Commodities offer tangible assets such as metals, oil, and agricultural products that provide physical value and market liquidity, making them attractive for traditional asset portfolios. Carbon credits represent intangible environmental assets aimed at offsetting carbon emissions, appealing to investors prioritizing sustainability and regulatory compliance. Choosing between commodities and carbon credits depends on balancing physical asset stability with the growing demand for environmentally responsible investments.

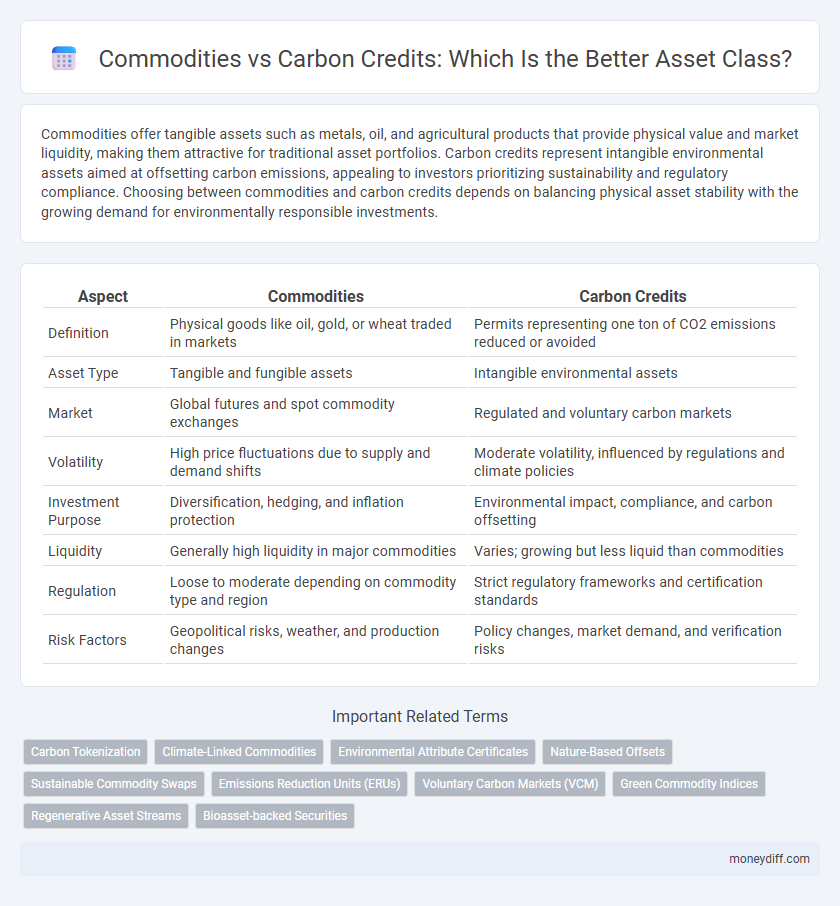

Table of Comparison

| Aspect | Commodities | Carbon Credits |

|---|---|---|

| Definition | Physical goods like oil, gold, or wheat traded in markets | Permits representing one ton of CO2 emissions reduced or avoided |

| Asset Type | Tangible and fungible assets | Intangible environmental assets |

| Market | Global futures and spot commodity exchanges | Regulated and voluntary carbon markets |

| Volatility | High price fluctuations due to supply and demand shifts | Moderate volatility, influenced by regulations and climate policies |

| Investment Purpose | Diversification, hedging, and inflation protection | Environmental impact, compliance, and carbon offsetting |

| Liquidity | Generally high liquidity in major commodities | Varies; growing but less liquid than commodities |

| Regulation | Loose to moderate depending on commodity type and region | Strict regulatory frameworks and certification standards |

| Risk Factors | Geopolitical risks, weather, and production changes | Policy changes, market demand, and verification risks |

Understanding Commodities as Traditional Assets

Commodities, such as oil, gold, and agricultural products, serve as traditional tangible assets widely traded in global markets, providing investors with portfolio diversification and inflation hedging. These physical goods hold intrinsic value derived from supply and demand dynamics, established market infrastructure, and regulated exchanges like the NYMEX and LME. Understanding commodities as traditional assets highlights their role in stabilizing portfolios through cyclical economic exposure and quantifiable market liquidity.

The Emergence of Carbon Credits in Asset Portfolios

Carbon credits are increasingly integrated into asset portfolios, offering a novel approach to diversifying investments beyond traditional commodities like oil, gold, and agricultural products. These credits represent verified reductions in greenhouse gas emissions, attracting investors focused on environmental, social, and governance (ESG) criteria and sustainable finance. As regulatory frameworks tighten globally, carbon credits gain prominence as assets with potential for long-term value appreciation and risk mitigation against climate-related impacts.

Comparing Risk Profiles: Commodities vs Carbon Credits

Commodities exhibit high price volatility driven by geopolitical events, supply-demand imbalances, and macroeconomic factors, leading to elevated market and liquidity risks. Carbon credits, although less liquid, present regulatory and policy uncertainties, with risks tied to evolving environmental regulations and market acceptance. Investors must assess the contrasting risk profiles, balancing commodities' price fluctuations against carbon credits' regulatory and compliance exposure to align with their asset risk tolerance.

Liquidity and Market Accessibility: A Direct Comparison

Commodities offer high liquidity with global exchanges such as the CME and ICE facilitating frequent trading and immediate price discovery, making them accessible to a broad range of investors. Carbon credits, while growing in market size, still face limited liquidity and regulatory complexity across regional markets, which can restrict swift transactions and affect market entry. The disparity in trading volume and market infrastructure between commodities and carbon credits significantly influences their attractiveness as liquid assets.

Volatility Trends in Commodities and Carbon Credits

Commodities exhibit high volatility due to geopolitical tensions, supply-demand imbalances, and macroeconomic factors, often resulting in sharp price fluctuations. Carbon credits demonstrate comparatively lower volatility, influenced primarily by regulatory frameworks and environmental policies that create more predictable market conditions. Investors seeking asset diversification may consider carbon credits as a stabilizing complement to the traditionally volatile commodities market.

Potential Returns: Profitability Analysis

Commodities often offer tangible assets with historically high volatility, enabling potentially significant short-term profits through price fluctuations in markets like oil, gold, and agricultural products. Carbon credits, representing verified emissions reductions, provide investors with steady returns driven by regulatory demand and increasing corporate sustainability commitments, making them attractive for stable, long-term profitability. Evaluating assets requires analyzing market liquidity, risk profiles, and growth forecasts for commodities versus the emerging carbon credit markets to optimize portfolio performance.

Regulatory Frameworks Affecting Asset Classes

Commodities and carbon credits as asset classes are subject to distinct regulatory frameworks that impact their market behavior and investment risk profiles. Commodities markets are governed by established regulations such as the Commodity Exchange Act and oversight by entities like the Commodity Futures Trading Commission (CFTC), ensuring transparency and limiting market manipulation. In contrast, carbon credits fall under evolving environmental policies and international agreements, including the Paris Agreement, with regulatory regimes varying widely by jurisdiction, influencing their valuation and liquidity dynamics.

ESG Integration: Carbon Credits vs Commodities

Carbon credits offer a targeted approach to ESG integration by directly supporting carbon reduction projects, making them a strategic asset for companies aiming to meet sustainability goals. Commodities, while essential for economic activity, often carry higher environmental risks and less direct impact on carbon footprint management. Investing in carbon credits aligns asset strategies with regulatory compliance and stakeholder expectations on climate responsibility.

Diversification Benefits in Portfolio Construction

Commodities and carbon credits offer distinct diversification benefits in portfolio construction due to their low correlation with traditional asset classes like equities and bonds. Commodities provide hedge potential against inflation and supply-demand shocks, while carbon credits introduce exposure to emerging environmental markets driven by regulatory frameworks and sustainability goals. Combining these assets can enhance risk-adjusted returns by balancing traditional economic cycles with climate-oriented investment themes.

Future Growth Prospects: Commodities and Carbon Credits

Commodities, driven by global economic growth and industrial demand, are expected to see sustained price volatility and opportunities in energy, metals, and agriculture markets. Carbon credits are rapidly gaining traction due to increasing regulatory pressures and corporate commitments to net-zero targets, positioning them for significant expansion in environmental finance. Future growth prospects favor carbon credits as governments and businesses intensify efforts to meet climate goals while commodities remain essential for core economic activities.

Related Important Terms

Carbon Tokenization

Carbon tokenization transforms carbon credits into digital assets on blockchain platforms, enabling enhanced transparency, liquidity, and traceability compared to traditional commodities. This innovation facilitates seamless trading, fractional ownership, and real-time verification, positioning carbon credits as a dynamic asset class within sustainable finance.

Climate-Linked Commodities

Climate-linked commodities integrate environmental sustainability with market demand by embedding carbon reduction metrics directly into physical asset transactions, enhancing transparency and regulatory compliance. Unlike traditional carbon credits, these commodities offer tangible asset backing while actively contributing to decarbonization goals, positioning them as innovative investment vehicles in climate finance.

Environmental Attribute Certificates

Environmental Attribute Certificates such as carbon credits represent verified reductions in greenhouse gas emissions and provide assets with measurable environmental value, unlike traditional commodities which primarily serve as raw materials or goods. These certificates enable asset holders to demonstrate sustainability performance, facilitating compliance with carbon markets and enhancing corporate social responsibility profiles.

Nature-Based Offsets

Nature-based offsets within carbon credits offer assets tied to the preservation and restoration of ecosystems, delivering environmental benefits alongside carbon sequestration, unlike conventional commodities that focus primarily on raw material value. These nature-based carbon credits provide a unique opportunity for investors seeking sustainable asset classes that contribute to climate mitigation and biodiversity conservation.

Sustainable Commodity Swaps

Sustainable commodity swaps enable investors to hedge risks while promoting environmentally friendly practices by exchanging conventional commodities for sustainability-linked assets, such as carbon credits. This strategy leverages carbon credits' ability to offset emissions, aligning asset portfolios with global climate goals and enhancing long-term value through eco-conscious asset management.

Emissions Reduction Units (ERUs)

Emissions Reduction Units (ERUs) represent tradable carbon credits generated from projects that reduce greenhouse gas emissions under the Kyoto Protocol, offering an asset class focused on environmental impact and regulatory compliance. Unlike traditional commodities, ERUs provide measurable contributions to carbon neutrality goals and serve as critical financial instruments for companies managing their carbon footprints.

Voluntary Carbon Markets (VCM)

Voluntary Carbon Markets (VCM) offer carbon credits as tradable assets that represent verified emissions reductions, providing companies with a flexible mechanism for offsetting their carbon footprint compared to traditional commodities, which are primarily physical goods like oil, metals, or agricultural products. Carbon credits in VCM are increasingly valued for their role in corporate sustainability strategies, featuring attributes such as standardization, traceability, and certification, which distinguish them from the fungible and supply-driven nature of commodities markets.

Green Commodity Indices

Green Commodity Indices track sustainable raw materials like renewable energy metals and agricultural products, providing investors exposure to eco-friendly asset classes within commodity markets. Carbon credits represent tradable permits for greenhouse gas emissions, serving as regulatory tools for carbon offsetting rather than traditional asset investments.

Regenerative Asset Streams

Commodities provide tangible asset value through physical goods like metals, oil, and agricultural products, while carbon credits represent regenerative asset streams that monetize environmental impact by enabling verifiable carbon offsetting. Investing in carbon credits supports sustainable asset portfolios by integrating ecological regeneration and long-term climate risk mitigation into financial performance.

Bioasset-backed Securities

Bioasset-backed securities represent an innovative class of assets that combine the tangible value of commodities with the environmental benefits of carbon credits, offering investors exposure to sustainable resource management and carbon sequestration projects. These securities leverage biological assets such as timber, agricultural products, or biomass, enhancing liquidity and value through verified carbon offsetting mechanisms that address climate risk while delivering potential financial returns.

Commodities vs Carbon Credits for asset. Infographic

moneydiff.com

moneydiff.com