More complex legal agreements and contracts. |

Understanding Asset Ownership in Money Management

Asset ownership in money management involves holding full rights and control over an asset, allowing for complete utilization, sale, or leveraging in financial strategies. Fractional ownership divides these rights among multiple investors, enabling shared investment and risk in high-value assets like real estate or art. Understanding the distinction aids investors in aligning asset control levels with their liquidity needs and risk tolerance in portfolio management.

What Is Fractional Ownership?

Fractional ownership allows multiple investors to share the costs and benefits of an asset by dividing its ownership into equal parts, enabling access to high-value assets with lower individual capital investment. This approach contrasts with traditional asset purchasing, where a single entity holds full ownership and responsibility for expenses, risk, and management. Fractional ownership models optimize money management by reducing financial barriers and diversifying exposure across a portfolio of shared assets.

Key Differences: Asset vs. Fractional Ownership

Asset ownership grants full control and rights over a tangible or intangible resource, allowing unilateral decisions regarding usage, sale, or management. Fractional ownership divides an asset among multiple stakeholders, each holding a percentage, which necessitates shared decision-making and often involves legal agreements specifying rights and responsibilities. Key differences include liquidity, control, cost of entry, and complexity in management, with fractional ownership typically lowering initial investment but requiring coordination among co-owners.

Pros and Cons of Full Asset Ownership

Full asset ownership grants complete control and decision-making authority, enabling direct management of investments such as real estate or stocks. This approach allows for potential tax benefits, appreciation, and income generation but requires significant upfront capital and exposes the owner to full financial risk and maintenance responsibilities. Unlike fractional ownership, full ownership lacks shared liability, but also misses out on diversification and reduced management burdens.

Benefits and Risks of Fractional Ownership

Fractional ownership allows investors to acquire partial shares of high-value assets, enabling diversified portfolios with lower capital requirements and increased liquidity compared to full asset ownership. The benefits include reduced financial risk, shared maintenance costs, and access to premium assets otherwise unaffordable individually. Risks involve limited control over asset decisions, potential conflicts among co-owners, and dependence on the management entity for asset performance and resale timing.

Liquidity Comparison: Asset vs. Fractional Models

Direct asset ownership offers higher liquidity as individuals can sell the entire asset quickly on open markets, providing immediate access to funds. In contrast, fractional ownership often involves limited liquidity due to the need for multiple co-owners' agreements or waiting for specific trading platforms to facilitate partial sales. This liquidity differential critically affects cash flow flexibility and investment exit strategies in money management decisions.

Cost Considerations for Investors

Asset ownership involves direct purchasing costs, including upfront capital and ongoing maintenance fees, which can significantly impact an investor's budget. Fractional ownership reduces individual financial burdens by spreading costs like property taxes and management fees across multiple stakeholders, improving affordability. Investors must assess these cost structures to optimize returns and align with their capital allocation strategies.

Diversification Strategies: Full vs. Fractional Assets

Diversification strategies differ significantly between full asset ownership and fractional ownership, impacting portfolio risk and flexibility. Full asset ownership allows investors complete control and the ability to diversify by selecting various asset classes independently. Fractional ownership provides access to high-value assets with lower capital, enabling broader diversification across multiple assets but with shared control and potential liquidity constraints.

Tax Implications: Asset and Fractional Ownership

Asset ownership often allows for straightforward tax deductions on depreciation and interest expenses, alongside clear capital gains tax treatment upon sale. Fractional ownership complicates tax reporting as income, deductions, and gains must be prorated among owners, potentially triggering varied tax obligations based on individual shares. Understanding IRS rules on passive income and capital gains distribution is crucial for optimizing tax benefits in fractional asset investments.

Which Asset Ownership Model Is Right for You?

Choosing between asset ownership and fractional ownership depends on your financial goals, risk tolerance, and investment timeline. Full asset ownership provides complete control and potential for long-term appreciation, ideal for investors seeking direct management and maximum returns. Fractional ownership offers diversified exposure with lower upfront costs, making it suitable for those wanting to minimize risk while still benefiting from asset appreciation.

Related Important Terms

Tokenized Assets

Tokenized assets enable fractional ownership by dividing high-value assets into digital tokens, allowing investors to acquire smaller, more affordable shares while maintaining transparency and liquidity. This decentralized approach to ownership simplifies money management by providing accessible investment opportunities and real-time asset tracking on blockchain platforms.

Fractional Real Estate Investing

Fractional real estate investing allows individuals to acquire partial ownership in high-value properties, enabling diversified asset portfolios without the full capital outlay required for sole ownership. This method enhances liquidity and risk management by spreading investment across multiple assets, contrasting traditional asset ownership's concentration and higher entry barriers.

Micro-Investments

Micro-investments in fractional ownership allow investors to acquire partial stakes in high-value assets, reducing entry barriers and enhancing portfolio diversification. This contrasts with traditional asset ownership, which demands full capital commitment and limits flexibility in money management strategies.

Shared Economy Assets

Shared economy assets leverage fractional ownership to optimize money management by allowing multiple investors to co-own high-value properties, vehicles, or equipment, reducing individual capital outlay and risk exposure. This model enhances liquidity and asset utilization while enabling more diversified portfolios compared to traditional single-owner asset structures.

Digital Asset Securitization

Digital asset securitization transforms ownership into tradable fractions, enhancing liquidity and diversifying investment portfolios beyond traditional asset management. Fractional ownership in digital assets enables efficient money management by providing accessible entry points and streamlined transferability within decentralized financial markets.

Blockchain Fractionalization

Blockchain fractionalization enables asset ownership to be divided into smaller, tradable units, enhancing liquidity and accessibility compared to traditional full asset ownership models. This decentralized approach improves money management by allowing investors to diversify portfolios with lower capital while maintaining transparent and secure asset records on the blockchain.

Partial Stock Ownership

Partial stock ownership offers a flexible alternative to full asset acquisition by enabling investors to hold shares in high-value stocks without the capital required for whole shares. This fractional ownership model enhances diversification and liquidity, optimizing portfolio management while reducing risk exposure inherent in traditional asset ownership.

NFTs as Asset Fractions

NFTs as asset fractions enable decentralized ownership of valuable assets, allowing users to invest in and manage shares of high-value items such as real estate, art, or collectibles without purchasing the entire asset. This fractional ownership model increases liquidity and democratizes access to wealth by breaking down expensive assets into tradable, verifiable NFT tokens on blockchain networks.

Peer-to-Peer Asset Sharing

Peer-to-peer asset sharing leverages fractional ownership to distribute the costs and benefits of high-value assets among multiple users, enhancing liquidity and reducing individual financial risk. This model enables efficient money management by allowing investors to hold partial stakes in assets, optimizing capital allocation while maintaining shared access and utilization rights.

Decentralized Asset Pools

Decentralized asset pools enable shared ownership and collective management without the need for traditional fractional ownership structures, enhancing liquidity and transparency in money management. These pools leverage blockchain technology to provide secure, immutable records of asset contributions, facilitating efficient allocation and reducing administrative overhead.

Asset vs Fractional Ownership for money management. Infographic

moneydiff.com

moneydiff.com