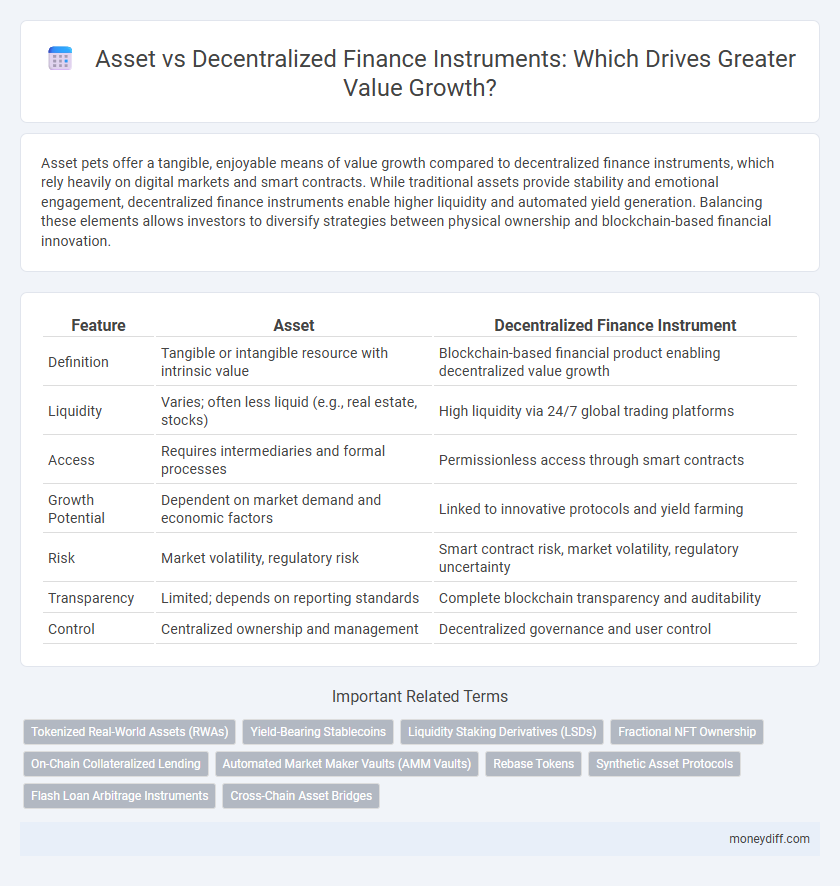

Asset pets offer a tangible, enjoyable means of value growth compared to decentralized finance instruments, which rely heavily on digital markets and smart contracts. While traditional assets provide stability and emotional engagement, decentralized finance instruments enable higher liquidity and automated yield generation. Balancing these elements allows investors to diversify strategies between physical ownership and blockchain-based financial innovation.

Table of Comparison

| Feature | Asset | Decentralized Finance Instrument |

|---|---|---|

| Definition | Tangible or intangible resource with intrinsic value | Blockchain-based financial product enabling decentralized value growth |

| Liquidity | Varies; often less liquid (e.g., real estate, stocks) | High liquidity via 24/7 global trading platforms |

| Access | Requires intermediaries and formal processes | Permissionless access through smart contracts |

| Growth Potential | Dependent on market demand and economic factors | Linked to innovative protocols and yield farming |

| Risk | Market volatility, regulatory risk | Smart contract risk, market volatility, regulatory uncertainty |

| Transparency | Limited; depends on reporting standards | Complete blockchain transparency and auditability |

| Control | Centralized ownership and management | Decentralized governance and user control |

Understanding Traditional Assets and Their Role in Value Growth

Traditional assets such as stocks, bonds, and real estate have long been fundamental in wealth accumulation due to their established markets and regulatory frameworks. These assets provide predictable value growth through dividends, interest, and capital appreciation supported by tangible economic activity. Understanding their historical performance and risk profiles is essential for comparing with emerging decentralized finance instruments that operate on blockchain technology.

Introduction to Decentralized Finance Instruments

Decentralized Finance (DeFi) instruments represent a transformative shift in how assets generate value by leveraging blockchain technology to enable transparent, permissionless financial transactions. Unlike traditional assets that rely on centralized intermediaries, DeFi instruments use smart contracts to facilitate lending, borrowing, and yield farming, offering higher liquidity and accessibility. These instruments democratize asset growth, creating new opportunities for investors to maximize returns through decentralized protocols.

Key Differences Between Assets and DeFi Instruments

Assets represent tangible or intangible items with inherent value, such as real estate, stocks, or intellectual property, typically regulated and offering steady appreciation or income. Decentralized Finance (DeFi) instruments, including liquidity pools, yield farming, and synthetic assets, operate on blockchain networks, enabling peer-to-peer transactions without intermediaries, often characterized by higher volatility and innovative value-generation mechanisms. Key differences lie in asset custody, regulatory oversight, liquidity, and risk profiles, with assets offering stability and DeFi instruments emphasizing decentralized access and potential for higher yields.

Risk Profiles: Traditional Assets vs DeFi Instruments

Traditional assets like stocks, bonds, and real estate offer established risk profiles with regulatory protections and predictable market behaviors, making them suitable for conservative investors seeking steady value growth. Decentralized Finance (DeFi) instruments, including tokens and liquidity pools, present higher volatility and smart contract vulnerabilities, resulting in greater potential rewards but elevated risk exposure. Understanding these distinct risk profiles is crucial for balancing portfolio diversification and optimizing long-term asset growth strategies.

Liquidity Comparison: Asset Markets vs DeFi Protocols

Traditional asset markets offer higher liquidity with established exchanges and larger trading volumes, enabling faster execution of buy and sell orders. Decentralized Finance (DeFi) protocols often face liquidity fragmentation and slippage due to limited participants and automated market maker models. As a result, asset markets generally provide more stable and predictable liquidity compared to the variable conditions found in DeFi ecosystems.

Accessibility: Who Can Invest in Assets vs DeFi Instruments?

Traditional assets such as stocks and real estate often require significant capital and regulatory approval, limiting access primarily to accredited investors or those with substantial financial resources. Decentralized Finance (DeFi) instruments, built on blockchain technology, offer greater accessibility by enabling almost anyone with an internet connection and digital wallet to participate in value growth opportunities without intermediaries. This democratization of investment through DeFi platforms reduces barriers and expands market inclusion globally.

Transparency and Security: Asset Management vs DeFi Platforms

Asset management offers enhanced transparency through regulated frameworks and clear ownership records, ensuring reliable value tracking over time. DeFi platforms rely on blockchain transparency but face challenges with smart contract vulnerabilities and regulatory uncertainties impacting security. The comparative robustness of traditional asset management systems often results in greater investor confidence and predictable growth trajectories.

Value Growth Potential: Assets vs Decentralized Finance

Assets such as real estate, stocks, and commodities have historically demonstrated steady value growth supported by tangible fundamentals and market demand. Decentralized finance (DeFi) instruments offer high growth potential driven by blockchain innovation and yield opportunities, but they carry increased volatility and regulatory uncertainty. Evaluating value growth potential requires balancing the stability of traditional assets against the dynamic, sometimes exponential, returns available in DeFi markets.

Regulatory Landscape for Assets and DeFi Instruments

The regulatory landscape for traditional assets is well-established, with clear guidelines governing securities, property, and commodities to ensure investor protection and market stability. In contrast, decentralized finance (DeFi) instruments operate in a rapidly evolving and often ambiguous regulatory environment, facing challenges related to jurisdiction, compliance, and enforcement due to their decentralized nature. Navigating these complex regulations is critical for securing value growth, as compliance impacts investor confidence and institutional adoption in both asset classes.

Future Trends: Asset Evolution vs DeFi Innovation

Asset evolution is increasingly characterized by tokenization, enabling fractional ownership and enhanced liquidity, while DeFi innovation focuses on creating interoperable financial instruments that operate without intermediaries. Future trends predict a convergence where traditional assets are integrated into DeFi protocols, leveraging smart contracts for automated yield generation and risk management. This synergy is expected to redefine value growth by combining the stability of tangible assets with the flexibility and accessibility of decentralized finance instruments.

Related Important Terms

Tokenized Real-World Assets (RWAs)

Tokenized Real-World Assets (RWAs) enable fractional ownership and increased liquidity of traditionally illiquid assets by leveraging blockchain technology, offering enhanced transparency and security compared to conventional assets. These digital representations within Decentralized Finance (DeFi) platforms facilitate seamless value growth through programmable smart contracts and global accessibility.

Yield-Bearing Stablecoins

Yield-bearing stablecoins offer a decentralized finance (DeFi) instrument that combines asset stability with consistent value growth through automated interest generation, outperforming traditional assets in liquidity and yield efficiency. These stablecoins leverage blockchain protocols to provide transparent, low-volatility returns, making them a superior choice for investors seeking reliable income streams within the DeFi ecosystem.

Liquidity Staking Derivatives (LSDs)

Liquidity Staking Derivatives (LSDs) bridge traditional asset management and decentralized finance instruments by enabling tokenized staking positions to generate passive income while maintaining liquidity. These derivatives enhance value growth through flexible, tradeable assets on DeFi platforms, outperforming conventional asset constraints by leveraging blockchain transparency and dynamic yield opportunities.

Fractional NFT Ownership

Fractional NFT ownership revolutionizes asset value growth by enabling multiple stakeholders to invest in high-value digital and physical assets, enhancing liquidity and democratizing access compared to traditional decentralized finance instruments. This model leverages blockchain technology to ensure transparent, secure fractional shares, optimizing portfolio diversification and unlocking new avenues for capital appreciation.

On-Chain Collateralized Lending

On-chain collateralized lending leverages decentralized finance instruments to unlock asset value by enabling users to borrow funds against tokenized assets with transparent, automated smart contracts. This approach enhances liquidity and value growth opportunities compared to traditional asset-based lending by reducing intermediaries and increasing accessibility within blockchain ecosystems.

Automated Market Maker Vaults (AMM Vaults)

Automated Market Maker Vaults (AMM Vaults) optimize asset value growth by providing continuous liquidity and enabling automated trading on decentralized finance platforms, reducing reliance on traditional centralized assets. These vaults leverage algorithmic market making to enhance yield generation and risk management compared to conventional asset holdings.

Rebase Tokens

Rebase tokens, a novel asset class in decentralized finance (DeFi), adjust supply algorithmically to stabilize price while enabling value growth through demand dynamics rather than fixed quantity appreciation. Unlike traditional assets, rebase tokens optimize capital efficiency by automatically expanding or contracting circulating supply, offering unique exposure to market volatility and protocol incentives within DeFi ecosystems.

Synthetic Asset Protocols

Synthetic asset protocols enable the creation of decentralized finance instruments that mirror real-world assets, offering enhanced liquidity and diversification without direct ownership. These protocols drive value growth by providing seamless exposure to commodities, equities, and cryptocurrencies through programmable smart contracts on blockchain networks.

Flash Loan Arbitrage Instruments

Flash Loan Arbitrage Instruments in decentralized finance enable rapid, collateral-free borrowing to exploit price discrepancies across multiple exchanges, maximizing asset value growth efficiently. Unlike traditional asset holdings, these instruments leverage smart contracts and automated execution to achieve high-frequency, low-risk profits through instant liquidity arbitrage opportunities.

Cross-Chain Asset Bridges

Cross-chain asset bridges enhance value growth by enabling seamless transfer of assets across multiple blockchain networks, increasing liquidity and market access beyond isolated decentralized finance instruments. These bridges mitigate fragmentation risks and unlock diversified opportunities, driving more efficient capital allocation and asset utilization in the decentralized finance ecosystem.

Asset vs Decentralized Finance Instrument for value growth. Infographic

moneydiff.com

moneydiff.com